https://www.axios.com/2024/01/05/us-jobs-report-december-2023

The U.S. economy added 216,000 jobs last month while the unemployment rate held at 3.7%, the Labor Department said on Friday.

Why it matters:

The final snapshot of the 2023 labor market shows hot hiring — the latest sign that the American job market continues to defy expectations of a slowdown.

- The figure is well-above the roughly 170,000 jobs economists expected.

The big picture:

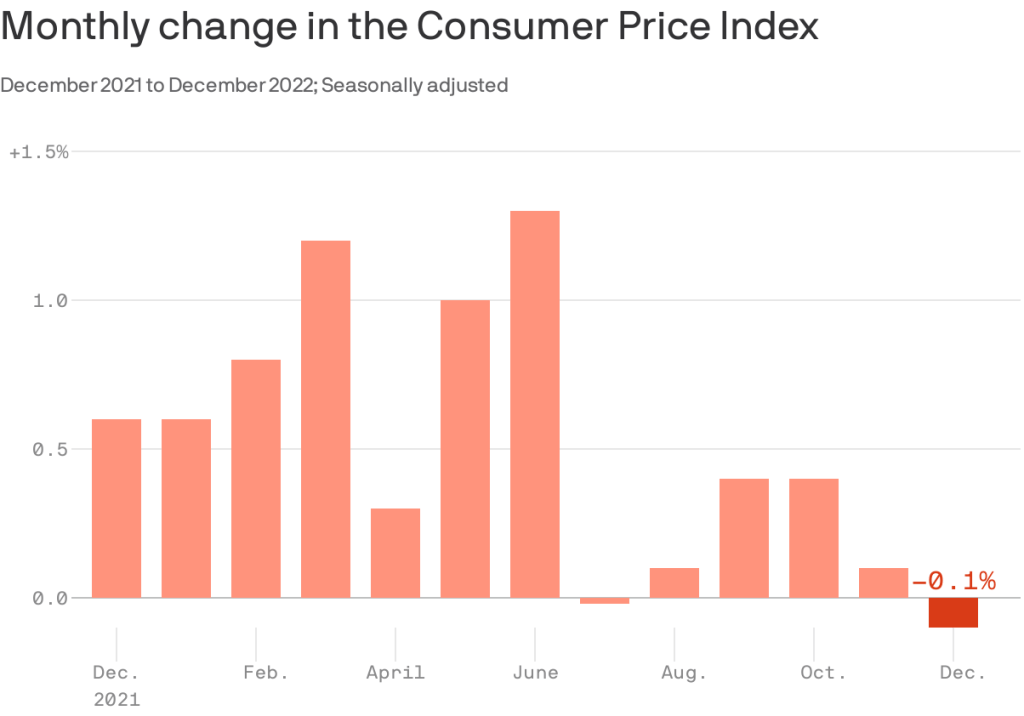

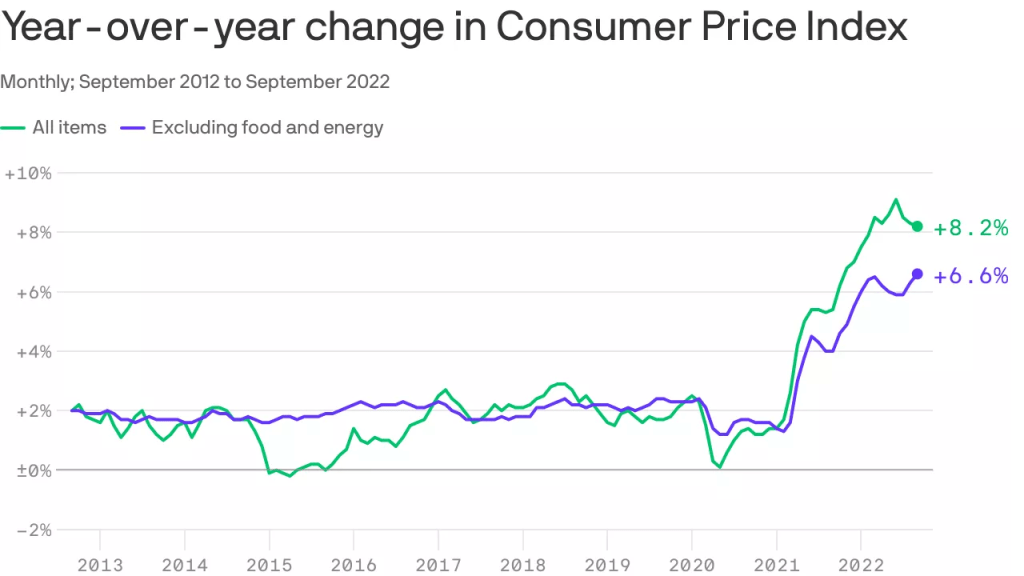

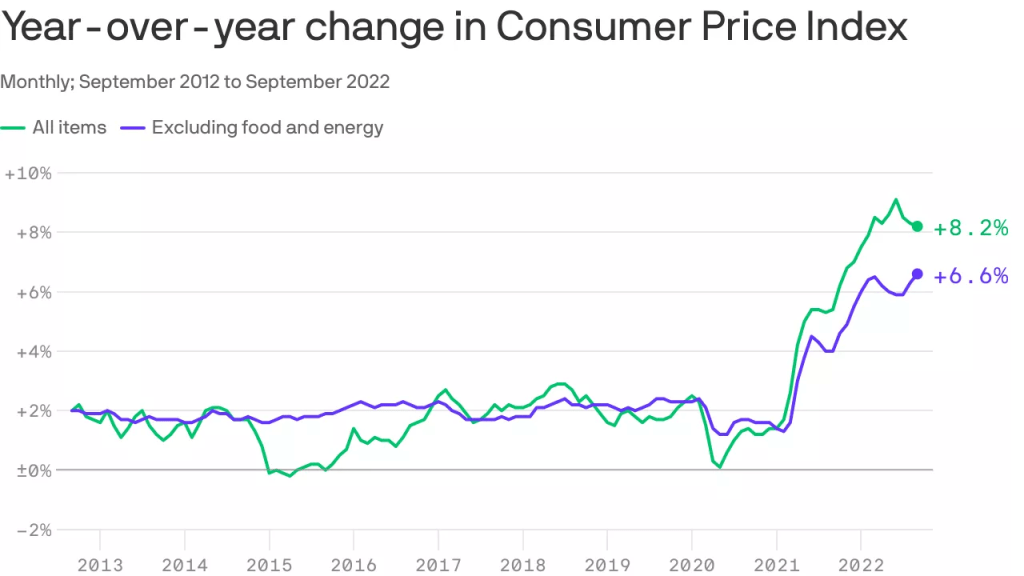

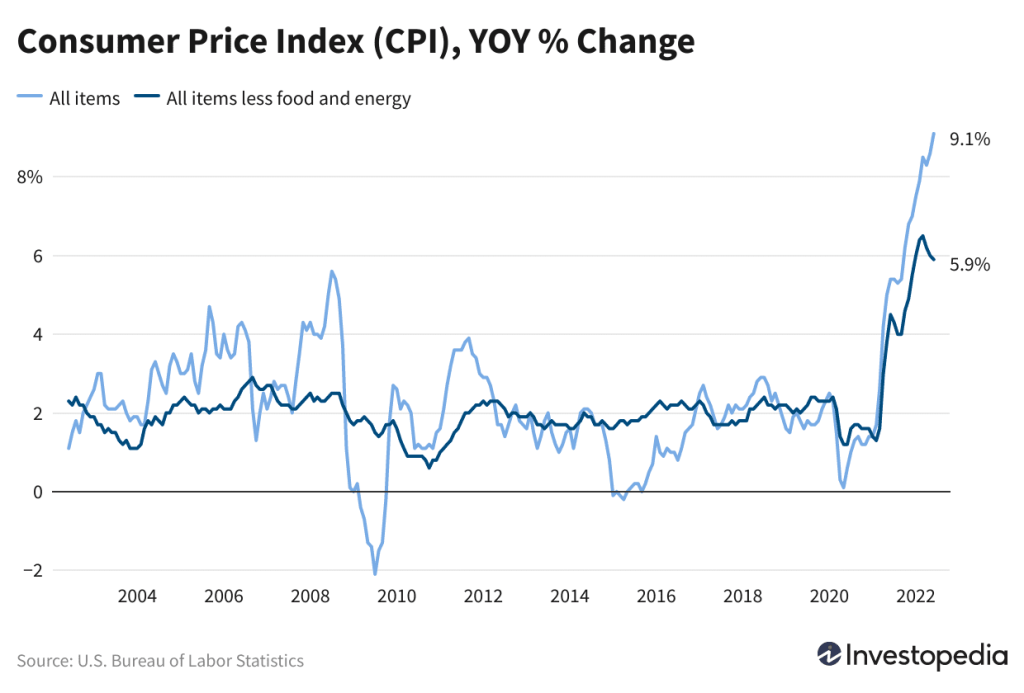

The Federal Reserve has hinted it likely won’t raise interest rates again with encouraging signs that inflation is easing and the labor market is cooling.

- That concludes an aggressive rate hiking cycle that began in 2022 and lasted through much of last year.

For now, however, there is little evidence those rate hikes translated into pain for workers in 2022.

- American consumers, however, remain dissatisfied with the economy — a problem that may continue to weigh on the Biden White House as the 2024 election heats up.

Details:

Friday’s jobs report shows the labor market stayed strong. Hiring increased in sectors including government, health care, and construction. Transportation and warehousing shed jobs.

- Average hourly earnings, a measure of wages, rose by 0.4% last month. Compared to the prior year, average hourly earnings rose 4.1%.

- The share of the population with in the labor force — that is, with a job or looking for one — was 62.5% in December, roughly 0.3 percentage point less than the prior month.

- The Labor Department also said the economy added a combined 71,000 fewer jobs than initially estimated in October and November.

The bottom line:

The hotter-than-expected jobs figures are one of several more key economic reports due before Federal Reserve officials meet at the end of the month.