The Trump administration formally declared its opposition to the entire Affordable Care Act on Wednesday, arguing in a federal appeals court filing that the signature Obama-era legislation was unconstitutional and should be struck down.

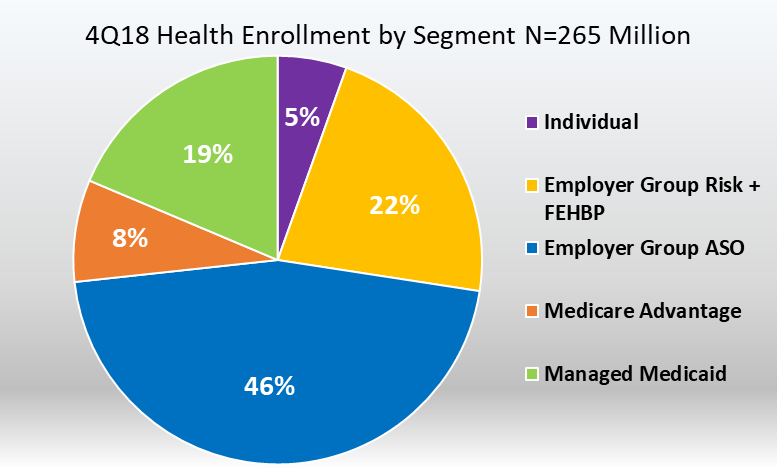

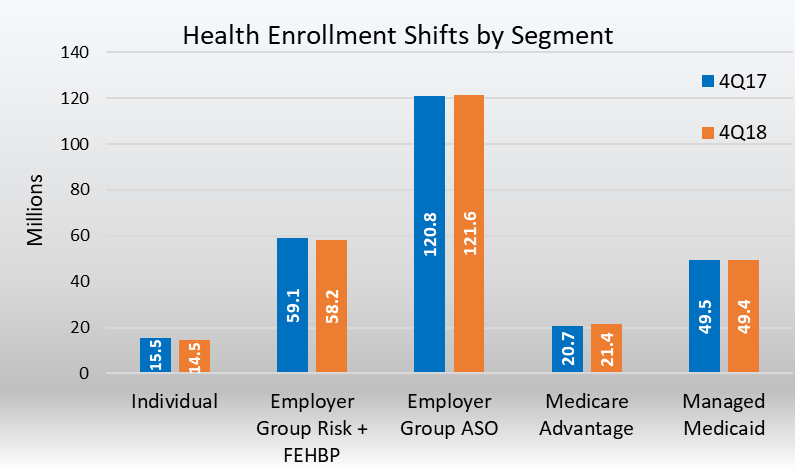

Such a decision could end health insurance for some 21 million Americans and affect many millions more who benefit from the law’s protections for people with pre-existing medical conditions and required coverage for pregnancy, prescription drugs and mental health.

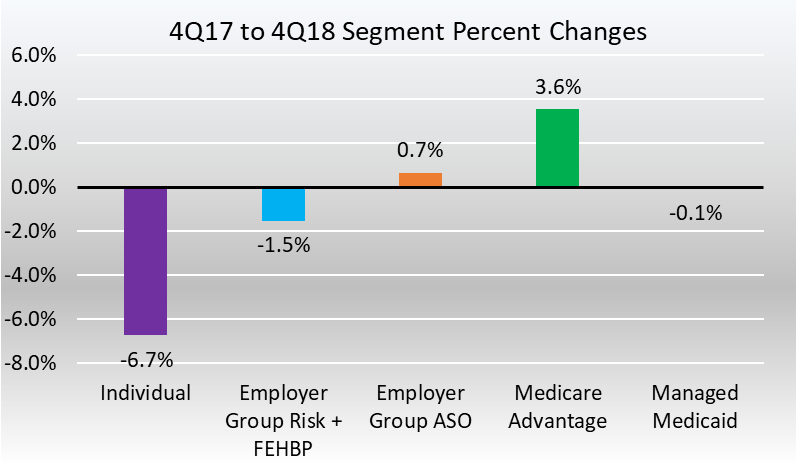

In filing the brief, the administration abandoned an earlier position — that some portions of the law, including the provision allowing states to expand their Medicaid programs, should stand. The switch, which the administration disclosed in late March, has confounded many people in Washington, even within the Republican Party, who came to realize that health insurance and a commitment to protecting the A.C.A. were among the main issues that propelled Democrats to a majority in the House of Representatives last fall.

The filing was made in a case challenging the law brought by Ken Paxton, the attorney general of Texas, and 17 other Republican-led states. In December, a federal judge from the Northern District of Texas, Reed O’Connor, ruled that the law was unconstitutional.

A group of 21 Democratic-led states, headed by California, immediately appealed, and the case is now before the Fifth Circuit Court of Appeals in New Orleans. The House of Representatives has joined the case as well to defend the law.

Democrats wasted no time responding to the filing Wednesday. Xavier Becerra, the attorney general of California, a Democrat, said: “The Trump administration chose to abandon ship in defending our national health care law and the hundreds of millions of Americans who depend on it for their medical care. Our legal coalition will vigorously defend the law and the Americans President Trump has abandoned.”

The government’s brief did not shed light on why it had altered its earlier position, referring only to “further consideration and review of the district court’s opinion.”

Oral arguments in the appeals court are expected in July, with a possible decision by the end of the year, as the 2020 presidential campaign gets going in earnest. Whichever side loses is expected to appeal to the Supreme Court.

The Justice Department’s request to expedite oral arguments, granted last month, suggests that the administration is eager for a final ruling. In its application, it said that “prompt resolution of this case will help reduce uncertainty in the health care sector, and other areas affected by the Affordable Care Act.”

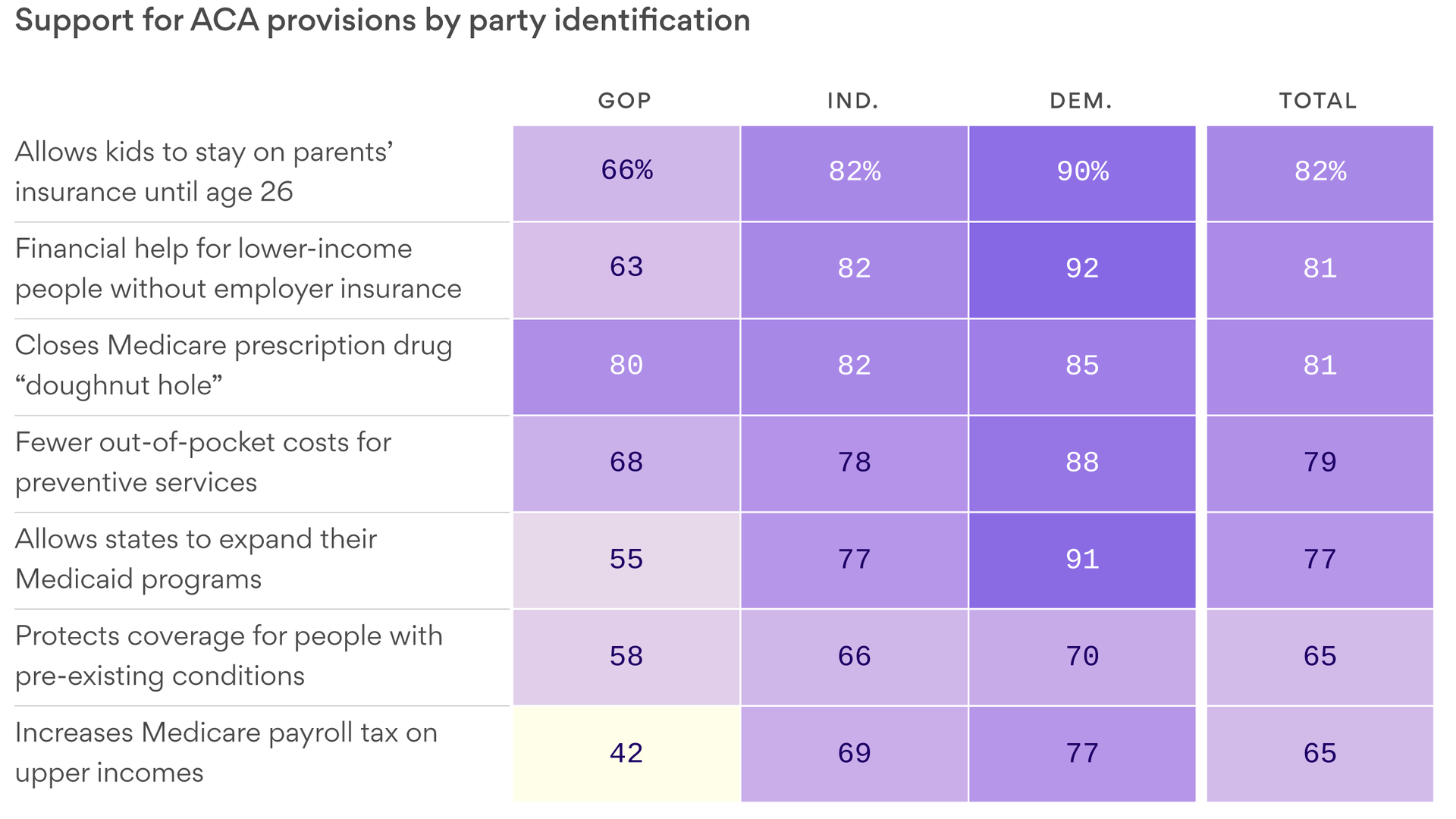

Democrats, seizing on the health law’s popularity and its decisive role in their winning the House last fall, are already using the case as a cudgel against President Trump as his re-election campaign gets started. The law’s guarantee of coverage for people with pre-existing medical conditions, in particular, remains very popular with voters in both parties as well as independents.

But Mr. Trump has appeared undaunted, tweeting in April that “Republicans will always support Pre-Existing Conditions” and that a replacement plan “will be on full display during the Election as a much better & less expensive alternative to Obamacare.”

Instead of providing specifics, though, Mr. Trump, members of his administration and other Republicans have focused on attacking the Medicare for All plans that some Democratic presidential candidates have sponsored or endorsed as a dangerous far-left idea that would, as Mr. Trump tweeted, cause millions of Americans “to lose their beloved private health insurance.”

As the administration and Texas noted in their briefs, Judge O’Connor’s ruling turned on the law’s requirement that most people have health coverage or be subject to a tax penalty.

But in the 2017 tax legislation, Congress reduced that penalty to zero, effectively eliminating it. Judge O’Connor, the plaintiff states, and now the Trump administration reasoned that, like a house of cards, when the tax penalty fell, the so-called individual mandate became unconstitutional and unenforceable. Therefore, the entire law had to fall as well.

Mr. Paxton, the Texas attorney general, whose office also filed a brief on Wednesday, said: “Congress meant for the individual mandate to be the centerpiece of Obamacare. Without the constitutional justification for the centerpiece, the law must go down.”

Whether that position will survive judicial scrutiny is another question. Nicholas Bagley, who teaches health law at the University of Michigan Law School, noted that only two lawyers signed the brief. That is highly unusual in a case with such a high profile, he said.

“This is a testament to the outrageousness of the Justice Department position, that no reasonable argument could be made in the statute’s defense,” Mr. Bagley said. “It is a truly indefensible position. This is just partisan hardball.”

Many legal scholars have also said that even before appellate judges wade into the more obscure pools of legal reasoning, they could reach a decision by addressing the question of congressional intent. If Congress had meant the erasure of the tax penalty to wipe out the entire act, such an argument goes, it would have said so.

If the Fifth Circuit overturns the O’Connor decision, there is no guarantee that the Supreme Court would take an appeal. The court has ruled on two earlier A.C.A. challenges, finding in favor of the act, although narrowing it.

Of course, the composition of the Supreme Court has since changed.