Since filing for bankruptcy Monday, Steward Health Care revealed it’s carrying more than $1 billion in debt and said its entire hospital portfolio is for sale.

At 3:30 a.m. Monday, Steward Health Care filed for Chapter 11 protections in U.S. Bankruptcy Court for the Southern District of Texas.

Eleven minutes later, Steward employees had an email waiting from their CEO, Ralph de la Torre. The CEO told his staff that industrywide economic headwinds and delays in Steward’s planned asset sales had forced the physician-owned health network to initiate restructuring proceedings.

“It is incumbent on all of us to ensure that this process has no impact on the quality care our patients, their families, and our communities can continue to receive at our hospitals,” de la Torre wrote in an email viewed by Healthcare Dive. “To the vast majority of you, operations will either not be different or improve.”

“To be clear, this is a restructuring under chapter 11; it is not a closure and it is not a liquidation,” he wrote.

The email was the first time employees had heard directly from Steward leadership about the company’s financial distress — though rumors and uncertainty about the operator had been festering for weeks, according to Marlishia Aho, regional communications director for the union 1199SEIU United Healthcare Workers East.

Leading up to Monday’s filing, state and federal lawmakers were increasingly worried about how a bankruptcy at the largest physician-led hospital operator in the country would impact access to care.

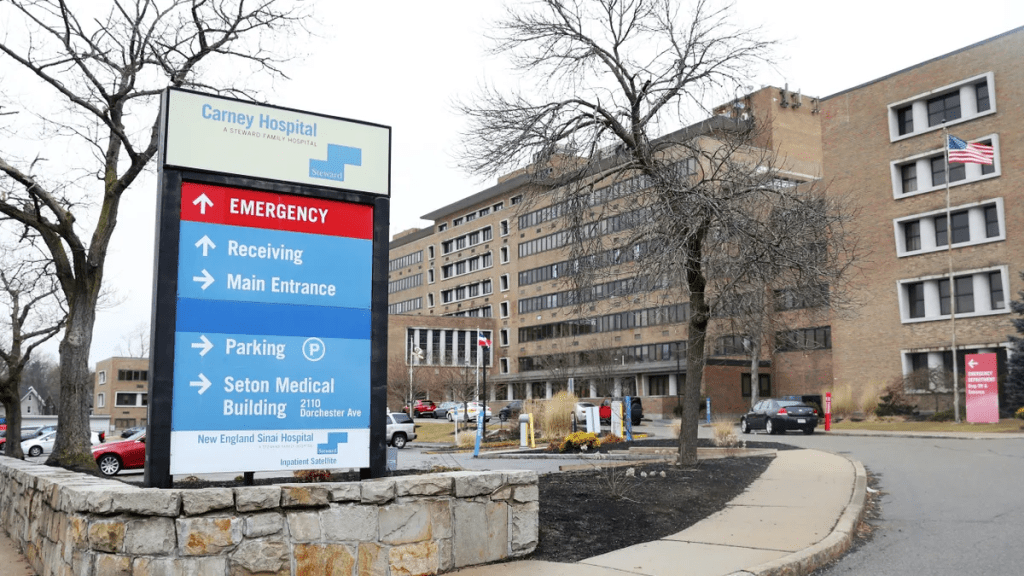

Regulators in Massachusetts — where Steward operates eight hospitals — held closed-door strategy sessions to map out contingency in case of a bankruptcy, and workers staged rallies to protest possible hospital closures.

Steward provides care for more than 2 million patients each year across 31 hospitals and 400 facility locations, according to bankruptcy filings. The company also employs nearly 30,000 employees across its eight-state portfolio, including 4,500 primary and specialty care physicians.

Steward’s first-day bankruptcy motions shed light on the operator’s future — and outlines its strategy for paying down its massive debt by selling assets. Here are the biggest takeaways.

Steward’s sprawling debt

Steward has earned a reputation for being cagey about its finances — to the dismay of Massachusetts Gov. Maura Healey, who accused the company of operating in a “black box” in a letter to its CEO earlier this year.

The operator has refused to file routine finances with Massachusetts regulators for years, citing a need to protect confidential business data. Even as the company shuttered hospitals this winter, regulators said Steward still dragged its feet on providing financial data, frustrating policymakers’ efforts to build out contingency plans.

“One of the good things about bankruptcy is that Steward and its CEO … will no longer be able to lie,” said Healey during a press conference Monday morning. “Transparency is really important here, and that’s why you know we’re looking forward to seeing what is in the various documents … We need clarity about debts and liabilities.”

In a slew of first-day motions, Steward now revealed it owes around $1.2 billion in total loan debts and about $6.6 billion in long-term lease payments.

Steward owes north of $600 million to 30 of its largest lenders, which include UnitedHealth-owned Change Healthcare, Philips North America LLC, Medline Industries, AYA Healthcare and Cerner.

The healthcare operator owes $289.8 million in unpaid compensation obligations, including $68 million to its own workers in unpaid employee salaries, $105.6 million in payments for physician services and $47.7 million owed to staffing agencies.

It also has approximately $979.4 million outstanding in trade obligations, of which approximately 70% are over 120 days past due.

The filings follow lawsuits from a multitude vendors — including staffing firms, consultants, medical equipment companies, electricians and marketing research companies — who said Steward reneged on payment obligations.

Steward’s interim funding tied to hospital sales

Though Steward had a consortium of six private lenders financing its asset-based loans this year, now only one lender is listed in bankruptcy filings as funding its debtor-in-possession financing: its landlord, Medical Properties Trust.

The change in vendors is notable, according to Laura Coordes, professor of law at the Sandra Day O’Connor College of Law at Arizona State University.

“Something went on to get these other lenders to drop out,” she said.

The landlord may be opting to fund Steward during bankruptcy proceedings in hopes of getting its own money back more expediently, according to Coordes.

Steward is MPT’s largest tenant and the healthcare network will owe MPT at least $6.9 billion in debt and lease obligations by 2041, according to the filings.

MPT agreed to finance $75 million debtor-in-possession financing and could fund up to $225 million more if Steward completes asset sale milestones on time.

During Tuesday morning’s first day hearing a representative for Steward told Judge Chris Lopez that all of Steward’s 31 hospitals are for sale. But to receive the $225 million from MPT, Steward has to hit aggressive sales milestones. It must host an auction for all non-Florida hospitals by June 28 and all Florida properties by July 30.

Since February, MPT executives have said there is strong interest from buyers in taking over Steward leases. However, Steward has yet to sell a hospital.

Experts have told Healthcare Dive they’re skeptical other operators would take on Steward’s leases at MPT’s current rental rates.

“Given the unaffordability of the leases and given that it hasn’t worked in the past, I do think that really material rent concessions are going to be needed to get this done,” said Rob Simone, sector head of real estate investment trusts at analyst firm Hedgeye.

Steward also signed a letter of intent to sell its physician group, Stewardship Health, to UnitedHealth. Although the deal was first announced in March, regulators have not yet begun reviewing the deal, according to David Seltz, executive director of the Massachusetts Health Policy Commission. Seltz said missing paperwork is delaying the review.

The Stewardship deal is not tied to further funding. A representative from UnitedHealth declined to comment on the pending deal and whether the bankruptcy proceeding would impact the sale.

Future of Steward

Employees have received conflicting messages about the future of Steward hospitals.

On one hand, both de la Torre and Massachusetts officials said Monday that Steward hospitals would remain open this week. However, Healey also emphasized that she wants Steward out of the state.

“Ultimately, [bankruptcy] is a step toward our goal of getting Steward out of Massachusetts,” Healey said during a press conference Monday.

Some Steward facilities may wind down during the bankruptcy proceedings, said Massachusetts Attorney General Andrea Campbell. Her office will oversee that process closely, and Steward will be required to provide licensing and notice obligations.

A healthcare worker at Steward’s Nashoba Valley Hospital told Healthcare Dive Monday she’s particularly concerned about the fate of her facility, which she says serves 14 communities but is small compared to some other hospitals in Steward’s portfolio. She doesn’t want regulators to forget about Nashoba.

“What I’m hoping for is that our state representatives and our local representatives really push to keep the hospital open,” she said. “But my concern is we get overlooked.”

State officials said they would continue monitoring Steward facilities to ensure quality care and push for the appointment of a patient care ombudsman to represent the interests of patients and employees during bankruptcy proceedings. Officials have already launched a website to offer resources about the bankruptcy process.

Still, employees are unsure of the path forward.

The Nashoba Valley Hospital employee told Healthcare Dive they’re conflicted about whether to stay at the hospital they’ve worked at for years or try to find a new position while they can.

“I’ve used the hospital since I moved out here. I’ve been living out in this area for like 25 years … I’ve brought my mother to this hospital,” the worker said. “It’s my hospital. It’s not just where I work. It’s what I use, and it’s vitally important to the community.”