Cartoon – Understanding the Value of Teamwork

Industry consolidation was listed as the most important trend of the year, leading the way with 25.2% of the votes, followed by consumerism at 14.4%.

Definitive tracked 803 mergers and acquisitions along with 858 affiliation and partnership announcements last year, a trend that is not expected to slow in 2019.

Thirty-five percent of healthcare M&A activity occurred in the long-term care field, according to CEO Jason Krantz.

Widespread industry consolidation as well as the growing influence of consumerism registered as the most important trends healthcare leaders are paying attention to in 2019, according to a Definitive Healthcare survey released Monday morning.

Industry consolidation was listed as the most important trend of the year, leading the way with 25.2% of the votes, followed by consumerism at 14.4%.

Other topics that received double-digit percentages of the vote were telehealth at 13.8%, AI and machine learning at 11.4%, and staffing shortages at 11.1%. Cybersecurity, EHR optimization, and wearables rounded out the list.

The top results are generally in-line with some of the top storylines from the past year in healthcare, including focus on several vertical megamergers and longstanding business models being redefined by consumer behavior.

Jason Krantz, CEO of Definitive Healthcare, told HealthLeaders that healthcare is becoming increasingly more complicated and leaders are looking at a host of business strategies to navigate industry challenges or emerging market conditions.

“Something that’s on the mind of all of the people that [Definitive Healthcare] has been talking to, whether they are pharma leaders, healthcare IT companies, or providers, is that they’re constantly grappling with all of these new regulations, consolidation, and new technologies,” Krantz said. “[They’re asking] ‘What does that mean for my business and how do I address my strategy as a result?'”

In 2018, Definitive tracked 803 mergers and acquisitions along with 858 affiliation and partnership announcements, a trend Krantz does not expect to slow in 2019.

While Krantz cited some of the major health system mergers from last year as examples, he said another area that is experiencing widespread M&A activity is the post-acute care side.

Thirty-five percent of healthcare M&A activity occurred in the long-term care field, according to Krantz, and this is indicative of hospitals seeking to control costs and drive down rising readmission rates.

It also relates to another issue likely to accelerate in the coming years, which are the staffing shortages facing providers.

The sector currently suffering the most are long-term care facilities, which struggle to maintain an adequate nursing workforce due to the advanced age of most doctors and nurses in the face of the rapidly aging baby boomer generation. Krantz warns that all providers are likely to face these issues going forward.

Krantz also expects consumerism to hold steady as a top issue facing healthcare, citing the growing popularity of urgent care centers and the interconnection of telehealth services to provide patients with care outside of the traditional delivery sites.

However, the growth of these are reliable business options are all dependent on figuring out an adequate reimbursement rates for telehealth services rendered, Krantz said, which has not been fully addressed.

“I think until [telehealth reimbursement rates] get completely figured out, it’s hard for the providers to invest heavily in it,” Krantz said. “This is why you see a lot of non-traditional providers getting into telehealth, but I think it is something that people are thinking about and they know they need to adjust to, though nobody’s stepping up and being first in [telehealth] right now.”

For AI, machine learning, wearables, and cybersecurity, though the responses are split into smaller amounts, Krantz emphasized their combined score, which encompasses more than 25% of total votes, as a sign that healthcare leaders are paying attention to the area despite market complexity.

He added that they are all interconnected issues that deal with technological changes health systems are aware they will have to address in the coming years.

One issue related to harnessing technological change is EHR optimization, which Krantz believes leaders on the provider side are finally starting to gain excitement around. He said most leaders who have waited years to set up a comprehensive EHR system and input data are in-line to now utilize the data in their respective system.

“There’s a lot of great data in there and people are starting to figure out how to utilize that and improve patient outcomes based on the sharing of data,” Krantz said.

A year after facing a federal funding cliff, CHCs in expansion states are thriving.

CHCs provide care to 27 million patients each year, according to the Health Resources and Services Administration.

The financial stability of CHCs, which serve medically vulnerable communities, is a benefit for health systems.

Community health centers (CHC) operating in states that expanded Medicaid under the ACA are 28% more likely to report improvements to their financial stability, according to a Commonwealth Fund report released Thursday morning.

CHCs in Medicaid expansion states reported were more likely to report improvements in their ability to provide affordable care to patients, 76%, than their counterparts in non-expansion states, 52%.

More than 60% of CHCs in expansion states reported improved ability to fund service or site expansions and upgrades for facilities, while only 46% of CHCs in non-expansion states said the same.

These facilities reported higher levels of unfilled job openings for mental health professional and social workers, while also implying a greater openness to operating under a value-based payment model.

The success and viability of CHCs are essential for larger health systems, according to Melinda K. Abrams, M.S., vice president and director of the Commonwealth Fund’s Health Care Delivery System Reform program, adding that CHCs act as a strong foundation for providing primary care to medically vulnerable populations in rural communities.

Abrams said that by making sure patients are insured and receiving care up front, rather than delaying treatment and exacerbating their condition, they are less likely to end up in a hospital emergency room and contribute to a rise in uncompensated care for hospitals.

She also told HealthLeaders that populations with higher enrollment rates make it easier for CHCs to innovate, invest in technology, hire new staff, train existing the workforce, and adopt new models of care.

“[Medicaid expansion] makes it a lot easier to provide high-quality comprehensive care when [a CHC’s] patients have health insurance,” Abrams said. “In this particular instance, it’s a lot easier to innovate and have financial stability when you have more paying patients, which means that it is easier if you are [a CHC] in a state that has expanded Medicaid.”

The Commonwealth Fund report provides a welcome note of positivity for CHCs, which serve vulnerable populations primarily composed by the uninsured, but have faced funding challenges in the past.

During the budget battles that produced multiple government shutdowns throughout the early portion of 2018, advocates wondered anxiously whether Congress would provide long term funding to the nearly 1,400 CHCs operating at nearly 12,000 service delivery sites across the country.

According to the Health Resources and Services Administration, CHCs provide care to more than 27 million patients annually.

The Community Health Center Fund (CHCF), created in 2010 as a result of the ACA, is the largest source of comprehensive primary care for medically underserved communities, according to the Kaiser Family Foundation.

However, Abrams said that Medicaid expansion has also been a beneficial tool for CHCs, as they have begun to see more insured patients while also benefiting from Medicaid reimbursements, even though they are low compared to other reimbursement rates.

CHCs in states that expanded Medicaid have been able to grow the services that are offered while assisting in the ongoing fight against the opioid epidemic, according to the Commonwealth Fund report.

Abrams said that one downside to the growing success of CHCs have been the unfilled positions, mostly for mental health providers, that are falling behind rising demand levels, though she added that this finding is not surprising.

“I think it’s in part because the supply of the workforce is lagging a little bit behind the demand,” Abrams said. “There’s no reason to think that over time that this gap wouldn’t be closed. But we did find that as a challenge, that [CHCs] have a lot of positions open [yet] they’re hiring. A number of these CHCs are in economically depressed areas, so the good news is that there are some jobs available.”

CHCs are much more likely to participate in value-based payment models as a result of Medicaid expansion, with Abrams explaining that changes in payments and delivery models are common during insurance expansions.

She sees the continued progress made on the value-based front by CHCs as a way to “promote better healthcare and save money” over time.

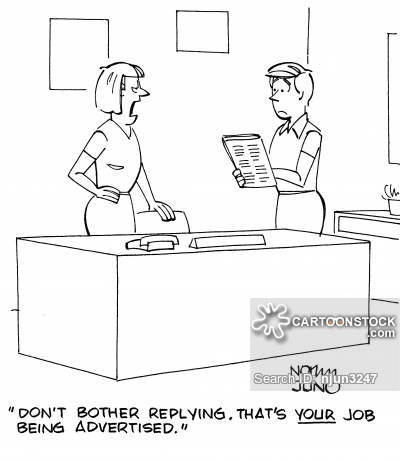

We live in a time when acrimony and resentment seem to be at an all-time high. These days, individuals feel comfortable hiding behind screens to voice their opinions without giving much thought to the repercussions or the feelings of others.

I freely acknowledge that there have always been mean-spirited people in our lives, workplaces, schools and communities. However lately, it seems as if there is carte blanche to act like a jerk. Maybe this is why kindness seems a bit harder to come by, and why I find myself mentoring young people on how to deal with difficult colleagues more than usual.

I am certainly not immune to jerks. We’ve all dealt with them — the mean-spirited colleague who thought they knew everything. The person who did not like to share their toys in the proverbial sandbox. The team member who jumped at every opportunity to claim credit for success, plow over others or immediately blame others for failure. Simply put, we’ve all worked with jerks.

While jerks can be highly effective at delivering results, don’t confuse value with productivity. By this, I mean that the toxicity jerks infuse into a team and their work environment can significantly outweigh their contributions. These folks tend to be mean-spirited, manipulative, and can often undermine both the organization’s work and their colleagues’ productivity. They cause strife and, in some cases, drive excellent colleagues away from an organization. At the end of the day, they do far more harm than good, and they make the work environment an unpleasant place to spend the day.

Throughout my career, I have managed a few so-called jerks. While it has not always been easy, and I have certainly made my share of mistakes, I’ve learned to effectively deal with these personalities along the way. Beyond that, I’ve developed some management techniques for how to handle them.

As far as I’m concerned, jerks need not apply to positions within my organization. I have adopted a strict “jerk-free” policy for every organization I lead. From the moment I walk in the door on the first day, I articulate that jerks are not welcome. Personally, I would much rather work with a less experienced person who is kind-hearted and receptive to training than an arrogant jerk, any day of the week.

So, how do you move from simply putting up a “jerks aren’t welcome sign” to creating a jerk-free culture? How can you cultivate anti-jerk behavior across your team and coach others to do the same?

1. Communicate. Talk it out from the outset. You need to communicate, communicate and communicate again. Let your teammates and colleagues know what you need and what you expect. You want to set expectations from the outset, so everyone is on the same page, and there is no room for confusion or deniability. You should also be open, transparent and honest. While there are times it is not the easiest thing to do, the payoff is huge and will keep things running smoothly.

2. Lead by example. Jerks gravitate to jerks. Do your best to be kind, helpful, open and honest. It will do more to inspire others and generate positivity than anything else.

3. Build trust. You build trust and inspire loyalty when you foster an environment where differences of opinion are welcomed and encouraged. Where there is trust and good feeling, it makes it harder for jerks to thrive.

4. Let them know. If someone is a jerk and you feel uncomfortable, let them know. Don’t let behavior that bothers you fester. You want to nip it in the bud. In a positive non-judgmental language explain to them how their behavior is not working for you and reflect on how things can change. I always say the first approach to any situation should be: acknowledge, reflect, move forward.

5. Value differences. It’s important to celebrate differences and the wide variety of skills team members bring to the table. If folks feel they have a unique niche to fill and special skills to contribute, they are less likely to be passive aggressive and will feel confident in their contributions.

6. Celebrate. Having a good time is essential. Work is hard, and it’s important to let off a little steam sometimes. I can’t encourage enough the opportunity to have fun and facilitate opportunities where colleagues can get together outside of the office.

7. Coach it out. I have found that all is not lost when it comes to jerks. There is hope. Some jerks can be rehabilitated. They just need effective coaching to turn their attitude around. Of course, there are rare cases when a jerk is, and always will be, a jerk. Unfortunately, there are times when you will have to make the tough call and leave them behind.

A jerk-free workplace certainly has numerous benefits. Not only is your space more enjoyable and pleasant, but a no-jerk policy also attracts and contributes to retaining the best possible team members — those who are incredibly productive, highly effective and extremely positive.

What team member wants to sign up to work with jerks? A positive environment drives productivity as time is not wasted battling destructive behavior or playing pointless games. It also enhances quality and helps delivers excellent customer service, because team members are happy in their work. The ripple effect of that is that they pass it along to anyone with whom they interact.

Think about it: Your team is like a family, and frankly, we often spend more time with them than anyone else in our lives. While we all enjoy a wacky cousin or a wisecracking uncle, no one likes to engage with the family member who is always complaining or rude to others. So, do you and your fellow team members a favor and say goodbye to the jerks. Make more room at the table for positive and enjoyable folks. Everyone will be glad that you did.

Abstract: This article is the first in a series that explores the critical success factors of being successful in a competitive recruitment process. Getting a ‘gig’ as an interim requires essentially the same method as landing a permanent job. The primary difference is that the cycle time from initial contact to the decision on a potential interim engagement is much faster than it is when a permanent candidate is under consideration. The articles on this topic are focused on helping the reader improve their probability of success in fiercely competitive recruitment, and all recruitments are competitive.

I have been involved with a lot of recruiting, and it is impressive that not only are individuals with executive talent significantly different, but their job seeking abilities are equally disparate. In some cases, it is disheartening to witness how poorly some of these ‘professionals’ are prepared to compete head’s up in a talent search. There have been cases where I knew a candidate and knew them to be much better than they came across in interviews.

I place most of the blame for poor job seeking performance at the feet of the incumbents, but I have been equally disappointed at how poorly some executive recruiters AKA headhunters prepare their recommended candidates to be successful in a competitive executive search AKA a beauty pageant.

In many respects, a search is a beauty pageant, hence the name. All too frequently, the candidate selected is the one that is most charismatic to the decision maker(s) and not necessarily the best credentialed, experienced or qualified. Sometimes personal biases, ulterior motives or politics influence executive search outcomes. I believe that one of the reasons that some executives do so poorly in searches is that job hustling is not something they regularly do so their interviewing skills and other skills necessary to advance in a search are not well developed and practiced. Getting yourself hired is a much more intense, skill dependent process than I believe many candidates appreciate. This is especially true if you harbor disdain for selling.

Time after time, I have participated in executive recruitment where unprepared candidates spent the majority of their time just being themselves and treating their interview (at-bat) as a casual encounter like you would expect in a bar. Zig Ziglar and others argue that most everything in life amounts to selling. Like any other skill, the skill of selling (yourself) requires study, practice, and development if it is to be executed successfully. Candidates that come up short in these competitions frequently blame recruiters or hiring decision makers instead of taking a look into their mirror.

If there was ever a time that your success selling is critical, it is when you are trying to sell strangers on the concept that hiring you will advance their personal and corporate objectives. It is hard to tell where the adage came from, but sources suggest that people buy for only two reasons; solutions to problems or good feelings. If you intend to successfully convince the hiring decision maker that you are the correct choice among a strong field of competitors, to which of their motivations do you want to appeal? If you do not believe that a hiring decision maker is choosing the candidate, they feel will best make their life easier or themselves more successful, you are naive. What do you do when you are the decision maker on a recruitment?

Some hiring decision makers are not very sophisticated, and as I have facilitated searches, I have observed them making bizarre, irrational or emotional decisions when choosing a candidate from a search pool. For example, I witnessed a C-Suite candidate getting ruled out of a search because his wife had a visible tattoo on her leg. Others are more deliberate and analytical, and they will make a more objective, reasoned decision. What kind of decision maker are you up against? How can you tell? Of course, this assumes you ever make it past step one.

Executive recruitment, especially a retained search is like a funnel or a pyramid. The recruiter starts with a large number of applications from initial sourcing and gets down to less than ten that are presented to the client. If the initial sourcing turns up 300 potential candidates which is common and you put your pony into the show, you have about a 10% chance of getting to a phone interview with the recruiter and then about a 30% chance of getting an interview with the hiring decision-maker. The cumulative probability that any candidate will make it to an in-person interview in a hospital is around 3% or less. Everything being equal (which is never the case), your probability of being selected after an in-person interview is about 20% to 30% making your overall probability of being hired in any particular search at around 1% or less. The question is, what do you need to do to raise your game to come across as a better alternative than 99% of the competitors you will be up against in your next search? There are at least four candidate controllable areas that could make the difference the next time you decide to pursue an opportunity inside or outside your current situation.

Qualification for the job

While it should be rote to assume that a candidate in a search is appropriately qualified, that is often not the case. If you are not qualified and you know it, save yourself and the recruiter some time, don’t waste it by applying for a job you cannot win. Qualifications include education, experience, relevance to the situation and credentialing. It is too late to start working on any of these requirements when you become aware of an opportunity. In other words, if you desire career advancement, start preparing yourself NOW. If you wait until opportunities present themselves, you are late before the process even begins.

Resume or CV

Your resume is arguably the essential tool needed to get a job. Your resume is you and speaks for you in those critical first seconds when the appeal of your CV or lack thereof gets you ruled in or out of the first round of consideration. I have read sources that say that you are lucky if your CV spends thirty seconds in front of a reader before a decision occurs as to whether or not the candidate moves forward. I have been in this situation when a net is cast, and before you know it, there are hundreds of CVs to review for a position. After the first twenty or so, the review process speeds up dramatically. Developing a winning resume is beyond the scope of this article, but you should not underestimate the power of your CV to move you forward or get you eliminated from a search – long before you ever have a chance to speak for yourself.

Contact me to discuss any questions or observations you might have about these articles, leadership, transitions or interim services. I might have an idea or two that might be valuable to you. An observation from my experience is that we need better leadership at every level in organizations. Some of my feedback is coming from people that are demonstrating an interest in advancing their careers, and I am writing content to address those inquiries..

If you would like to discuss any of this content, provide private feedback or ask questions, you can reach me at ras2@me.com.