https://www.fiercehealthcare.com/tech/health-insurance-marketplace-gohealth-files-to-go-public?utm_medium=nl&utm_source=internal&mrkid=959610&mkt_tok=eyJpIjoiWmpjeVlXVTRZV0l5T1RndyIsInQiOiJLWWxjamNKK2lkZmNjcXV4dm0rdjZNS2lOanZtYTFoenViQjMzWnF0RGNlY1pkcjVGcFwvZFY4VjFaUUlZaFRBT1NRMGE5eWhGK1ZmR01ZSWVZWGMxOHRzTkptZVZXZmc5UnNvM3pVM2VIWDh6VllldFc3OGNZTTMxTDJrXC8wbzN1In0%3D

GoHealth, an online health insurance marketplace, is looking to raise up to $100 million in an initial public offering, according to a filing with the U.S. Securities and Exchange Commission (SEC) Friday.

The Chicago company, launched in 2001, said its stock will trade on the Nasdaq Global Market under the symbol “GHTH,” according to an S-1 filing.

The company didn’t list specific share price or the number of shares it’s selling in the filing.

GoHealth operates a health insurance portal offering a variety of plans that allows customers to compare numerous insurance plans such as family health plans and self-employed insurance.

The company works with more than 300 health insurance carriers and has enrolled more than 5 million people into health plans.

Goldman Sachs, BofA Securities and Morgan Stanley are acting as the managing book runners for the proposed offering. Barclays, Credit Suisse, Evercore ISI, RBC Capital Markets and William Blair are acting as book runners for the proposed offering. Cantor and SunTrust Robinson Humphrey are acting as co-managers for the proposed offering, according to a GoHealth press release.

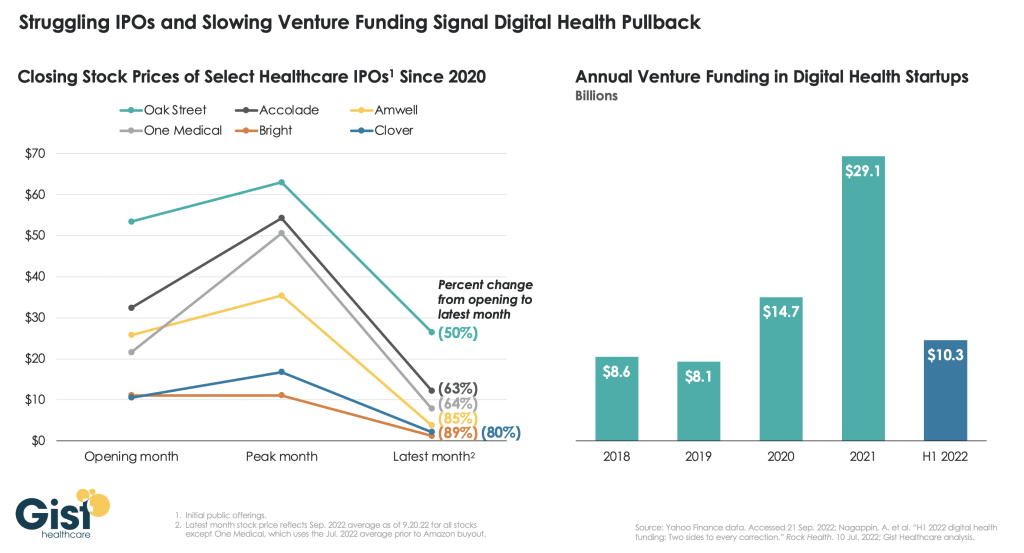

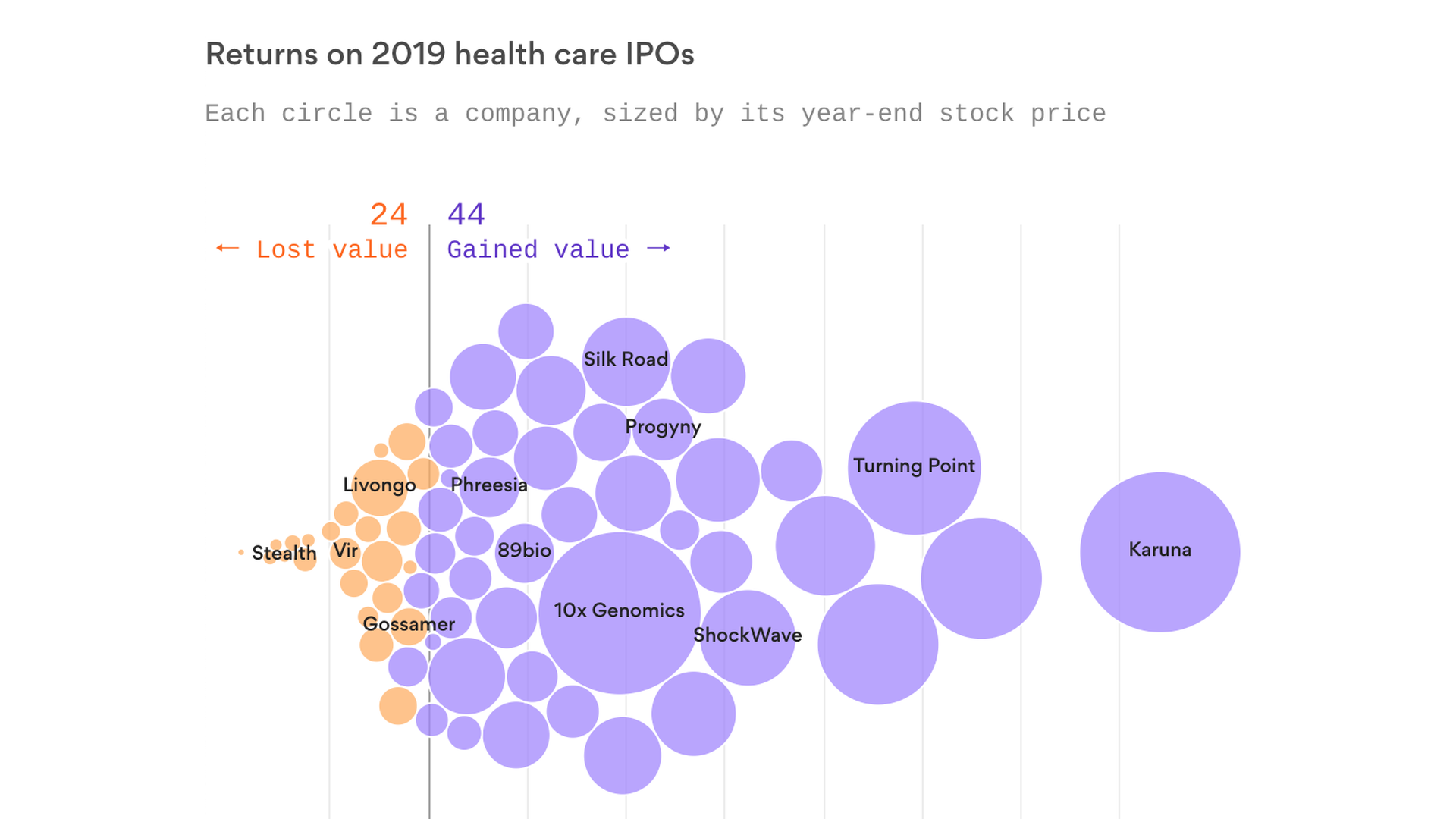

GoHealth will join a growing list of technology-enabled healthcare companies that are testing the public markets, including One Medical, Livongo, Phreesia, Health Catalyst, Change Healthcare and Progyny.

The company has shifted its focus toward Medicare products over the past four years, positioning itself to capitalize on strong demographic trends and an aging population.

Medicare enrollment is expected to grow from approximately 61 million individuals in 2019 to approximately 77 million individuals by 2028, the company said in its SEC filing.

At the same time, an increasing proportion of the Medicare-eligible population is choosing commercial insurance solutions, with 38% of Medicare beneficiaries, or approximately 23 million people, enrolled in Medicare Advantage plans in 2019, an increase of approximately 1.5 million people from 2018 to 2019, the company said.

The market is “ripe for disruption” by digitally enabled and technology-driven marketplaces like the GoHealth platform, according to the company.

GoHealth estimates a total addressable market of $28 billion for Medicare Advantage and Medicare Supplement products.

“We believe that these trends will drive a larger market in the coming years that, when taken together with our other product and plan offerings, will result in an even larger addressable market. We also believe that we are poised to benefit from market share gains in what has traditionally been a highly fragmented market,” the company said in the S-1 filing.

The company uses machine-learning algorithms and insurance behavioral data to match customers with the health insurance plan that meets their specific needs.

In 2019, the company generated over 42.2 million consumer interactions.

In September 2019, Centerbridge acquired a majority stake of GoHealth in a deal that reportedly valued the company at $1.5 billion, the Chicago Tribune reported.

Net revenues grew to $141 million for the first quarter of this year, compared to $69.1 million last year. The company reported 2019 pro forma net revenues of $540 million, up 139% from 2018’s revenue of $226 million, the company reported in its SEC filing.

The company reported a net loss of $937,000 for the first quarter of 2020 compared to a net income of $5 million for the same period in 2019, according to its IPO.

Demographic, consumer preference and regulatory factors are driving growth in the individual health insurance market, according to the company. Medicare enrollment is expected to grow significantly over the next 10 years as 10,000-plus individuals turn 65 each day and become Medicare-eligible.

At the same time, the growth in plan choices makes education and assistance with plan selection more important for consumers, GoHealth said.

“Marketplaces such as ours help educate consumers, and assist them in making informed plan choices,” the company said.

The company also faces significant risks that may impede its growth. Currently, a large portion of GoHealth’s revenue is derived from a limited number of carriers. Carriers owned by Humana and Anthem accounted for approximately 42% and 32%, respectively, of the company’s net revenues for the first three months of 2020, the company said in its IPO paperwork.

The COVID-19 pandemic also creates uncertainty in the healthcare market, and future developments in the outbreak could impact the company’s financial performance, GoHealth said.