You have three days left, if you got suckered in by those omnipresent ads for Medicare Advantage and left regular Medicare for the siren song of cheaper coverage, “free” vision, hearing, or dental, or even “free” money to buy groceries or rides to the doc.

The open enrollment period for real Medicare closes at the end of the day Saturday, December 7th; after that, you’re locked into the Medicare Advantage plan you may have bought until next year.

If you’ve had Medicare Advantage for a year or more, however, the open enrollment period is still “open” until December 7th, but you will want to make sure you can get a “Medigap” plan that fills in the 20% that real Medicare doesn’t cover.

Companies are required to write a Medigap policy for you at a reasonable price when you turn 65, no matter how sick you are or what preexisting conditions you may have, but if you’ve been “off Medicare” by being on Medicare Advantage for more than a year, they don’t have to write you a policy, so double-check that and sign up for a Medigap policy before making the switch back to real Medicare.

So, what’s this all about and why is it so complicated?

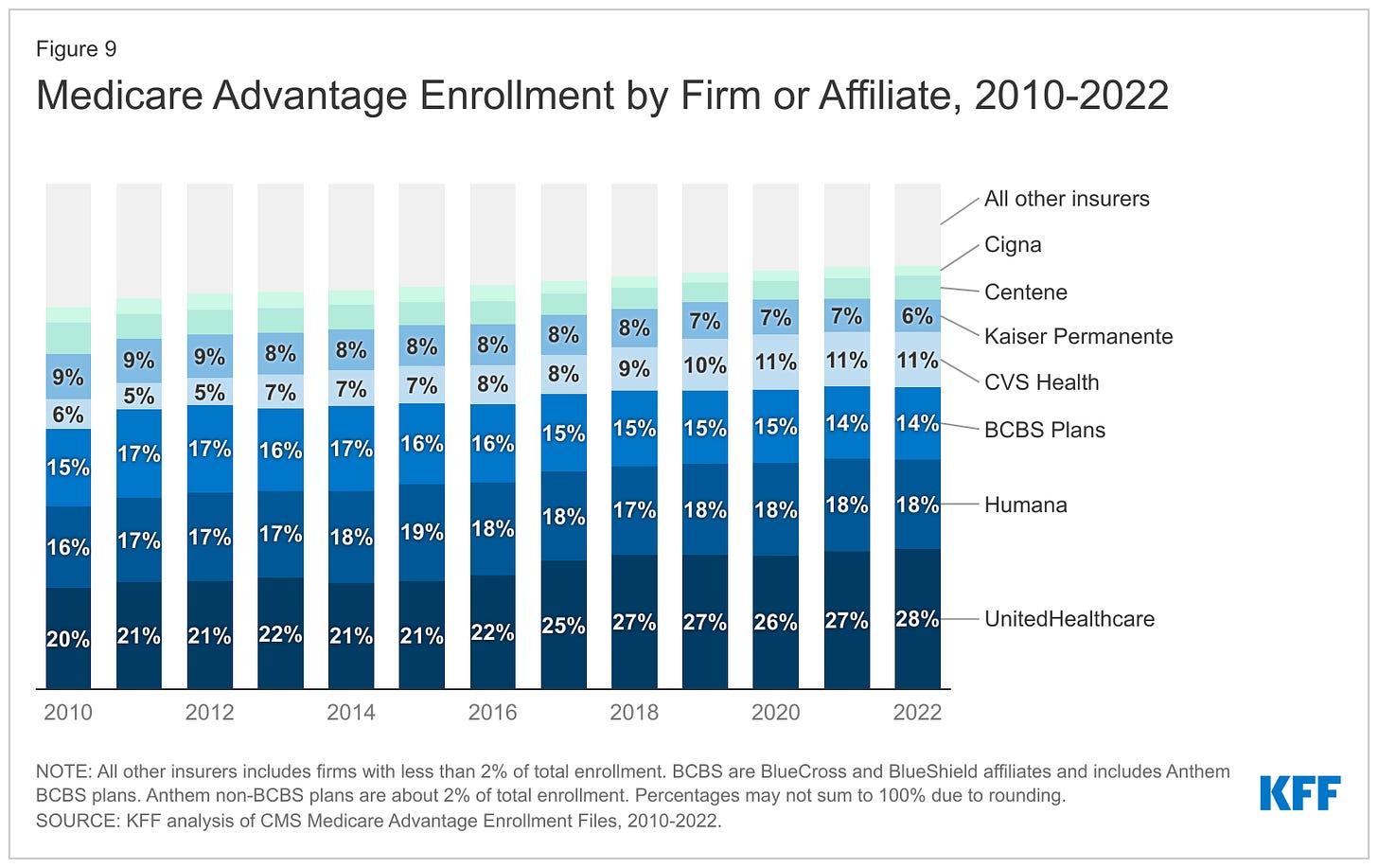

When George W. Bush and congressional Republicans (and a handful of bought-off Democrats) created Medicare Advantage in 2003, it was the fulfillment of half of Bush’s goal of privatizing Social Security and Medicare, dating all the way back to his unsuccessful run for Congress in 1978 and a main theme of his second term in office.

Medicare Advantage is not Medicare.

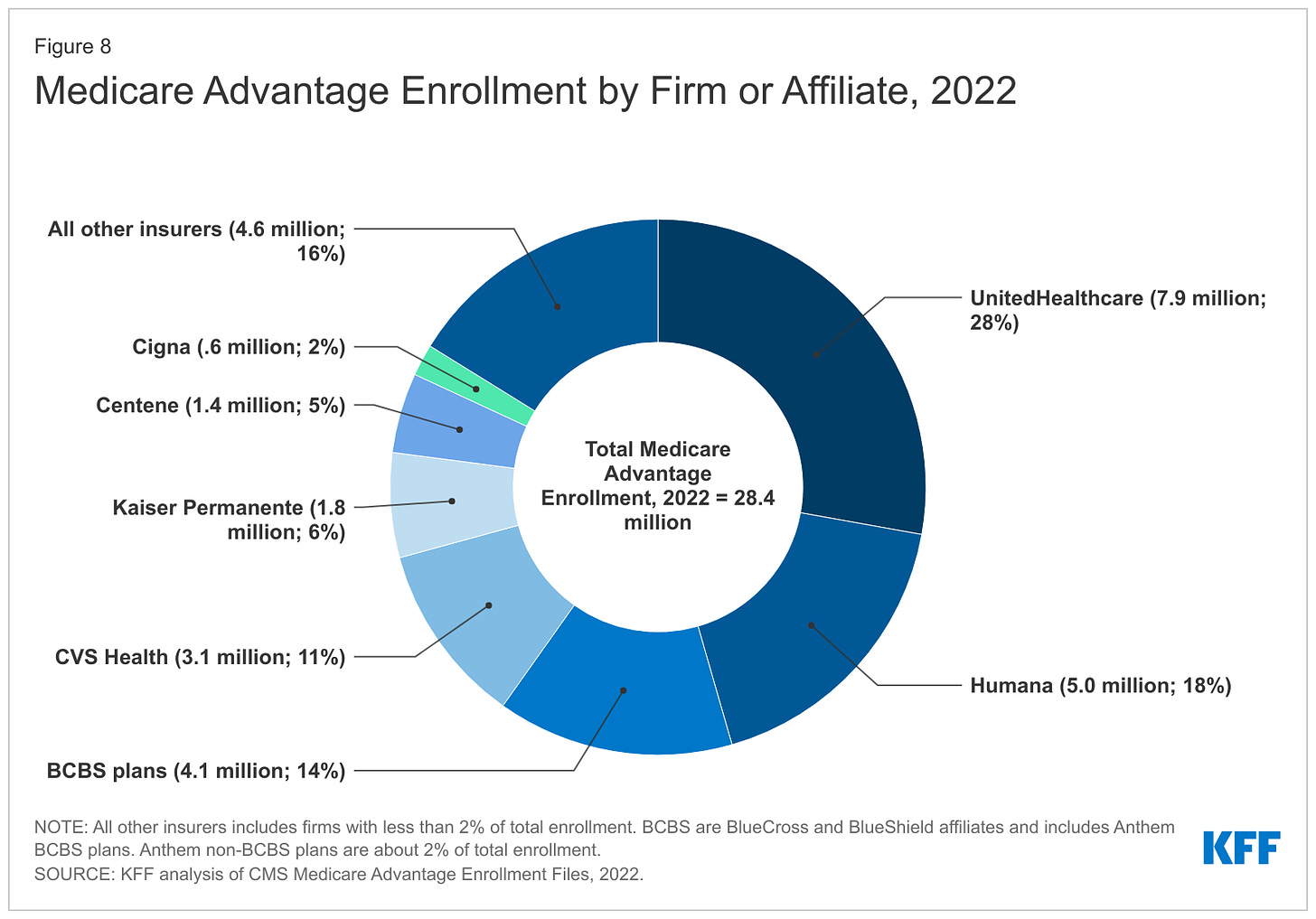

These plans are private health insurance provided by private corporations, who are then reimbursed at a fixed rate by the Medicare trust fund regardless of how much their customers use their insurance. Thus, the more they can screw their customers and us taxpayers by withholding healthcare payments, the more money they make.

With real Medicare,

if your doctor says you need a test, procedure, scan, or any other medical intervention you simply get it done and real Medicare pays the bill. No muss, no fuss, no permission needed. Real Medicare always pays, and if they think something’s not kosher, they follow up after the payment’s been made so as not to slow down the delivery of your healthcare.

With Medicare Advantage,

however, you’re subject to “pre-clearance,” meaning that the insurance company inserts itself between you and your doctor: You can’t get the medical help you need until or unless the insurance company pre-clears you for payment.

These companies thus make much of their billions in profit by routinely denying claims — 1.5 million, or 18 percent of all claims, were turned down in one year alone — leaving Advantage policy holders with the horrible choice of not getting the tests or procedures they need or paying for them out-of-pocket.

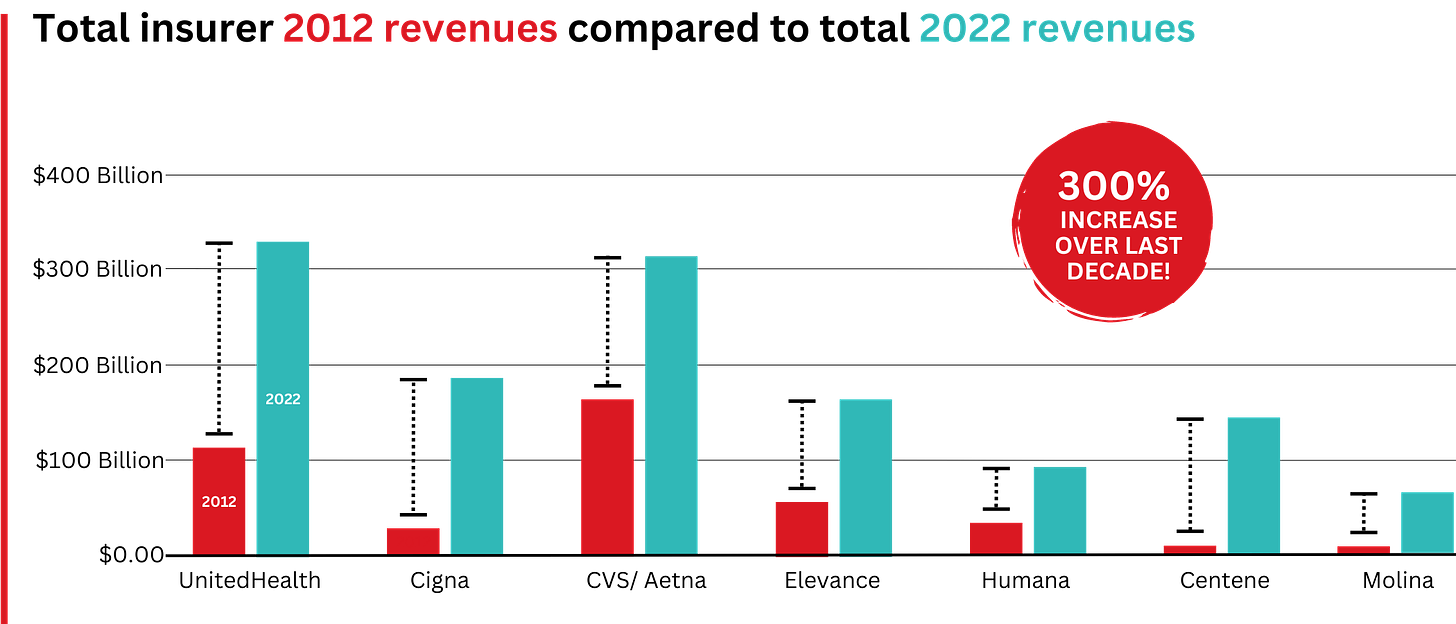

Given this, you’d think that most people would stay as far away from these private Medicare Advantage plans as they could. But Congress also authorized these plans to compete unfairly with real Medicare by offering things real Medicare can’t (yet). These include free or discounted dental, hearing, eyeglasses, gym memberships, groceries, rides to the doctor, and even cash rebates.

You and I pay for those freebies, but that’s only half of the horror story.

This year, as Matthew Cunningham-Cook pointed out in Wendell Potter’s brilliant Health Care un-covered Substack newsletter, we’re ponying up an additional $64 billion to give to these private insurance companies to “reimburse” them for the freebies they relentlessly advertise on television, online, and in print.

And here’s the most obscene part of the whole thing: the companies won’t tell the government (us!) how much of that $64 billion they’ve actually spent. They just take the money and say, “Thank you very much.” And then, presumably, throw a few extra million into the pockets of each of their already obscenely-well-paid senior executives.

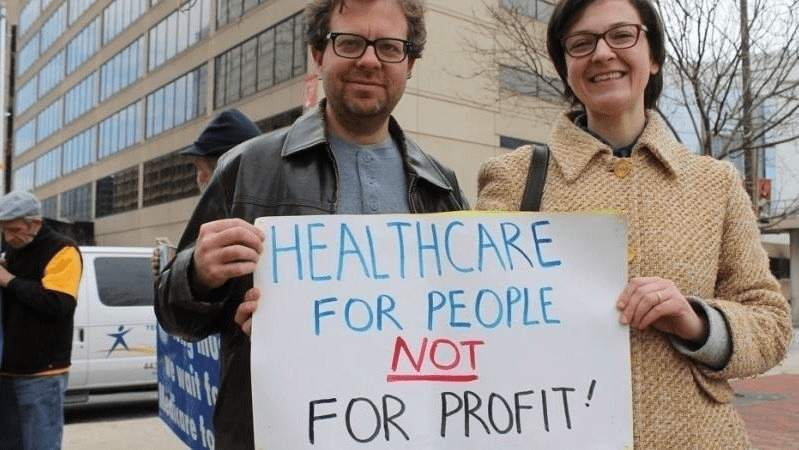

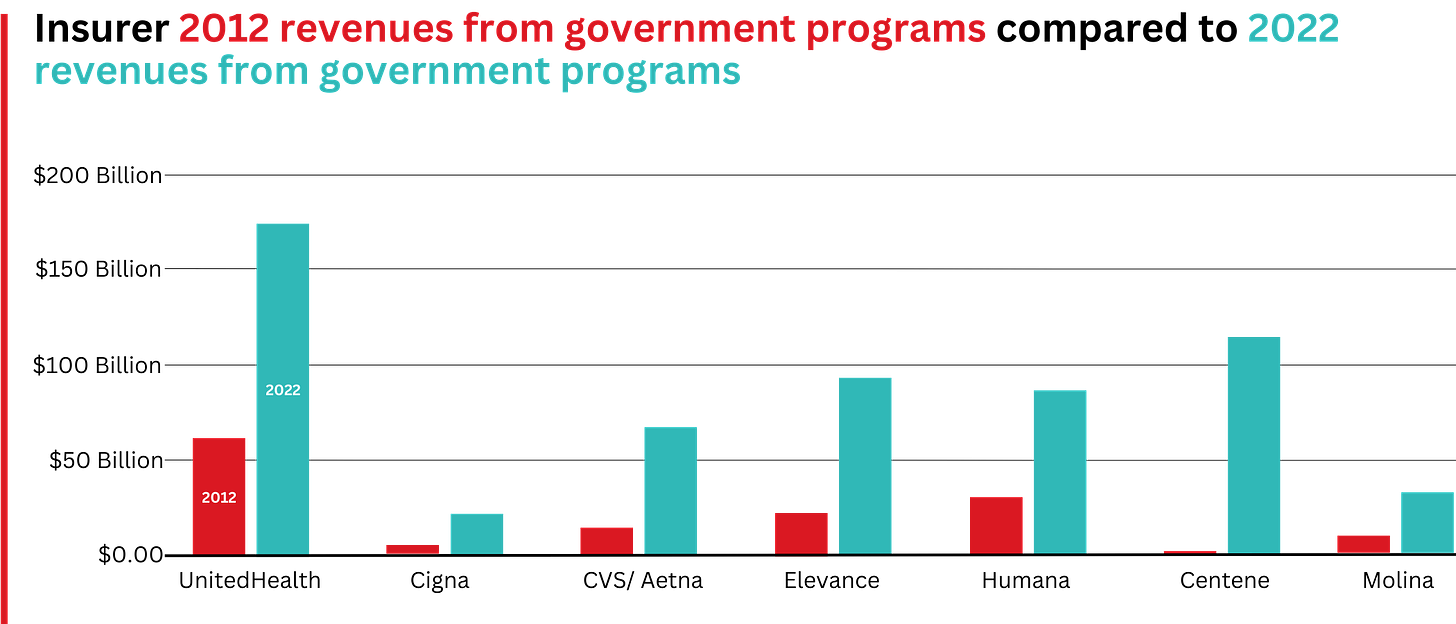

For example, the former CEO of the nation’s largest Medicare Advantage provider, UnitedHealth, walked away with over a billion dollars in total compensation. With a “B.” One guy. His successor made off with over a half-billion dollars in pay and stock.

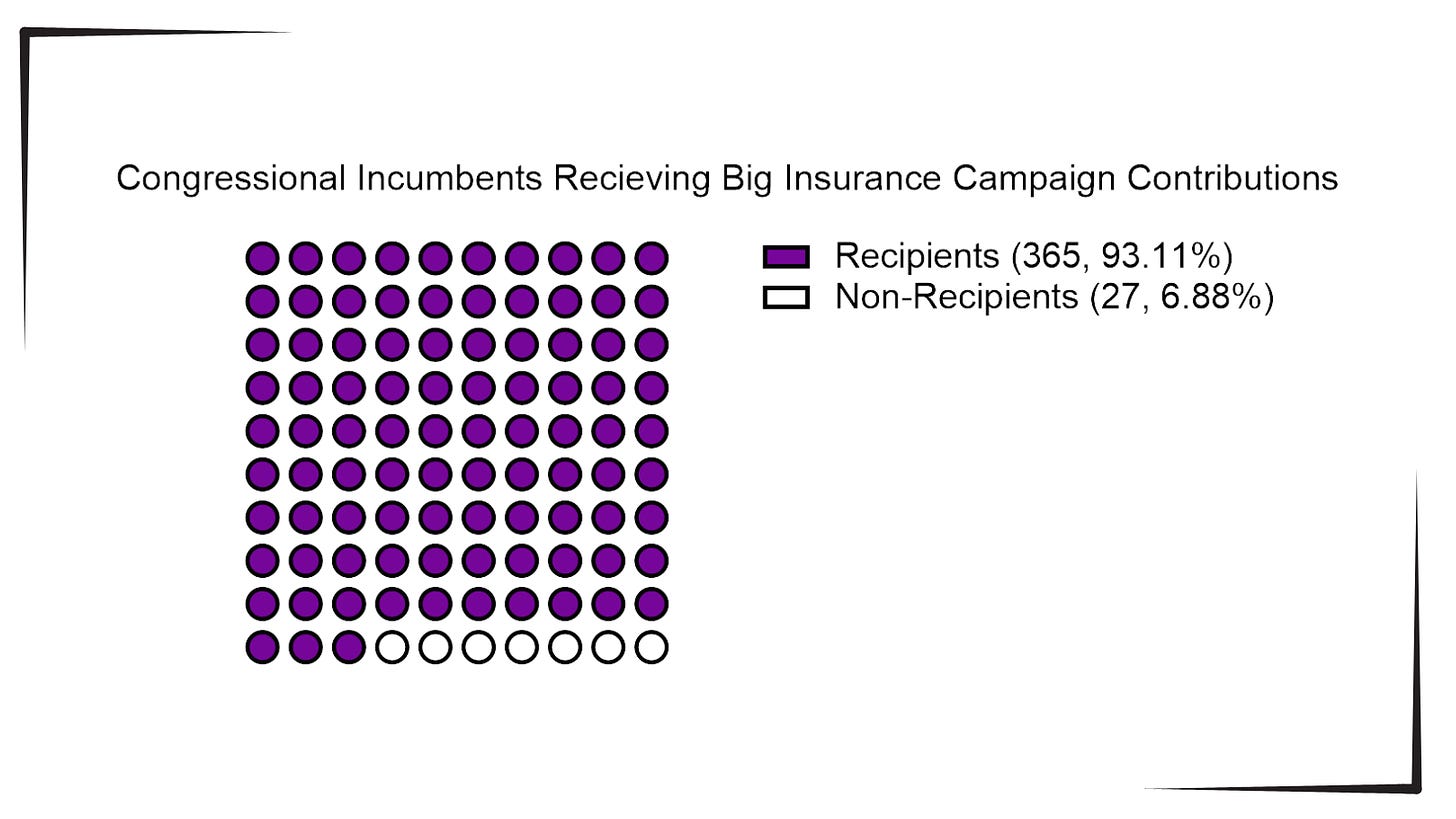

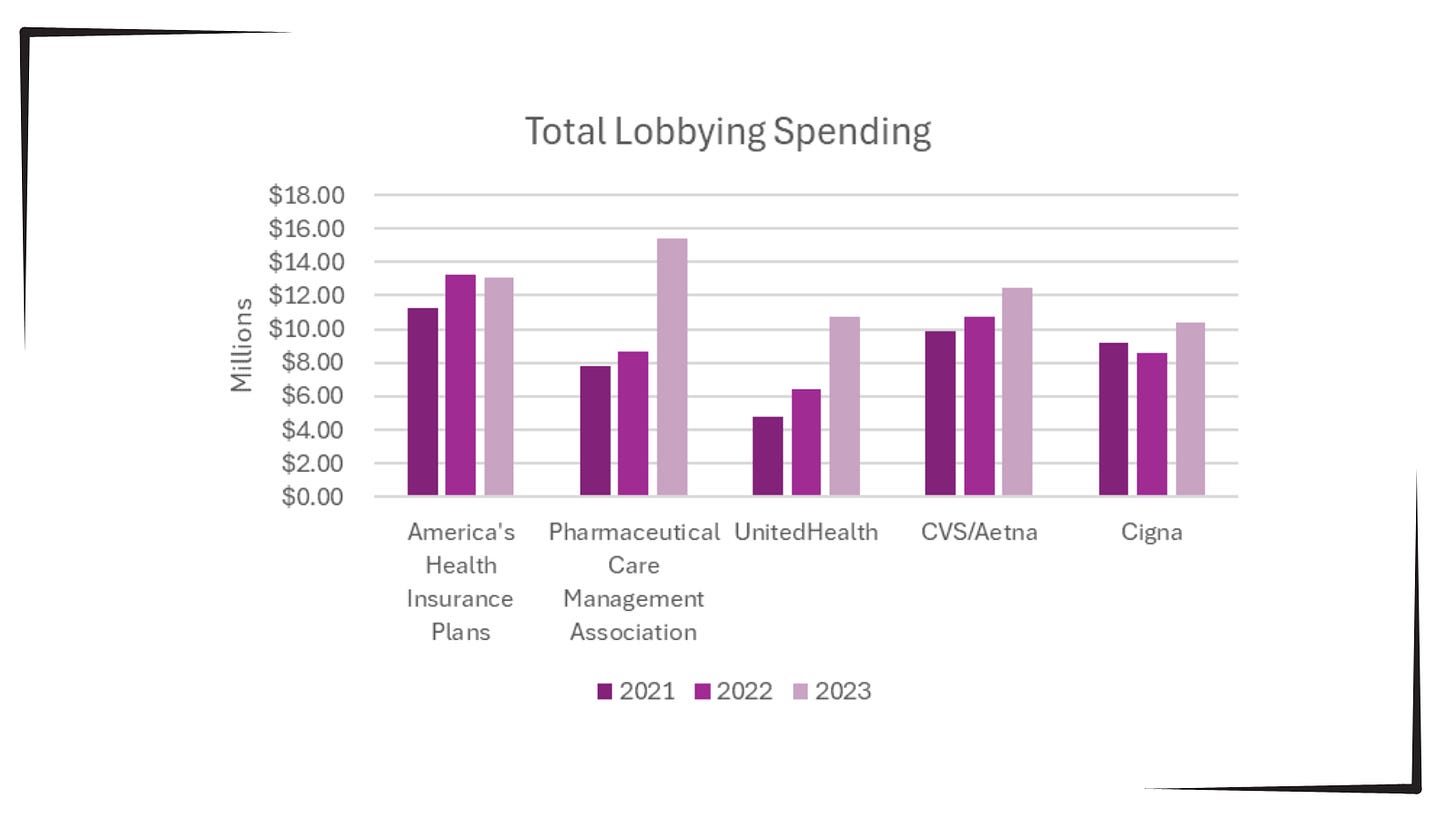

Good work if you can get it: all you need do is buy off a hundred or so members of Congress, courtesy of Clarence Thomas’ billionaire-funded tie-breaking vote on Citizens United, and threaten the rest of Congress with massive advertising campaigns for their opponents if they try to stop you.

And while the companies refuse to tell us how much of the $64 billion that we’re throwing at them this year to offer “free” dental, etc. is actually used, what we do know is that most of that money is not going to pay for the freebies they advertise. As Cunningham-Cook noted, in one study only 11 percent of Advantage policyholders who’d signed up with plans offering dental care used that benefit.

Another study showed over-the-counter-drug freebies were used only a third of the time, leaving $5 billion in the insurance companies money bins just for that “reimbursable” goodie. A later study found that at least a quarter of all Advantage policyholders failed to use any of the freebies they’d been offered when they signed up.

That’s an enormous amount of what the industry calls “breakage”; benefits offered and paid for by the government but not used. Billions of dollars left over every month. And, used or not, you and I sure paid for them.

In my book The Hidden History of American Healthcare: Why Sickness Bankrupts You and Makes Others Insanely Rich, I lay out the story of this scam and how badly so many American seniors — and all American taxpayers, regardless of age — get ripped off by it.

And now it looks like things are about to get a whole lot worse.

When he was president last time, Donald Trump substantially expanded Medicare Advantage, calling real Medicare “socialism.” Project 2025 and candidate Trump both promised to end real Medicare “immediately” if Trump was re-elected; at the very least, they’ll make Medicare Advantage the “default” program people are steered into when they turn 65 and sign up for Medicare.

These giant insurance companies ripped off us taxpayers last year to the tune of an estimated $140 billion over and above what it would’ve cost us if people had simply been on real Medicare, according to a report from Physicians for a National Health Program (PNHP).

If there was no Medicare Advantage scam bleeding off all that cash to pay for executives’ private jets, real Medicare could be expanded to cover dental, vision, and hearing and even end the need for Medigap plans.

But for now, the privatization gravy train continues to roll along. The insurance giants use some of that money to buy legislators, and some of it for expensive advertising to dupe seniors into joining their programs. The company (Benefytt) that hired Joe Namath to pitch Medicare Advantage, for example, was recently hit with huge fines by the Federal Trade Commission for deceptive advertising.

The FTC news release laid it out:

“Benefytt pocketed millions selling sham insurance to seniors and other consumers looking for health coverage,” said Samuel Levine, Director of the FTC’s Bureau of Consumer Protection. “The company is being ordered to pay $100 million, and we’re holding its executives accountable for this fraud.”

And what was it that the Federal Trade Commission called “sham insurance”? Medicare Advantage. Nonetheless, the Centers for Medicare Services continues to let Benefytt and Namath market these products: welcome to the power of organized money.

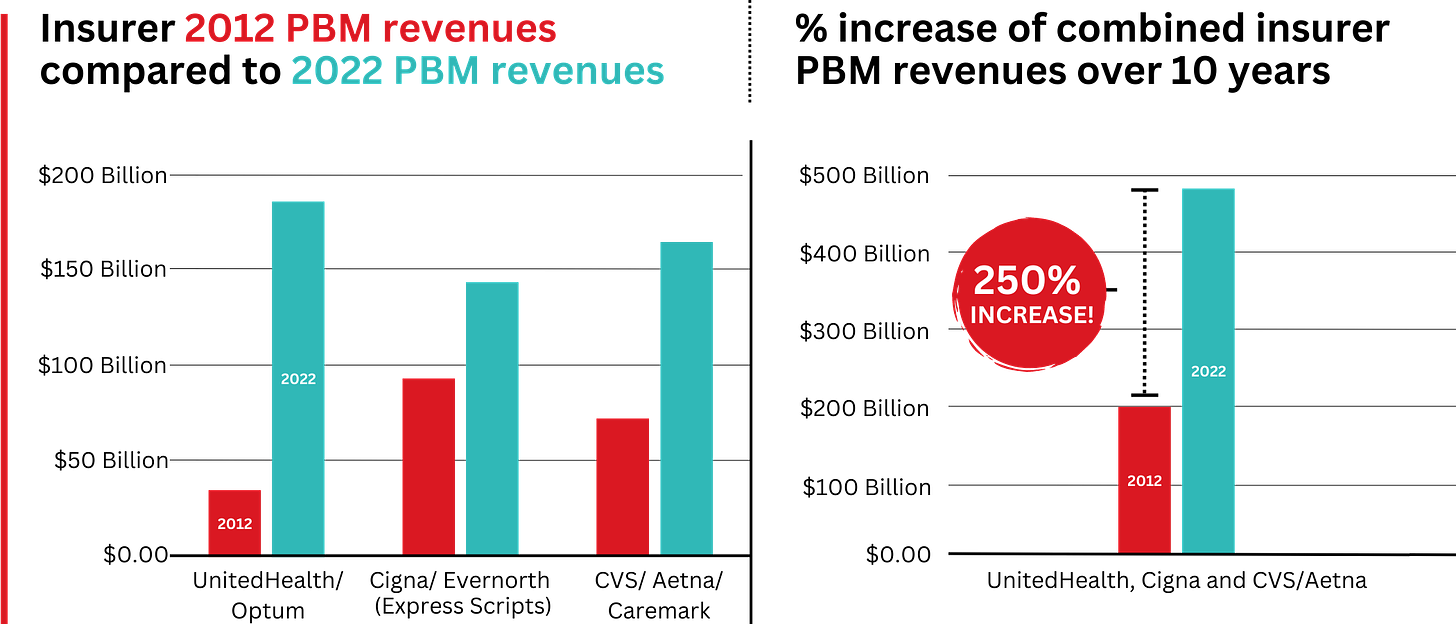

And it’s huge organized money. Medicare Advantage plans are massive cash cows for the companies that run them. As Cigna prepares for a merger, for example, they’re being forced to sell off their Medicare Advantage division: it’s scheduled to go for $3.7 billion. Nobody pays that kind of money unless they expect enormous returns.

And how do they make those billions?

Most Medicare Advantage companies regularly do everything they can to intimidate you into paying yourself out-of-pocket. Often, they simply refuse payment and wait for you to file a complaint against them; for people seriously ill the cumbersome “appeals” process is often more than they can handle so they just write a check, pull out a credit card, or end up deeply in debt in their golden years.

As a result, hospitals and doctor groups across the nation are beginning to refuse to take Medicare Advantage patients. And in rural areas many hospitals are simply going out of business because Medicare advantage providers refuse to pay their bills.

California-based Scripps Health, for example, cares for around 30,000 people on Medicare Advantage and recently notified all of them that Scripps will no longer offer medical services to them unless they pay out-of-pocket or revert back to real Medicare.

They made this decision because over $75 million worth of services and procedures their physicians had recommended to their patients were turned down by Medicare Advantage insurance companies. In many cases, Scripps had already provided the care and is now stuck with the bills that the Advantage companies refuse to pay.

Scripps CEO Chris Van Gorder told MedPage Today:

“We are a patient care organization and not a patient denial organization and, in many ways, the model of managed care has always been about denying or delaying care – at least economically. That is why denials, [prior] authorizations and administrative processes have become a very big issue for physicians and hospitals…”

Similarly, the Mayo Clinic has warned its customers in Florida and Arizona that they won’t accept Medicare Advantage any more, either. Increasing numbers of physician groups and hospitals are simply over being ripped off by Advantage insurance companies.

Traditional Medicare has been serving Americans well since 1965: it’s one of the most efficient single-payer systems to fund healthcare that’s ever been devised. But nobody was making a buck off it, so nobody could share those profits with greedy politicians. Enter Medicare Advantage, courtesy of George W. Bush and the GOP.

While several bills have been offered in Congress to do something about this — including Mark Pocan’s and Ro Khanna’s Save Medicare Act that would end these companies’ ability to use the word “Medicare” in their policy names and advertising — the amounts of money sloshing around DC in the healthcare space now are almost unfathomable.

So far this year, according to opensecrets.org, the insurance industry has spent $117,305,895 showering gifts and persuasion on our federal lawmakers to keep their obscene profits flowing.

It’s all one more example of how five corrupt Republicans on the US Supreme Court legalizing political bribery with Citizens United have screwed average Americans and made a handful of industry executives and investors fabulously rich.

They get away with it because when people choose to sign up for Medicare Advantage at 65 (or convert to these plans in their 60s or early 70s) they’re typically not sick — and thus cost the insurance companies little.

Tragically, the people signing up for these plans have no idea all the hassles, hoops, and troubles they might have to jump through when they do get sick, have an accident, or otherwise need medical assistance.

And since the last three years of life are typically the most expensive years for healthcare, the insurance denials are more likely to happen then — long after the person’s signed up with the Advantage company and it’s too late to go back to real Medicare.

This is why it typically takes a few years for people to figure out how badly they got screwed by not going with regular Medicare but instead putting themselves in the hands of private insurance companies.

The New York Times did an exposé of the problem in an article titled “Medicare Advantage Plans Often Deny Needed Care, Federal Report Finds.” It tells the story of “Kurt Pauker, an 87-year-old Holocaust survivor in Indianapolis” who’d bought an Advantage policy from Humana:

“In spite of recommendations from Mr. Pauker’s doctors, his family said, Humana has repeatedly denied authorization for inpatient rehabilitation after hospitalization, saying at times he was too healthy and at times too ill to benefit.”

This is not at all uncommon, the Times notes:

“Tens of millions of denials are issued each year for both authorization and reimbursements, and audits of the private insurers show evidence of ‘widespread and persistent problems related to inappropriate denials of services and payment,’ the investigators found.”

If you have “real” Medicare with a heavily regulated Medigap policy to cover the 20% Medicare doesn’t, you never have to worry.

Your bills get paid, you can use any doctor or hospital in the country who takes Medicare, and neither Medicare nor your Medigap provider will ever try to collect from you or force you to pay for what you thought was covered.

Neither you or your doctor will ever have to do the “pre-authorization” dance with real Medicare: those terrible experiences dealing with for-profit insurance companies are part of the past.

But if you have Medicare Advantage — which is not Medicare, but private health insurance — you’re on your own.

As the Times laid out:

“About 18 percent of [Advantage] payments were denied despite meeting Medicare coverage rules, an estimated 1.5 million payments for all of 2019. In some cases, plans ignored prior authorizations or other documentation necessary to support the payment. These denials may delay or even prevent a Medicare Advantage beneficiary from getting needed care…”

Buying a Medicare Advantage policy is a leap in the dark, and the federal government is not there to catch you. And it’s all perfectly legal, thanks to Bush’s 2003 law, so your state insurance commissioner usually can’t or won’t help.

Thus, here we are, handing billions of dollars a month to insurance industry executives so they can buy new Swiss chalets, private jets, and luxury yachts. And so they can compete — unfairly — with Medicare itself, driving LBJ’s most proud achievement into debt and crisis.

Enough is enough. Let your members of Congress know it’s beyond time to fix the Court and Medicare, so scams like Medicare Advantage can no longer rip off America’s seniors while making industry executives richer than Midas.

And if you got hooked into switching out of real Medicare and now find yourself in a Medicare Advantage plan, you have three days to back out and return to real Medicare. For more information, you can also contact the nonprofit and real-Medicare-supporting Medicare Rights Center at 800-333-4114.