https://www.healthleadersmedia.com/finance/nonprofit-hospital-consolidation-continue-2019

Despite increased scrutiny from regulators, nonprofit health systems will remain active through mergers and acquisitions this year, according to a new Moody’s report.

The deluge of M&A activity among nonprofit health systems is expected to continue on in 2019, with the potential for some “unconventional relationships,” according to a Moody’s report released Friday morning.

Driven by tight financial conditions challenging the nonprofit hospital business model, as well as the entrance of nontraditional corporate players to healthcare and the potential changes to the ACA, more M&A activity is expected throughout the year.

Moody’s expects nonprofit health systems to engage in partnerships with other hospitals but also seek to align with companies specializing in data analytics or ridesharing services to continue the transition from inpatient care to outpatient care.

Nonprofit health systems are also aiming to increase their footing when negotiating with payers, which involves strategic decisions to diversity service options and increase their geographic reach.

The report cites ProMedica’s acquisition of HCR Manorcare and Tower Health’s purchase of five for-profit acute care hospitals as examples of nonprofit systems taking a short-term credit hit to gain stable long-term positioning for the organization.

Though M&A activity is expected to be widespread and a primary objective for many nonprofit systems, the Moody’s report warned that additional scrutiny from state and federal regulators is on the way.

The requirements put in place on the CHI-Dignity Health merger by California Attorney General Xavier Becerra, along with price increase restrictions imposed by Massachusetts Attorney General Maura Healey on CareGroup and Lahey Health, are cited as examples of the terms health systems should expect to meet.

For-profits will tap into capital markets

The Moody’s report also indicates that for-profit hospitals will delve further into capital markets so long as they remain receptive and buoyed by low interest rates. This approach could lead to lower interest costs and improve liquidity, which would bolster their credit standing.

Jessica Gladstone, Moody’s associate managing director and lead analyst on for-profit hospitals, told HealthLeaders that rising interest rates would a material impact on many for-profit hospitals.

“High cash interest costs relative to earnings are already consuming the majority of cash for many FP hospital companies,” Gladstone said. “For companies with floating rate debt, rising interest rates (depending on the amount of the increase) could leave some FP hospitals with very little free cash flow left to pay down debt or otherwise invest to grow operations.”

Gladstone added that while many of the same headwinds facing for-profit hospitals remain a challenge in 2019, executives can be encouraged by the opportunities ahead to refinance high-cost debt and achieve cost savings.

Several deals are listed as potential opportunities that could benefit for-profit healthcare organizations in 2019 regarding changes to capital structure, interest cost savings, as well as M&A activity:

- Tenet Healthcare Corp. and AHP Health Partners Inc.

- Quorum Health Corp. and LifePoint Health Inc.

- Universal Health Services Inc. and HCA Healthcare Inc.

Additional highlights from the Moody’s report:

- Expect smaller community and regional nonprofit hospitals to join cooperatives to gain leverage at the negotiating table on supply costs among other price points.

- Growing investment by private equity firms in physician practices and ambulatory services, will put a pinch on nonprofit systems.

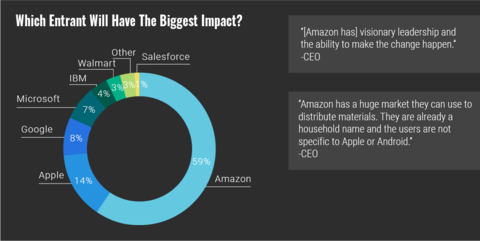

- The entrance of Amazon, Walmart, and Apple can’t be discounted as another driver of M&A activity in 2019.

- Vertical mergers like CVS-Aetna and the continued rise of telemedicine will drive patients away from traditional areas of care delivery, like hospitals.

- Though major changes to the ACA remain unlikely due to the split government in Congress, smaller changes could still make a significant impact.

- The report cites potential changes to site-neutral payments, Medicare quality-factor penalties, and DSH payment reductions as examples.