Editor’s Note: This story has been updated with the DOJ’s statement regarding its civil fraud complaint. This story was originally filed June 3.

Updated: July 13, 3:30 p.m.

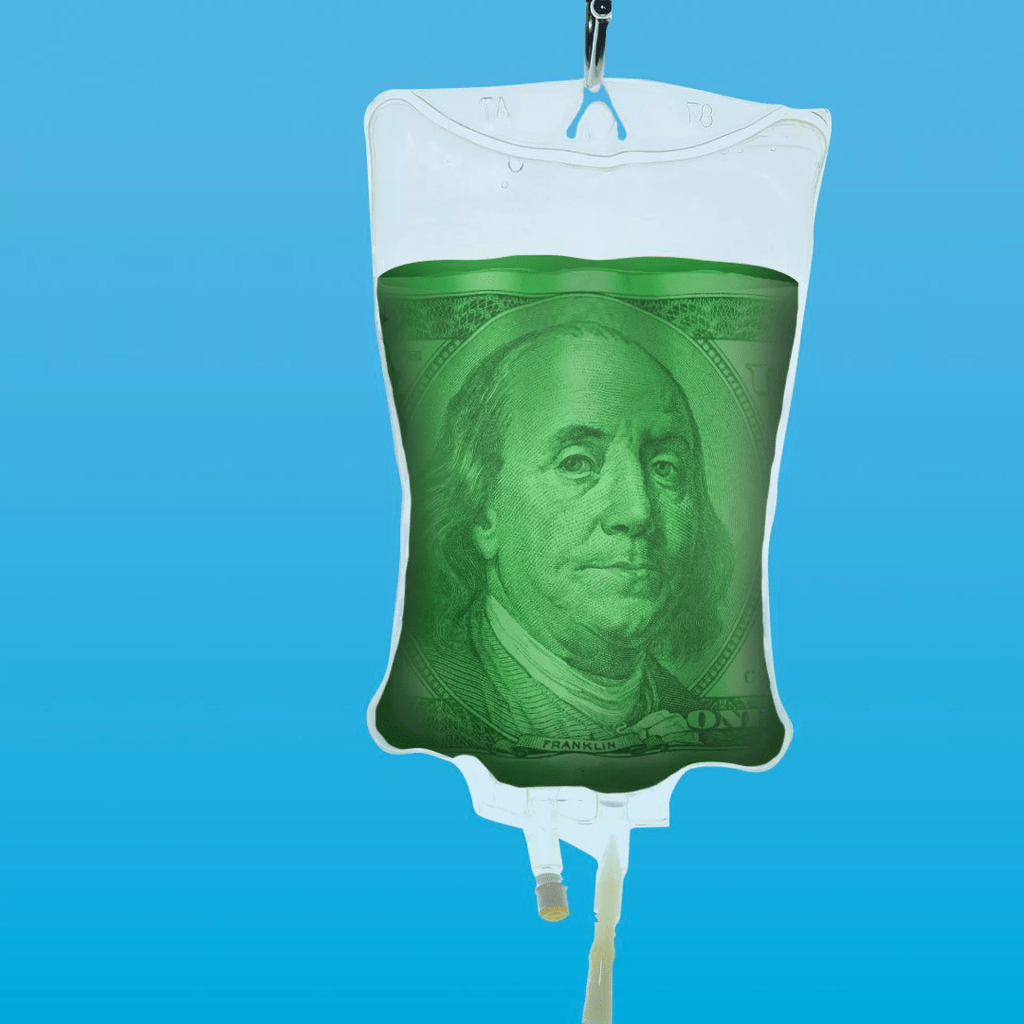

The federal government filed a civil complaint Tuesday in federal court in Brooklyn against the country’s largest dialysis provider alleging that the company performed unnecessary procedures on dialysis patients.

The Department of Justice has formally intervened and joined the False Claims Act whistleblower lawsuit filed against dialysis giant Fresenius Medical Care, according to court documents filed in U.S. District Court in Brooklyn.

The DOJ’s False Claims Act complaint alleges Fresenius Vascular Care, a business unit of Fresenius Medical Care performed these unnecessary procedures at nine centers across New York City, Long Island and Westchester, and billed the procedures to Medicare, Medicaid, the Federal Health Benefits Program and TRICARE. The complaint seeks damages and penalties under the False Claims Act.

The whistleblower complaint alleges that from about January 1, 2012 through June 30, 2018, Fresenius routinely performed certain procedures on patients with end stage renal disease (ESRD) who were receiving dialysis, without sufficient clinical indication that the patients needed the procedures. Fresenius knowingly subjected ESRD patients—who included elderly, disadvantaged minority, and low-income individuals—to these procedures to increase its revenues, the DOJ complaint states.

A Fresenius spokesperson said the company disputes the allegations contained in both the relators’ complaint and the U.S. government’s complaint and “intends to vigorously defend the litigation.”

“Our network of vascular centers is leading efforts to reduce total healthcare costs and improve patient outcomes by expanding access to innovative and less-invasive procedures. Our policies are intended to result in a high standard of care and compliance with government regulations,” the Fresenius spokesperson said in a statement.

Breon Peace, United States Attorney for the Eastern District of New York, called the company’s alleged conduct “egregious,” claiming that Fresenius “not only defrauded federal healthcare programs but also subjected particularly vulnerable people to medically unnecessary procedures.”

“This Office will hold medical providers accountable for practices that needlessly expose patients to harm for financial gain at taxpayer expense,” Peace said in a statement.

Two doctors allege in a lawsuit that the country’s largest dialysis provider performed potentially thousands of unnecessary, invasive vascular procedures on late-stage kidney disease patients and fraudulently charged Medicare and Medicaid for these procedures.

The lawsuit, originally filed in 2014 in New York, claims Fresenius Medical Care and its business unit, Azura Vascular Care, violated the federal False Claims Act. The case remained under seal until the court lifted the seal May 9. The federal government has 60 days to file its complaint.

Nineteen states also are included in the lawsuit and potentially could join the case.

The U.S. attorney in the Eastern District of New York will be taking over with respect to federal False Claims Act fraud claims against Fresenius, according to law firm Cohen Milstein Sellers & Toll, which is representing the plaintiffs in the case.

The U.S. attorney’s office declined to comment at the time.

The plaintiffs, two practicing nephrologists, charge in the complaint that Fresenius performed thousands of end-stage renal disease-related treatments that were “not medically reasonable and necessary” and that “exposed patients to undue and unnecessary risks.”

In a statement provided by a spokesperson, Fresenius declined to comment on the lawsuit.

Fresenius Medical Care North America is the largest dialysis provider in the U.S., operating over 2,600 dialysis units nationwide and treating over 205,000 patients annually. Its business unit, Azura Vascular Care, operates more than 90 vascular care facilities across the country.