Elevance’s Anthem Blue Cross plans are joining Big Insurance’s latest profit play — cutting payments to hospitals and providers under the pretense of reducing patients’ out-of-pocket costs.

Anthem Blue Cross plans have joined UnitedHealth and Cigna in taking extreme measures to satisfy Wall Street but penalize hospitals and potentially thousands of doctors and physician groups that Anthem excludes from its provider networks.

What Anthem is proposing is not only extreme but brazen in that it goes way beyond what any managed care company I know of has ever undertaken to pad its bottom line by reducing patient choice. It wouldn’t just restrict access to certain providers, it would effectively eliminate access.

Anthem, which is owned by the for-profit corporation Elevance Health Inc., has notified hospitals in 11 of the 14 states where it operates that starting in January it will slash reimbursements by 10% every time a doctor who works in the hospital – but who is not in Anthem’s network – provides care to a patient enrolled in an Anthem health plan.

The move clearly will save Elevance money and help it meet its shareholders’ profit expectations, but it will be a potential nightmare and administrative expense for thousands of hospitals and outpatient facilities. And it could put many independent physician practices out of business.

As Fierce Healthcare reported Friday, Anthem will impose an administrative penalty equal to 10% of the allowed amount on a hospital or outpatient facility’s claims that include out-of-network providers. If those facilities don’t meet Anthem’s terms, they will be at risk of being dropped from Anthem’s network.

Anthem’s announcement comes on the heels of UnitedHealth’s disclosure to investors last month that it plans to dump thousands of doctors from its networks to boost profits. A UnitedHealth executive said during the company’s third quarter call with shareholders that there were too many doctors in the company’s network who were not aligned with UnitedHealth’s business model, which he called “value-based care.”

“We are moving to employed or contractually dedicated physicians wherever possible,” said Patrick Conway, CEO of UnitedHealth’s Optum division, which has bought hundreds of physician practices over the past several years. UnitedHealth is already the biggest employer of doctors in the country.

And last month, Cigna began reducing payments to many doctors automatically by resurrecting a practice called downcoding that was banned by a federal court more than two decades ago. Cigna also is threatening to drop hundreds of hospitals and outpatient facilities operated by Tenet Health from its provider network next year.

The stock prices of all three insurers have been under pressure this year as shareholders have sold millions of their shares in reaction to what they consider bad news from the companies. Most investors consider increases in paid medical claims to be bad news and a threat to the value – and earnings potential – of their holdings.

Anthem claimed in its notice to hospitals and other facilities last month that it is implementing the new policy “to support patient care and to help reduce out-of-pocket expenses for our members.” The notice went on to say that, “As a participating facility in Anthem’s care provider network, your role in guiding members to in-network care providers is vital in ensuring members receive high-quality, cost-effective, and coordinated care.”

Sounds good, right? But how is a patient to know that the doctors in Anthem’s network are really the ones that truly deliver high-quality coordinated care? Could it be that the top priority of the insurer is to include providers in its network who agree, first and foremost, to reimbursement terms especially favorable to the insurer?

And for hospitals, this could lead to higher administrative costs in trying to figure out which doctors are available at any given time to treat an Anthem patient. A highly regarded anesthesiologist might be just fine – and available – to treat patients insured by Cigna or Aetna or Humana, but off limits to treat an Anthem-insured patient. The hospital will have to be especially vigilant to keep that doctor out of the operating room when an Anthem patient needs surgery. If it slips up the hospital could get booted out of Anthem’s network. The doctor, however, would not be able to bill the patient for any amount because of the federal No Surprises Act (NSA), which prohibits balance-billing.

Anthem’s claim that it is taking this action to reduce patients’ out-of-pocket expenses is especially rich when you remember that Anthem and other big insurers created the problem Anthem says it is seeking to address. Anthem, Cigna, UnitedHealth and other big insurers led what became an industry-wide strategy in the early 2000s to force as many of their health plan enrollees as possible – and as soon as possible – into high-deductible plans. That strategy was so successful that more than 100 millions Americans – the vast majority of whom have health insurance – are mired in medical debt.

Fierce Healthcare quoted an Elevance executive as saying that the new Anthem policy “was designed in response to provider behavior under the independent dispute resolution (IDR) process” established by the No Surprises Act. He said Anthem had seen “a consistent pattern of IDR being used as a ‘back-door payment channel’ for pricey, nonemergent procedures.”

But as HEALTH CARE un-covered reported recently, research is showing that insurers are manipulating the IDR process to their advantage by exploiting loopholes in the NSA. Doctors have told me that even when they prevail in a dispute, insurers often refuse to pay promptly, if at all, and they report long delays, repeated administrative hurdles, and in some cases outright nonpayment of arbitration awards. And a report published last week in Health Affairs describes the “hidden incentives” of insurers in the IDR process that the authors say add costs to health plans and beneficiaries “and the health care system at large.”

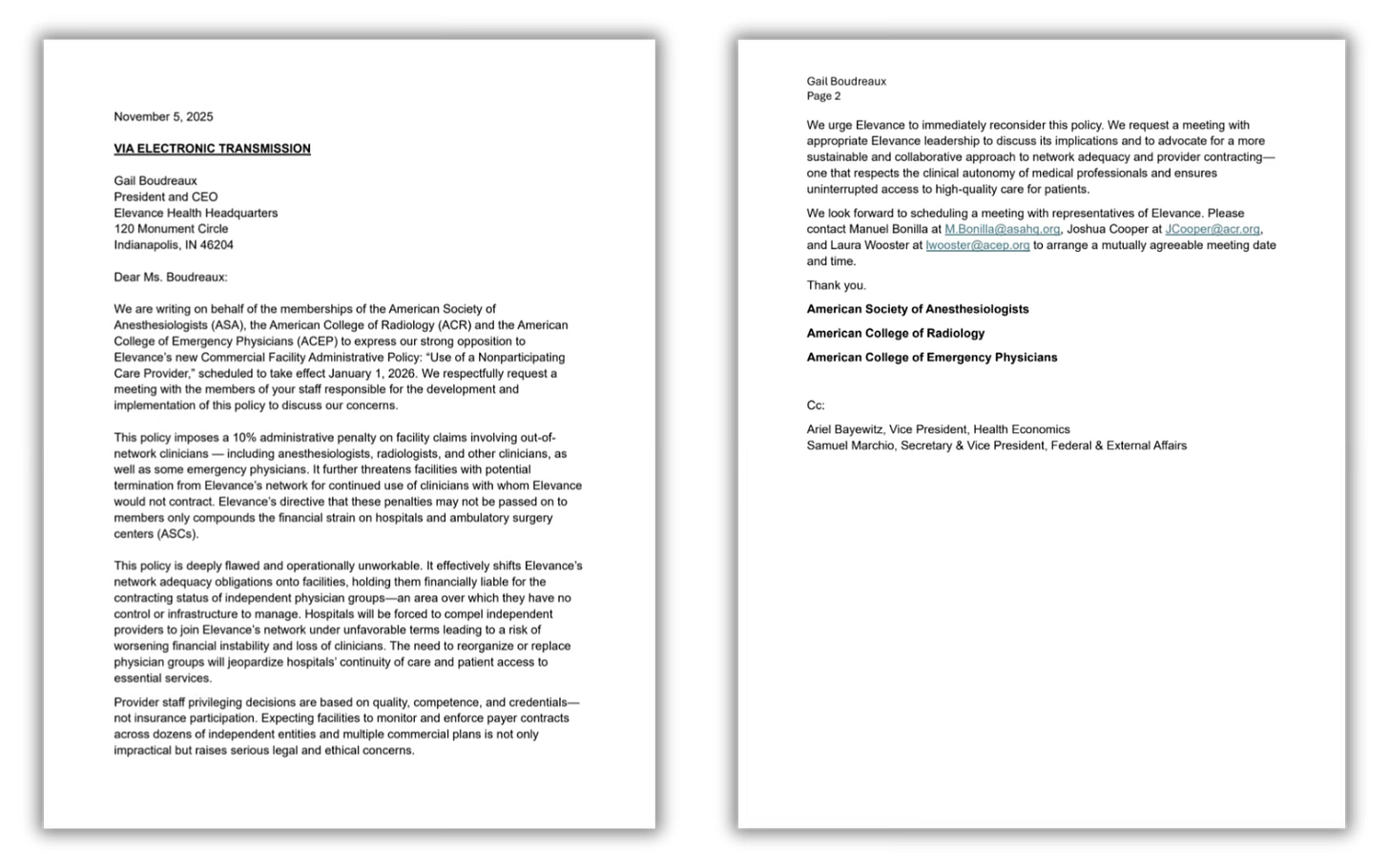

Independent practice physicians have begun raising alarms about Anthem’s new policy. And on Wednesday, medical societies representing thousands of doctors sent a letter to Elevance CEO Gail Boudreaux protesting Anthem’s plans and asking for a meeting.

“This policy is deeply flawed and operationally unworkable,” they wrote. “It effectively shifts Elevance’s network adequacy obligations onto facilities, holding them financially liable for the contracting status of independent physician groups–an area over which they have no control or infrastructure to manage. Hospitals will be forced to compel independent providers to join Elevance’s network under unfavorable terms leading to a risk of worsening financial instability and the loss of clinicians. The need to reorganize or replace physician groups will jeopardize hospitals’ continuity of care and patient access to care.”

The letter went on to say that, “Expecting facilities to monitor and enforce payer contracts across dozens of independent entities and multiple commercial plans is not only impractical but raises serious legal and ethical concerns.”

If the doctors can’t persuade Boudreaux to ditch the new policy, people enrolled in Anthem plans who need care in a hospital or outpatient facility next year could face confusion and delays in getting that care, and the facilities currently in their network might be kicked out of it if they make any mistakes.

Doctors’ concern about Anthem’s policy cannot be dismissed as an overreaction to one company’s business decision. It poses an existential threat to physician practices that want to stay independent and not sell out to either a hospital system or an insurance company. If the other health insurers follow Anthem’s lead – and there is no reason to think they will not – the number of doctors in independent practice in the United States will dwindle to extinction. There aren’t many left as it is.

Because of the control Wall Street now has over the health insurance industry, Boudreaux is likely less concerned about physician autonomy than what investors think and want, and she is under the gun to get back into their good graces in a matter of months. Her company’s shares have lost a third of their value since the first of this year. If she can’t demonstrate that she’s getting Elevance back on track to profitable growth, she’ll be out of a job soon.

Lawmakers and regulators at all levels of government need to keep an eye on this and intervene if doctors and Anthem patients can’t change her mind.