The government shutdown has left many federal workers furloughed, caused nationwide flight delays, left small businesses unable to access loans and put nonprofit services in jeopardy. It’s only expected to get worse.

As Congress remains deadlocked over passing a stopgap measure to reopen the government, thousands of Americans are at risk of losing benefits from the Supplemental Nutrition Assistance Program (SNAP); the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC); and other programs at the beginning of November.

An additional burden on Americans is the start of open enrollment for the Affordable Care Act (ACA), also known as ObamaCare, on Nov. 1, where they will see more costly health insurance premium plans unless lawmakers act.

Democrats and Republicans have spent weeks pointing fingers at each other, with no deal in sight. The Senate on Tuesday failed to advance a Republican stopgap measure to end the shutdown for the 13th time, while the House was out of session and President Trump was traveling abroad.

With uncertainty around the shutdown’s timeline growing day by day, here are six ways Americans will start to feel more of the shutdown’s impact.

Federal employees

At least 670,000 federal workers have been furloughed while about 730,000 are working without pay as of Oct. 24, according to data from the Bipartisan Policy Center, a think tank based in Washington, D.C. The center estimates that if the shutdown continues through the beginning of December, federal civilian employees will miss roughly 4.5 million paychecks.

The American Federation of Government Employees (AFGE), the nation’s largest federal workers union, urged Congress to pass a “clean” funding measure known as a continuing resolution to reopen the government. AFGE President Everett Kelley said in an Oct. 27 statement, “No half measures, and no gamesmanship. Put every single federal worker back on the job with full back pay — today.”

However, House and Senate Democrats have resisted pressure from the union.

“I get where they’re coming from. We want the shutdown to end too. But fundamentally, if Trump and Republicans continue to refuse to negotiate with us to figure out how to lower health care costs, we’re in the same place that we’ve always been,” Sen. Tina Smith (D-Minn.) told The Hill on Tuesday.

SNAP and WIC

The U.S. Department of Agriculture (USDA) said benefits won’t be issued on Nov. 1 for SNAP, a program that helps low-income families afford food. Nearly 42 million Americans rely on SNAP benefits every month, according to data from the USDA.

Though the USDA formed a plan earlier this year that said the department is obligated to use contingency funds to pay out benefits during a shutdown, it has since been deleted. The USDA wrote in a memo this month that the contingency fund is only designed for emergencies such as “natural disasters like hurricanes, tornadoes, and floods, that can come on quickly and without notice.”

Democratic officials in more than two dozen states sued the Trump administration this week, arguing the USDA is legally required to tap into those funds. But House Speaker Mike Johnson (R-La.) has claimed those funds are not “legally available.”

Families who rely on WIC, a program that provides food aid and other services to low-income pregnant and postpartum women, infants, and children younger than 5 years old, could also face trouble. The White House had provided $300 million to WIC to keep the program afloat in early October. But 44 organizations signed on to an Oct. 24 letter from the National WIC Association to the White House requesting an additional $300 million in emergency funds, warning that “numerous states are projected to exhaust their resources for WIC benefits” on Nov. 1.

Military pay

Payday is coming up at the end of this week for members of the military.

Earlier this month, Trump directed Defense Secretary Pete Hegseth to “use all available funds” to pay troops. Officials ended up reallocating $8 billion in unspent funds meant for Pentagon research and development efforts toward service members’ paychecks. The administration also received a $130 million donation from a private donor to help cover military members’ paychecks.

Vice President Vance said he believes active-duty service members will get paid this Friday. But Treasury Secretary Scott Bessent told CBS News’s Margaret Brennan on Sunday that troops could go without pay on Nov. 15 if the shutdown continues.

Senate Democrats blocked a bill sponsored by Sen. Ron Johnson (R-Wis.) earlier this month to pay active-duty members and other essential federal workers.

ACA subsidies

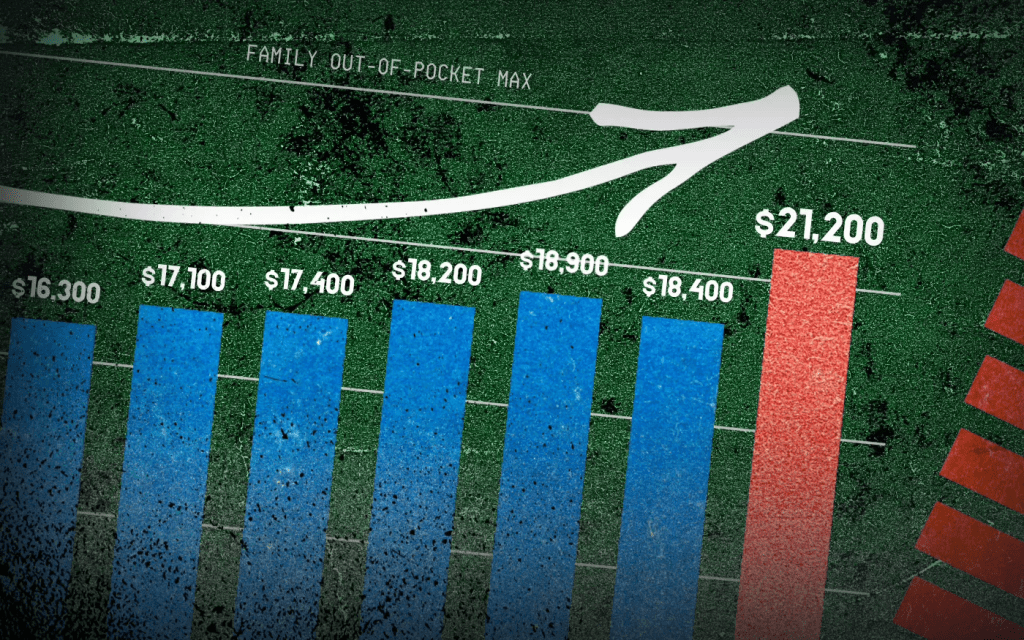

At the center of the shutdown fight is the ACA subsidies, which are set to expire at the end of this year. Democrats have been urging Republicans to extend the subsidies, arguing that ACA health insurance premium costs will increase if no action is taken.

Americans can choose their insurance plans for next year on the federal Affordable Care Act exchange website starting Saturday. An analysis from KFF found that without the subsidies extended, Americans will see their marketplace premium payments increase by 114 percent.

Republicans have been firm in their position of reopening the government first before discussing the ACA subsidies.

“The expiring ObamaCare subsidy at the end of the year is a serious problem. If you look at it objectively, you know that it is subsidizing bad policy. We’re throwing good money at a bad, broken system, and so it needs real reforms,” Speaker Johnson said at a Monday press conference.

Head Start

About 140 Head Start programs across 41 states and Puerto Rico serving more than 65,000 children could go dark if the shutdown goes past Nov 1., according to a joint statement from more than 100 national, state and local organizations focused on childhood education and development.

“Without funding, many of these programs will be forced to close their doors, leaving children without care, teachers without pay, and parents without the ability to work,” the statement says.

Head Start programs are designed to help low-income families and their children from birth to age 5 with a focus on health and wellness services, family well-being and engagement and early learning, according to its website.

Nonprofits

Diane Yentel, president and CEO of the National Council of Nonprofits, told The Hill in a statement that the shutdown has forced many nonprofits to halt their operations because of frozen federal reimbursements and grants.

The nonprofits include those handling wildfire recovery in Colorado, housing vulnerable youth in Utah and helping with conservation work in Montana, Yentel said. Many federal workers without pay have also turned to their local food banks, further putting a financial strain on nonprofits.

“With the November 1 cutoff of SNAP and WIC looming, the situation will get even worse. Nonprofit food banks are already facing rising grocery costs and increased demand, including from federal workers and military families,” Yentel said. “If millions of Americans suddenly lose access to these life-saving nutrition programs, local nonprofits will be overwhelmed, and far too many seniors, children, and families will go without help.”