Marketplace Confusion Opens Door To Questions About Skinny Plans

Consumers coping with the high cost of health insurance are the target market for new plans claiming to be lower-cost alternatives to the Affordable Care Act that fulfill the law’s requirement for health coverage.

But experts and regulators warn consumers to be cautious and are raising red flags about one set of limited benefit plans marketed to individuals for as little as $93 a month. Offered through brokers and online ads, the plans promise to be an “ACA compliant, affordable, integrated solution that help … individuals avoid the penalties under [the health law].”

Legal and policy experts have raised concerns that the new plans could leave buyers incorrectly thinking they are exempt from paying a penalty for not having coverage. Additionally, they say, plans sold to individuals must be state-licensed.

Apex Management Group of Oak Brook, Ill., and Pennsylvania-based Xpress Healthcare have teamed up to offer the plans, and executives from both companies say they don’t need state approval to sell them.

In California, Insurance Commissioner Dave Jones has already asked for an investigation.

“Generally speaking, any entity selling health insurance in the state of California has to have a license,” Jones said earlier this month. “I have asked the Department of Insurance staff to open an investigation with regard to this company to ascertain whether it is in violation of California law if they are selling it in California.”

Asked about a possible investigation, Apex owner Jeffrey Bemoras recently emailed a statement saying the firm is not offering the plans to individuals in California.

Bruce Benton, spokesman for the California Association of Health Underwriters, which represents the state’s health insurance agents, said his organization has not heard of Apex or Xpress and does not know of anybody who is selling their skinny plans in California.

These skinny plans — sold for the first time to individuals in other states across the country — come amid uncertainty over the fate of the ACA and whether President Donald Trump’s administration will ease rules on plans in the individual market. Dozens of brokers are offering the plans.

“The Trump administration is injecting a significant amount of confusion into the implementation of the ACA,” said Kevin Lucia, project director at Georgetown University’s Health Policy Institute. “So it doesn’t surprise me that we would have arrangements popping up that might be trying to take advantage of that confusion.”

David Shull, Apex’s director of business development, said “this is not insurance” and the plans are designed to meet the “bulk of someone’s day-to-day needs.”

In his email, Bemoras wrote that “Apex Management group adheres closely to all state and federal rules and regulations surrounding offering a self-insured MEC [minimal essential coverage] program.” He added: “We are test marketing our product in the individual environment, [and] if at some point it doesn’t make sense to continue that investment we will not invest or focus in on that market.”

Price-Tag Appeal, But What About Coverage?

The new plans promise to be a solution for individuals who say that conventional health insurance is too expensive. Those looking for alternatives to the ACA often earn too much to qualify for tax subsidies under the federal law.

Donna Harper, an insurance agent who runs a two-person brokerage in Crystal Lake, Ill., found herself in that situation. She sells the Xpress plans — and decided to buy one herself.

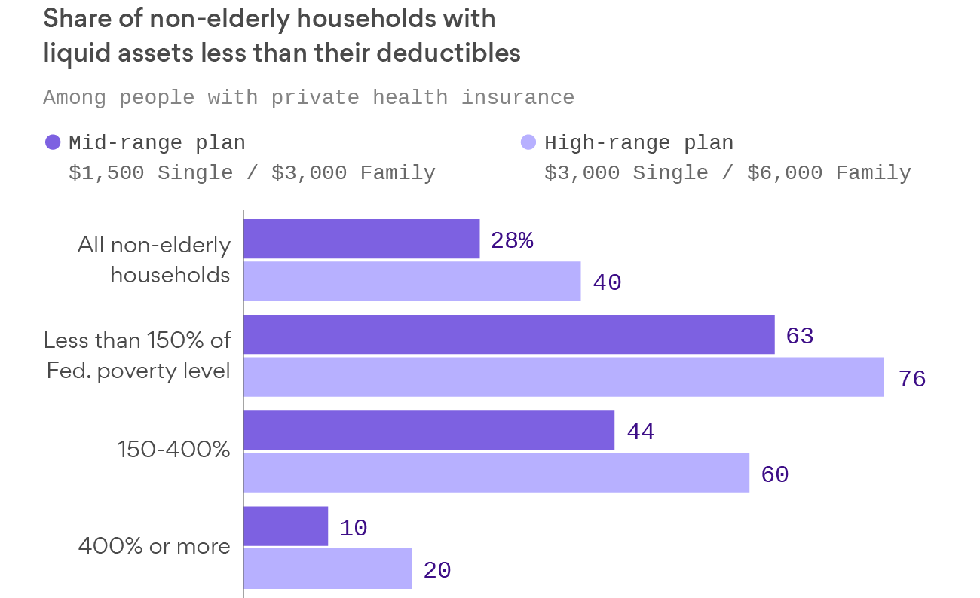

Harper says she canceled her BlueCross BlueShield plan, which did meet the ACA’s requirements, after it rose to nearly $11,000 in premiums this year, with a $6,000 annual deductible.

“Self-employed people are being priced out of the market,” she said, noting the new Xpress plan will save her more than $500 a month.

The Xpress Minimum Essential Coverage plans come in three levels, costing as little as $93 a month for individuals to as much as $516 for a family. They cover preventive care — including certain cancer screenings and vaccinations — while providing limited benefits for doctor visits, lab tests and lower-cost prescription drugs.

There is little or no coverage for hospital, emergency room care and expensive prescription drugs, such as chemotherapy.

Harper said she generally recommends that her clients who sign up for an Xpress plan also buy a hospital-only policy offered by other insurers. That extra policy would pay a set amount toward in-patient care — often ranging from $1,500 to $5,000 or so a day.

Still, experts caution that hospital bills are generally much higher than those amounts. A three-day stay averages $30,000, according to the federal government’s insurance website. And hospital plans can have tougher requirements. Unlike the Xpress programs, which don’t reject applicants who have preexisting medical conditions, most hospital-only plans often do. Harper says she personally was rejected for one.

“I haven’t been in the hospital for 40 years, so I’m going to roll the dice,” she said. And if she winds up in the hospital? “I’ll just pay the bill.”

About 100 brokers nationwide are selling the plans, and interest “is picking up quick,” said Edward Pettola, co-owner and founder of Xpress, which for years has sold programs that offer discounts on dental, vision and prescription services.

Caveat Emptor

Experts question whether the plans exempt policyholders from the ACA’s tax penalty for not having “qualified” coverage, defined as a policy from an employer, a government program or a licensed product purchased on the individual market.

The penalty for tax year 2017 is the greater of a flat fee or a percentage of income. The annual total could range from as little as $695 for an individual to as much as $3,264 for a family.

Trump issued an executive order in October designed to loosen insurance restrictions on lower-cost, alternative forms of coverage, but the administration has not signaled its view on what would be deemed qualified coverage.

Responding to questions from KHN, officials from Apex and Xpress said their plans are designed to be affordable, not to mimic ACA health plans.

“If that is what we are expected to do, just deliver what every Marketplace plan or carriers do, provide a Bronze, Silver Plan, etc. it would not solve the problem in addressing a benefit plan that is affordable,” the companies said in a joint email on Nov. 14. “Individuals are not required to have an insurance plan, but a plan that meets minimum essential coverage, the required preventive care services.”

Bemoras, in a separate interview, said his company has been selling a version of the plan to employers since 2015.

“As we see the political environment moving and wavering and not understanding what needs to be done, the individual market became extremely attractive to us,” Bemoras said.

Still, experts who reviewed the plans for KHN said policies sold to individuals must cover 10 broad categories of health care to qualify as ACA-compliant, including hospitalization and emergency room care, and cannot set annual or lifetime limits.

The Xpress/Apex programs do set limits, paying zero to $2,500 annually toward hospital care. Doctor visits are covered for a $20 copayment, but coverage is limited to three per year. Lab tests are limited to five services annually. To get those prices, patients have to use a physician or facility in the PHCS network, which says it has 900,000 providers nationwide. Low-cost generics are covered for as little as a $1 copay, but the amount patients pay rises sharply for more expensive drugs.

“I’m very skeptical,” said attorney Alden J. Bianchi of Mintz Levin, who advises firms on employee benefits. “That would be hard [to do] because in the individual market, you have to cover all the essential health benefits.”

The details can be confusing, partly because federal law allows group health plans — generally those offered by large employers — to provide workers with self-funded, minimal coverage plans like those offered by Apex, Bianchi said.

Apex’s Shull said in a recent email that the firm simply wants to offer coverage to people who otherwise could not afford an ACA plan.

“There will be states that want to halt this. Why, I do not understand,” he wrote. “Would an individual be better off going without anything? If they need prescriptions, lab or imaging services subject to a small copay, would you want to be the one to deny them?”

Some consumers might find the price attractive, but also find themselves vulnerable to unexpected costs, including the tax liability of not having ACA-compliant coverage.

Harper, the broker who signed up for one of the plans, remains confident: “As long as Xpress satisfies the [mandate], which I’m told it does, my clients are in good hands. Even if it doesn’t, I don’t think it’s a big deal. You are saving that [the tax penalty amount] a month.”