It is a somber year for health care in America. While we commemorate both the 60th anniversary of Medicare and Medicaid and the 15th anniversary of the Affordable Care Act (ACA), we’re watching health-care costs soar to unaffordable levels and millions of Americans lose access to these very programs. Of the many devastating consequences we can anticipate from these policy choices, we should expect to see the crisis of medical debt in America worsen.

But the immediate harms of medical debt, or money owed for past medical care, are solvable problems—and solving them can point us toward bolder solutions to the crisis of unaffordable health care.

During my time as director of policy in the Office of Cook County Board President Toni Preckwinkle, I and my colleague Nish Dittakavi helped launch the Cook County Medical Debt Relief Initiative using federal funding from the American Rescue Plan Act. This established the first publicly funded program in the United States to buy and cancel residents’ medical debt. In June 2025, President Preckwinkle announced that since its launch in 2022, the program has successfully abolished over $664 million in medical debt so far, benefiting 556,815 residents of Cook County, Illinois.

Cook County’s innovative program also catalyzed a movement across state and local governments.1 As my colleagues at the New School’s Institute on Race, Power and Political Economy have found, since Cook County announced its program, 29 state and local governments across 19 states have collectively pledged to eliminate $15.8 billion in debt for more than 6.3 million Americans. As of October 25, 2022, these programs have abolished nearly $11 billion in medical debt on behalf of more than 6 million residents.

We have shown that erasing medical debt like this can transform people’s lives. Now, we must leverage the momentum of debt cancellation to meet our current moment. Rather than leaving us satisfied with the short-term aid we can provide through medical debt cancellation, the popularity and success of these programs must push us to ask bigger questions about the upstream interventions we need to fix a broken health-care system that forces people to accrue this debt in the first place.

Our Medical Debt Crisis Is Bad, and Will Likely Get Worse

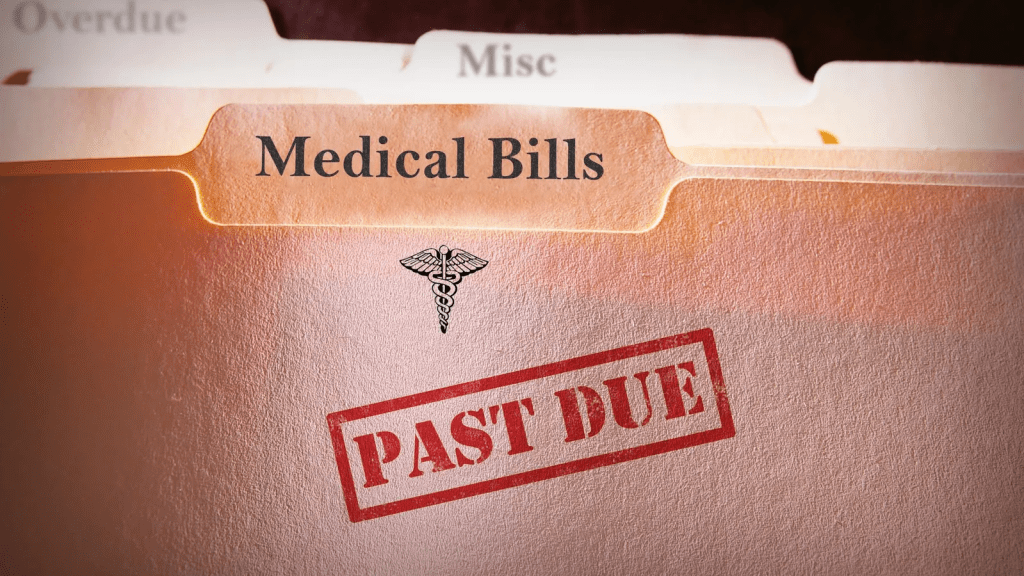

Amid rising health-care costs and increasingly stretched household budgets, medical debt has become a frequent focus of policy attention in the US. And with good reason: According to a 2021 KFF analysis, 20 million people, or nearly 1 in 12 adults, owe medical debt, totaling more than $220 billion. The Consumer Financial Protection Bureau (CFPB) found that medical debt accounted for 58 percent of debt in collections that same year.2

This economic burden can quickly spiral, as the Roosevelt Institute’s Stephen Nuñez examined in a May issue brief. Patients may be denied medical care due to unpaid bills or struggle to afford other basic needs like food. As emergency physician and historian Dr. Luke Messac details in Your Money or Your Life: Debt Collection in American Medicine, owing medical debt can impact your credit score and thus your ability to access loans, land you in court, result in wage garnishment (withholding earnings to pay off a debt), and even lead to arrest.3

These harms are not felt equally. Given existing disparities across a range of economic and health measures—from wealth and neighborhood segregation to quality of insurance coverage and access to paid family leave—it’s perhaps unsurprising that Black Americans, women, and people with chronic health challenges hold a disproportionate amount of medical debt. This further exacerbates existing health inequities and deepens the racial wealth gap.

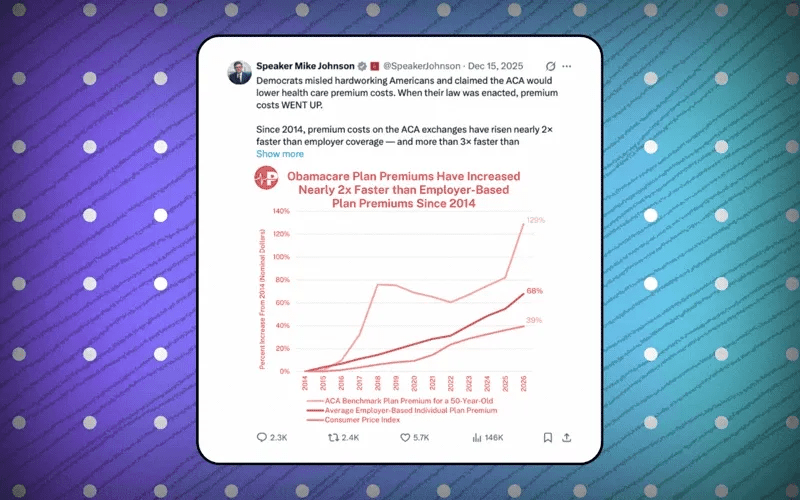

Sadly, we should expect these numbers to rise thanks to the Trump administration’s gutting of our public health insurance system. Under the administration’s so-called signature legislative achievement, HR 1, an estimated 12 million people will lose health insurance by 2034, and hospitals and community health centers across the country will face severe threats to their solvency. Even sooner, without congressional action by December an additional 24 million people who purchase ACA plans will simultaneously face steep insurance premium increases and cuts to the tax credits that help subsidize these costs—a key focus of the federal government shutdown this fall.

An estimated 12 million people will lose health insurance by 2034, and hospitals and community health centers across the country will face severe threats to their solvency.

By decreasing eligibility for public insurance and increasing the cost many Americans must pay for non-employer-sponsored private insurance, these policy choices will increase medical debt.4

How Myths About Our Health-Care System Perpetuate Medical Debt

Myths that have dominated decades of health policy can trick us into believing medical debt is an unfortunate bug in an otherwise well-designed system.5

Many proponents of the current system claim that cost-sharing (when patients pay for a portion of their care through copayments, coinsurance, and deductibles) benefits the system by making patients more responsible and frugal when they seek care. But this myth conveniently ignores the vast body of evidence that shows cost-sharing decreases adherence to treatment, leads to worse health outcomes, and, importantly, does not lead to decreased total costs across the system.

The myth that health care can function like a traditional market, with the burden on us as consumers to just make more informed choices, hides the reality that we are patients whose access to needed care is determined by factors beyond our control—what insurance, if any, our job provides, what that insurance chooses to cover, the cost-sharing that insurance chooses to require, and the covered medicines set by the pharmacy benefit manager (PBM) that insurer works with (and increasingly owns). The myth that our health-care system is a functioning market that can and will course-correct any problems on its own also leaves us looking for solutions from the very stakeholders who benefit from the structure as it is currently.

The myth that our health-care system is a functioning market that can and will course-correct any problems on its own also leaves us looking for solutions from the very stakeholders who benefit from the structure as it is currently.

The reality is that medical debt is the logical outcome of core characteristics of the American health-care system, which include

- high prices set by hospitals, health-care organizations, pharmaceutical companies, and PBMs;

- a costly maze created by insurance companies that exclude, deny, and burden people in need;

- the significant public dollars for health extracted by corporations for their own profits;

- a system ultimately designed to place the financial burden of care on patients; and

- decades of policy that has failed to rectify the cruel and unsustainable harms these choices have created.

Medical Debt Is a Symptom of a Broken System, Not a Solution to Its Troubles

In the constrained environment under which so much of our health-care system operates, it might seem that collecting on medical debt is unfortunate but essential to keeping the system afloat. Yet even the most aggressive debt collection practices do not generate substantial revenue for hospitals and health-care organizations, as evidenced by a 2017 study in Virginia that found suing patients and garnishing their wages comprised only 0.1 percent of hospital revenue on average. Dr. Marty Makary, a coauthor of the study and the current commissioner of the Food and Drug Administration under the Trump administration, put the implications bluntly: “The argument that we have to do something this ugly in order to stay afloat is not supported by the data.”

Hospitals and health systems know this too, and recognize that most patients with debt simply cannot afford to pay. Precisely because the prospect of collecting full payment is so low, many choose instead to sell this debt cheaply—for pennies on the dollar—and write it off as a loss on their taxes. The cheapness of this debt is what allows cancellation programs like Cook County’s to achieve the high return on investment that is part of their popularity and success.6

This alone should point us to a fundamental question: If we can buy medical debt so cheaply and cancel it so easily, is this debt really necessary in the first place?

Of course, our health-care system needs significant resources to function. But if we are serious about finding sustainable revenue streams to stabilize it, we must acknowledge the needed money will not come from medical debt collection, nor from any other solution that increases the already heavy burden on individuals and maintains the power of the private sector.