https://www.healthcaredive.com/news/nonprofit-hospitals-on-an-unsustainable-path-moodys-says/531245/

Dive Brief:

- Not-for-profit and public hospitals spent more than they gained in revenues for the second consecutive year in fiscal 2017, according to Moody’s Investors Service.

- Moody’s said the widening gap leaves facilities “on an unsustainable path” and will remain the largest strain on nonprofits through next year.

- Median annual expense growth decreased to 5.7% in 2017 from 7.1%. That’s compared to annual revenue growth, which declined to 4.6% from 6.1%, according to Moody’s analyst Rita Sverdlik.

Dive Insight:

Hospitals, especially nonprofit facilities, are facing difficult times. Morgan Stanley recently reported that about 18% of more than 6,000 hospitals studied were at a risk of closure or are performing weakly. About 8% of studied hospitals were at risk of closing and 10% were called “weak,” according to that report.

For perspective, just 2.5% of hospitals closed over the past five years.

What’s in store for hospitals in the near term depends on the specific outlook. Moody’s this year revised its outlook for the sector from stable to negative. That move followed nonprofit hospitals seeing more credit downgrades in 2017.

On the other hand, Fitch Ratings recently called off its “Rating Watch” for U.S. nonprofit hospitals and health systems after the organizations showed improved or stable results this year.

So, there are signs of improvement in the sector, but challenges with revenues, sagging reimbursements and lower admissions will continue to plague hospitals.

The reasons Moody’s gave for lower revenue growth came from lower reimbursements, the shift to outpatient care, increased M&A activity and additional ambulatory competition. It said the move away from inpatient to outpatient moved into its fifth year.

“Reversing sluggish volume trends and growing profitable service lines will be critical to improving the sector’s financial trajectory over the near-term as most hospitals continue to operate in a fee-for-service environment,” Sverdlik said.

Moody’s added that more hospitals reported operating deficits in 2017. That coincided with lower absolute operating cash flow. It said 28.4% of nonprofit hospital experienced operating losses, an increase from 16.5% in 2016. Also, 59% of providers reported lower absolute operating cash flow, which was more than double the 24% noted in 2015. The 2017 figure was the highest percentage in five years.

Don’t expect times to get better any time soon. Moody’s said nonprofit hospital margins will continue to remain thin through this year. Margins have fallen to an all-time low of 1.6% operating and 8.1% of operating cash flow.

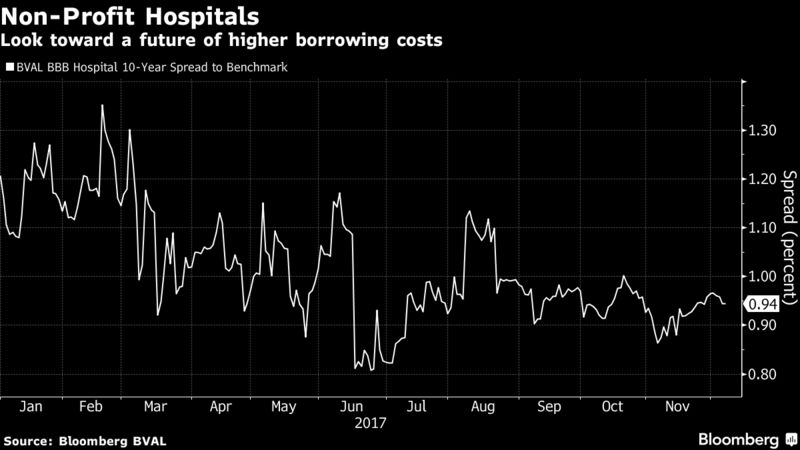

“Margin pressures led to softened debt coverage ratios, though the median growth rate of total debt has been negative over the last five years,” Sverdlik said. “Ongoing operating pressures will constrain the ability to reverse these trends, especially if providers turn to debt to fund capital needs.”

However, it’s not all bad news. Moody’s said the medians have shown positive signs. For instance, median unrestricted cash and investments growth rate improved to 8.9% thanks to strong market returns and steady capital spending. Also, absolute cash growth exceeded expenses growth, which caused improved median cash on hand. That trend isn’t expected to continue if hospitals spend more cash flow on capital or if equity markets fall.