“Value-based care” in UnitedHealth’s Optum division apparently means fewer doctors for fatter margins.

UnitedHealth Group announced last week that it plans to cut thousands of doctors from its network, a move CEO Stephen Hemsley said will increase profits for the country’s richest health care conglomerate.

UnitedHealth assembled a network of nearly 90,000 physicians across the country as it bought hundreds of physician practices, began managing the Medicaid program in many states and became the biggest Medicare Advantage company. It also owns one of the nation’s largest pharmacy benefit managers, Optum Rx.

Of those 90,000 doctors, the company says fewer than 10,000 are currently directly employed by UnitedHealth. The company has been gobbling up a broad range of medical facilities in recent years, buying or creating nearly 2,700 subsidiaries and gaining direct control or affiliation with 10% of doctors working in the U.S. in the process.

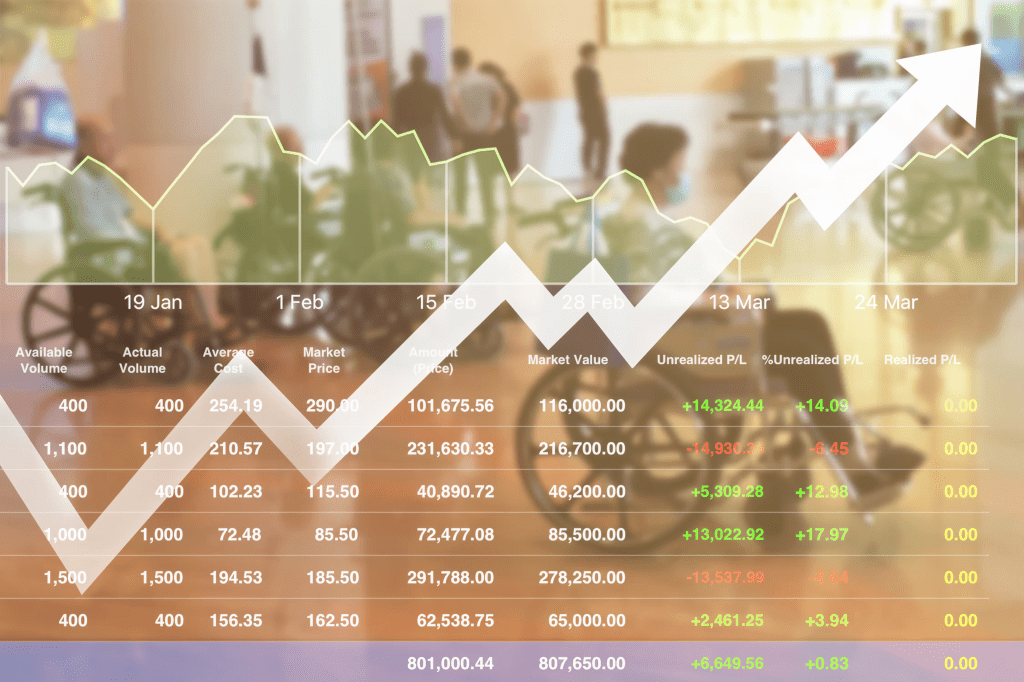

The announcement by Hemsley came during a third-quarter earnings call with investors last week, when UnitedHealth announced it made $4.3 billion in profit in the last three months by generating revenues of $113 billion.

Read more here on how they did that. Spoiler alert: It involves raising health care premiums and collecting billions more from the Medicare Trust Fund and seniors.

Hemsley said the company’s health care services division, Optum Health, needed to consolidate its physician rolls to improve its bottom line.

He passed questions about how that will be done to Optum’s CEO Patrick Conway, who said too many doctors in the network weren’t aligned with UnitedHealth’s business model, which he called “value-based care.”

“We are moving to employed or contractually dedicated physicians wherever possible,” Conway said.

Overseeing an empire that offers health insurance, pharmacy benefits and doctors who provide care and write prescriptions, UnitedHealth has become America’s third-richest company behind Walmart and Amazon. There are 29.9 million Americans enrolled in UnitedHealthcare’s commercial plans, 8.4 million in its Medicare Advantage plans and 7.5 million in state-run Medicaid programs.

In 2024, the company brought in more than $400 billion in revenue, according to its financial filings.

Americans’ health care premiums are expected to rise drastically in 2026 after climbing as much as 6% on average this year compared to 2024.

UnitedHealth’s decision to remove doctors from networks means that many of its patients will have to find new, in-network physicians unless they change their insurers.

UnitedHealth isn’t alone in taking steps to trim its medical expenses to boost its bottom line. Both CVS Health, which owns Aetna, the PBM CVS Caremark and more than 9,000 retail pharmacies, and Cigna, which owns the PBM Express Scripts, also told investors they are implementing plans to improve earnings next year.

CVS Health is just behind UnitedHealth at No. 5 on the country’s Fortune 500 list, bringing in nearly $373 billion in revenue last year. Cigna is 13th with $247 billion in revenue.