Even as CMS documents improper denials, ghost networks and unlawful out-of-pocket charges, enforcement remains weak with just $3 million in fines levied in early 2025 against billion-dollar insurers.

Enrolling in Traditional Medicare means paying more upfront to protect against catastrophic costs because Traditional Medicare lacks an out-of-pocket cap, but in return, you get the care your treating physicians recommend you need. In stark contrast, enrolling in Medicare Advantage typically means allowing a for-profit insurer to second-guess your treating physician and inappropriately delay or deny the care you need, forcing you to gamble with your health and, sometimes, your life. What’s worse is that our federal government is rarely willing or able to punish Medicare Advantage insurers for their bad acts. Consequently, Medicare Advantage insurers too often can get away with restricting access to specialists and specialty hospitals and not covering the treatments their enrollees are entitled to.

Penalties on Medicare Advantage insurers that deprive their enrollees of the care they need are few and far between. In the first four months of 2025, the Trump administration imposed more penalties on the insurers in Medicare Advantage than they faced during the entire four years of the Biden administration. Still, it only imposed about $3 million in penalties, reports Rebecca Pifer Parduhn for HealthcareDive. That is tiny relative to the billions in profits of the big insurers.

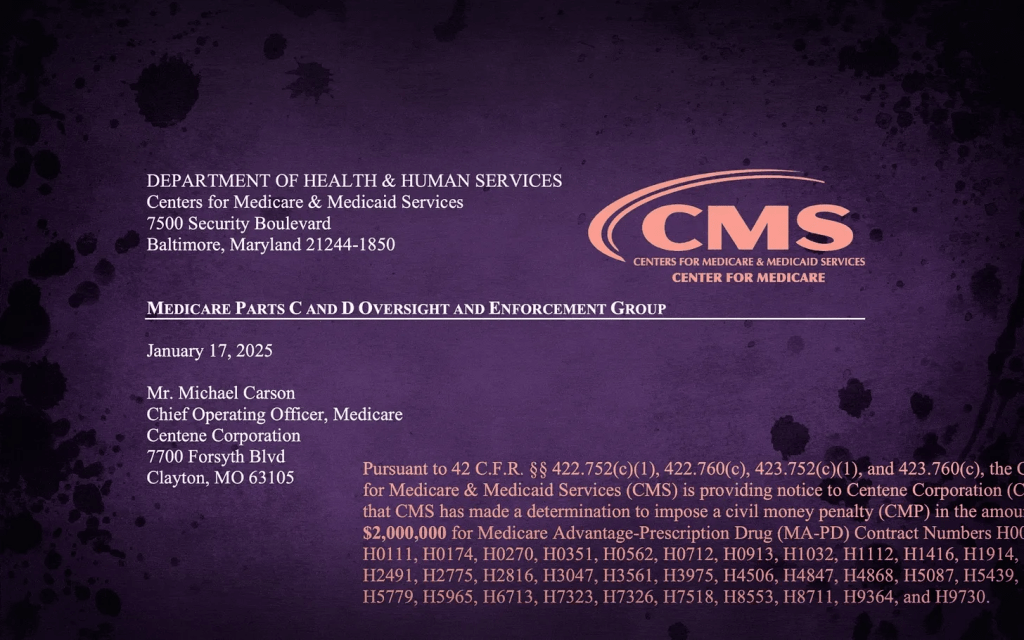

Most of the penalties the Centers for Medicare & Medicaid Services (CMS) has imposed in the last few years for Medicare Advantage insurer violations are under $50,000. Penalties imposed were for serious offenses, including improper insurer delays and denials of care and insurers requiring people to spend more out of their own pockets than allowed under the law. Centene was hit with the largest penalty of $2 million for charging its enrollees above the out-of-pocket maximum permitted to be charged, in violation of 42 C.F.R. Part 422, Subpart C.

Molina received the second largest penalty of just over $285,000 for its failure to comply with prescription drug coverage requirements. CMS said that Molina’s failure was “systemic and adversely affected, or had the substantial likelihood of adversely affecting, enrollees because the enrollees experienced delayed access to medications, paid out-of-pocket costs for medications, or never received medications.” It’s hard to believe that Molina didn’t substantially benefit financially from its violations even after paying the $285,000 fine.

Susan Jaffe reports for KFF News that over a seven-year stretch between 2016 and 2022, CMS, under both Trump and Biden, did almost nothing to ensure network adequacy for Medicare Advantage enrollees. Moreover, it did very little to penalize the Medicare Advantage insurers CMS identified as operating Medicare Advantage plans with inadequate networks.

After KFF made a Freedom of Information Act request regarding enforcement actions against Medicare Advantage insurers with inadequate networks, CMS turned over just five letters to insurers regarding seven MA plans with inadequate provider networks. Given the widespread reporting of network inadequacy in Medicare Advantage, it’s inconceivable that only seven MA plans had inadequate networks. When questioned as to why CMS took action in so few instances, the agency explained that it is not overseeing all of the more than 3,000 Medicare Advantage plans but conducting “targeted” reviews of Medicare Advantage plan provider networks.

What’s clear is that CMS does not begin to have the resources to oversee more than 3,000 Medicare Advantage plans to ensure they are in compliance with their contractual obligations and delivering the care they are required to. As a result, Medicare Advantage enrollees are left unprotected. Too often, Medicare Advantage plans have “ghost networks,” networks that look good in the provider directory but turn out to include physicians who are out of network. These MA plans might not have enough primary care physicians, mental health providers, specialists, hospitals, nursing homes, rehab facilities or mental health professionals in their networks.

Technically, CMS can prevent insurers with inadequate networks from marketing their Medicare Advantage plans, freeze enrollment, fine them or even terminate the Medicare Advantage plans. But it never has. In its June 2024 report, the Medicare Payment Advisory Commission (MedPAC) wrote: “CMS has the authority to impose sanctions for noncompliance with network adequacy standards but has never done so.” CMS often doesn’t even let Medicare Advantage enrollees know about the inadequacy of the provider network or allow enrollees the ability to disenroll.

For CMS to oversee Medicare Advantage plans effectively and impose sanctions where appropriate it would need far more resources than it currently has. Moreover, penalties would likely need to be non-discretionary or they would be subject to political interference. In addition, to simplify the process and reduce costs, insurers likely would need to be required to offer the same network for all their Medicare Advantage plans in a given community.