Ballad CFO Lynn Krutak said the health system faces significant financial challenges but has the discipline and leadership to navigate obstacles ahead.

KEY TAKEAWAYS

CFO Lynn Krutak said the system’s most significant challenge is its payer mix.

Luckily, she says, Virginia’s decision to expand Medicaid will help somewhat in terms of recouping from years of cuts.

Ballad Health also has a $308 million, 10-year spending plan in the works.

Last year, Mountain States Health Alliance (MSHA) and Wellmont Health System, merged to form Ballad Health. The fact that the two rural systems merged was not typical because it formed under a certificate of public advantage (COPA).

This legal agreement governs the merger through joint oversight from both the state of Tennessee and Virginia and also includes “enforceable commitments” to invest in population health, expand patient access, and boost research and education opportunities.

According to the Millbak Memorial Fund, the COPA acts as a “state-monitored monopoly—or a public utility model of healthcare delivery.”

Related: Ballad Health Launches Changes Across Newly Merged Hospital Network

Lynn Krutak, who served as CFO for both MSHA and its corporate parent Blue Ridge Medical Management, was elevated as CFO at Ballad Health. In an interview with HealthLeaders, Krutak emphasized how she implemented effective cost-cutting strategies within a challenging payer mix and low-wage index area.

This transcript has been lightly edited for brevity and clarity.

HealthLeaders: Can you describe the challenges and opportunities for Ballad Health in its provider market?

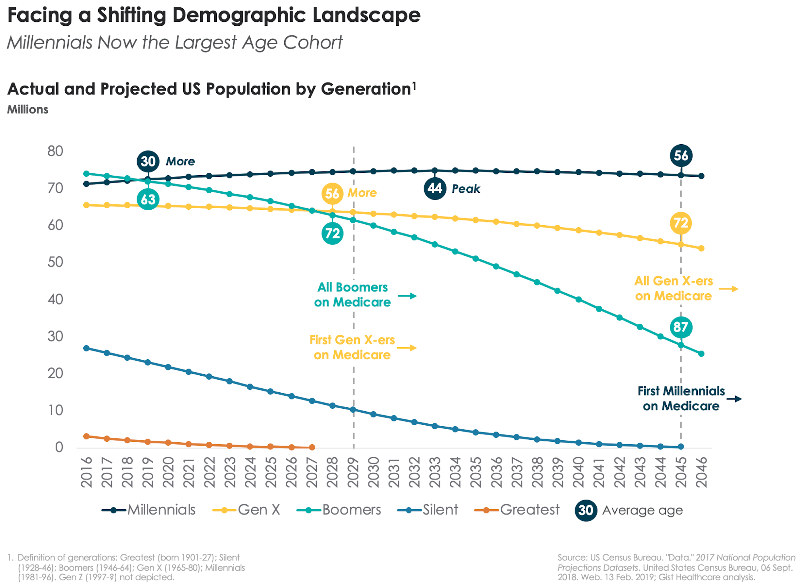

Krutak: The majority of our hospitals are either in southwest Virginia or northeast Tennessee, so we have high-use rates. From the payer standpoint, as more people move into managed Medicare and managed Medicaid, we know those use rates are going to fall.

Our population growth is flat to even declining; a lot of our counties in southwest Virginia are coal counties that have been hit hard by the [employment] reductions. So, with the use-rates decline, population decline, and the reimbursement decline that we’re all faced with, we know that there are going to be issues going forward.

As far as our payer mix, we’re heavily governmental. Over 70% of our payer mix is Medicare, Medicaid, or self-pay. We can continue to see the payer mix decline as well. We are also faced with high-deductible health plans out there now, with the patient portion of those deductibles being so high our bad debt has increased over 30%.

Fortunately, Virginia has implemented a Medicaid expansion program, so we will get some relief. However, we’ve had years of ACA cuts and this is a small portion. With the cuts that we’ve had versus what we’re going to gain back from Medicaid expansion, we’ll still be in the red.

Our wage index with Medicare is another hurdle we have. We are in the fourth-lowest wage index area in the country; we’re getting about half of what other [systems] are getting. We’ve done a good job of controlling our costs because we have to.

We’re excited about the potential with some of the things that we’re going to be able to do as a merged organization. We have $308 million in spending commitments over the next 10 years, but we have about twice as much in estimated savings. We’ve been able to achieve a lot of that already and we’re working hard on our continued integration.

This merger’s unique and what we’re going to be able to do is take costs out of the system, as far as redundant and duplicative costs go, and then reinvest them back.

HL: Can you describe some initiatives Ballad is looking to pursue in the next few years?

Krutak: As far as the labor costs, we’ve done a great job controlling our labor by not using contract labor for nursing. During the nursing shortage, other systems were using contract labor, it was something that MSHA did not have to do.

We have East Tennessee State University right in our backyard in Johnson City, where we work with them to develop nursing programs and offer scholarships to students in return for a work commitment.

Of the investments through COPA, where we have committed $308 million over a 10-year period, [is] $75 million is going to common health issues facing children. We’ve made a commitment to bring on specialists—specifically pediatrics—and be able to keep these patients and their families in the region and not have to send them elsewhere.

We’ve also committed $140 million to mental health, addiction, or rural health [initiatives] with $85 million going to behavioral health. That’s an issue for our service area in northeast Tennessee and southwest Virginia.

Finally, we have $8 million set for clinical effectiveness and patient engagement mainly related to health information exchange. Wellmont was on Epic, MSHA was on Cerner, so we agreed to convert the whole system to Epic, which will happen in April 2020.

HL: How is Ballad best positioned to navigate the direction healthcare is going while still providing the best quality service to its patients?

Krutak: We’ve been working with our state representatives to craft a fair wage index bill, where Ballad would get some relief and revamp how those calculations are done. In other words, you would not be penalized if you do a good job controlling your costs.

Our CEO, Alan Levine was secretary of health in Florida and secretary of health in Louisiana. We have Tony Keck, who is the executive vice president of our development, innovation, and population health improvement, who was secretary of health in South Carolina. We have a lot of insight on the [governmental] side of things from them.

We’re positioning ourselves to take costs out of the system but also to switch over from fee-for-service plans to looking at risk-based contracts. How do we get paid more for showing better patient outcomes? We’re looking over the next five years to transition into more of that than your traditional payments.

HL: What advice would you give to CFOs from rural systems to make the most of what are sometimes challenging financial situations?

Krutak: As a result of the merger, I’m relieved that we’re going to be able to have these savings to reinvest in rural areas. The largest issue we face with the payer mix shift is that it’s hard to get physicians in rural areas.

My advice to them is just make sure that you are controlling your costs as much as you possibly can and look to partner with other systems that may be near you that could provide physician-sharing arrangements.

For the reimbursement side, it’s always actively looking at how you’re being paid and what you’re being paid. Work with your government officials and partner with your hospital associations, to say, ‘Hey, if we’re going to continue to keep these rural hospitals and provide access, then there’s going to have to be changes as far as how that reimbursement is calculated and how those facilities are compensated.’

On the cost side, make sure that that you’ve situated yourself appropriately and then as things transition to outpatient, be sure the investments that you’re making are being made in the right places.