Politicians, economists, auto industry analysts and main street business owners are closely watching the UAW strike that began at midnight last Thursday. Healthcare should also pay attention, especially hospitals. medical groups and facility operators where workforce issues are mounting.

Auto manufacturing accounts for 3% of America’s GDP and employs 2.2 million including 923,000 in frontline production. It’s high-profile sector industry in the U.S. with its most prominent operators aka “the Big Three” operating globally. Some stats:

- The US automakers sold an estimated 13.75 million new and 36.2 million used vehicles in 2022.

- The total value of the US car and automobile manufacturing market is $104.1 billion in 2023:

- 9.2 million US vehicles were produced in 2021–a 4.5% increase from 2020 and 11.8% of the global total ranking only behind China in total vehicle production.

- As of 2020, 91.5% of households report having access to at least one vehicle.

- There were 290.8 million registered vehicles in the United States in 2022—21% of the global market.

- Americans spend $698 billion annually on the combination of automobile loans and insurance.

By comparison, the healthcare services industry in the U.S.—those that operate facilities and services serving patients—employs 9 times more workers, is 29 times bigger ($104 Billion vs. $2.99 trillion/65% of total spend) and 6 times more integral in the overall economy (3% vs. 18.3% of GDP).

Surprisingly, average hourly wages are similar ($31.07 in auto manufacturing vs. $33.12 in healthcare per BLS) though the range is wider in healthcare since it encompasses licensed professionals to unskilled support roles. There are other similarities:

- Each industry enjoys ubiquitous presence in American household’ discretionary. spending.

- Each faces workforce issues focused on pay parity and job security.

- Each is threatened by unwelcome competitors, disruptive technologies and shifting demand complicating growth strategies.

- Each is dependent on capital to remain competitive.

- And each faces heightened media scrutiny and vulnerability to misinformation/disinformation as special interests seek redress or non-traditional competitors seek advantage.

Ironically, the genesis of the UAW dispute is not about wages; it is about job security as electric-powered vehicles that require fewer parts and fewer laborers become the mainstay of the sector. CEO compensation and the corporate profits of the Big Three are talking points used by union leaders to galvanize sympathizer antipathy of “corporate greed” and unfair treatment of frontline workers.

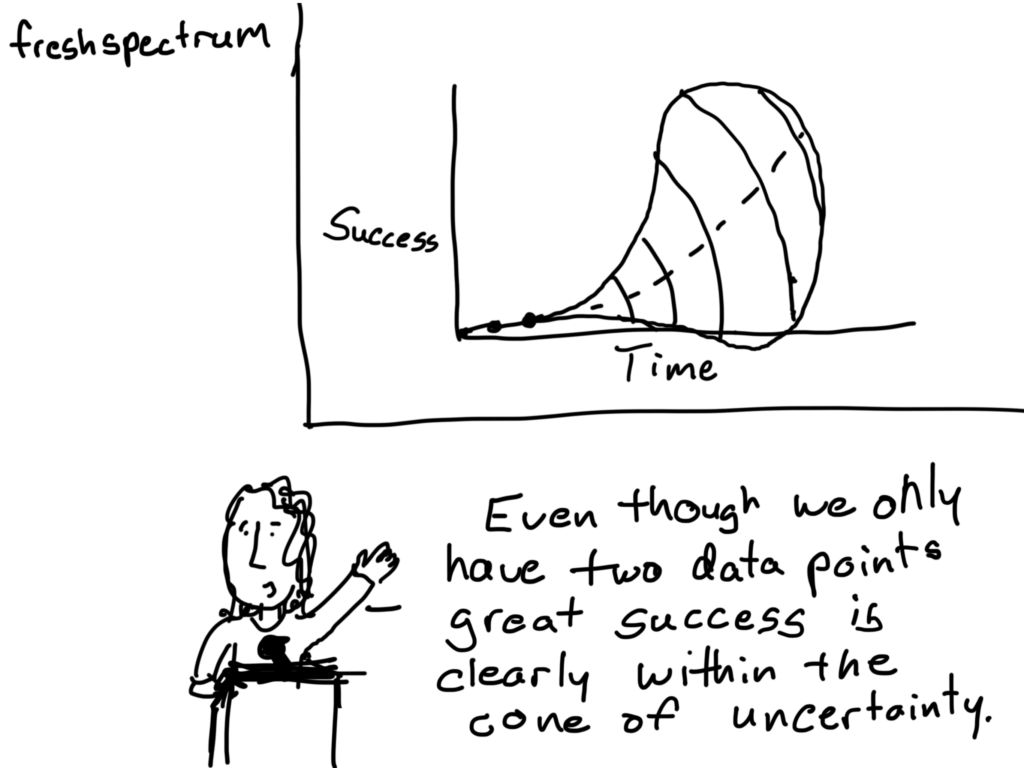

But the real issue is uncertainty about the future: will auto workers have jobs and health benefits in their new normal?

In healthcare services sectors—hospitals, medical groups, post-acute care facilities, home-care et al—the scenario is similar: workers face an uncertain future but significantly more complicated. Corporate greed, CEO compensation and workforce discontent are popular targets in healthcare services media coverage but the prominence of not-for-profit organizations in healthcare services obfuscates direct comparisons to for-profit organizations which represents less than a third of the services economy. For example, CEO compensation in NFPs—a prominent target of worker attention—is accounted differently for CEOs in investor-owned operations in which stock ownership is not treated as income until in options are exercised or shares sold. Annual 990 filings by NFPs tell an incomplete story nonetheless fodder for misinformation.

The competitive landscape and regulatory scrutiny for healthcare services are also more complicated for healthcare services. Unlike auto manufacturing where electric vehicles are forcing incumbents to change, there’s no consensus about what the new normal in U.S. healthcare services will be nor a meaningful industry-wide effort to define it. Each sector is defining its own “future state” based on questionable assumptions about competitors, demand, affordability, workforce requirements and more. Imagine an environmental scan in automakers strategy that’s mute on Tesla, or mass transit, Zoom, pandemic lock-downs or energy costs?

While the outlook for U.S. automakers is guardedly favorable, per Moody’s and Fitch, for not-for-profit health services operators it’s “unsustainable” and “deteriorating.”

Nonetheless, the parallels between the current state of worker sentiment in the U.S. auto manufacturing and healthcare services sectors are instructive. Auto and healthcare workers want job security and higher pay, believing their company executives and boards but corporate profit above their interests and all else. And polls suggest the public’s increasingly sympathetic to worker issues and strikes like the UAW more frequent.

Ultimately, the UAW dispute with the Big Three will be settled. Ultimately, both sides will make concessions. Ultimately, the automakers will pass on their concession costs to their customers while continuing their transitions to electric vehicles.

In health services, operators are unable to pass thru concession costs due to reimbursement constraints that, along with supply chain cost inflation, wipe out earnings and heighten labor tension.

So, the immediate imperatives for healthcare services organizations seem clear as labor issues mount and economics erode:

- Educate workers—all workers—is a priority. That includes industry trends and issues in sectors outside the organization’s current focus.

- Define the future. In healthcare services, innovators will leverage technology and data to re-define including how health is defined, where it’s delivered and by whom. Investments in future-state scenario planning is urgently needed.

- Address issues head-on: Forthrightness about issues like access, prices, executive compensation, affordability and more is essential to trustworthiness.

Stay tuned to the UAW strike and consider fresh approaches to labor issues. It’s not a matter of if, but when.

PS: I drive an electric car—my step into the auto industry future state. It took me 9 hours last Thursday to drive 275 miles to my son’s wedding because the infrastructure to support timely battery charges in route was non-existent. Ironically, after one of three self-charges for which I paid more than equivalent gas, I was prompted to “add a tip”. So, the transition to electric vehicles seems certain, but it will be bumpy and workers will be impacted.

The future state for healthcare is equally frought with inadequate charging stations aka “systemness” but it’s inevitable those issues will be settled. And worker job security and labor costs will be significantly impacted in the process.