Half of all Americans now die in hospice care. Easy money and a lack of regulation transformed a crusade to provide death with dignity into an industry rife with fraud and exploitation.

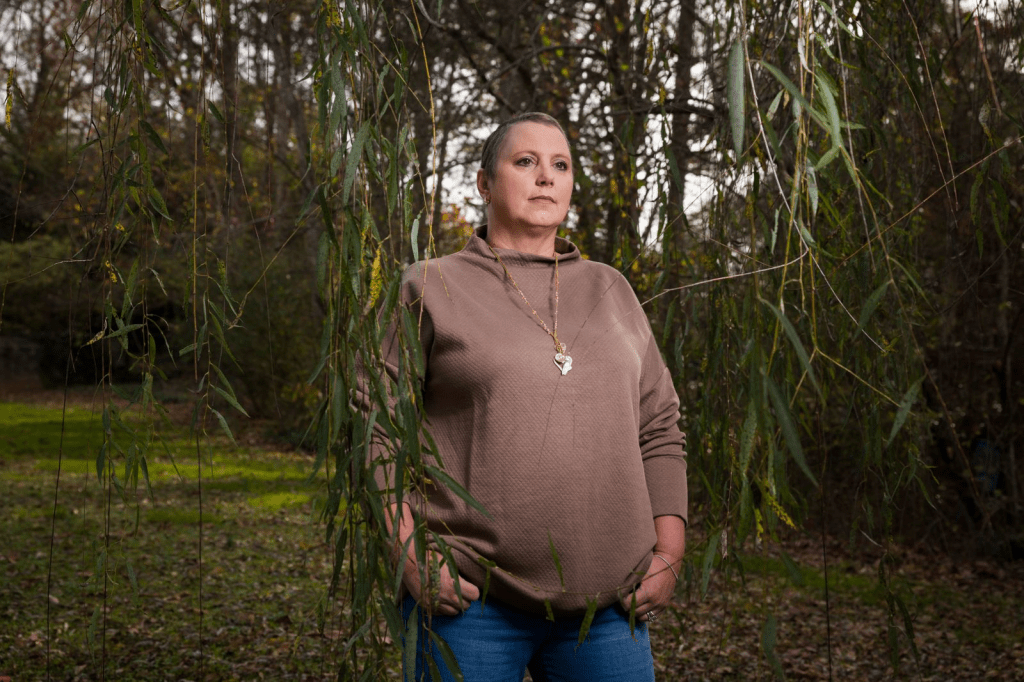

Over the years, Marsha Farmer had learned what to look for. As she drove the back roads of rural Alabama, she kept an eye out for dilapidated homes and trailers with wheelchair ramps. Some days, she’d ride the one-car ferry across the river to Lower Peach Tree and other secluded hamlets where a few houses lacked running water and bare soil was visible beneath the floorboards. Other times, she’d scan church prayer lists for the names of families with ailing members.

Farmer was selling hospice, which, strictly speaking, is for the dying. To qualify, patients must agree to forgo curative care and be certified by doctors as having less than six months to live. But at AseraCare, a national chain where Farmer worked, she solicited recruits regardless of whether they were near death. She canvassed birthday parties at housing projects and went door to door promoting the program to loggers and textile workers. She sent colleagues to cadge rides on the Meals on Wheels van or to chat up veterans at the American Legion bar. “We’d find run-down places where people were more on the poverty line,” she told me. “You’re looking for uneducated people, if you will, because you’re able to provide something to them and meet a need.”

Farmer, who has doe eyes and a nonchalant smile, often wore scrubs on her sales routes, despite not having a medical background. That way, she said, “I would automatically be seen as a help.” She tried not to mention death in her opening pitch, or even hospice if she could avoid it. Instead, she described an amazing government benefit that offered medications, nursing visits, nutritional supplements and light housekeeping — all for free. “Why not try us just for a few days?” she’d ask families, glancing down at her watch as she’d been trained to do, to pressure them into a quick decision.

Once a prospective patient expressed interest, a nurse would assess whether any of the person’s conditions fit — or could be made to fit — a fatal prognosis. The Black Belt, a swath of the Deep South that includes parts of Alabama, has some of the highest rates of heart disease, diabetes and emphysema in the country. On paper, Farmer knew, it was possible to finesse chronic symptoms, like shortness of breath, into proof of terminal decline.

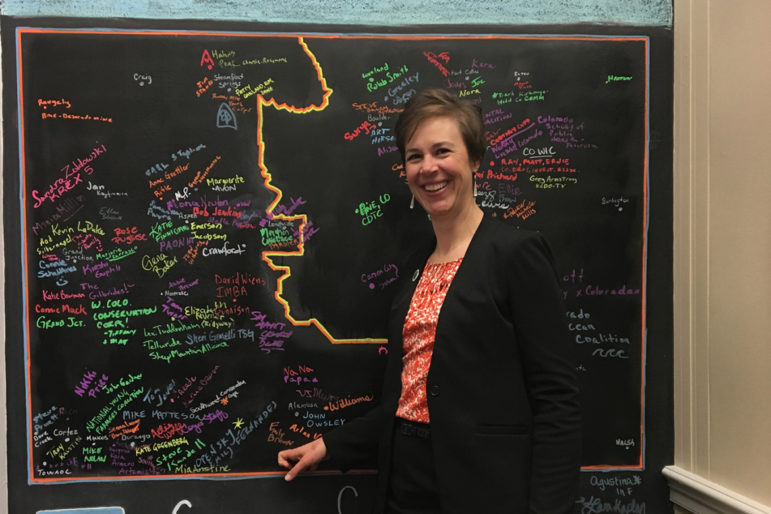

When Farmer started out in the hospice business, in 2002, it felt less like a sales gig than like a calling. At 30, she’d become a “community educator,” or marketer, at Hospice South, a regional chain that had an office in her hometown, Monroeville, Alabama. Monroeville was the kind of place where, if someone went into hospice, word got around and people sent baked goods. She often asked patients to write cards or make tape recordings for milestones — birthdays, anniversaries, weddings — that they might not live to see. She became an employee of the month and, within a year, was promoted to executive director of the branch, training a staff of her own to evangelize for end-of-life care.

Things began to change in 2004, when Hospice South was bought by Beverly Enterprises, the second-largest nursing-home chain in the country, and got folded into one of its subsidiaries, AseraCare. Not long before the sale, Beverly had agreed to pay a $5 million criminal fine and a $175 million civil settlement after being accused of Medicare fraud. Its stock value had slumped, and Beverly’s CEO had decided that expanding its empire of hospices would help the company attract steadier revenue in “high-growth, high-margin areas of health care services.” Less than two years later, as part of a wave of consolidations in the long-term-care industry, Beverly was sold to a private-equity firm, which rebranded it as Golden Living.

It might be counterintuitive to run an enterprise that is wholly dependent on clients who aren’t long for this world, but companies in the hospice business can expect some of the biggest returns for the least amount of effort of any sector in American health care. Medicare pays providers a set rate per patient per day, regardless of how much help they deliver. Since most hospice care takes place at home and nurses aren’t required to visit more than twice a month, it’s not difficult to keep overhead low and to outsource the bulk of the labor to unpaid family members — assuming that willing family members are at hand.

Up to a point, the way Medicare has designed the hospice benefit rewards providers for recruiting patients who aren’t imminently dying. Long hospice stays translate into larger margins, and stable patients require fewer expensive medications and supplies than those in the final throes of illness. Although two doctors must initially certify that a patient is terminally ill, she can be recertified as such again and again.

Almost immediately after the AseraCare takeover, Farmer’s supervisors set steep targets for the number of patients marketers had to sign up and presented those who met admissions quotas with cash bonuses and perks, including popcorn machines and massage chairs. Employees who couldn’t hit their numbers were fired. Farmer prided herself on being competitive and liked to say, “I can sell ice to an Eskimo.” But as her remit expanded to include the management of AseraCare outposts in Foley and Mobile, she began to resent the demand to bring in more bodies. Before one meeting with her supervisor, Jeff Boling, she stayed up late crunching data on car wrecks, cancer and heart disease to figure out how many people in her territories might be expected to die that year. When she showed Boling that the numbers didn’t match what she called his “ungodly quotas,” he was unmoved. “If you can’t do it,” she recalled him telling her, “we’ll find someone who can.”

Farmer’s bigger problem was that her patients weren’t dying fast enough. Some fished, drove tractors and babysat grandchildren. Their longevity prompted concern around the office because of a complicated formula that governs the Medicare benefit. The federal government, recognizing that an individual patient might not die within the predicted six months, effectively demands repayment from hospices when the average length of stay of all patients exceeds six months.

But Farmer’s company, like many of its competitors, had found ways to game the system and keep its money. One tactic was to “dump,” or discharge, patients with overly long stays. The industry euphemism is “graduated” from hospice, though the patient experience is often more akin to getting expelled: losing diapers, pain medications, wheelchairs, nursing care and a hospital-grade bed that a person might not otherwise be able to afford. In 2007, according to Farmer’s calculations around the time, 70% of the patients served by her Mobile office left hospice alive.

Another way to hold on to Medicare money was to consistently pad the roster with new patients. One day in 2008, facing the possibility of a repayment, AseraCare asked some of its executive directors to “get double digit admits” and to “have the kind of day that will go down in the record books.” A follow-up email, just an hour later, urged staff to “go around the barriers and make this happen now, your families need you.”

That summer, Boling pushed Farmer to lobby oncologists to turn over their “last breath” patients: those with only weeks or days to live. At the time, Farmer’s 59-year-old mother was dying of metastatic colon cancer. Although Farmer knew that the service might do those last-breath people good, it enraged her that her hospice was chasing them cynically, to balance its books. The pressure was so relentless that sometimes she felt like choking someone, but she had two small children and couldn’t quit. Her husband, who had been a co-worker at AseraCare, had already done so. Earlier that year, after fights with Boling and other supervisors about quotas, he had left for a lower-paying job at Verizon.

Farmer’s confidante at work, Dawn Richardson, shared her frustration. A gifted nurse who was, as Farmer put it, “as country as a turnip,” Richardson hated admitting people who weren’t appropriate or dumping patients who were. She was a single mom, though, and needed a paycheck. One evening in early 2009, the two happened upon another way out.

The local news was reporting that two nurses at SouthernCare, a prominent Alabama-based competitor, had accused the company of stealing taxpayer dollars by enrolling ineligible patients in hospice. SouthernCare, which admitted no wrongdoing, settled with the Justice Department for nearly $25 million, and the nurses, as whistle-blowers, had received a share of the sum — $4.9 million, to be exact. Farmer and Richardson had long felt uneasy about what AseraCare asked them to do. Now, they realized, what they were doing might be illegal. They decided to call James Barger, a lawyer who had represented one of the SouthernCare nurses. That March, he helped Farmer and Richardson file a whistleblower complaint against AseraCare and Golden Living in the Northern District of Alabama, accusing the company of Medicare fraud. The case would go on to become the most consequential lawsuit the hospice industry had ever faced.

The philosophy of hospice was imported to the United States in the 1960s by Dame Cicely Saunders, an English doctor and social worker who’d grown appalled by the “wretched habits of big, busy hospitals where everyone tiptoes past the bed and the dying soon learn to pretend to be asleep.” Her counterpractice, which she refined at a Catholic clinic for the poor in East London, was to treat a dying patient’s “total pain” — his physical suffering, spiritual needs and existential disquiet. In a pilot program, Saunders prescribed terminally ill patients cocktails of morphine, cocaine and alcohol — whiskey, gin or brandy, depending on which they preferred. Early results were striking. Before-and-after photos of cancer patients showed formerly anguished figures knitting scarves and raising toasts.

Saunders’ vision went mainstream in 1969, when the Swiss-born psychiatrist Elisabeth Kübler-Ross published her groundbreaking study, “On Death and Dying.” The subjects in her account were living their final days in a Chicago hospital, and some of them described how lonely and harsh it felt to be in an intensive-care unit, separated from family. Many Americans came away from the book convinced that end-of-life care in hospitals was inhumane. Kübler-Ross and Saunders, like their contemporaries in the women’s-health and deinstitutionalization movements, pushed for greater patient autonomy — in this case, for people to have more control over how they would exit the world. The first American hospice opened in Connecticut in 1974. By 1981, hundreds more hospices had started, and, soon after, President Ronald Reagan recognized the potential federal savings — many people undergo unnecessary, expensive hospitalizations just before they die — and authorized Medicare to cover the cost.

Forty years on, half of all Americans die in hospice care. Most of these deaths take place at home. When done right, the program allows people to experience as little pain as possible and to spend meaningful time with their loved ones. Nurses stop by to manage symptoms. Aides assist with bathing, medications and housekeeping. Social workers help families over bureaucratic hurdles. Clergy offer what comfort they can, and bereavement counselors provide support in the aftermath. This year, I spoke about hospice with more than 150 patients, families, hospice employees, regulators, attorneys, fraud investigators and end-of-life researchers, and all of them praised its vital mission. But many were concerned about how easy money and a lack of regulation had given rise to an industry rife with exploitation. In the decades since Saunders and her followers spread her radical concept across the country, hospice has evolved from a constellation of charities, mostly reliant on volunteers, into a $22 billion juggernaut funded almost entirely by taxpayers.

For-profit providers made up 30% of the field at the start of this century. Today, they represent more than 70%, and between 2011 and 2019, research shows, the number of hospices owned by private-equity firms tripled. The aggregate Medicare margins of for-profit providers are three times that of their nonprofit counterparts. Under the daily-payment structure, a small hospice that bills for just 20 patients at the basic rate can take in more than a million dollars a year. A large hospice billing for thousands of patients can take in hundreds of millions. Those federal payments are distributed in what is essentially an honor system. Although the government occasionally requests more information from billers, it generally trusts that providers will submit accurate claims for payment — a model that critics deride as “pay and chase.”

Jean Stone, who worked for years as a program-integrity senior specialist at the Centers for Medicare and Medicaid Services, said that hospice was a particularly thorny sector to police for three reasons: “No one wants to be seen as limiting an important service”; it’s difficult to retrospectively judge a patient’s eligibility; and “no one wants to talk about the end of life.” Although a quarter of all people in hospice enter it only in their final five days, most of the Medicare spending on hospice is for patients whose stays exceed six months. In 2018, the Office of Inspector General at the Department of Health and Human Services estimated that inappropriate billing by hospice providers had cost taxpayers “hundreds of millions of dollars.” Stone and others I spoke to believe the figure to be far higher.

Some hospice firms bribe physicians to bring them new patients by offering all-expenses-paid trips to Las Vegas nightclubs, complete with bottle service and private security details. (The former mayor of Rio Bravo, Texas, who was also a doctor, received outright kickbacks.) Other audacious for-profit players enlist family and friends to act as make-believe clients, lure addicts with the promise of free painkillers, dupe people into the program by claiming that it’s free home health care or steal personal information to enroll “phantom patients.” A 29-year-old pregnant woman learned that she’d been enrolled in Revelation Hospice, in the Mississippi Delta (which at one time discharged 93% of its patients alive), only when she visited her doctor for a blood test. In Frisco, Texas, according to the FBI, a hospice owner tried to evade the Medicare-repayment problem by instructing staff to overdose patients who were staying on the service too long. He texted a nurse about one patient: “He better not make it tomorrow. Or I will blame u.” The owner was sentenced to more than 13 years in prison for fraud, in a plea deal that made no allegations about patient deaths.

A medical background is not required to enter the business. I’ve come across hospices owned by accountants; vacation-rental superhosts; a criminal-defense attorney who represented a hospice employee convicted of fraud and was later investigated for hospice fraud himself; and a man convicted of drug distribution who went on to fraudulently bill Medicare more than $5 million for an end-of-life-care business that involved handling large quantities of narcotics.

Once a hospice is up and running, oversight is scarce. Regulations require surveyors to inspect hospice operations once every three years, even though complaints about quality of care are widespread. A government review of inspection reports from 2012 to 2016 found that the majority of all hospices had serious deficiencies, such as failures to train staff, manage pain and treat bedsores. Still, regulators rarely punish bad actors. Between 2014 and 2017, according to the Government Accountability Office, only 19 of the more than 4,000 U.S. hospices were cut off from Medicare funding.

Because patients who enroll in the service forgo curative care, hospice may harm patients who aren’t actually dying. Sandy Morales, who until recently was a case manager at the California Senior Medicare Patrol hotline, told me about a cancer patient who’d lost access to his chemotherapy treatment after being put in hospice without his knowledge. Other unwitting recruits were denied kidney dialysis, mammograms, coverage for lifesaving medications or a place on the waiting list for a liver transplant. In response to concerns from families, Morales and her community partners recently posted warnings in Spanish and English in senior apartment buildings, libraries and doughnut shops across the state. “Have you suddenly lost access to your doctor?” the notices read. “Can’t get your medications at the pharmacy? Beware! You may have been tricked into signing up for a program that is medically unnecessary for you.”

Some providers capitalize on the fact that most hospice care takes place behind closed doors, and that those who might protest poor treatment are often too sick or stressed to do so. One way of increasing company returns is to ghost the dying. A 2016 study in JAMA Internal Medicine of more than 600,000 patients found that 12% received no visits from hospice workers in the last two days of life. (Patients who died on a Sunday had some of the worst luck.) For-profit hospices have been found to have higher rates of no-shows and substantiated complaints than their nonprofit counterparts, and to disproportionately discharge patients alive when they approach Medicare’s reimbursement limit.

“There are so many ways to do fraud, so why pick this one?” Stone said. This was more or less what Marsha Farmer and Dawn Richardson had been wondering when they filed their complaint against AseraCare in 2009. Now, working undercover, they imagined themselves as part of the solution.

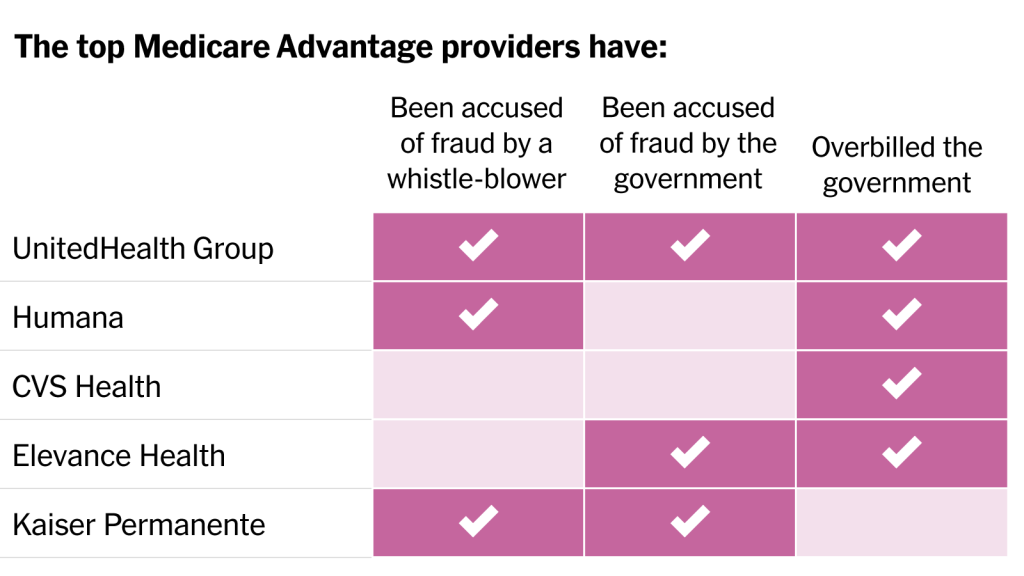

In the absence of guardrails, whistleblowers like Farmer and Richardson have become the government’s primary defense against hospice wrongdoing — an arrangement that James Barger, their lawyer, describes as placing “a ludicrous amount of optimism in a system with a capitalist payee and a socialist payer.” Seven out of 10 of the largest hospices in the U.S. have been sued at least once by former employees under the federal False Claims Act. The law includes a “qui tam” provision — the term derives from a Latin phrase that translates as “he who sues on behalf of the King as well as himself ” — that deputizes private citizens to bring lawsuits that accuse government contractors of fraud and lets them share in any money recovered. Qui-tam complaints, like Farmer and Richardson’s, are initially filed secretly, under seal, to give the Justice Department a chance to investigate a target without exposing the tipster. If the government decides to proceed, it takes over the litigation. In 2021 alone, the government recovered more than $1.6 billion from qui-tam lawsuits, and the total amount awarded to whistleblowers was $237 million.

In the two years after Farmer and Richardson filed their complaint, both slept poorly. But their covert undertaking also felt cathartic — mental indemnification against a job that troubled their consciences. Farmer continued to bring in patients at AseraCare while passing company documents to Barger, including spreadsheets analyzing admissions quotas and a training PowerPoint used by the company’s national medical adviser, Dr. James Avery. A pulmonologist who was fond of citing Seneca, Tolstoy and Primo Levi in his slides, Avery urged nurses to “be a detective” and to “look for clues” if a patient didn’t initially appear to fit a common hospice diagnosis. (Avery said that he never encouraged employees to admit ineligible patients.) He sometimes concluded his lectures with a spin on an idea from Goethe’s “Faust”: “Perpetual striving that has no goal but only progress or increase is a horror.”

Barger was impressed by the records that Farmer collected and even more so by her candor about her involvement in AseraCare’s schemes. She and Richardson reminded him of friends he’d had growing up: smart, always finishing each other’s sentences and not, he said, “trying to be heroes.” Nor, as it turned out, were they the only AseraCare employees raising questions about company ethics. The year before, three nurses in the Milwaukee office had filed a qui-tam complaint outlining similar corporate practices. The False Claims Act has a “first to file” rule, so the Wisconsin nurses could have tried to block Farmer and Richardson from proceeding with their case. Instead, the nurses decided to team up with their Alabama colleagues, even if it meant that they’d each receive a smaller share of the potential recovery. Also joining the crew was Dr. Joseph Micca, a former medical director at an AseraCare hospice in Atlanta. Every hospice is required to hire or contract with a doctor to sign forms certifying a patient’s eligibility for the program, and Micca accused the company of both ineligible enrollments and lapses in patient care. In his deposition, he described one patient who was given morphine against his orders and was kept in hospice care for months after she’d recovered from a heart attack. The woman, who was eventually discharged, lived several more years.

Among the most critical pieces of evidence to emerge in the discovery process was an audit that echoed many of the allegations made by the whistleblowers. In 2007 and 2008, AseraCare had hired the Corridor Group, a consulting firm, to visit nine of its agencies across the country, including the Monroeville office that Farmer oversaw. The Corridor auditors observed a “lack of focus” on patient care and “little discussion of eligibility” at regular patient-certification meetings. Clinical staff were undertrained, with a “high potential for care delivery failures,” and appeared reluctant to discharge inappropriate patients out of fear of being fired. Emails showed that the problems raised by the audit were much discussed among AseraCare’s top leadership, including its vice president of clinical operations, Angie Hollis-Sells.

One morning in the spring of 2011, Hollis-Sells strode into the old bank building that housed the Monroeville office, her expression uncommonly stern. Farmer knew at once that her role in the case had been exposed. She was sent home on paid leave, and that evening half a dozen colleagues showed up at her clapboard house in the center of town. Some felt betrayed. Their manager had kept from them a secret that might upend their livelihoods; worse, her accusations seemed to condemn them for work she’d asked them to do. But shortly afterward, when Farmer took a job as the executive director of a new hospice company in Monroeville, Richardson and several other former co-workers joined her.

Less than a year later, the Justice Department, after conducting its own investigation, intervened in the whistleblowers’ complaint, eventually seeking from AseraCare a record $200 million in fines and damages. As Barger informed his clients, the company was likely to settle. Most False Claims Act cases never reach a jury, in part because trials can cost more than fines and carry with them the threat of exclusion from the Medicare program — an outcome tantamount to bankruptcy for many medical providers. In 2014, Farmer traveled to Birmingham for her deposition, imagining that the case would soon end. But, in the first of a series of unexpected events, AseraCare decided to fight.

United States v. AseraCare, which began on Aug. 10, 2015, in a federal courthouse in Birmingham, was one of the most bizarre trials in the history of the False Claims Act. To build its case against AseraCare, the government had identified some 2,100 of the company’s patients who had been in hospice for at least a year between 2007 and 2011. From that pool, a palliative care expert, Dr. Solomon Liao, of the University of California, Irvine, reviewed the records of a random sample of 233 patients. He found that around half of the patients in the sample were ineligible for some or all of the hospice care they’d received. He also concluded that ineligible AseraCare patients who had treatable or reversible issues at the root of their decline were unable to get the care they needed, and that being in hospice “worsened or impeded the opportunity to improve their quality of life.”

Before the trial started, the judge in the case, Karon O. Bowdre, disclosed that she’d had good experiences with hospice. Her mother, who had an ALS diagnosis, had spent a year and a half on the service, and her father-in-law had died in hospice shortly before the trial. Principals in the case disagree about whether she disclosed that the firm handling AseraCare’s defense, Bradley Arant, had just hired her son as a summer associate.

The defense team had petitioned Bowdre to separate the proceedings into two parts: the first phase limited to evidence about the “falsity” of the 123 claims in question, and the second part examining, among other things, the company’s “knowledge of falsity.” The Justice Department objected to this “arbitrary hurdle,” arguing that the purpose of the False Claims Act was to combat intentional fraud, not accidental mistakes. “The fact that AseraCare knowingly carried out a scheme to submit false claims is highly relevant evidence that the claims were, in fact, false,” the government wrote. Nonetheless, in an unprecedented legal move, Bowdre granted AseraCare’s request.

Trial lawyers are expected to squabble over the relevance of the opposing party’s evidence — and, in the private sector, they are compensated handsomely for doing so. But the government lawyers seemed genuinely confused about what the judge would and wouldn’t allow into the courtroom during the trial’s “falsity” phase. In long sidebar discussions, during which jurors languished and white noise was piped in through the speakers, Bowdre berated the prosecution for its efforts to “poison the well” with “all this extraneous stuff that the government wants to stir up to play on the emotions of the jury.” Much of her vexation was directed at Jeffrey Wertkin, one of the Justice Department’s top picks for difficult fraud assignments. A prosecutor in his late 30s, he had a harried, caffeinated air about him and had helped bring about settlements in more than a dozen cases. This was only his second trial, however, and Bowdre was reprimanding him like a schoolboy. “It made me sick to watch her treatment of him,” Henry Frohsin, one of Barger’s partners, recalled. “At some point, I couldn’t watch it, so I just got up and left.”

The judge’s prohibition on “knowledge” during the trial’s first phase constrained testimony in sometimes puzzling ways. Richardson, for instance, could talk about admitting patients, but she couldn’t allude to the pressure she was under to do so. The audit by the Corridor Group that corroborated whistleblower claims was forbidden because it wasn’t directly tied to the specific patients in the government’s sample. Micca, the former medical director from Atlanta, was not allowed to testify for the same reason. Nonetheless, over several days, the government’s witnesses managed to paint a picture of AseraCare’s cavalier attitude toward patient eligibility. Its medical directors were part time, as is common in the industry, and workers testified that they’d presented these doctors with misleading patient records to secure admissions. One said that a director had pre-signed blank admissions forms. “Ask yourself: How could a doctor be exercising their clinical judgment,” Wertkin told the jury at one point, “if he’s signing a blank form?”

When Farmer took the stand, Wertkin asked if she was nervous. “A lot nervous today,” she replied. She thought the jurors might judge her for trolling for wheelchair ramps or other recruitment tactics. She needn’t have worried. Bowdre’s restrictions prevented Farmer from testifying about much of anything. “I felt like the judge did not want to know the truth,” she said. “The whole time that I was on the stand, I kept thinking, Why would you not listen to the story?”

The bulk of phase one was dominated by doctors: Liao, the government’s expert, read selections from thousands of pages of medical files to explain why he’d concluded that patients were ineligible, and AseraCare’s medical experts took the stand and disagreed with most of his conclusions. However, the crux of AseraCare’s defense was that the entire debate about eligibility was essentially moot because, although death is certain, its timing is not. A medical director who signed a hospice certification form would have had no way of anticipating whether a patient’s illness would deviate from the expected trajectory of decline. Even Medicare, the defense team emphasized, has noted that predicting life expectancy is “not an exact science.”

After nearly two months of testimony, the jurors deliberated for nine days on phase one. On Oct. 15, 2015, they found 86% of the patient sample ineligible for some period of hospice care. Elated, Barger rushed out of the courtroom to call Farmer and tell her that the jury had come back overwhelmingly in the government’s favor. The next part of the trial will be icing on the cake, she remembers thinking.

The next part never happened. A few days later, Bowdre made a startling announcement: She had messed up. The instructions that she’d given the jury had been incomplete, she said, and because of this “major reversible error” she was overturning the jury’s findings and granting a request by AseraCare for a new trial. She invited the government to submit evidence other than Liao’s opinion to prove that the claims were false; the government replied that the record presented ample evidence of falsity. Five months later, in March 2016, Bowdre granted summary judgment to AseraCare.

It’s unusual for a judge to overturn a jury’s findings, order a new trial and then declare summary judgment on her own accord, Zack Buck, a legal scholar at the University of Tennessee who studies health care fraud, told me. The case, he said, “just kept getting weirder.” Wertkin, who had expected to return to Washington, D.C., with that rare article — a jury verdict in a False Claims Act case — later said he felt as though the “rug had been ripped out from under me.”

In a widely circulated opinion, Bowdre wrote that clinical disagreement among doctors was not enough on its own to render a claim false. Otherwise, hospice providers would be subject to liability “any time the Government could find a medical expert who disagreed” with their physician, and “the court refuses to go down that road.” The Justice Department appealed Bowdre’s ruling, but many in the hospice industry celebrated the opinion. “There are huge implications,” Buck said. “So much of our system is based on a doctor’s discretion, and if you can’t say the doctor is wrong you’ve really hamstrung the government’s ability to bring these kinds of cases.” In op-eds and on the lecture circuit, defense lawyers for health care companies hailed the beginning of a post-AseraCare era.

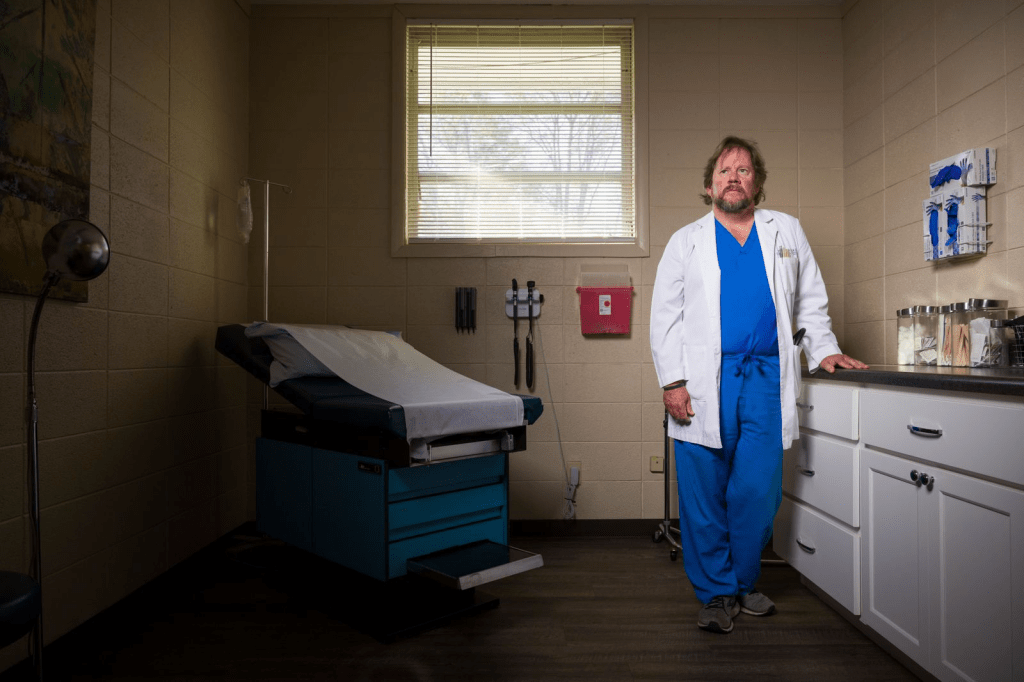

That year, Dr. Scott Nelson, a family practitioner in Cleveland, Mississippi, was wrapping up a lucrative tour of duty in the hospice trade. Since 2005, Nelson had referred approximately 763 patients to 25 hospices, 14 of which employed him as the medical director, according to a special agent in the Department of Health and Human Services’ Office of Inspector General. Some of Nelson’s patients, however, didn’t know that they were dying and a decade or more later remained stubbornly alive.

In the course of roughly six years, by the doctor’s own account, he received around $400,000 for moonlighting as the medical director at eight of the companies. Meanwhile, those hospice owners, some of whom were related to one another, received a total of more than $15 million from Medicare for the patients he’d certified. In a scheme that the special agent, Mike Loggins, later testified was spreading across the Mississippi Delta “like cancer,” hospices bused in vans of people to Nelson’s clinic. The owner of Word of Deliverance Hospice — one small-town provider that briefly put Nelson on its payroll — bought a $300,000 Rolls-Royce that was later confiscated by the government. Nelson, who was convicted earlier this year of seven counts of health care fraud, told me that he’d fallen victim to greedy hospice entrepreneurs who had done hundreds of “third-grader-level forgeries” of his signature when racking up illegal enrollments, and that he’d assumed other forms he’d signed were truthful. Nelson awaits sentencing and has filed a motion challenging the verdict.

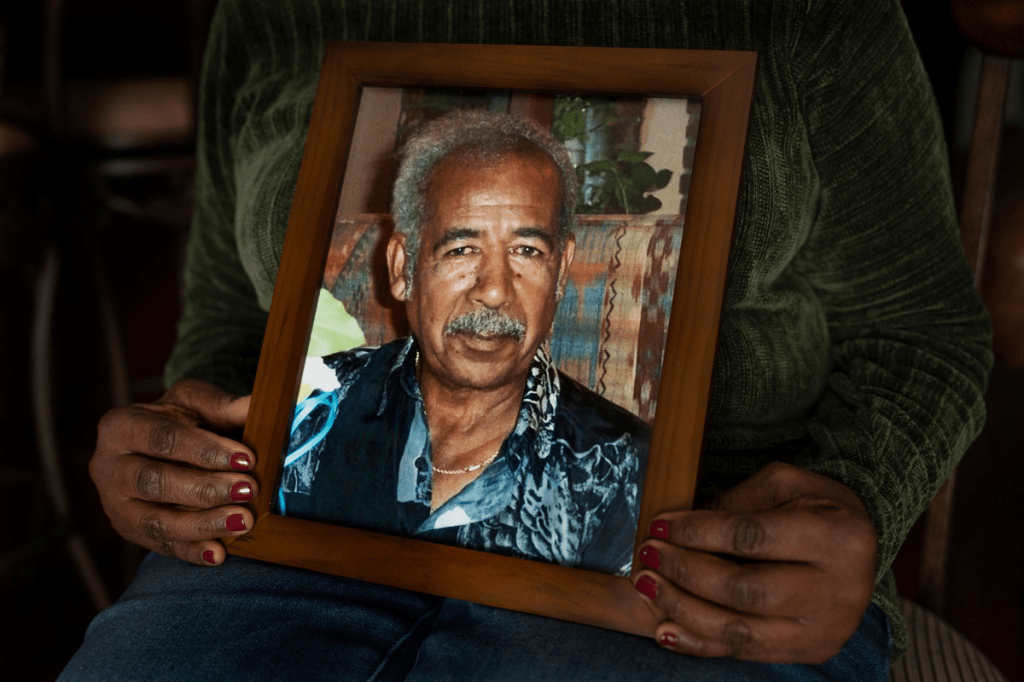

The Mississippi Delta has an acute shortage of primary-care providers — a problem that contributes to the region’s poor health outcomes. When I visited some of the fraud victims in the case, all of whom were Black, they told me that the experience of being duped had deepened their mistrust of a health care system that already seemed out of reach. Some of the patients Nelson had approved for hospice were in their 40s and 50s. One had cognitive disabilities, and another couldn’t read. Marjorie and Jimmie Brown, former high school sweethearts in their 70s, found out that they had been enrolled in Lion Hospice only in 2017, when Loggins knocked on the front door of their yellow brick bungalow. A worker for Lion had tricked the Browns into trading away their right to curative care, and Nelson — whom they’d never heard of, let alone seen — was one of two doctors whose names were on the paperwork.

Losing access to care is hardly the only thing that can go wrong for patients inappropriately assigned to hospice. In May 2016, Lyman Marble found his wife, Patricia, unresponsive and lying face down in their bed. At a hospital near their home in Whitman, Massachusetts, doctors were shocked by the high doses of opiates she’d been prescribed. An addiction specialist later observed that she was ingesting the equivalent of dozens of Percocet pills a day. Only after Lyman told the doctors to “flush her out like Elvis” did her family come to suspect that her health crisis was caused by hospice care itself.

The Marbles, who had been married for more than 50 years, worked together in a variety of jobs, among them operating an outer-space-themed carnival ride. Five years earlier, Patricia had been admitted to a hospice owned by Amedisys, the third-largest provider in the country. The diagnosis was end-stage chronic obstructive pulmonary disease.

She was 70 years old and had health troubles: She used a wheelchair and supplemental oxygen, and had diabetes, hypertension and a benign tumor that caused her pain. That pain had been treated by a fentanyl patch, but once she was in hospice the medical director, Dr. Peter Roos, prescribed morphine, Vicodin, Ativan and gabapentin, too. Over the next five years, he kept prescribing narcotics, recertifying her for hospice 30 times. (Roos, who said in a deposition that he prescribed morphine to ease Marble’s respiratory distress, did not respond to requests for comment.) Court documents later revealed that cash bonuses were a reward for good enrollment numbers at that branch of Amedisys, and that nurses had resigned after being pressured to admit and recertify patients who they didn’t think were dying.

While under the care of Amedisys, Patricia sometimes couldn’t remember who or where she was. “I felt like I was dead,” she later said. “It just made me feel like ‘That’s right, I’m in the right place because I’m going to die.’” But after Lyman learned that he could “fire hospice,” as he put it, and Patricia was slowly weaned from narcotics, her memory began to return and her breathing improved. Lyman, who had thought that he might lose his wife at any moment (at one point, Amedisys had asked if he was making funeral arrangements), was stunned by her transformation. Today, more than a decade after first enrolling in hospice, Patricia remains opioid-free and has described her lost years as like being on “the moon or someplace.” For that misadventure, the company billed Medicare almost half a million dollars. Last year, Amedisys settled a suit brought by the Marbles for $7.75 million. The company declined to comment, stating that the settlement was confidential.

Because pinpointing what constitutes a “good death” is nearly as difficult as determining what makes a good life, families may not always realize when hospice is failing them — even when they work in the industry. In November 2014, Carl Evans, a 77-year-old former janitor from Orange County, took a fall and, when hospitalized, was tentatively diagnosed as having end-stage thymus cancer. Soon after, he was discharged to a nursing home and enrolled in a hospice run by Vitas, one of the largest providers of end-of-life care in the United States. Andrea Crawford, one of his daughters, was a hospice nurse and had worked for the company early in her career. When she visited her father in his private room, which had a sofa and a flat-screen TV, he told her that he was being treated “like a king.”

Evans had been living independently, with his longtime girlfriend, before his fall. And, unlike many hospice patients, he remained mobile and gregarious, with a big appetite much noted in his charts. Early in the morning of Nov. 22, in search of a non-institutional meal, he climbed out a window and got on a bus to his girlfriend’s house. (His preferred ride, a lovingly maintained burgundy Trans Am, was unavailable.) A family friend eventually located him, 30 miles away.

On Evans’ return, Dr. Thomas Bui, a medical director at Vitas, placed an urgent order for him to receive phenobarbital, a barbiturate that is sometimes prescribed for agitation and can cause extreme drowsiness. A few days later, Vitas records show, Bui added Keppra, an anti-seizure medication that also has sedative properties, to the mix. Evans had no known history of seizures, and Crawford later suspected that the two drugs had been prescribed to subdue him for the convenience of the staff. After the addition of Keppra, his chart shows, Evans became wobbly on his feet and then so lethargic that he couldn’t get out of bed — though he remained alert enough to be terrified at his sudden decline. Crawford, concerned, attributed the change to the drugs he was taking, as did a Vitas employee, according to medical records. On Dec. 6, Evans died.

The official cause of death was cancer (hospice patients are not typically given autopsies), but Evans’ family filed a suit against Vitas and Bui. The lawsuit was settled, and Vitas denies allegations of wrongdoing. Bui, who said in a deposition that he medicated Evans to soothe his agitation, didn’t respond to requests for comment. The California medical board disciplined him for his handling of the case. He was placed on a three-year probation, during which he was prohibited from practicing alone, and was ordered to take a course on safe prescribing.

Malpractice cases against hospices are rare. As Reza Sobati, an elder-abuse lawyer who represented Evans’ family, told me: “The defense we often get in a nursing home case is that they were going to die anyway from their issues. That’s even harder to overcome with hospice, since a doctor has literally certified it will happen.”

Afterward, as Crawford reviewed medical charts and tried to understand what had happened to her father, she came across some notes that surprised her. When Evans entered hospice, Vitas had certified him for a heightened level of care intended for patients with uncontrolled pain or severe and demanding symptoms, which Evans didn’t have. As a hospice nurse, Crawford knew that such coding allowed Vitas to bill Medicare more — roughly four times more — per day than the rate for a routine patient. (Vitas denies inappropriate billing.)

In 2016, not long after Judge Bowdre dismissed the AseraCare case, someone began to anonymously contact companies that were the subjects of sealed qui-tam complaints. Those sealed complaints named the whistleblowers and the details of their accusations — information that the accused companies could use to get ahead of government investigators and their subpoenas or possibly to intimidate informers into silence. When a general counsel at a tech firm returned the mysterious voicemail, the insider, who called himself Dan, offered to share a complaint that named the company in exchange for a “consulting fee” of $300,000, preferably paid in bitcoin.

The lawyer alerted the FBI and began recording his conversations with Dan, including one arranging the handoff of the documents in Silicon Valley. On the morning of Jan. 31, 2017, Dan texted an FBI agent posing as one of the tech company’s employees the address of a hotel in Cupertino and instructed him to sit in the lobby on “a chair with a newspaper on it” just past “the water station.” Moments after the undercover agent sat down, Dan approached him with a copy of the complaint and was arrested. It turned out that Dan, who the FBI said was disguised in a wig, was the former government prosecutor Jeffrey Wertkin.

By then, Wertkin had left the Department of Justice to become a partner at the elite law firm Akin Gump, a job that paid $450,000 a year. His bio on the company’s website noted that, after leading more than 20 fraud cases, he had “first-hand knowledge of the legal and practical considerations that shape government investigations.” As part of a plot that his former Justice Department colleagues termed “the most serious and egregious example of public corruption by a DOJ attorney in recent memory,” Wertkin had, on his way out the door, taken at least 40 sealed qui-tam complaints belonging to the Civil Fraud Section.

He later ascribed his short-lived criminal spree, which his defense team compared to “a scene out of a B-grade action movie,” to what had occurred in Judge Bowdre’s courtroom. Wertkin’s wife said in a letter to the court that he had returned home from the AseraCare trial a “shell of a man” who drank heavily and spent several days watching movies on his phone in bed. Wertkin, who pleaded guilty in 2017 and was sentenced to two and a half years in prison, wrote in a statement that the government’s reversal of fortune in the case had led him “to question things I never doubted before. Does the system even work?” At his sentencing hearing, a prosecutor argued that the False Claims Act itself was one of Wertkin’s victims. “The False Claims Act is incapable of deterring fraud if the Department of Justice can’t be trusted by whistleblowers,” she said. “We have no way of measuring what chilling impact there might be on whistleblowers based on what the defendant did in compromising their secrecy.”

On Sept. 9, 2019, the False Claims Act took a second hit when the U.S. Court of Appeals for the Eleventh Circuit published a long-anticipated ruling on the AseraCare case. The judges concurred with Bowdre that the government needed more than the testimony of an outside expert to prove a claim was false. However, they vacated Bowdre’s summary judgment, saying that the prosecution should have been able to present all its evidence, including AseraCare’s alleged “knowledge of falsity,” and sent the case back to her courtroom for a retrial. “When the goalpost gets moved in the final seconds of a game,” the judges wrote, “the team with the ball should, at the least, have one more opportunity to punch it into the endzone.”

The government did not appear enthusiastic about trying the AseraCare case for a second time before Bowdre, though. Wertkin had been disbarred and was serving his sentence, and some of his former colleagues had left for the private sector. In February, 2020, 11 years after Farmer and Richardson filed their complaint, the government reached a settlement with AseraCare for a million dollars. As in most such settlements, AseraCare paid the sum, admitted no wrongdoing and was allowed to keep billing Medicare. Jack Selden, a partner at Bradley Arant who worked on the defense team, told the trade journal Law360, “When a case settles for $1 million where the claims have been for over $200 million, I think that speaks for itself.”

From a certain point of view, Wertkin’s attempts to shake down government contractors made manifest the transactional logic that governs the False Claims Act. Even to some of their biggest beneficiaries, these qui-tam settlements have come to resemble a mutual-protection racket: Executives keep their jobs and their companies keep billing Medicare; whistleblowers and their lawyers get a cut; and Justice Department attorneys can cash in on their tough-on-fraud reputations by heading to white-shoe law firms to defend the companies they once prosecuted.

In 2020, not long after AseraCare settled with the government, the company was bought for $235 million by Amedisys, which was facing qui-tam troubles of its own. A nurse from an Amedisys office in South Carolina had filed a lawsuit accusing the corporation of admitting ineligible patients, falsifying paperwork and handing out bonuses to staff to entice new recruits. (Amedisys denies the allegations.) This time, the government has declined to join the nurse’s case.

Earlier this year, when I visited Farmer at her home in Alabama, boxes were piled in the living room. She was preparing for an upcoming move to Missouri, where her husband had taken a job with a nonprofit hospice and home health company. Farmer had remained close with Richardson, who told me: “I have a whole different view of justice in America now. It’s definitely powered by the dollar bill.” But the women no longer talked about the trial. “Nobody really cared,” Farmer said. “The government didn’t care, the judge didn’t care, and all of these people’s money was wasted.” Sitting in a plush reclining chair, Farmer let out a short, sharp cough as she spoke. In December, she had been diagnosed as having an aggressive form of breast cancer, and the chemotherapy had left her vulnerable to lingering infections.

The hospice benefit imposes a dichotomy between caring for the living and caring for the dying, when, in truth, the categories are often indistinguishable. Most older people will face a chronic disability or a disease in the last years of their life and will need extra care to remain safely at home. That help is rarely available, and Americans often end up in a social-welfare purgatory, forced to spend down their savings to become eligible for a government-funded aide or a nursing home bed. “We all think it’s not going to affect us, but if you have a stroke and go bankrupt you’re not just going to go out and shoot yourself in the desert,” Dr. Joanne Lynn, an elder-care advocate and a former medical officer at the Centers for Medicare and Medicaid Services, told me. Once you cross over into the kingdom of the sick, she said, it’s easier to see that some problems classified as hospice fraud are really problems of the inadequate long-term-care system in this country.

In the 1970s, Lynn worked at one of the first hospices in the United States. At the time, most of the patients had cancer and died within weeks; the six-month guidance was originally designed around their needs. Today, the majority of hospice patients have chronic illnesses, including heart disease and dementia. And some of them — regardless of whether they have six months or six years to live — depend on hospice for in-home support and holistic services that would otherwise be unavailable. Yet under the current system, as the number of patients with ambiguous prognoses rises, providers (including ethical ones) are under financial pressure to abandon those who don’t die quickly enough. It’s a typically American failure of imagination that people with dire but unpredictable declines are all but left for dead.

Elisabeth Kübler-Ross thought she understood why societies isolate the old and the dying: They remind the rest of us of our own mortality. This aversion might partly explain why decades of warnings about hospice care — including a full quarter century of pointed alerts from the inspector general’s office at the Department of Health and Human Services — have gone largely unheeded. Recently, though, some of the reports were so disturbing (maggots circling feeding tubes, crater-like bedsores) that members of Congress have called for reforms, and the Centers for Medicare and Medicaid Services is enacting a few. The agency has just begun making available to the public a greater range of data on hospice providers, including the average number of visits that nurses and social workers make in the last days of a person’s life. More significantly, the agency now has the power to impose fines on problem providers, should it choose to use it. (Previously, the agency’s only consequential penalty for bad hospices was to boot them from the Medicare program, an option it seldom exercised.)

Some state lawmakers, too, are asking deeper questions about end-of-life care. This year, in the wake of a Los Angeles Times investigation, California placed a moratorium on new hospices, and state auditors raised alarms about a raft of tiny new hospices, some with fictional patients and medical staff, that were engaged in “a large-scale, targeted effort to defraud Medicare.” In Los Angeles County alone, there are more than a thousand hospices, 99% of them for-profit. By comparison, Florida, which, unlike California, requires new providers to prove a need for their services, has 51 hospices.

But when regulators close a door they sometimes open a window. Licensing data I’ve reviewed suggests that, as scrutiny of end-of-life-care providers intensified in California, the hospice boom traveled eastward. In Clark County, which contains Las Vegas, the number of new hospices has more than doubled in the past two years, and in Harris County, which encompasses Houston, the number has grown almost as quickly. Sheila Clark, the president of the California Hospice and Palliative Care Association, attributed some of the surge in new licenses to a scheme called “churn and burn.”

“Providers open up a hospice and bill, bill, bill,” she said. Once that hospice is audited or reaches the Medicare-reimbursement limit, it shuts down, keeps the money, buys a pristine license that comes with a new Medicare billing number, transfers its patients over and rakes in the dollars again. The directors of two nonprofit hospices in the Southwest told me that they had been accepting patients who were fleeing such new providers. Some patients switched because while they were with the startup hospices they hadn’t seen a nurse in two weeks, and no one was answering the phone.

On a rainy morning in November, I found myself in a vast, sand-colored commercial plaza on the outskirts of Phoenix. The complex was designed in the style of a Spanish hacienda, with a central courtyard, a stone fountain and a stately bell tower. Maricopa County was another place where the number of hospices had doubled in two years; 33 new ones, licensing data indicated, had appeared at this single address. There was no building directory, but eventually I realized that most of the hospices were clustered together on the basement level. All the hospices listed the same phone number for inspectors to call, and some had taped the same apology to their door: “Sorry we missed you! We’ll be back in 45 mins, if you need immediate assistance pls call us.” Each time I called the listed number, I got an answering machine whose mailbox was full.

When I buzzed the Ring video doorbell of B-116, which housed at least nine hospices, I was told by the man who answered that the manager was currently on the other side of the building. When I walked to the other side and rang B-117, the same man picked up. Sensing my confusion, he said, “I’m just the voice at the door.” His name was Ted Garcia, and he had been hired to monitor the hospices from his laptop at home. I told him that I was searching for a registered nurse named Svetik Harutyunyan, who was listed as the CEO of multiple hospices in the neighborhood, among them Ruby, Sapphire and Garnet, which were within the complex, as well as Platinum, Bright Star and First Light, down the road. I told Garcia that I particularly wanted to ask Harutyunyan about Ruby Hospice, which I’d seen listed for sale in an online ad for a quarter of a million dollars.

The day before, I’d searched for her at a squat building in Los Angeles that had drawn auditors’ attention. That address holds, according to state records, 129 hospices — a tenth of the city’s supply. When I knocked on the door of a hospice that the licensing data had linked to Harutyunyan, a worker told me that no one by that name was involved. Later, when Harutyunyan and I spoke by phone, she acknowledged owning hospices in California and Arizona and said that the arrangement was legal. She had wanted every member of her family to have one, she said.

Garcia told me through the doorbell that, as far as he understood, the hospices he monitored weren’t seeing actual patients; instead, the offices were a kind of “holding pen” to keep the licenses viable with requisite physical addresses until demand could be drummed up. The remote work was dull, he allowed. Apart from inspectors occasionally stopping by and transient people defecating outside the doors at night, my visit was the most action he’d seen in months. As the rain let up and I sat in the deserted courtyard trying to decide which of Harutyunyan’s holdings to visit next, it occurred to me that this world of paper hospices — empty of patients, valued at six figures, watched over by virtual guards — might be the clearest expression of the industry’s untamed frontier that I was going to encounter.

Later that afternoon, Garcia told me that he’d begun to research whether he could open a hospice himself. The market was bigger and more lucrative than he’d realized. People in Montana and Texas and Tennessee, he said, were posting ads online for “turnkey-ready hospices” for as much as half a million dollars. He called an ex-cop he knew to see if he wanted in. “We can turn a profit and split it,” he said.