Category Archives: High Drug Prices

BIG INSURANCE 2023: Revenues reached $1.39 trillion thanks to taxpayer-funded Medicaid and Medicare Advantage businesses

The Affordable Care Act turned 14 on March 23. It has done a lot of good for a lot of people, but big changes in the law are urgently needed to address some very big misses and consequences I don’t believe most proponents of the law intended or expected.

At the top of the list of needed reforms: restraining the power and influence of the rapidly growing corporations that are siphoning more and more money from federal and state governments – and our personal bank accounts – to enrich their executives and shareholders.

I was among many advocates who supported the ACA’s passage, despite the law’s ultimate shortcomings. It broadened access to health insurance, both through government subsidies to help people pay their premiums and by banning prevalent industry practices that had made it impossible for millions of American families to buy coverage at any price. It’s important to remember that before the ACA, insurers routinely refused to sell policies to a third or more applicants because of a long list of “preexisting conditions” – from acne and heart disease to simply being overweight – and frequently rescinded coverage when policyholders were diagnosed with cancer and other diseases.

While insurance company executives were publicly critical of the law, they quickly took advantage of loopholes (many of which their lobbyists created) that would allow them to reap windfall profits in the years ahead – and they have, as you’ll see below.

Among other things, the ACA made it unlawful for most of us to remain uninsured (although Congress later repealed the penalty for doing so). But, notably, it did not create a “public option” to compete with private insurers, which many advocates and public policy experts contended would be essential to rein in the cost of health insurance. Many other reform advocates insisted – and still do – that improving and expanding the traditional Medicare program to cover all Americans would be more cost-effective and fair.

I wrote and spoke frequently as an industry whistleblower about what I thought Congress should know and do, perhaps most memorably in an interview with Bill Moyers. During my Congressional testimony in the months leading up to the final passage of the bill in 2010, I told lawmakers that if they passed it without a public option and acquiesced to industry demands, they might as well call it “The Health Insurance Industry Profit Protection and Enhancement Act.”

A health plan similar to Medicare that could have been a more affordable option for many of us almost happened, but at the last minute, the Senate was forced to strip the public option out of the bill at the insistence of Sen. Joe Lieberman (I-Connecticut), who died on March 27, 2024. The Senate did not have a single vote to spare as the final debate on the bill was approaching, and insurance industry lobbyists knew they could kill the public option if they could get just one of the bill’s supporters to oppose it. So they turned to Lieberman, a former Democrat who was Vice President Al Gore’s running mate in 2000 and who continued to caucus with Democrats. It worked. Lieberman wouldn’t even allow a vote on the bill if it created a public option. Among Lieberman’s constituents and campaign funders were insurance company executives who lived in or around Hartford, the insurance capital of the world. Lieberman would go on to be the founding chair of a political group called No Labels, which is trying to find someone to run as a third-party presidential candidate this year.

The work of Big Insurance and its army of lobbyists paid off as insurers had hoped. The demise of the public option was a driving force behind the record profits – and CEO pay – that we see in the industry today.

The good effects of the ACA:

Nearly 49 million U.S. residents (or 16%) were uninsured in 2010. The law has helped bring that down to 25.4 million, or 8.3% (although a large and growing number of Americans are now “functionally uninsured” because of unaffordable out-of-pocket requirements, which President Biden pledged to address in his recent State of the Union speech).

The ACA also made it illegal for insurers to refuse to sell coverage to people with preexisting conditions, which even included birth defects, or charge anyone more for their coverage based on their health status; it expanded Medicaid (in all but 10 states that still refuse to cover more low-income individuals and families); it allowed young people to stay on their families’ policies until they turn 26; and it required insurers to spend at least 80% of our premiums on the health care goods and services our doctors say we need (a well-intended provision of the law that insurers have figured out how to game).

The not-so-good effects of the ACA:

As taxpayers and health care consumers, we have paid a high price in many ways as health insurance companies have transformed themselves into massive money-making machines with tentacles reaching deep into health care delivery and taxpayers’ pockets.

To make policies affordable in the individual market, for example, the government agreed to subsidize premiums for the vast majority of people seeking coverage there, meaning billions of new dollars started flowing to private insurance companies. (It also allowed insurers to charge older Americans three times as much as they charge younger people for the same coverage.) Even more tax dollars have been sent to insurers as part of the Medicaid expansion. That’s because private insurers over the years have persuaded most states to turn their Medicaid programs over to them to administer.

Insurers have bulked up incredibly quickly since the ACA was enacted through consolidation, vertical integration, and aggressive expansion into publicly financed programs – Medicare and Medicaid in particular – and the pharmacy benefit space. Premiums and out-of-pocket requirements, meanwhile, have soared.

We invite you to take a look at how the ascendency of health insurers over the past several years has made a few shareholders and executives much richer while the rest of us struggle despite – and in some cases because of – the Affordable Care Act.

BY THE NUMBERS

In 2010, we as a nation spent $2.6 trillion on health care. This year we will spend almost twice as much – an estimated $4.9 trillion, much of it out of our own pockets even with insurance.

In 2010, the average cost of a family health insurance policy through an employer was $13,710. Last year, the average was nearly $24,000, a 75% increase.

The ACA, to its credit, set an annual maximum on how much those of us with insurance have to pay before our coverage kicks in, but, at the insurance industry’s insistence, it goes up every year. When that limit went into effect in 2014, it was $12,700 for a family. This year, it has increased by 48%, to $18,900. That means insurers can get away with paying fewer claims than they once did, and many families have to empty their bank accounts when a family member gets sick or injured. Most people don’t reach that limit, but even a few hundred dollars is more than many families have on hand to cover deductibles and other out-of-pocket requirements.

Now 100 million Americans – nearly one of every three of us – are mired in medical debt, even though almost 92% of us are presumably “covered.” The coverage just isn’t as adequate as it used to be or needs to be.

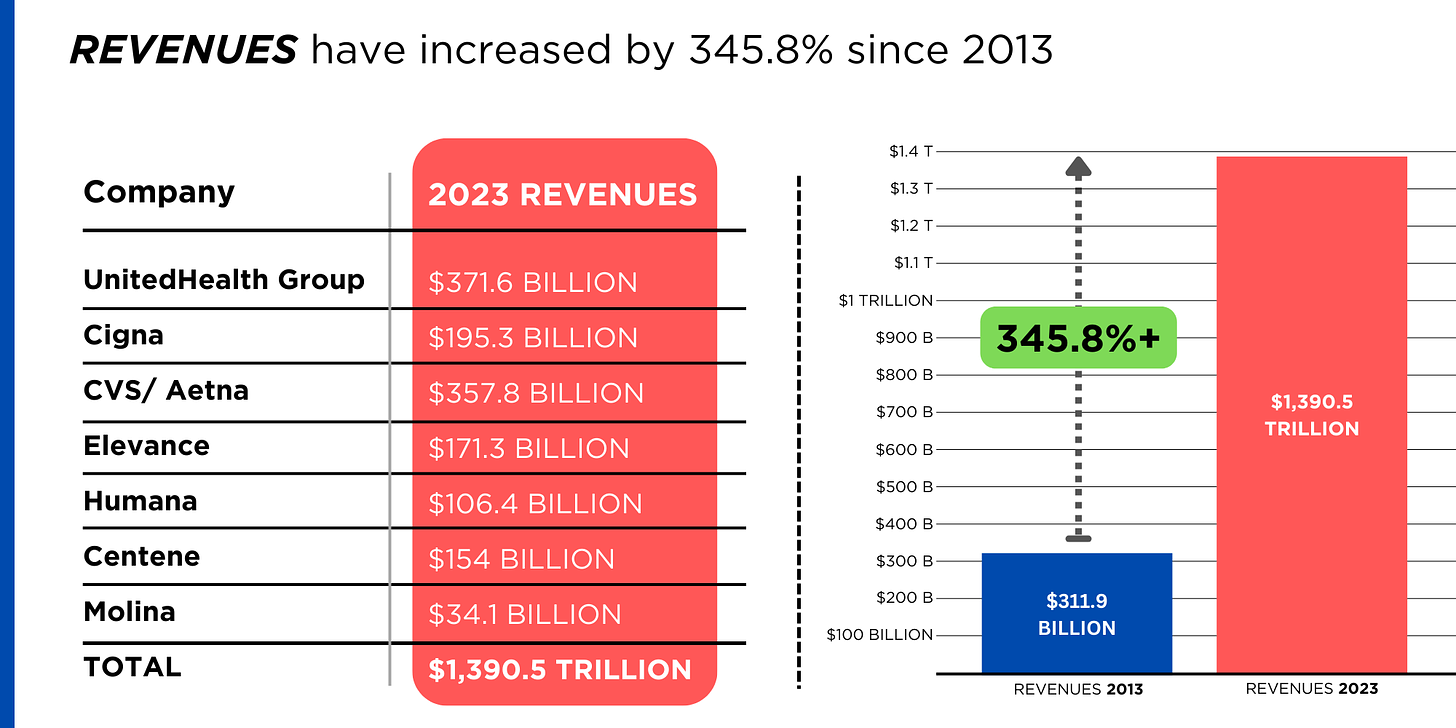

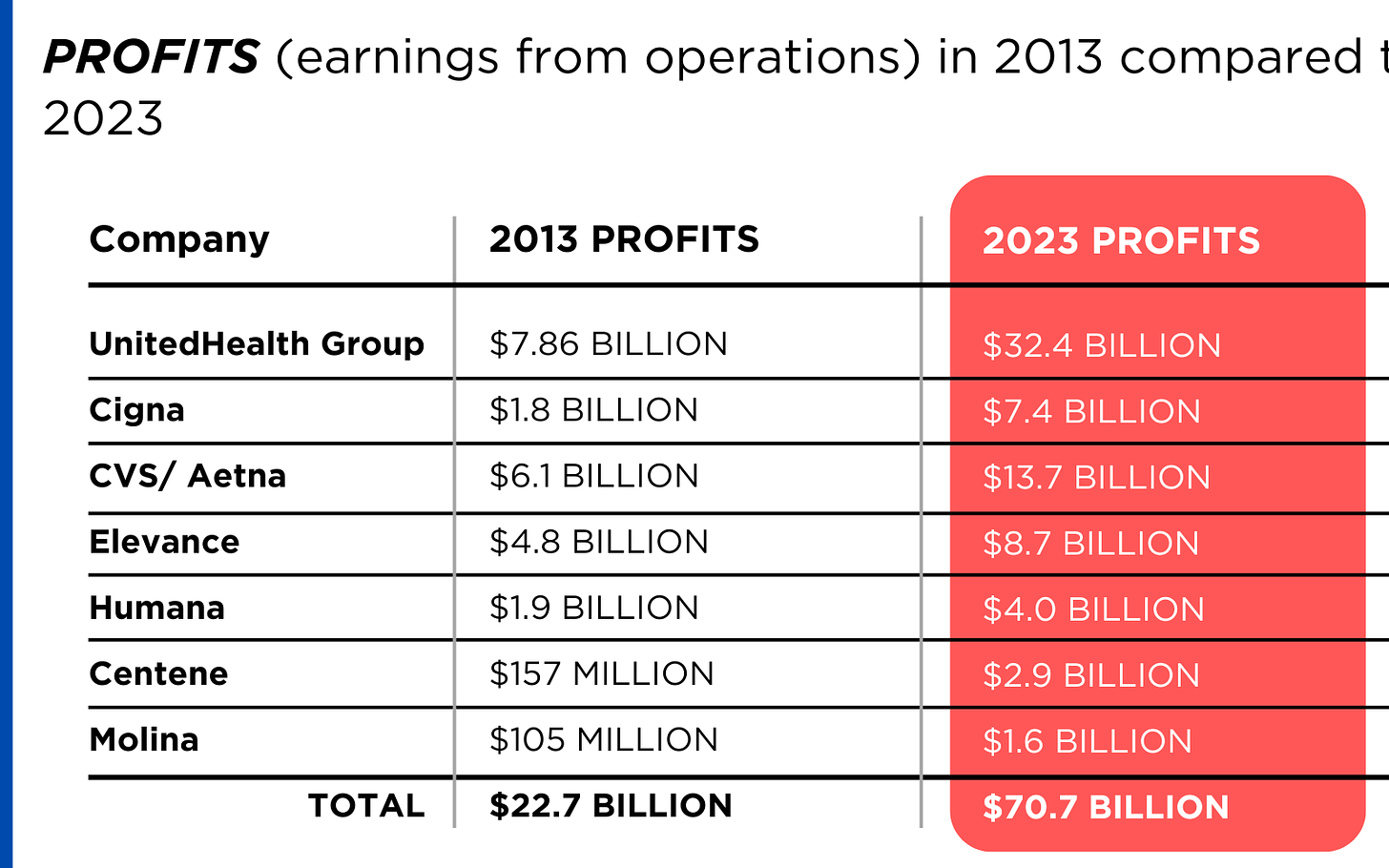

Meanwhile, insurance companies had a gangbuster 2023. The seven big for-profit U.S. health insurers’ revenues reached $1.39 trillion, and profits totaled a whopping $70.7 billion last year.

SWEEPING CHANGE, CONSOLIDATION–AND HUGE PROFITS FOR INVESTORS

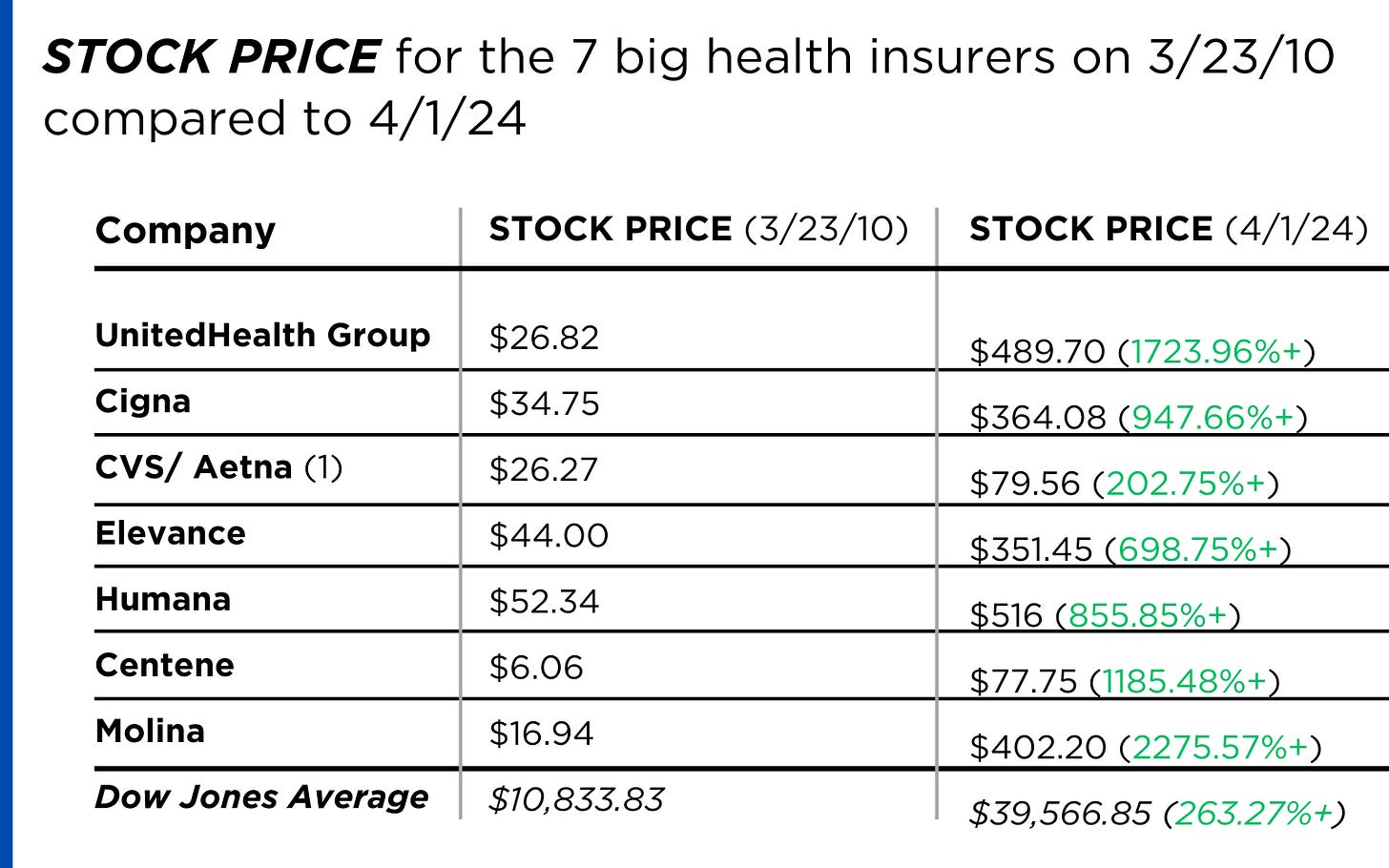

Insurance company shareholders and executives have become much wealthier as the stock prices of the seven big for-profit corporations that control the health insurance market have skyrocketed.

REVENUES collected by those seven companies have more than tripled (up 346%), increasing by more than $1 trillion in just the past ten years.

PROFITS (earnings from operations) have more than doubled (up 211%), increasing by more than $48 billion.

The CEOs of these companies are among the highest paid in the country. In 2022, the most recent year the companies have reported executive compensation, they collectively made $136.5 million.

U.S. HEALTH PLAN ENROLLMENT

Enrollment in the companies’ health plans is a mix of “commercial” policies they sell to individuals and families and that they manage for “plan sponsors” – primarily employers and unions – and government/enrollee-financed plans (Medicare, Medicaid, Tricare for military personnel and their dependents and the Federal Employee Health Benefits program).

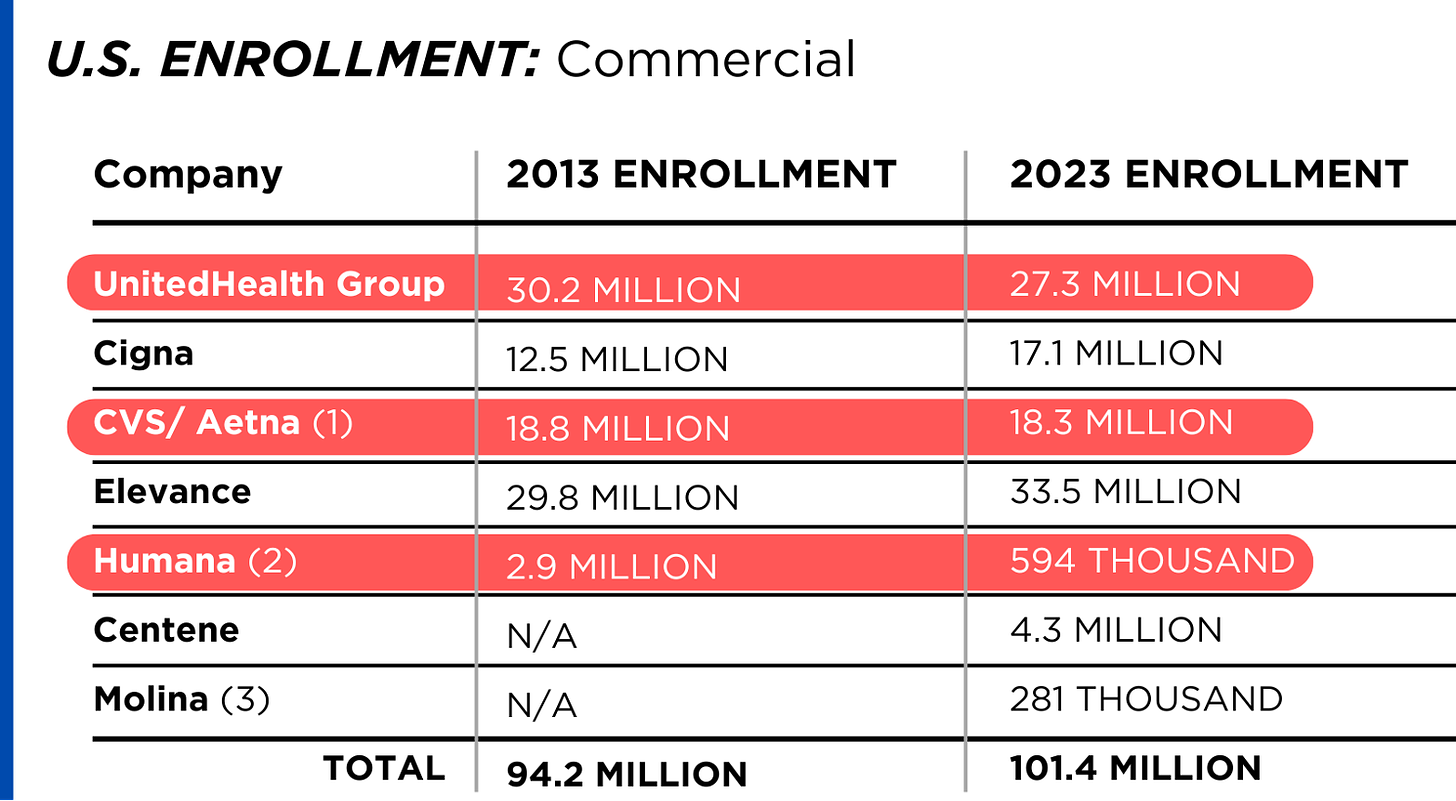

Enrollment in their commercial plans grew by just 7.65% over the 10 years and declined significantly at UnitedHealth, CVS/Aetna and Humana. Centene and Molina picked up commercial enrollees through their participation in several ACA (Obamacare) markets in which most enrollees qualify for federal premium subsidies paid directly to insurers.

While not growing substantially, commercial plans remain very profitable because insurers charge considerably more in premiums now than a decade ago.

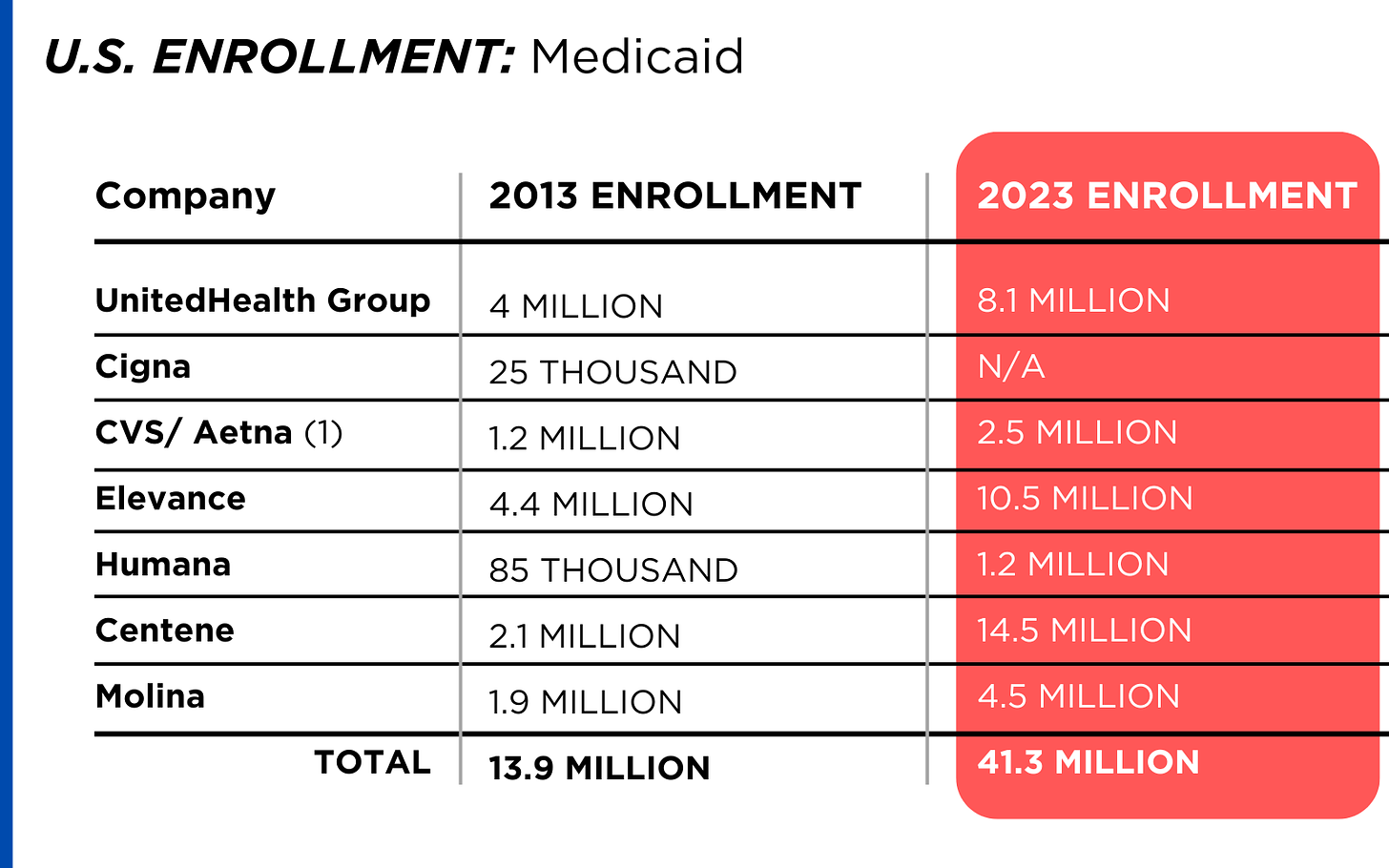

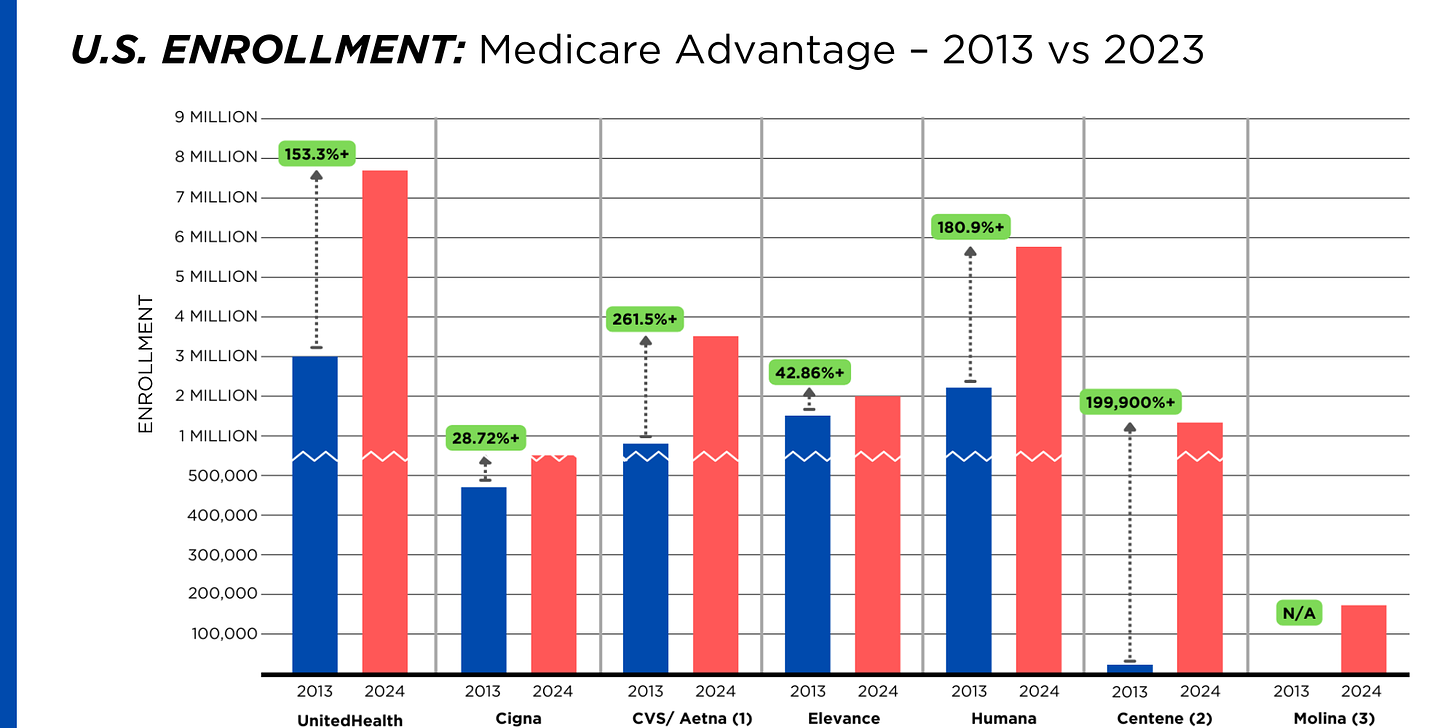

By contrast, enrollment in the government-financed Medicaid and Medicare Advantage programs has increased 197% and 167%, respectively, over the past 10 years.

Of the 65.9 million people eligible for Medicare at the beginning of 2024, 33 million, slightly more than half, enrolled in a private Medicare Advantage plan operated by either a nonprofit or for-profit health insurer, but, increasingly, three of the big for-profits grabbed most new enrollees. Of the 1.7 million new Medicare Advantage enrollees this year, 86% were captured by UnitedHealth, Humana and Aetna. Those three companies are the leaders in the Medicare Advantage business among the for-profit companies, and, according to the health care consulting firm Chartis, are taking over the program “at breakneck speed.”

It is worth noting that although four companies saw growth in their Medicare Supplement enrollment over the decade, enrollment in Medicare Supplement policies has been declining in more recent years as insurers have attracted more seniors and disabled people into their Medicare Advantage plans.

OTHER FEDERAL PROGRAMS

In addition to the above categories, Humana and Centene have significant enrollment in Tricare, the government-financed program for the military. Humana reported 6 million military enrollees in 2023, up from 3.1 million in 2013. Centene reported 2.8 million in 2023. It did not report any military enrollment in 2013.

Elevance reported having 1.6 million enrollees in the Federal Employees Health Benefits Program in 2023, up from 1.5 million in 2013. That total is included in the commercial enrollment category above.

PBMs

As with Medicare Advantage, three of the big seven insurers control the lion’s share of the pharmacy benefit market (and two of them, UnitedHealth and CVS/Aetna, are also among the top three in signing up new Medicare Advantage enrollees, as noted above). CVS/Aetna’s Caremark, Cigna’s Express Scripts and UnitedHealth’s Optum Rx PBMs now control 80% of the market.

At Cigna, Express Scripts’ pharmacy operations now contribute more than 70% to the company’s total revenues. Caremark’s pharmacy operations contribute 33% to CVS/Aetna’s total revenues, and Optum Rx contributes 31% to UnitedHealth’s total revenues.

WHAT TO DO AND WHERE TO START

The official name of the ACA is the Patient Protection and Affordable Care Act. The law did indeed implement many important patient protections, and it made coverage more affordable for many Americans. But there is much more Congress and regulators must do to close the loopholes and dismantle the barriers erected by big insurers that enable them to pad their bottom lines and reward shareholders while making health care increasingly unaffordable and inaccessible for many of us.

Several bipartisan bills have been introduced in Congress to change how big insurers do business.

They include curbing insurers’ use of prior authorization, which often leads to denials and delays of care; requiring PBMs to be more “transparent” in how they do business and banning practices many PBMs use to boost profits, including spread pricing, which contributes to windfall profits; and overhauling the Medicare Advantage program by instituting a broad array of consumer and patient protections and eliminating the massive overpayments to insurers.

And as noted above, President Biden has asked Congress to broaden the recently enacted $2,000-a-year cap on prescription drugs to apply to people with private insurance, not just Medicare beneficiaries. That one policy change could save an untold number of lives and help keep millions of families out of medical debt. (A coalition of more than 70 organizations and businesses, which I lead, supports that, although we’re also calling on Congress to reduce the current overall annual out-of-pocket maximum to no more than $5,000.)

I encourage you to tell your members of Congress and the Biden administration that you support these reforms as well as improving, strengthening and expanding traditional Medicare. You can be certain the insurance industry and its allies are trying to keep any reforms that might shrink profit margins from becoming law.

Cartoon – Out of Pocket Experience

Cartoon – Ask Your Congressman

Unpacking one aspect of healthcare affordability

https://www.kaufmanhall.com/insights/blog/gist-weekly-april-12-2024

In this week’s graphic, we showcase recent KFF survey data on how healthcare costs impact the public, particularly those with health insurance.

Nearly half of US adults say it is difficult to afford healthcare, and in the last year, 28 percent have skipped or postponed care due to cost, with an even greater share of younger people delaying care due to cost concerns.

Although healthcare affordability has long been a problem for the uninsured, one in five adults with insurance skipped care in the past year because of cost. Insured Americans report low satisfaction with the affordability of their coverage.

In addition to high premiums, out-of-pocket costs to see a physician or fill a prescription are particular sources of concern. Adults with employer-sponsored or marketplace plans are far more likely to be dissatisfied with the affordability of their coverage, compared to those with government-sponsored plans.

With eight in ten American voters saying that it is “very important” for the 2024 presidential candidates to focus on the affordability of healthcare, we’ll no doubt see more attention focused on this issue as the presidential election race heats up.

Has U.S. Healthcare reached its Tipping Point?

Last week was significant for healthcare:

- Tuesday, the, FTC, and DOJ announced creation of a task force focused on tackling “unfair and illegal pricing” in healthcare. The same day, HHS joined FTC and DOJ regulators in launching an investigation with the DOJ and FTC probing private equity’ investments in healthcare expressing concern these deals may generate profits for corporate investors at the expense of patients’ health, workers’ safety and affordable care.

- Thursday’s State of the Union address by President Biden (SOTU) and the Republican response by Alabama Senator Katey Britt put the spotlight on women’s reproductive health, drug prices and healthcare affordability.

- Friday, the Senate passed a $468 billion spending bill (75-22) that had passed in the House Wednesday (339-85) averting a government shutdown. The bill postpones an $8 billion reduction in Medicaid disproportionate share hospital payments for a year, allocates $4.27 billion to federally qualified health centers through the end of the year and rolls back a significant portion of a Medicare physician pay cut that kicked in on Jan. 1. Next, Congress must pass appropriations for HHS and other agencies before the March 22 shutdown.

- And all week, the cyberattack on Optum’s Change Healthcare discovered February 21 hovered as hospitals, clinics, pharmacies and others scrambled to manage gaps in transaction processing. Notably, the American Hospital Association and others have amplified criticism of UnitedHealth Group’s handling of the disruption, having, bought Change for $13 billion in October, 2022 after a lengthy Department of Justice anti-trust review. This week, UHG indicates partial service of CH support will be restored. Stay tuned.

Just another week for healthcare: Congressional infighting about healthcare spending. Regulator announcements of new rules to stimulate competition and protect consumers in the healthcare market. Lobbying by leading trade groups to protect funding and disable threats from rivals. And so on.

At the macro level, it’s understandable: healthcare is an attractive market, especially in its services sectors. Since the pandemic, prices for services (i.e. physicians, hospitals et al) have steadily increased and remain elevated despite the pressures of transparency mandates and insurer pushback. By contrast, prices for most products (drugs, disposables, technologies et al) have followed the broader market pricing trends where prices for some escalated fast and then dipped.

While some branded prescription medicines are exceptions, it is health services that have driven the majority of health cost inflation since the pandemic.

UnitedHealth Group’s financial success is illustrative:

it’s big, high profile and vertically integrated across all major services sectors. In its year end 2023 financial report (January 12, 2024) it reported revenues of $371.6 Billion (up 15% Year-Over-Year), earnings from operations up 14%, cash flows from operations of $29.1 Billion (1.3x Net Income), medical care ratio at 83.2% up from 82% last year, net earnings of $23.86/share and adjusted net earnings of $25.12/share and guidance its 2024 revenues of $400-403 billion. They buy products using their scale and scope leverage to pay less for services they don’t own less and products needed to support them. It’s a big business in a buyer’s market and that’s unsettling to many.

Big business is not new to healthcare:

it’s been dominant in every sector but of late more a focus of unflattering regulator and media attention. Coupled with growing public discontent about the system’s effectiveness and affordability, it seems it’s near a tipping point.

David Johnson, one of the most thoughtful analysts of the health industry, reminded his readers last week that the current state of affairs in U.S. healthcare is not new citing the January 1970 Fortune cover story “Our Ailing Medical System”

“American medicine, the pride of the nation for many years, stands now on the brink of chaos. To be sure, our medical practitioners have their great moments of drama and triumph. But much of U.S. medical care, particularly the everyday business of preventing and treating routine illnesses, is inferior in quality, wastefully dispensed, and inequitably financed…

Whether poor or not, most Americans are badly served by the obsolete, overstrained medical system that has grown up around them helter-skelter. … The time has come for radical change.”

Johnson added: “The healthcare industry, however, cannot fight gravity forever. Consumerism, technological advances and pro-market regulatory reforms are so powerful and coming so fast that status-quo healthcare cannot forestall their ascendance. Properly harnessed, these disruptive forces have the collective power necessary for U.S. healthcare to finally achieve the 1970 Fortune magazine goal of delivering “good care to every American with little increase in cost.”

He’s right.

I believe the U.S. health system as we know it has reached its tipping point. The big-name organizations in every sector see it and have nominal contingency plans in place; the smaller players are buying time until the shoe drops. But I am worried.

I am worried the system’s future is in the hands of hyper-partisanship by both parties seeking political advantage in election cycles over meaningful creation of a health system that functions for the greater good.

I am worried that the industry’s aversion to price transparency, meaningful discussion about affordability and consistency in defining quality, safety and value will precipitate short-term gamesmanship for reputational advantage and nullify systemness and interoperability requisite to its transformation.

I am worried that understandably frustrated employers will drop employee health benefits to force the system to needed accountability.

I am worried that the growing armies of under-served and dissatisfied populations will revolt.

I am worried that its workforce is ill-prepared for a future that’s technology-enabled and consumer centric.

I am worried that the industry’s most prominent trade groups are concentrating more on “warfare” against their rivals and less about the long-term future of the system.

I am worried that transformational change is all talk.

It’s time to start an adult conversation about the future of the system. The starting point: acknowledging that it’s not about bad people; it’s about systemic flaws in its design and functioning. Fixing it requires balancing lag indicators about its use, costs and demand with assumptions about innovations that hold promise to shift its trajectory long-term. It requires employers to actively participate: in 2009-2010, Big Business mistakenly chose to sit out deliberations about the Affordable Care Act. And it requires independent, visionary facilitation free from bias and input beyond the DC talking heads that have dominated reform thought leadership for 6 decades.

Or, collectively, we can watch events like last week’s roll by and witness the emergence of a large public utility serving most and a smaller private option for those that afford it. Or something worse.

P.S. Today, thousands will make the pilgrimage to Orlando for HIMSS24 kicking off with a keynote by Robert Garrett, CEO of Hackensack Meridian Health tomorrow about ‘transformational change’ and closing Friday with a keynote by Nick Saban, legendary Alabama football coach on leadership. In between, the meeting’s 24 premier supporters and hundreds of exhibitors will push their latest solutions to prospects and customers keenly aware healthcare’s future is not a repeat of its past primarily due to technology. Information-driven healthcare is dependent on technologies that enable cost-effective, customized evidence-based care that’s readily accessible to individuals where and when they want it and with whom.

And many will be anticipating HCA Mission Health’s (Asheville NC) Plan of Action response due to CMS this Wednesday addressing deficiencies in 6 areas including CMS Deficiency 482.12 “which ensures that hospitals have a responsible governing body overseeing critical aspects of patient care and medical staff appointments.” Interest is high outside the region as the nation’s largest investor-owned system was put in “immediate jeopardy” of losing its Medicare participation status last year at Mission. FYI: HCA reported operating income of $7.7 billion (11.8% operating margin) on revenues of $65 billion in 2023.

What a Biden-Trump Re-Match means for Healthcare Politics: How the Campaigns will Position their Differences to Voters

With the South Carolina Republican primary results in over the weekend, it seems a Biden-Trump re-match is inevitable. Given the legacies associated with Presidencies of the two and the healthcare platforms espoused by their political parties, the landscape for healthcare politics seems clear:

| Healthcare Issue | Biden Policy | Trump Policy |

| Access to Abortion | ‘It’s a basic right for women protected by the Federal Government’ | ‘It’s up to the states and should be safe and rare. A 16-week ban should be the national standard.’ |

| Ageism | ‘President Biden is alert and capable. It’s a non-issue.’ | ‘President Biden is senile and unlikely to finish a second term is elected. President Trump is active and prepared.’ |

| Access to IVF Treatments | ‘It’s a basic right and should be universally accessible in every state and protected’ | ‘It’s a complex issue that should be considered in every state.’ |

| Affordability | ‘The system is unaffordable because it’s dominated by profit-focused corporations. It needs increased regulation including price controls.’ | ‘The system is unaffordable to some because it’s overly regulated and lacks competition and price transparency.’ |

| Access to Health Insurance Coverage | ‘It’s necessary for access to needed services & should be universally accessible and affordable.’ | ‘It’s a personal choice. Government should play a limited role.’ |

| Public health | ‘Underfunded and increasingly important.’ | ‘Fragmented and suboptimal. States should take the lead.’ |

| Drug prices | ‘Drug companies take advantage of the system to keep prices high. Price controls are necessary to lower costs.’ | ‘Drug prices are too high. Allowing importation and increased price transparency are keys to reducing costs.’ |

| Medicare | ‘It’s foundational to seniors’ wellbeing & should be protected. But demand is growing requiring modernization (aka the value agenda) and additional revenues (taxes + appropriations).’ | ‘It’s foundational to senior health & in need of modernization thru privatization. Waste and fraud are problematic to its future.’ |

| Medicaid | ‘Medicaid Managed Care is its future with increased enrollment and standardization of eligibility & benefits across states.’ | ‘Medicaid is a state program allowing modernization & innovation. The federal role should be subordinate to the states.’ |

| Competition | ‘The federal government (FTC, DOJ) should enhance protections against vertical and horizontal consolidation that reduce choices and increase prices in every sector of healthcare.’ | ‘Current anti-trust and consumer protections are adequate to address consolidation in healthcare.’ |

| Price Transparency | ‘Necessary and essential to protect consumers. Needs expansion.’ | ‘Necessary to drive competition in markets. Needs more attention.’ |

| The Affordable Care Act | ‘A necessary foundation for health system modernization that appropriately balances public and private responsibilities. Fix and Repair’ | ‘An unnecessary government takeover of the health system that’s harmful and wasteful. Repeal and Replace.’ |

| Role of federal government | ‘The federal government should enable equitable access and affordability. The private sector is focused more on profit than the public good.’ | ‘Market forces will drive better value. States should play a bigger role’ |

My take:

Polls indicate Campaign 2024 will be decided based on economic conditions in the fall 2024 as voters zero in on their choice. Per KFF’s latest poll, 74% of adults say an unexpected healthcare bill is their number-one financial concern—above their fears about food, energy and housing. So, if you’re handicapping healthcare in Campaign 2024, bet on its emergence as an economic issue, especially in the swing states (Michigan, Florida, North Carolina, Georgia and Arizona) where there are sharp health policy differences and the healthcare systems in these states are dominated by consolidated hospitals and national insurers.

- Three issues will be the primary focus of both campaigns: women’s health and access to abortion, affordability and competition. On women’s health, there are sharp differences; on affordability and competition, the distinctions between the campaigns will be less clear to voters. Both will opine support for policy changes without offering details on what, when and how.

- The Affordable Care Act will surface in rhetoric contrasting a ‘government run system’ to a ‘market driven system.’ In reality, both campaigns will favor changes to the ACA rather than repeal.

- Both campaigns will voice support for state leadership in resolving abortion, drug pricing and consolidation. State cost containment laws and actions taken by state attorneys general to limit hospital consolidation and private equity ownership will get support from both campaigns.

- Neither campaign will propose transformative policy changes: they’re too risky. integrating health & social services, capping total spending, reforms of drug patient laws, restricting tax exemptions for ‘not for profit’ hospitals, federalizing Medicaid, and others will not be on the table. There’s safety in promoting populist themes (price transparency, competition) and steering away from anything more.

As the primary season wears on (in Michigan tomorrow and 23 others on/before March 5), how the health system is positioned in the court of public opinion will come into focus.

Abortion rights will garner votes; affordability, price transparency, Medicare solvency and system consolidation will emerge as wedge issues alongside.

PS: Re: federal budgeting for key healthcare agencies, two deadlines are eminent: March 1 for funding for the FDA and the VA and March 8 for HHS funding.

The Four Conflicts that Hospitals must Resolve in 2024

If you’re a U.S. health industry watcher, it would appear the $4.5 trillion system is under fire at every corner.

Pressures to lower costs, increase accessibility and affordability to all populations, disclose prices and demonstrate value are hitting every sector. Complicating matters, state and federal legislators are challenging ‘business as usual’ seeking ways to spend tax dollars more wisely with surprisingly strong bipartisan support on many issues. No sector faces these challenges more intensely than hospitals.

In 2022 (the latest year for NHE data from CMS), hospitals accounted for 30.4% of total spending ($1.35 trillion. While total healthcare spending increased 4.1% that year, hospital spending was up 2.2%–less than physician services (+2.7%), prescription drugs (+8.4%), private insurance (+5.9%) and the overall inflation rate (+6.5%) and only slightly less than the overall economy (GDP +1.9%). Operating margins were negative (-.3%) because operating costs increased more than revenues (+7.7% vs. 6.5%) creating deficits for most. Hardest hit: the safety net, rural hospitals and those that operate in markets with challenging economic conditions.

In 2023, the hospital outlook improved. Pre-Covid utilization levels were restored. Workforce tensions eased somewhat. And many not-for-profits and investor-owned operators who had invested their cash flows in equities saw their non-operating income hit record levels as the S&P 500 gained 26.29% for the year.

In 2024, the S&P is up 5.15% YTD but most hospital operators are uncertain about the future, even some that appear to have weathered the pandemic storm better than others. A sense of frustration and despair is felt widely across the sector, especially in critical access, rural, safety net, public and small community hospitals where long-term survival is in question.

The cynicism felt by hospitals is rooted in four conflicts in which many believe hospitals are losing ground:

Hospitals vs. Insurers:

Insurers believe hospitals are inefficient and wasteful, and their business models afford them the role of deciding how much they’ll pay hospitals and when based on data they keep private. They change their rules annually to meet their financial needs. Longer-term contracts are out of the question. They have the upper hand on hospitals.

Hospitals take financial risks for facilities, technologies, workforce and therapies necessary to care. Their direct costs are driven by inflationary pressures in their wage and supply chains outside their control and indirect costs from regulatory compliance and administrative overhead, Demand is soaring. Hospital balance sheets are eroding while insurers are doubling down on hospital reimbursement cuts to offset shortfalls they anticipate from Medicare Advantage. Their finances and long-term sustainability are primarily controlled by insurers. They have minimal latitude to modify workforces, technology and clinical practices annually in response to insurer requirements.

Hospitals vs. the Drug Procurement Establishment:

Drug manufacturers enjoy patent protections and regulatory apparatus that discourage competition and enable near-total price elasticity. They operate thru a labyrinth of manufacturers, wholesalers, distributors and dispensers in which their therapies gain market access through monopolies created to fend-off competition. They protect themselves in the U.S. market through well-funded advocacy and tight relationships with middlemen (GPOs, PBMs) and it’s understandable: the global market for prescription drugs is worth $1.6 trillion, the US represents 27% but only 4% of the world population.

And ownership of the 3 major PBMs that control 80% of drug benefits by insurers assures the drug establishment will be protected.

Prescription drugs are the third biggest expense in hospitals after payroll and med/surg supplies. They’re a major source of unexpected out-of-pocket cost to patients and unanticipated costs to hospitals, especially cancer therapies. And hospitals (other than academic hospitals that do applied research) are relegated to customers though every patient uses their products.

Prescription drug cost escalation is a threat to the solvency and affordability of hospital care in every community.

Hospitals vs. the FTC, DOJ and State Officials:

Hospital consolidation has been a staple in hospital sustainability and growth strategies. It’s a major focus of regulator attention. Horizontal consolidation has enabled hospitals to share operating costs thru shared services and concentrate clinical programs for better outcomes. Vertical consolidation has enabled hospitals to diversify as a hedge against declining inpatient demand: today, 200+ sponsor health insurance plans, 60% employ physicians directly and the majority offer long-term, senior care and/or post-acute services. But regulators like the FTC think hospital consolidation has been harmful to consumers and third-party data has shown promised cost-savings to consumers are not realized.

Federal regulators are also scrutinizing the tax exemptions afforded not-for-profit hospitals, their investment strategies, the roles of private equity in hospital prices and quality and executive compensation among other concerns. And in many states, elected officials are building their statewide campaigns around reining in “out of control” hospitals and so on.

Bottom line: Hospitals are prime targets for regulators.

Hospitals vs. Congress:

Influential members in key House and Senate Committees are now investigating regulatory changes that could protect rural and safety net hospitals while cutting payments to the rest. In key Committees (Senate HELP and Finance, House Energy and Commerce, Budget), hospitals are a target. Example: The Lower Cost, More Transparency Act passed in the the House December 11, 2023. It includes price transparency requirements for hospitals and PBMs, site-neutral payments, additional funding for rural and community health among more. The American Hospital Association objected noting “The AHA supports the elimination of the Medicaid disproportionate share hospital (DSH) reductions for two years. However, hospitals and health systems strongly oppose efforts to include permanent site-neutral payment cuts in this bill. In addition, the AHA has concerns about the added regulatory burdens on hospitals and health systems from the sections to codify the Hospital Price Transparency Rule and to establish unique identifiers for off-campus hospital outpatient departments (HOPDs).” Nonetheless, hospitals appear to be fighting an uphill battle in Congress.

Hospitals have other problems:

Threats from retail health mega-companies are disruptive. The public’s trust in hospitals has been fractured. Lenders are becoming more cautious in their term sheets. And the hospital workforce—especially its doctors and nurses—is disgruntled. But the four conflicts above seem most important to the future for hospitals.

However, conflict resolution on these is problematic because opinions about hospitals inside and outside the sector are strongly held and remedy proposals vary widely across hospital tribes—not-for profits, investor-owned, public, safety nets, rural, specialty and others.

Nonetheless, conflict resolution on these issues must be pursued if hospitals are to be effective, affordable and accessible contributors and/or hubs for community health systems in the future. The risks of inaction for society, the communities served and the 5.48 million (NAICS Bureau of Labor 622) employed in the sector cannot be overstated. The likelihood they can be resolved without the addition of new voices and fresh solutions is unlikely.

PS: In the sections that follow, citations illustrate the gist of today’s major message: hospitals are under attack—some deserved, some not. It’s a tough business climate for all of them requiring fresh ideas from a broad set of stakeholders.

PS If you’ve been following the travails of Mission Hospital, Asheville NC—its sale to HCA Healthcare in 2019 under a cloud of suspicion and now its “immediate jeopardy” warning from CMS alleging safety and quality concerns—accountability falls squarely on its Board of Directors. I read the asset purchase agreement between HCA and Mission: it sets forth the principles of operating post-acquisition but does not specify measurable ways patient safety, outcomes, staffing levels and program quality will be defined. It does not appear HCA is in violation with the terms of the APA, but irreparable damage has been done and the community has lost confidence in the new Mission to operate in its best interest. Sadly, evidence shows the process was flawed, disclosures by key parties were incomplete and the hospital’s Board is sworn to secrecy preventing a full investigation.

The lessons are 2 for every hospital:

Boards must be prepared vis a vis education, objective data and independent counsel to carry out their fiduciary responsibility to their communities and key stakeholders. And the business of running hospitals is complex, easily prone to over-simplification and misinformation but highly important and visible in communities where they operate.

Business relationships, price transparency, board performance, executive compensation et al can no longer to treated as private arrangements.

3 huge healthcare battles being fought in 2024

Three critical healthcare struggles will define the year to come with cutthroat competition and intense disputes being played out in public:

1. A Nation Divided Over Abortion Rights

2. The Generative AI Revolution In Medicine

3. The Tug-Of-War Over Healthcare Pricing American healthcare, much like any battlefield, is fraught with conflict and turmoil. As we navigate 2024, the wars ahead seem destined to intensify before any semblance of peace can be attained. Let me know your thoughts once you read mine.

Modern medicine, for most of its history, has operated within a collegial environment—an industry of civility where physicians, hospitals, pharmaceutical companies and others stayed in their lanes and out of each other’s business.

It used to be that clinicians made patient-centric decisions, drugmakers and hospitals calculated care/treatment costs and added a modest profit, while insurers set rates based on those figures. Businesses and the government, hoping to save a little money, negotiated coverage rates but not at the expense of a favored doctor or hospital. Disputes, if any, were resolved quietly and behind the scenes.

Times have changed as healthcare has taken a 180-degree turn. This year will be characterized by cutthroat competition and intense disputes played out in public. And as the once harmonious world of healthcare braces for battle, three critical struggles take centerstage. Each one promises controversy and profound implications for the future of medicine:

1. A Nation Divided Over Abortion Rights

For nearly 50 years, from the landmark Roe v. Wade decision in 1973 to its overruling by the 2022 Dobbs case, abortion decisions were the province of women and their doctors. This dynamic has changed in nearly half the states.

This spring, the Supreme Court is set to hear another pivotal case, this one on mifepristone, an important drug for medical abortions. The ruling, expected in June, will significantly impact women’s rights and federal regulatory bodies like the FDA.

Traditionally, abortions were surgical procedures. Today, over half of all terminations are medically induced, primarily using a two-drug combination, including mifepristone. Since its approval in 2000, mifepristone has been prescribed to over 5 million women, and it boasts an excellent safety record. But anti-abortion groups, now challenging this method, have proposed stringent legal restrictions: reducing the administration window from 10 to seven weeks post-conception, banning distribution of the drug by mail, and mandating three in-person doctor visits, a burdensome requirement for many. While physicians could still prescribe misoprostol, the second drug in the regimen, its effectiveness alone pales in comparison to the two-drug combo.

Should the Supreme Court overrule and overturn the FDA’s clinical expertise on these matters, abortion activists fear the floodgates will open, inviting new challenges against other established medications like birth control.

In response, several states have fortified abortion rights through ballot initiatives, a trend expected to gain momentum in the November elections. This legislative action underscores a significant public-opinion divide from the Supreme Court’s stance. In fact, a survey published in Nature Human Behavior reveals that 60% of Americans support legal abortion.

Path to resolution: Uncertain. Traditionally, SCOTUS rulings have mirrored public opinion on key social issues, but its deviation on abortion rights has failed to shift public sentiment, setting the stage for an even fiercer clash in years to come. A Supreme Court ruling that renders abortion unconstitutional would contradict the principles outlined in the Dobbs decision, but not all states will enact protective measures. As a result, America’s divide on abortion rights is poised to deepen.

2. The Generative AI Revolution In Medicine

A year after ChatGPT’s release, an arms race in generative AI is reshaping industries from finance to healthcare. Organizations are investing billions to get a technological leg up on the competition, but this budding revolution has sparked widespread concern.

In Hollywood, screenwriters recently emerged victorious from a 150-day strike, partially focused on the threat of AI as a replacement for human workers. In the media realm, prominent organizations like The New York Times, along with a bevy of celebs and influencers, have initiated copyright infringement lawsuits against OpenAI, the developer of ChatGPT.

The healthcare sector faces its own unique battles. Insurers are leveraging AI to speed up and intensify claim denials, prompting providers to counter with AI-assisted appeals.

But beyond corporate skirmishes, the most profound conflict involves the doctor-patient relationship. Physicians, already vexed by patients who self-diagnose with “Dr. Google,” find themselves unsure whether generative AI will be friend or foe. Unlike traditional search engines, GenAI doesn’t just spit out information. It provides nuanced medical insights based on extensive, up-to-date research. Studies suggest that AI can already diagnose and recommend treatments with remarkable accuracy and empathy, surpassing human doctors in ever-more ways.

Path to resolution: Unfolding. While doctors are already taking advantage of AI’s administrative benefits (billing, notetaking and data entry), they’re apprehensive that ChatGPT will lead to errors if used for patient care. In this case, time will heal most concerns and eliminate most fears. Five years from now, with ChatGPT predicted to be 30 times more powerful, generative AI systems will become integral to medical care. Advanced tools, interfacing with wearables and electronic health records, will aid in disease management, diagnosis and chronic-condition monitoring, enhancing clinical outcomes and overall health.

3. The Tug-Of-War Over Healthcare Pricing

From routine doctor visits to complex hospital stays and drug prescriptions, every aspect of U.S. healthcare is getting more expensive. That’s not news to most Americans, half of whom say it is very or somewhat difficult to afford healthcare costs.

But people may be surprised to learn how the pricing wars will play out this year—and how the winners will affect the overall cost of healthcare.

Throughout U.S. healthcare, nurses are striking as doctors are unionizing. After a year of soaring inflation, healthcare supply-chain costs and wage expectations are through the roof. A notable example emerged in California, where a proposed $25 hourly minimum wage for healthcare workers was later retracted by Governor Newsom amid budget constraints.

Financial pressures are increasing. In response, thousands of doctors have sold their medical practices to private equity firms. This trend will continue in 2024 and likely drive up prices, as much as 30% higher for many specialties.

Meanwhile, drug spending will soar in 2024 as weight-loss drugs (costing roughly $12,000 a year) become increasingly available. A groundbreaking sickle cell disease treatment, which uses the controversial CRISPR technology, is projected to cost nearly $3 million upon release.

To help tame runaway prices, the Centers for Medicare & Medicaid Services will reduce out-of-pocket costs for dozens of Part B medications “by $1 to as much as $2,786 per average dose,” according to White House officials. However, the move, one of many price-busting measures under the Inflation Reduction Act, has ignited a series of legal challenges from the pharmaceutical industry.

Big Pharma seeks to delay or overturn legislation that would allow CMS to negotiate prices for 10 of the most expensive outpatient drugs starting in 2026.

Path to resolution: Up to voters. With national healthcare spending expected to leap from $4 trillion to $7 trillion by 2031, the pricing debate will only intensify. The upcoming election will be pivotal in steering the financial strategy for healthcare. A Republican surge could mean tighter controls on Medicare and Medicaid and relaxed insurance regulations, whereas a Democratic sweep could lead to increased taxes, especially on the wealthy. A divided government, however, would stall significant reforms, exacerbating the crisis of unaffordability into 2025.

Is Peace Possible?

American healthcare, much like any battlefield, is fraught with conflict and turmoil. As we navigate 2024, the wars ahead seem destined to intensify before any semblance of peace can be attained.

Yet, amidst the strife, hope glimmers: The rise of ChatGPT and other generative AI technologies holds promise for revolutionizing patient empowerment and systemic efficiency, making healthcare more accessible while mitigating the burden of chronic diseases. The debate over abortion rights, while deeply polarizing, might eventually find resolution in a legislative middle ground that echoes Roe’s protections with some restrictions on how late in pregnancy procedures can be performed.

Unfortunately, some problems need to get worse before they can get better. I predict the affordability of healthcare will be one of them this year. My New Year’s request is not to shoot the messenger.

Cigna’s Express Scripts adopts cost-plus pricing model

https://mailchi.mp/169732fa4667/the-weekly-gist-november-17-2023?e=d1e747d2d8

This week, Express Scripts, the nation’s second-largest pharmacy benefit manager (PBM), which is owned by health insurer Cigna, announced a new pricing model.

It is giving employers and health plans the option to pay pharmacies up to 15 percent over acquisition costs, plus a dispensing fee, for covered drugs. This payment structure was popularized by the Mark Cuban Cost Plus Drugs Company, founded by the billionaire businessman in reaction to the opaque pricing and complicated discounts and rebates common among PBMs.

While Cigna is not promising that this new pricing model will result in lower prices, it says it will improve transparency and should benefit retail pharmacies, who will split the markup with Express Scripts.

Cigna projects that only some employers will lower their healthcare spending through the cost-plus model, and that patient cost-sharing should be similar under both approaches.

The Gist: Between disruptive competitors like Cuban’s venture and increasing scrutiny from Congress, PBMs are facing new pressures to improve transparency and account for their role in rising drug costs.

This move by Cigna is an attempt to address at least one of those concerns, possibly intended to preempt regulatory and legislative action.

After years of complaints surrounding their business practices, it appears that the Congressional tide may be turning toward PBM industry reform. However, patients—who by and large are unaware of what PBMs are or do—won’t be satisfied till they see their out-of-pocket prescription drug costs go down.

Next up on this front: seeing which provisions targeting PBMs, many which have bipartisan support, make it into the Senate’s broad healthcare legislation planned for the end of this year, and in what form that bill ultimately passes.