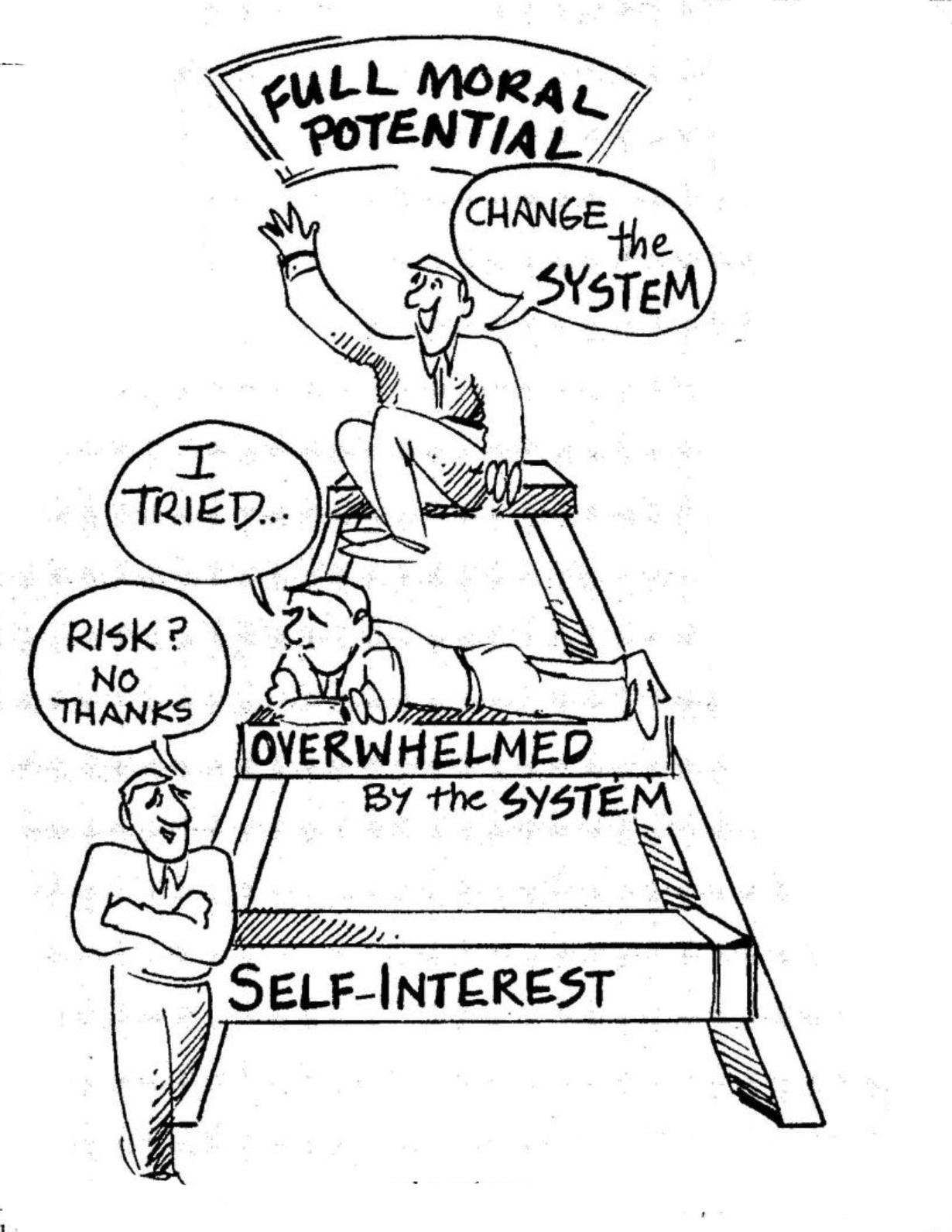

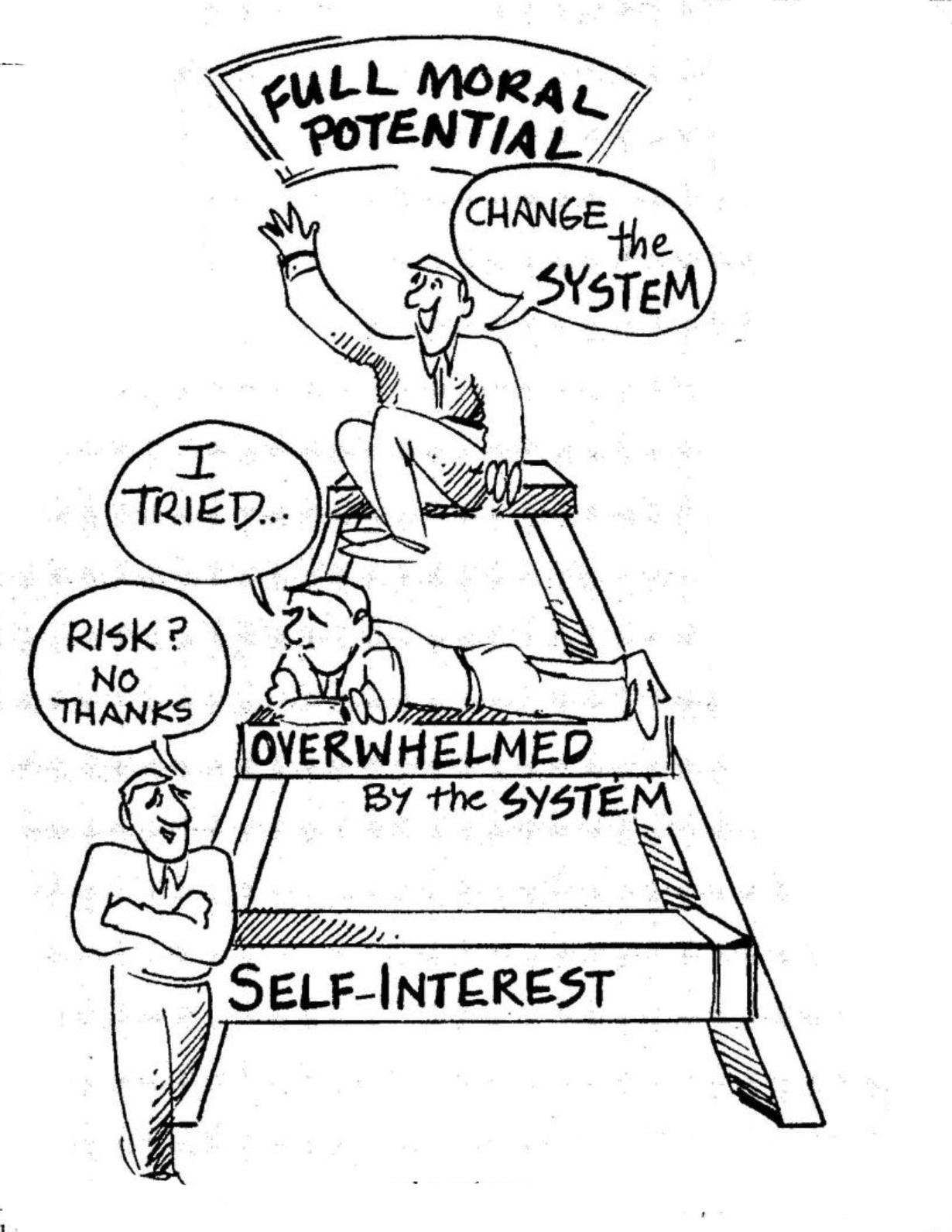

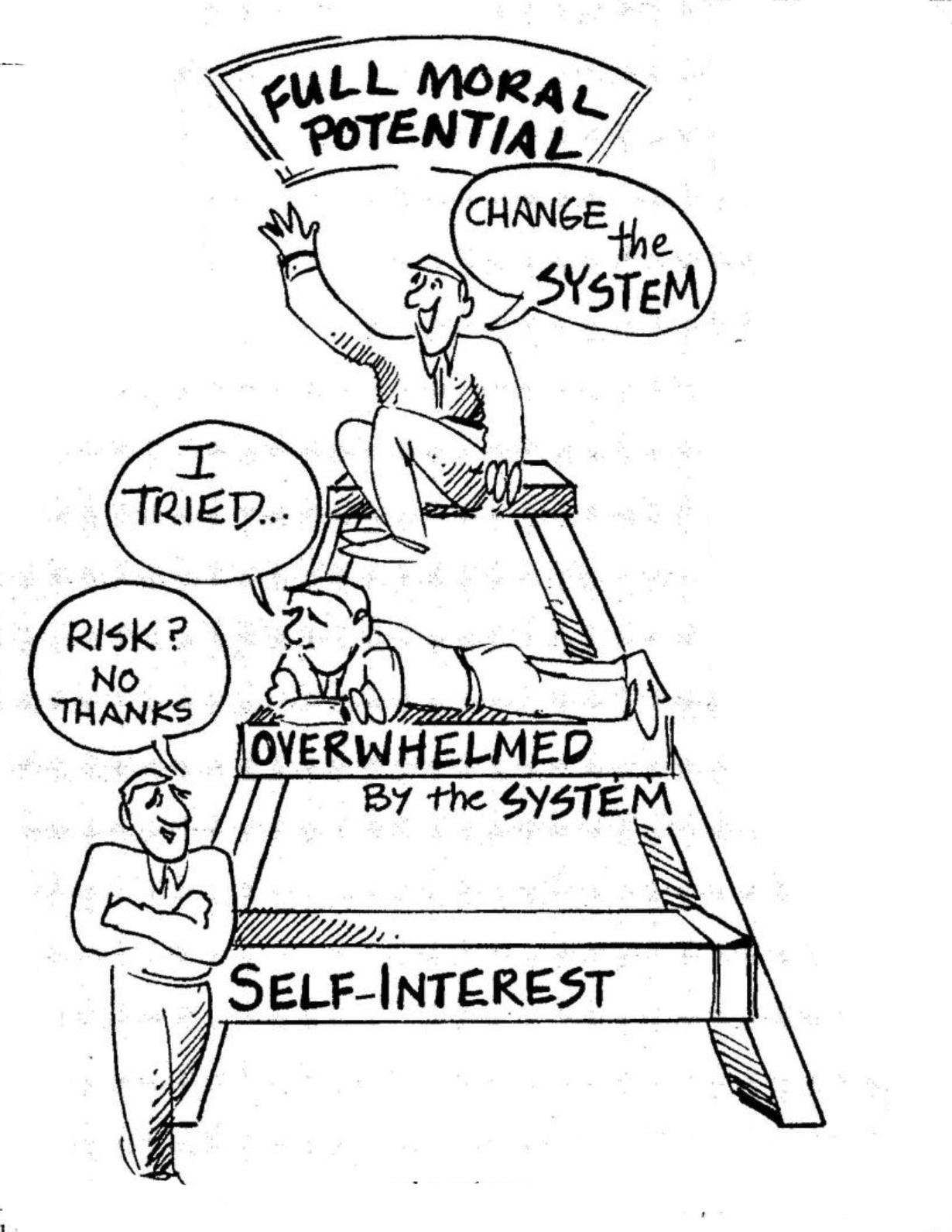

Cartoon – Full Moral Potential

The conditions follow a Health Policy Commission report that warned the merger could result in a $128.4 million to $170.8 million increase in healthcare spending for inpatient, outpatient and adult primary care services and up to $59.7 million for specialty physician services.

The commission concluded that while the merger could lead to improvements in quality and efficiencies, the companies hadn’t explained how that would happen. The new conditions call for a second report in five years to assess the merger’s impact on healthcare costs and services in the state.

BIDMC CEO Kevin Tabb called the commission’s conditions “strict,” but said they won’t discourage the planned merger. “While the conditions are unprecedented, we are eager to move forward together as Beth Israel Lahey Health,” he told Healthcare Dive via email. “The status quo in this market is unacceptable, and it’s time to do something different.”

As mergers and acquisitions continue in healthcare, potential problems could lead to more stringent conditions. Research has shown, for example, that horizontal mergers can drive up costs. Once completed, Beth Israel-Lahey Health would rival Partners HealthCare System in terms of market share in Massachusetts. The new company could use its increased bargaining power to raise prices for commercial payers, increasing healthcare spending.

A recent National Bureau of Economic Research analysis also played down the extent to which hospital mergers increase efficiencies. According to NBER, acquired hospitals save just 1.5% of total costs following a merger — or an average of $176,000 a year.

And a recent University of California-Berkeley study of health system consolidation in the state found that highly concentrated markets led to higher hospital and physician service fees, as well as higher Affordable Care Act premiums, especially in northern California.

California Aims To Tackle Health Care Prices In Novel Rate-Setting Proposal

Backed by labor and consumer groups, a California lawmaker unveiled a proposal Monday calling for the state to set health care prices in the commercial insurance market.

Supporters of the legislation, called the Health Care Price Relief Act, say California has made major strides in expanding health insurance coverage, but recent changes haven’t addressed the cost increases squeezing too many families.

To remedy this, Assembly Bill 3087 calls for an independent, nine-member state commission to set health care reimbursements for hospitals, doctors and other providers in the private-insurance market serving employers and individuals.

The bill faces formidable opposition from physician groups and hospitals.

“No state in America has ever attempted such an unproven policy of inflexible, government-managed price caps across every health care service,” Ted Mazer, president of the California Medical Association, said in a statement.

At a press conference Monday, Assembly member Ash Kalra (D-San Jose) and other sponsors of the bill said the commission would use Medicare reimbursements as a benchmark and then factor in providers’ operating costs, geography and a reasonable amount of profit to establish rates. More details on the legislation are expected during committee hearings.

Across the country, some employers have tried a similar approach by mostly sidestepping insurers and instead paying providers 125 to 150 percent of the Medicare price for any service. Proponents of this idea say it eliminates the worst abuses in billing, reduces administrative costs and promotes price transparency.

The California legislation envisions a system similar to the rate-setting done for public utilities.

The proposal also borrows from Maryland, which has set prices for hospital services since the 1970s.

“We have given free rein to medical monopolies — to insurers, doctors and hospitals — to charge out-of-control prices,” said Sara Flocks, policy coordinator at the California Labor Federation, which is co-sponsoring the bill, at the Monday news conference. “It’s not that we go to the doctor too much. It’s because the price is too much.”

Kalra, the assemblyman who introduced the bill, said consumers deserve relief now because soaring medical costs are eating up workers’ wages and contributing to income inequality.

“The status quo is unacceptable and unsustainable. Californians struggling to keep up demand action rather than politics as usual,” Kalra said at the news conference.

Health care providers immediately slammed the proposal, saying it would reduce patients’ access to care and drive medical providers out of the state.

Mazer countered that the bill would cause “an exodus of practicing physicians, which would exacerbate our physician shortage and make California unattractive to new physician recruits.”

Chad Terhune, a senior correspondent at California Healthline and Kaiser Health News, discussed the latest proposal and its future prospects with A Martinez, host of the “Take Two” show on Southern California Public Radio.

http://www.detroitnews.com/story/opinion/2017/04/23/valenti-health-care/100822732/

The phrase “repeal and replace Obamacare” might be in the news, but any new legislation regarding it means little for Michiganians.

Obamacare and the Republicans’ fix, the American Health Care Act, are almost entirely focused on the individual insurance market, yet the majority of Americans receive employer-sponsored health insurance coverage. More importantly, more than one million Metro Detroiters are covered by employers who “self-fund” or self-insure their employee health care benefits.

What does self-insure mean? It means your employer pays, right out of its annual budget, 100 percent of employee medical claims. Your card might read Blue Cross Blue Shield or Aetna, but the insurance company is simply the administrator who collects the claims and sends them off to your employer for payment.

Regardless of who is paying, rising health care costs are the No. 1 threat to American prosperity. Health care costs forced General Motors, Chrysler and the city of Detroit into bankruptcy; health care costs are the main reason wages have not grown in 20 years; and, Michigan spends 40 percent (and growing) of its annual budget on health care — crowding out spending on everything else.

But fixing our health care cost problem today doesn’t require a single action from Congress. Instead of marching on Washington and yelling at elected officials, we should be talking to our CEOs and heads of human resources.

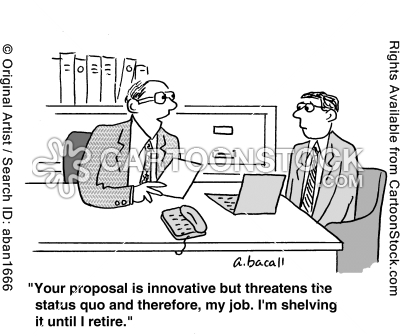

Self-insured employers have tremendous power to change health care. Most employers simply outsource health care benefit construction to consultants and brokers — the same people who are compensated to perpetuate our high-cost health care status quo.

When the lame, status quo attempts at cost-control fail, the usual employer response is to cut, cut, cut. They resort to using an axe to prune rose bushes; high deductible health plans are blunt force instruments that do not sustainably control health care costs and will eventually exacerbate our cost problem.

Indeed, a few, truly innovative employers are providing better employee benefits and reducing health care costs 20-50 percent. If everyone followed their lead, it could result in $2,500 to $5,000 annual raises for each of us and immediately pump $2 billion to 4 billion into the Metro Detroit economy every year.

The solution isn’t a secret. In fact, a non-profit/501(c)(3) called the Health Rosetta was formed to publicize the simple fixes. The organization was spurred by a concerned citizen and the former global head of Microsoft’s health care business named Dave Chase.

The Health Rosetta identifies a few, easy to implement, specific improvements, the most important of which focuses on the intake or front-end of the system: primary care. Hence, the Health Rosetta’s foundation is called Value-Based Primary Care or Direct Primary Care. Other improvements are then built on top, such as “Transparent Medical Markets,” where patients receive up-front pricing and even quality guarantees on a range of surgeries and procedures.

These are the kinds of solutions employers should be considering as everyone wrestles with skyrocketing health care costs.

Tom Valenti is the founding partner of Forthright Health.

In every senior position I held, I made extensive use of task forces to develop options, recommendations, and specific plans for implementation. I relied on such ad hoc groups to effect change instead of using existing bureaucratic structures because asking the regular bureaucratic hierarchy (as opposed to individuals within it) if the organization needs to change consistently yields the same response: it almost never provides bold options or recommendations that do more than nibble at the status quo.

– Robert M. Gates