In an era of significant medical debt, rising healthcare costs and delayed

treatments, our current healthcare system is ripe for solutions that alleviate the

burden of paying patient bills.

Enter embedded finance. While not a new concept by any stretch – it

has long existed in retail – fintechs and traditional banks are determined to give patients more

options and a fundamentally better experience in the way they pay for healthcare services. In doing

so, a financially strained domestic healthcare system stands to benefit from increased cash flow,

improved health equity and optimized patient engagement.

Simply put, embedded finance is the integration of financial services – such as payment, lending,

banking and insurance features – into another company’s normal service or products. We have all

undoubtedly come across these offerings in our daily lives as consumers. Think private label credit

cards with retail chains or airlines, digital wallet purchase options at the Amazon checkout, a buynow-pay-later (BNPL) plan from Affirm or Klarna, or insurance obtained from a car rental.

The goal of embedded finance:

is to improve a user’s experience by accessing financial services

without leaving a brand’s platform. By layering application programming interface (API)-driven

fintech or banking capabilities on top of a website or mobile app for, say, a hospital patient portal, the

bundled solution allows the user to stay on one website or application to complete a financial

transaction. Doing so removes friction in the experience and delivers a breadth of contextual

information that a provider or payer can use to prompt further action on the patient’s medical journey.

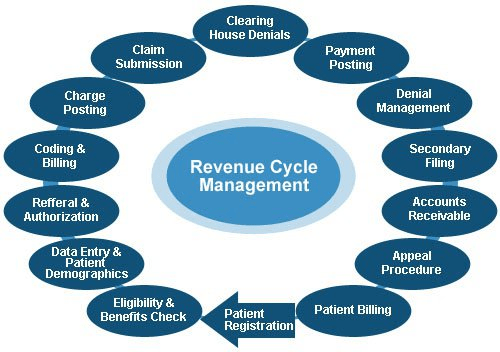

The implications for embedded finance in healthcare are vast and benefit every stakeholder across the revenue cycle value chain:

Patients: Flexibility and convenience to better structure and plan bill payment while receiving

greater access to financial options and additional services that improve the care experience

such as reminders and health tracking

Providers: Faster and higher rates of collections coupled with ongoing patient dialogue that

cements loyalty, affords clinicians the opportunity to suggest customized treatment options,

and improves revenue composition and potential valuation

Payers: More efficient claims processing cycle, automated processes and improved data

security

The burden of patient bills and increasing medical costs are not new to our system. Yet there has

been a confluence of fundamental changes that make embedded finance particularly attractive in

healthcare going forward, including increased smartphone usage and Internet penetration, COVID19 adoption of fintech products across healthcare settings, rising inflation rates that reduce a

patient’s ability to pay and the adoption of mobile-based apps among younger, digitally native

consumers and lower income patients.

These tailwinds support a massive addressable market as healthcare is expected to comprise approximately 23% of a U.S. embedded finance industry set to exceed $230 billion by 2025, or a 10x increase from $23 billion in 2020.

Significant attention and capital investment are accelerating the rise of embedded finance in healthcare.

Punctuated by attractive elements at the intersection of technology, financial services and healthcare sectors, nimble fintech companies and large financial institutions alike are competing for market presence. For example, pioneering healthcare-focused fintech PayZen closed $220 million in fresh capital in late 20223, while banks such as Wells Fargo and Synchrony have launched the popular medical-focused credit cards Health Advantage and CareCredit, respectively. Cain Brothers’ parent company, KeyBank, has also advanced an embedded strategy to provide healthcare digital innovation at scale and enhance patient experiences by acquiring XUP Payments in 2021. The resulting U.S. landscape for healthcare embedded finance is one that is evolving rapidly and that we are monitoring closely for investment and eventual M&A consolidation.

With expanding options around the type of medical care received and where it is received, we expect the financial tools at a patient’s disposal to garner significant attention in the years to come.

Embedded finance is a leading solution positioned to improve health equity and the financial well-being of millions of patients across the U.S., as well as fuel sector growth. Just as we’re accustomed now to buying pretty much anything with a few clicks, so too will embedded finance become a ubiquitous part of the healthcare landscape.