The massive Republican budget bill working its way through Congress has mostly drawn attention for its tax cuts and Medicaid changes.

- But it would also take steps to significantly roll back coverage under the Affordable Care Act, with echoes of the 2017 repeal-replace debate.

Why it matters:

The bill that passed the House before Memorial Day includes an overhaul of ACA marketplaces that would result in coverage losses for millions of Americans and savings to help cover the cost of extending President Trump’s tax cuts, Peter Sullivan wrote first on Pro.

- It comes after a growth spurt that saw ACA marketplace enrollment reach new highs, with more than 24 million people enrolling for 2025, according to KFF. The House’s changes would likely reverse that trend, unless the Senate goes in a different direction when it picks up the bill next week.

Driving the news:

The changes are not as sweeping as the 2017 effort at repealing the law, but many of them erect barriers to enrollment that supporters say are aimed at fighting fraud.

- Brian Blase, president of Paragon Health Institute and a health official in Trump’s first administration, said Republicans are focusing on rolling back Biden-era expansions “that have led to massive fraud and inefficiency.”

- The Congressional Budget Office estimates the ACA marketplace-related provisions would lead to about 3 million more people becoming uninsured.

- Cynthia Cox, a vice president at KFF, said while the changes “sound very technical” in nature, taken together “the implications are that it will be much harder for people to sign up for ACA marketplace plans.”

What’s inside:

The bill would end automatic reenrollment in ACA plans for people getting subsidies, instead requiring them to proactively reenroll and resubmit information about their incomes for verification.

- It would also prevent enrollees from provisionally receiving ACA subsidies in instances where extra eligibility checks are needed, which can take months.

- If people wound up making more income than they had estimated for a given year, the bill removes the cap on the amount of ACA subsidies they would have to repay to the government.

- Some legal immigrants would also be cut off from ACA subsidies, including people granted asylum and those in their five-year waiting period to be eligible for Medicaid.

What they’re saying:

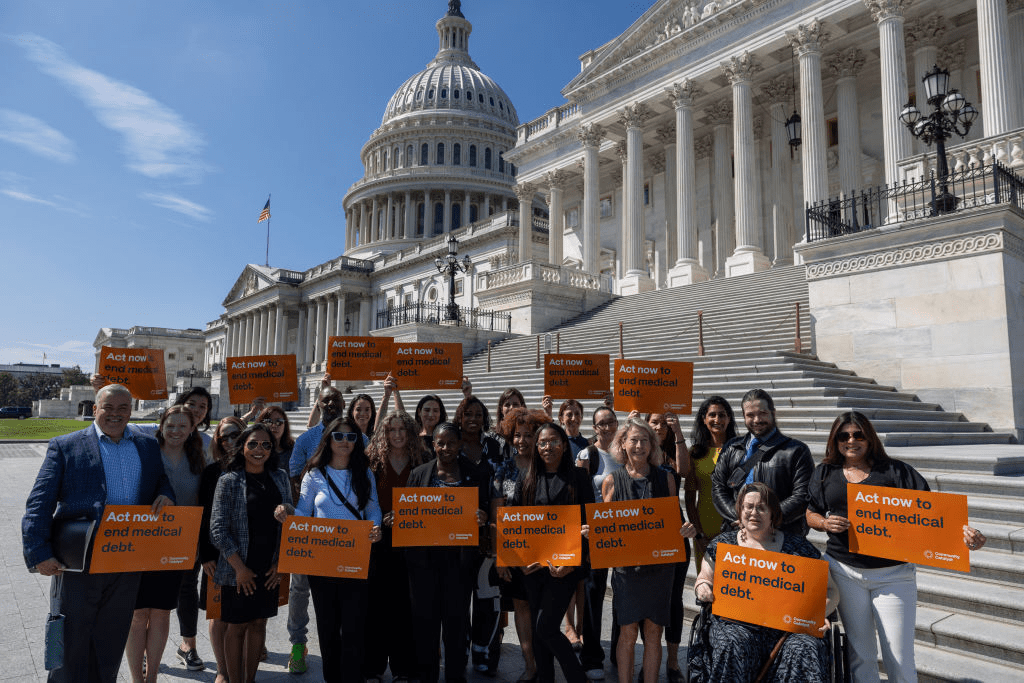

In a letter to Congress, patient groups pointed to the various barriers as “unprecedented and onerous requirements to access health coverage” that would have “a devastating impact on people’s ability to access and afford private insurance coverage.”

- The letter was signed by groups including the American Cancer Society Cancer Action Network, American Diabetes Association and American Lung Association.

Between the lines:

A last-minute addition to the bill would also make a technical but important change that increases government payments to insurers in ACA marketplaces.

- That would have the effect of reducing the subsidies that help people afford premiums and save the government money, by reducing the benchmark silver premiums that are used to set the subsidy amounts.

- Democrats are concerned that if Congress also allows enhanced ACA subsidies to expire at the end of this year, the combined effect would be even higher premium increases for enrollees next year.

Insurers that already are planning their premium rates for next year say the Republican funding changes are throwing uncertainty into the mix.

- “Disruption in the individual market could also result in much higher premiums,” the trade group AHIP warned in a statement on the bill.

The big picture:

Blase said changes like ending automatic reenrollment are needed to increase checks that ensure people are not claiming higher subsidies than they’re entitled to.

- Cox said another way to address fraud would be to target shady insurance brokers, rather than enrollees themselves. She estimated that marketplace enrollment could fall by roughly one-third from all the changes together.

- “The justification for many of these provisions is to address fraud,” she said. “The question is, how many people who are legitimately signed up are going to get lost in that process?”