The perfect storm has hit U.S. healthcare:

- The “Big Beautiful Budget Bill” appears headed for passage with cuts to Medicaid and potentially Medicare likely elements.

- The economy is slowing, with a mild recession a possibility as consumer confidence drops, the housing market slows and uncertainty about tariffs mounts.

- And partisan brinksmanship in state and federal politics has made political hostages of public and rural health safety net programs as demand increases for their services.

Last Wednesday, amidst mounting anxiety about the aftermath of U.S. bunker-bombing in Iran and escalating conflicts in Gaza and Ukraine, the Centers for Medicare and Medicaid Services (CMS) released its report on healthcare spending in 2024 and forecast for 2025-2033:

“National health expenditures are projected to have grown 8.2% in 2024 and to increase 7.1% in 2025, reflecting continued strong growth in the use of health care services and goods.

During the period 2026–27, health spending growth is expected to average 5.6%, partly because of a decrease in the share of the population with health insurance (related to the expiration of temporarily enhanced Marketplace premium tax credits in the Inflation Reduction Act of 2022) and partly because of an anticipated slowdown in utilization growth from recent highs. Each year for the full 2024–33 projection period, national health care expenditure growth (averaging 5.8%) is expected to outpace that for the gross domestic product (GDP; averaging 4.3%) and to result in a health share of GDP that reaches 20.3% by 2033 (up from 17.6% in 2023) …

Although the projections presented here reflect current law, future legislative and regulatory health policy changes could have a significant impact on the projections of health insurance coverage, health spending trends, and related cost-sharing requirements, and they thus could ultimately affect the health share of GDP by 2033.”

As has been the case for 20 years, spending for healthcare grew faster than the overall economy in 2024. And it is forecast to continue through 2033:

| 2024Baseline | 2033Forecast | % Nominal Chg.2024-2033 | |

| National Health Spending | $5,263B | $8,585B | +63.1% |

| US Population | 337,2M | 354.8M | +5.2% |

| Per capita personal health spending | $13,227 | $20,559 | +55.7% |

| Per capita disposable personal income | $21,626 | $31,486 | +45.6% |

| NHE as % of US GDP | 18.0% | 20.3% | +12.8% |

In its defense, industry insiders call attention to the uniqueness of the business of healthcare:

- ‘Healthcare is a fundamental need: the health system serves everyone.’

- ‘Our aging population, chronic disease prevalence and socioeconomic disparities are drive increased demand for the system’s products and services.’

- ‘The public expects cutting edge technologies, modern facilities, effective medications and the best caregivers and they’re expensive.’

- ‘Burdensome regulatory compliance costs contribute to unnecessary spending and costs.’

And they’re right.

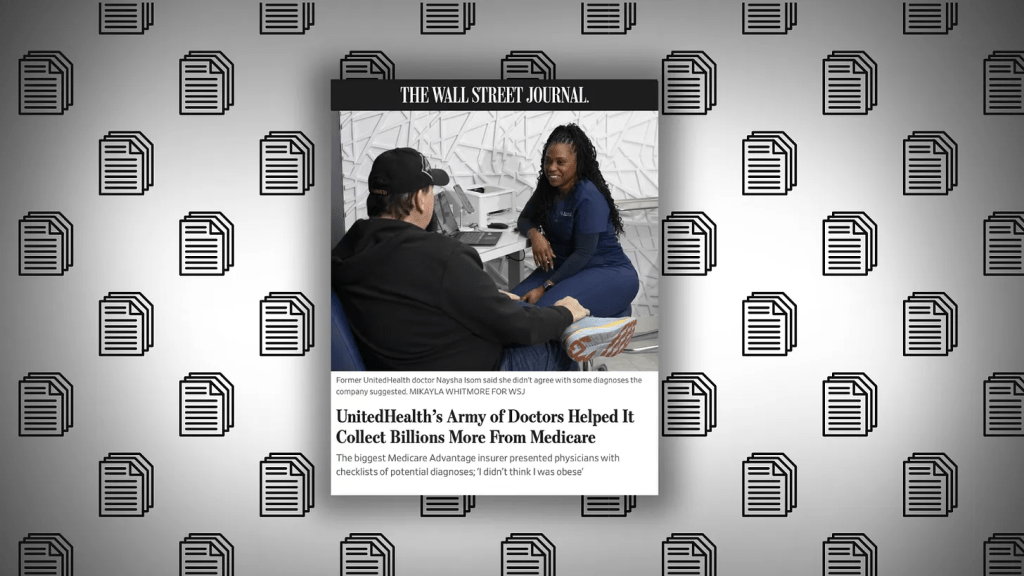

Critics argue the U.S. health system is the world’s most expensive but its results (outcomes) don’t justify its costs. They acknowledge the complexity of the industry but believe “waste, fraud and abuse” are pervasive flaws routinely ignored. And they remind lawmakers that the health economy is profitable to most of its corporate players (investor-owned and not-for-profits) and its executive handsomely compensated.

Healthcare has been hit by a perfect storm at a time when a majority of the public associates it more with corporatization and consolidation than caring. This coalition includes Gen Z adults who can’t afford housing, small employers who’ve cut employee coverage due to costs and large, self-insured employers who trying to navigate around the 10-20% employee health cost increase this year, state and local governments grappling with health costs for their public programs and many more. They’re tired of excuses and think the health system takes advantage of them.

As a percentage of the nation’s GDP and household discretionary spending, healthcare will continue to be disproportionately higher and increasingly concerning. Spending will grow faster than other industries until lawmakers impose price controls and other mechanisms like at least 8 states have begun already.

Most insiders are taking cover and waiting ‘til the storm passes. Some are content to cry foul and blame others. Others will emerge with new vision and purpose centered on reality.

Storm damage is rarely predictable but always consequential. It cannot be ignored. The Perfect has Hit U.S. healthcare. Its impact is not yet known but is certain to be a game changer.