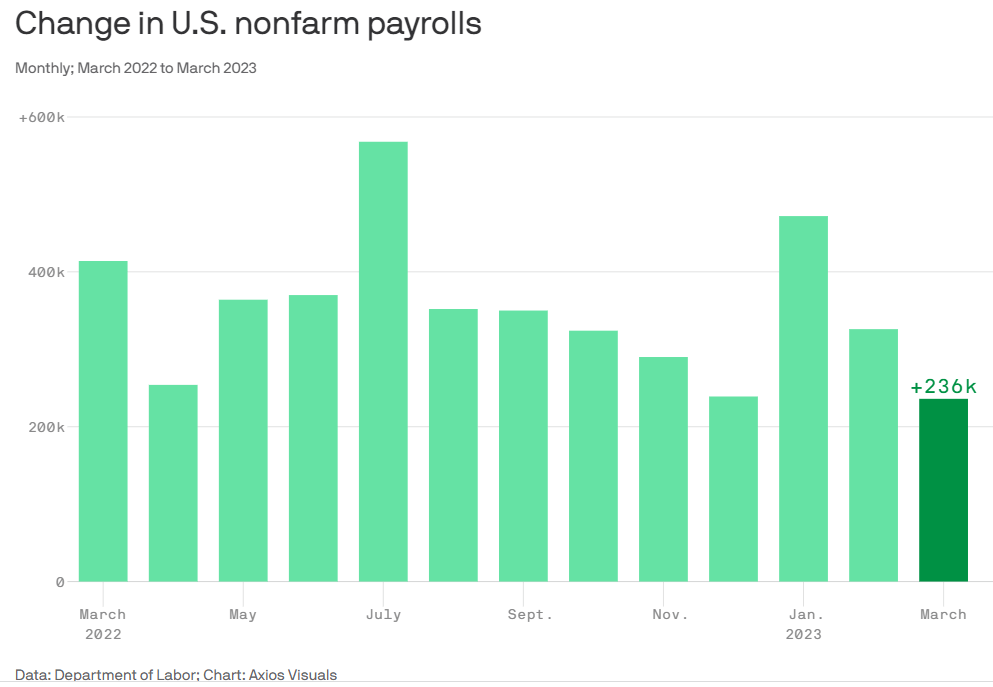

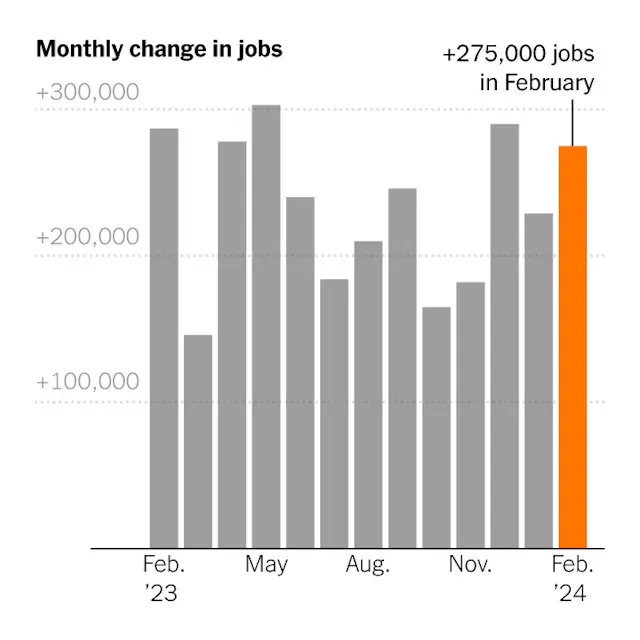

The labor market showed resiliency in February, adding 275,000 jobs, a sign that economic growth is still solid.

If the economy is slowing down, nobody told the labor market.

Employers added 275,000 jobs in February, the Labor Department reported Friday, in another month that exceeded expectations.

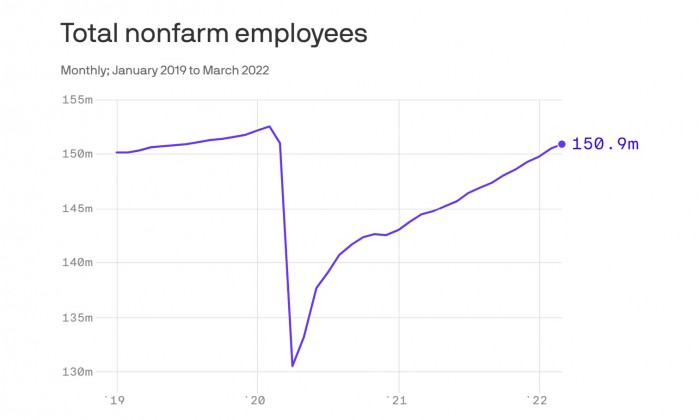

It was the third straight month of gains above 200,000, and the 38th consecutive month of growth — fresh evidence that after surging back from the pandemic shutdowns, America’s jobs engine still has plenty of steam.

“We’ve been expecting a slowdown in the labor market, a more material loosening in conditions, but we’re just not seeing that,” said Rubeela Farooqi, chief economist at High Frequency Economics.

The previous two months, December and January, were revised down by a combined 167,000 jobs, reflecting the higher degree of statistical volatility in the winter months. That does not disrupt a picture of consistent robust increases, which now looks slightly smoother..

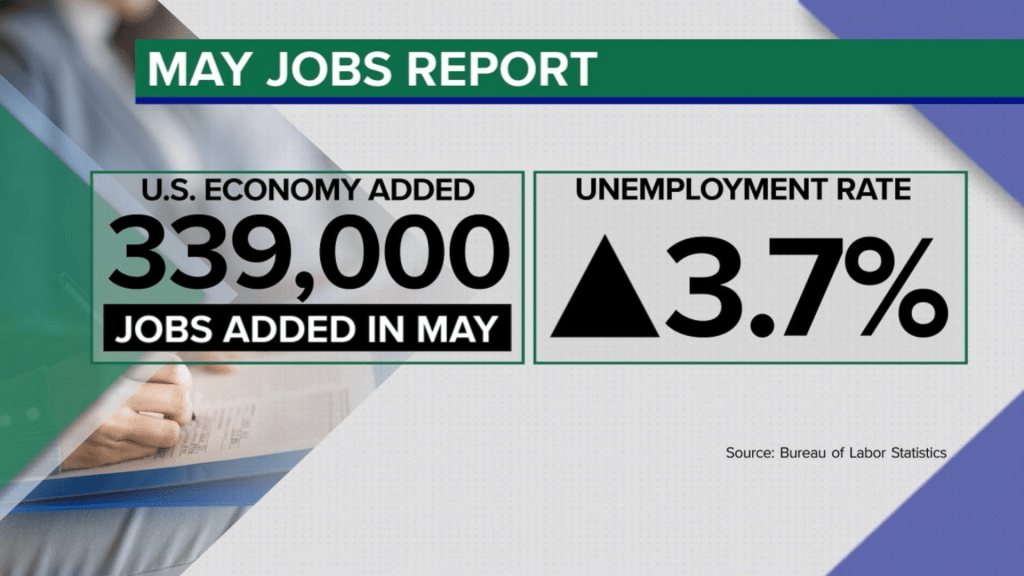

At the same time, the unemployment rate, based on a survey of households, increased to a two-year high of 3.9 percent, from 3.7 percent in January. A more expansive measure of slack labor market conditions, which includes people working part time who would rather work full time, has been steadily rising and now stands at 7.3 percent.

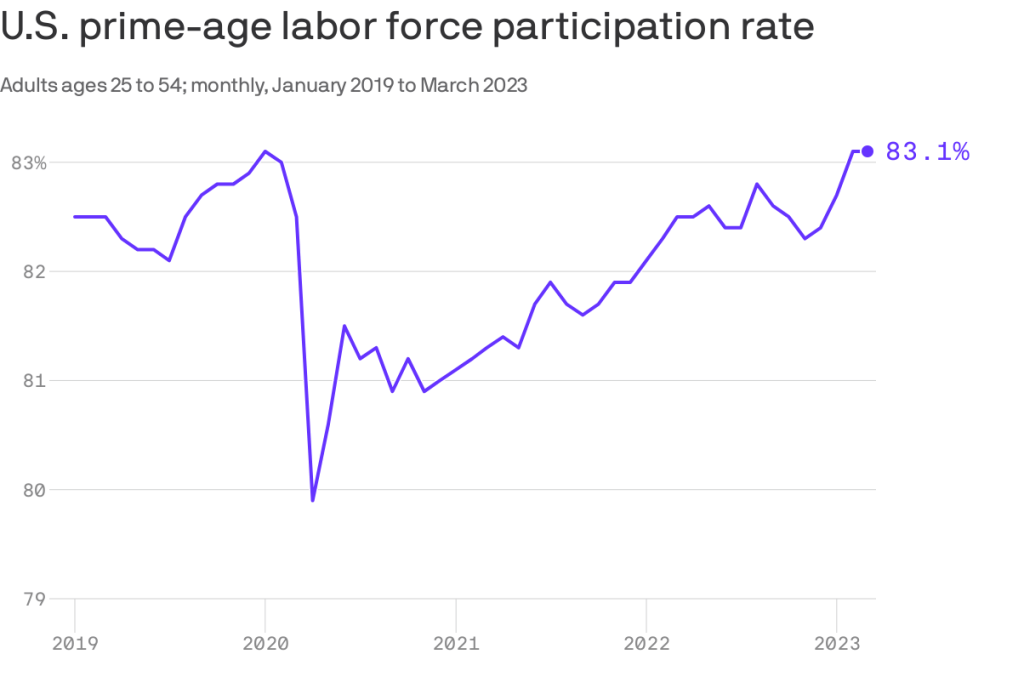

The unemployment rate was driven by people losing or leaving jobs as well as those entering the labor force to look for work. The labor force participation rate for people in their prime working years — ages 25 to 54 — jumped back up to 83.5 percent, matching a level from last year that was the highest since the early 2000s.

Average hourly earnings rose by 4.3 percent over the year, although the pace of increases has been fading.

“We’ve recently seen gains in real wages, and that’s encouraged people to re-enter the labor market, and that’s a good development for workers,” said Kory Kantenga, a senior economist at the job search website LinkedIn. As wage growth slows, he said, the likelihood that more people will start looking for work falls.

As late as last fall, economists were predicting much more modest employment increases, with hiring concentrated in a few industries. But while some pandemic-inflated industries have shed jobs, expected downturns in sectors like construction haven’t materialized. Rising wages, attractive benefits and more flexible work schedules have drawn millions of workers off the sidelines.

Elevated levels of immigration have also added to the labor supply. According to an analysis by the Brookings Institution, the influx has approximately doubled the number of jobs that the economy could add per month in 2024 without putting upward pressure on inflation, to between 160,000 and 200,000.

Health care and government again led the payroll gains in February, while construction continued its steady increase. Retail and transportation and warehousing, which have been flat to negative in recent months, picked up.

No major industries lost a substantial number of jobs. Credit intermediation continued its downward slide — that sector, which mostly includes commercial banking, has lost about 123,000 jobs since early 2021.

That doesn’t mean the employment landscape looks rosy to everyone. Employee confidence, as measured by the company rating website Glassdoor, has been falling steadily as layoffs by tech and media companies have grabbed headlines. That’s especially true in white-collar professions like human resources and consulting, while those in professions that require working in person — such as health care, construction and manufacturing — are more upbeat.

“It is a two-track labor market,” said Aaron Terrazas, Glassdoor’s chief economist, noting that job searches are taking longer for people with graduate degrees. “For skilled workers in risk-intensive industries, anyone who’s been laid off is having a hard time finding new jobs, whereas if you’re a blue-collar or frontline service worker, it’s still competitive.”

The last few months have been studded with strong economic data, leading analysts surveyed by the National Association for Business Economics to raise their forecasts for gross domestic product and lower their expectations for the trajectory of unemployment. It’s occurred even as inflation has eased, leading the Federal Reserve to telegraph its plans for interest rate cuts sometime this year, which has raised growth expectations further.

Mervin Jebaraj, director of the Center for Business and Economic Research at the University of Arkansas, helped tabulate the survey responses. He said the mood was buoyed partly by fading trepidation over federal government shutdowns and draconian budget cuts, after several close calls since the fall. And he sees no obvious reason for the recovery to end soon.

“Once it starts going, it keeps going,” Mr. Jebaraj said. “You had this external stimulus with all the trillions of dollars of government spending, Now it’s sort of self-sustaining, even though the money’s gone.”