Elizabeth Wilkins:

Hi, everybody. I’m Elizabeth Wilkins, president and CEO of the Roosevelt Institute, and I am delighted to be here today with some big news and a very special guest. I am thrilled to announce that Nobel Prize–winning economist Paul Krugman will be joining the Roosevelt Institute as a senior fellow. Paul is one of the world’s most cited economists and widely read commentators, and for good reason. His longtime New York Times column and his Substack now prove that he is not just a bold thinker, he is one of the clearest and most dynamic communicators in the field—skills that come in handy when you want to break through the noise of this moment and get people thinking about what the future of our economy and democracy might look like. And, of course, this is what Roosevelt is all about: understanding where we are in the moment and where we need to go.

So, Paul, I’m so excited to talk with you today. I started at Roosevelt in February, so we’re both new kids on the block here, and I will start with a question that I am getting a lot recently: Why your interest in affiliating with Roosevelt, and why now?

Paul Krugman:

Well, now I think because partly having retired from the New York Times, I’m free to pursue other affiliations. The Times is kind of a jealous organization. But now that I’m no longer there, I can do this. Roosevelt has been a tremendous reservoir of progressive thinking and progressive economics. I was heavily reliant on Roosevelt research particularly during the aftermath of the 2008 financial crisis—I’ve been around for a while here. [There’s] still novel stuff going on, and this seemed like a good affiliation to have in these times, to join the ranks of people with Roosevelt affiliations who have been providing really urgent commentary.

Elizabeth:

Thank you for the kind words. We appreciate it. One of the things that made your Times column such a hit for decades was the unique voice that you bring to economics: your ability to break down orthodoxy and cut to the core of what’s happening in plain terms. It almost goes without saying that there is a lot to cut through right now. We’ve seen attacks on government programs and on whole government agencies. And as you have noted and I have noted, the fate of Social Security and our social compact hangs in the balance right now. So, can you talk—with a little bit of your perspective on economic history—about what you think makes this moment unique? And through all this noise, what people should be paying attention to, and why?

Paul:

We are in a moment where we’ve lived, really since the New Deal in—whatever you want to call it—the Keynesian consensus. We’ve lived in a world where, we by no means went to socialism, but we had capitalism with some of the rough edges sanded off. Not as many of the rough edges that I would like, but we have Social Security, we’ve had Medicare since the 60s. We have Medicaid. We have the Affordable Care Act. We have a whole bunch of social insurance programs. We have government efforts to at least somewhat regulate the excesses and harms of markets. And now we are at a moment where there’s a real possibility that we may really lose that. We’re talking about possible retrogression, and the possibility of moving forward after this current moment has passed. But we really are at a point where the certainties of the underlying continuity of a fairly decent social compact is at risk. And so this is really new.

Elizabeth:

I really like that phrase, this “capitalism with the rough edges sanded off.” And what I’m hearing you say is basically the idea of the social compact is that, yes, we have capitalism, but we also have a commitment to providing a measure of security for people, and that’s the deal we have struck. You write a ton about the New Deal and FDR [Franklin D. Roosevelt]. Can you just expand a little bit about how to think about that trade-off, how long that consensus has held, and if there are any other moments in our economic history where there have been similar threats to that compact that we can learn from?

Paul:

I like to think about—it’s 1933, and the world economy has collapsed. There are a lot of reasonable people [who] have concluded that capitalism is irredeemable and can’t be saved, and that on the other hand, you have a lot of forces of repression out there. And along comes several countries—with the US in some ways leading the New Deal order, which says, no, we’re not actually going to go socialist. We’re not going to seize the commanding heights of production, but we are going to try to make sure that extreme hardship is vanished, as far as we can manage. We’re going to try to make sure that workers feel that they are a part of, and that they have rights and claims to, the system. There was very much this moment when we reached a kind of—I don’t know if it’s a compromise or a synthesis—but the idea of a basic standard of decency, the Four Freedoms. While at the same time saying that it’s not evil to make profits. It’s not evil to be personally ambitious. But we are going to try to make it so that everyone shares in the gains from economic activity.

And that really held. I mean, there was the moment when the Reagan administration came in, which represented, in many ways, a turn away from that New Deal consensus. But not to the extent that we have now. In moments of economic stress, people tend to say, well, maybe this thing doesn’t work anymore. The 1970s with stagflation, the aftermath of the 2008 financial crisis. That has basically been the case during attempts to turn away from the basic structure (which in the US context have always been a turn to the right, but in principle, you could imagine a turn to the left, but that hasn’t ever really happened in this country). And until right now, it has always seemed that the public wouldn’t stand for it. When push came to shove, when George W. Bush tried to privatize Social Security, it was a sort of resounding, “no, you don’t. We love Social Security.” But the possibility that we will have either explicitly or de facto undermining of those institutions seems much higher right now just because we live in such—well, we’re not gonna talk about the politics particularly, but there’s a possibility that we’ll lose it, that it will go away. And the one thing that I would say is that there’s this political action by itself, but there’s also the importance of getting the facts clear, getting the way the world works clear. No, there are not 10 million dead people receiving Social Security benefits. No, tax cuts and deregulation are not the only way to achieve economic growth. These are really critical things. Facts matter, analysis matters.

Elizabeth:

I’m just gonna pick up on that last thing you said about facts matter, analysis matters, and maybe go a little bit toward your true economist side. It’s not just Social Security we’re talking about. As you know and just mentioned, we’re in the middle of a tax and budget fight where we are very much looking at a situation where tax cuts for the wealthy might be traded for cuts to the programs that are specifically for our most vulnerable, like Medicaid and SNAP. This obviously has both political economy and democratic implications. It also has economic implications. Can you talk a little bit about this idea of what it means—this kind of wealth transfer, frankly, from the poorest to the richest, both in terms of hard facts, economics, and growth? And in terms of the social compacts that we’ve been talking about.

Paul:

It’s become increasingly clear that taking care of the most vulnerable members of society—it’s something you should do. It’s a moral obligation. But it’s also good economics, especially by the way of children. If you ask, a dollar spent on ensuring adequate health care and nutrition for children clearly pays off with multiple dollars of economic performance, because those children grow up to be more productive adults.

One way to say this is that conservative economic doctrine is all about punishing, it’s all about incentives: Poverty should be painful and wealth should be glorious. And what that all misses is the importance of just plain resources. That if low-income families cannot devote the resources to their children that you need to make those children fully productive adults—some will manage despite that, but just plain making sure that everybody in the country has the resources to make the most of themselves and their children is an enormously practical thing. It’s not just soft-hearted liberal talk, though I am a soft-hearted liberal, but it’s also just what you need to do if you want to make the most of your country’s potential.

Elizabeth:

I’m going to take another policy area, one actually that you know a lot about. It’s the area of focus that won you your Nobel Prize. You, in recent months, have been saying that one of the biggest risks of the Trump administration’s economic agenda is their chaotic tariff policy. We are currently recording the day after Liberation Day. And last year you predicted that the cronyism of those tariffs might be the biggest story in the long run, in addition to the chaos. So can you walk us through those risks, the chaos and the cronyism, and to what degree you’re seeing that play out for American workers and consumers? And, you know, why—I mean, there’s a lot of reasons why—but why are these tariffs different than the years that we’ve seen them in the past?

Paul:

There’s a standard economics case against tariffs, which is that it basically leads your economy to turn away from the things it’s really good at and start doing the things that it’s not especially good at. So for example, in New York, there’s lots of memories of the garment industry, but we really don’t wanna bring the garment industry back. Those were pretty bad jobs, and it happens to be stuff that can be done—where they can do it reasonably well—in Bangladesh, which desperately needs that industry, and we should be doing the things that we’re really good at instead. So that’s the classic case. What we’re discovering is that the rise of this hostility toward trade has additional costs. And the most immediate one is just plain that we don’t know what it’s gonna be.

As you said, we’re recording this the day after Liberation Day, which—nobody knows. I have to say that the actual tariff announcement shocked a lot of people, because it was both much bigger and much more arbitrary than people expected. I wouldn’t have been really shocked if there was a 15 percent across-the-board tariff, because that had been foreshadowed. But instead, there’s different tariffs for every country and this wasn’t really on anybody’s playbook. And nobody knows whether it [will] persist.

Think of yourself as being a business person trying to make decisions. You’re going to make an investment in your business—or are you? I mean, should you be spending money and making commitments on the basis that, okay, we’re gonna have 20 percent tariffs on all goods from Europe, or should you make it on the proposition that, “look, that’s crazy, those won’t last”? And both of those are defensible propositions. Anything you do, if you invest on the assumption that the tariffs are here to stay, then you’ll have made a terrible decision if they don’t. And so there’s a lot of paralysis that comes from the chaos. I’ve always been skeptical of people who invoke uncertainty as a reason that policy is holding the economy back, but because it’s often used as an argument against progressive policies: Oh, you know, your universal health care goals, that creates uncertainty. But in this case, this really is a major harmful issue.

We have not yet seen the cronyism, but it’s clearly potential. The whole root of—the reason why trade is where the dramatic stuff is happening [is because] US law creates a lot of discretion for the executive branch in tariff setting. Tariffs were only supposed to be applied as remedies for specific kinds of shocks or specific kinds of threats, but the decision about whether those conditions apply lies with the executive branch. So a president who wants to can do whatever they want on trade. And in the past, that’s always been held back by concern about: How will other countries react? What about the system? We built this global trading system. So it’s always been assumed that the president would have a wider view.

But if you take that away, then it’s not just arbitrary in terms of what are the overall levels of tariffs, it’s who gets a tariff break. And in fact, every time we do impose tariffs, there tend to be some exemptions. There are good reasons why sometimes you might want to exempt somebody from a tariff. But if it’s all arbitrary, the exemption might come because you go golfing with the president. And so that creates a lot of problematic incentives. We actually saw that in 2017, 2018, when the US was putting on tariffs—which looked trivial compared to what’s now on the plate—but it was very clear that industries and companies that were politically tied to the administration in power were much more likely to get exemptions than those that weren’t. So we actually saw this. We live in amazing times, and I mean that in the worst way. But everything that happened in the first go-around of what we called the trade war, it was really nothing—it was a skirmish compared with what’s happening now. But now, the possibilities are huge.

There’s a whole field of economic research on what the field calls rent-seeking. Economies where the way to succeed in business is not to be good at business, but to be good at cultivating political connections. And much of that actually was about tariffs and import quotas, but typically in developing countries. So there was a large concern that in places like Brazil or India, they were actually sacrificing a lot of potential gainful economic activity because businesses were focused instead on currying political favor. Well, could that happen here? Yes, it could. Very much down the road. I mean, I have to say that the speed and scale of the stuff that’s going on makes me think that we may have a global trade war and massive disruption before we even get around to the cronyism. But it’s down there, it’s in there. It’s in the mix.

Elizabeth:

We have seen, before yesterday, a real stop-start, put-on put-off, someone complains and we delay for a month. So I think we’ll really have to see, post-yesterday, where this goes. And this is a helpful roadmap for what to look for.

Paul:

And we should bear in mind also that the rest of the world has agency too. And part of the issue here is that the chaotic nature of the rollout is—again, the rest of the world has agency. And if you want to avoid getting into a lot of tit-for-tat, you probably want to at least explain what you’re doing and not be offending other countries unnecessarily. But, of course, we are doing that. I mean, to make Canada turn anti-American really takes—I didn’t think that—that wasn’t on my dance card for my career.

Elizabeth:

Roosevelt has argued for a long time for the strategic and targeted use of tariffs alongside industrial policy. And also, of course, alongside a strong sense of what rules and regulations you have to use to control unproductive uses of corporate and market power in that context, to make sure that the incentive structure that you’re creating actually targets the gains that you’re trying to make. But we’ve also argued for a way to transition into those things that takes account of some of the concerns that you’ve raised in terms of creating a stable business environment for investment, creating predictability, explaining things to mitigate the risk of fallout. And we’ve heard members of the administration say, “hey, yes.” [They] admit that this is going to be a little bit painful for a while, but it’ll be beneficial in the end.

You started to say this, but can you just pick apart for us when we hear someone say, “there might be a little bit of turmoil for a while,” what are the real costs of what that kind of turmoil might be for businesses, workers, consumers?

Paul:

I actually don’t buy—I mean, yes, there’s short-term pain, but it’s not short-term pain in exchange for a long-run gain, by any economic model I can think of applying. It’s actually short-term pain in return for probably even bigger long-term pain. The story about how this gets better is really not there.

I’m not a purist free trader. I’m not a laissez-faire guy. I mean, there’s a kind of idealized version of the post–New Deal consensus, which is, leave economic activity up to the markets, and then we’ll have a social safety net. But that has never been enough. We always need some additional stuff. We always need some industrial policy. And I think we need it more than we have actually had. But the reality is that you still want to have a lot of [trade]. International trade has, for the most part, been a plus for the US economy. There were distributional issues, but even there, it’s probably been a net-plus for the great majority of workers. And you’d want to mitigate the parts that aren’t. So the idea that shutting it down is going to produce a better outcome 5, 10 years down the pike, there’s really no clear argument to that effect. What is true is that we have this additional overlay, which is that nobody knows what the world is gonna look like next year. And so this is a tremendous inhibiting force.

Normally, when people say that, well, protectionism causes recessions, my answer has been no. There are lots of reasons not to like protectionism, but there’s no story about how it causes recessions. But protectionism where nobody knows what it’s gonna be, where nobody knows what the tariff rates are gonna be next year, that could cause a recession. So we may have the first real tariff-induced recession that I’m aware of in history, like, now.

Elizabeth:

That will give us something to keep an eye on over the next year and more.

I’m gonna change topics a little bit. We started, a little bit, to talk about power in the economy. Who has it? Who doesn’t? It’s something that you’ve explored. In your book Conscience of a Liberal, you wrote something that I really like: “The New Deal did more than create a middle-class society. It also brought America closer to its democratic ideals by giving working Americans real political power and ending the dominant position of the wealthy elite.”

Particularly in the environment we’re in today, what do you think policymakers should be thinking about in terms of what we can do to bring that New Deal power lens both to this moment and to a moment where we would have the ability to set the rules to put our country on a better course?

Paul:

There are two ends to that. One is just giving ordinary working- or middle-class people effective vehicles to exert political influence. And of course, we have the vote. (There may be that there’s no “of course” about that, but in principle, at least we have votes.) But I don’t think we really realized how much a strong union movement contributed toward making democracy work better. You can say, well, why isn’t the individual right to vote enough? And the answer is, look, there’s collective action problems. Politics is completely pervasive of things that would be good if everybody did them, but maybe [there’s] no individual incentives. So organizing politically is always hard, and unions are a big force in that—or were. And to some extent, still are, but much less than they used to be. And that’s really important. We are a less democratic country in practice because we don’t have workers organized. That’s one end of it, and there may be other ways, although I have to admit that I’m not all that creative. I think the success of unions in really making America more American in the postwar generation is something that we have never managed to find other routes to do.

Then on the other hand, there’s the question of the influence of malefactors of great wealth. The influence of vast wealth. And you don’t have to get too much into current events to say, well, we can really see that. I have to say, going back now, it looks like the plutocrats of the Gilded Age, by contemporary standards, were remarkable in their restraint and discretion. They didn’t try to buy influence as openly as the plutocrats today do. So now there are things you can do. It’s funny that our great grandfathers were much more open than we are in saying that one of the purposes of progressive taxation is to actually limit extreme wealth. And not simply because it’s more money to serve the common people, but because extreme wealth distorts democracy. Woodrow Wilson was much more willing to say things that would be regarded as extremely radical leftism now.

So really to reclaim who we are as a nation, [who we] are supposed to be, we need to work on both those ends. We need to try to empower basically working Americans, ordinary workers to have a role. And maybe there are other things besides unions, but that’s the obvious route.

And then you also need to try both with rules about money and politics, but also perhaps, if we can eventually, [through] constraining policy that limits the accumulation of enormous fortunes. That also limits that distortion because we really are in a situation now where it’s—all of the warnings about, as FDR would have said, the powers of organized money seem far more acute now than they ever did in the past.

Elizabeth:

You mentioned ideas that once were acceptable to say in polite company that seem more radical now. This is sort of the business of Roosevelt, to think big about how we can solve these questions of the maldistribution of power in the economy and do them at a structural level. And how to make ideas about that part of the common sense. You’ve talked about how that is part of what happened with the New Deal—that New Deal institutions that were at first considered novel and radical, by the Eisenhower presidency had become [a] normal part of American life. How did that happen in your view, that change in the common sense? And what made them so enduring and what lessons can we find for today about how to reorient what seems impossible and what seems a normal part of life?

Paul:

One of the things that strikes me when I look at history, both of economic institutions and of economic ideas, is that lots of things seem radical and scary until people have had a chance to experience them. So there’s the famous Nancy Pelosi quote—often out of context—where she said that for people to really understand the Affordable Care Act, we have to pass it. And it wasn’t like we were going to pull one over on people. It was that, as long as it was merely a theoretical thing, as long as it was something in prospect, it was possible to tell scare stories about death panels and just say, what will this do? But then after a few years, it becomes part of the fabric of life. And then, by the time we actually came fairly close to losing it, people were outraged because even imperfect as it is, Obamacare is a terrifically important safety net for many people.

You see that on a much larger scale [with] the New Deal changes. So if you go back to when FDR did his really stem-winding address in 1936 about the “I welcome their hatred” thing. The thing that was really the flash point—[that] was widely portrayed on one side of the political spectrum as an outrageous step that would destroy the market economy—was actually not Social Security, but unemployment insurance. It was like, “oh my god. You’re gonna actually pay people when they don’t have jobs.” And it turned out that hey, that’s okay. In fact—unemployment insurance was the most important thing that got us through COVID with minimal hardship. And now there are people, there’s always people who want to do away with these safety net programs. But things that can be made to sound ominous and radical when no one has actually experienced them can, after a few years, become part of the landscape.

The New Deal first got us through the Great Depression, then got us through the war. And by the time the war was over, we had become a very different country—and I would say a much better country—in which people accepted that, yeah, we have a kind of public responsibility to limit extreme inequality, to limit extreme hardship.

Elizabeth:

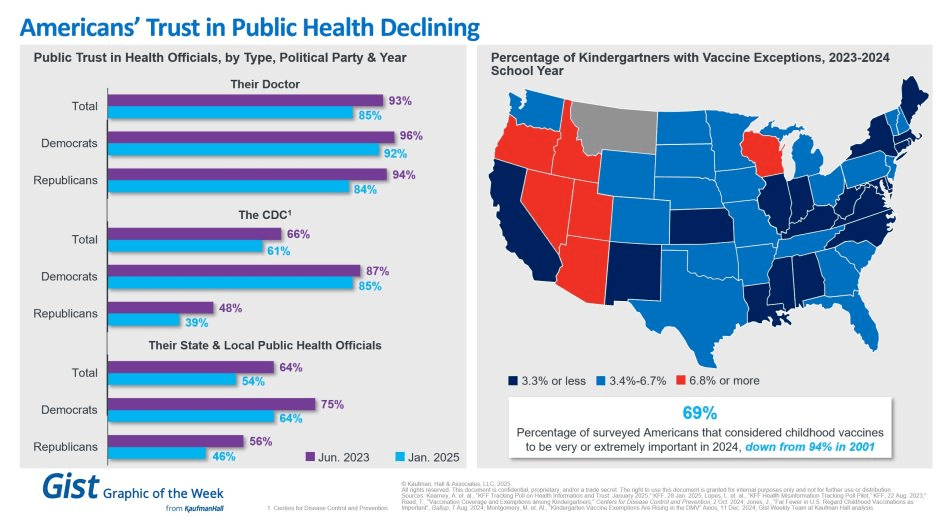

I want to close this out with a note that you struck in your final New York Times column last December. It was a tough one. You wrote, “optimism has been replaced by anger and resentment,” and that “the public no longer has faith that the people running things know what they’re doing, or that we can assume that they’re being honest.”

I think that applies to government. It also applies to a lot of institutions across the board. So here is my question for you: What do you think it will take to rebuild trust in public institutions? And also, on a more personal level, how do you find the hope that we can make it there from here?

Paul:

Well, there’s nothing like actually doing good to build trust. If we can find our way past the current turmoil, I think that there’s an underlying reservoir of optimism still in America. And if we can get our way past this, all of these things that led us to this rather scary moment, then a few years of good governance can actually do wonders. I mean, I’m older than you are, and certainly older than a lot of the people I deal with, but I remember the 1990s. And although there are many imperfections and lots of things, it’s hard to remember just how positive people were feeling about America by the end of that decade. And that was thrown away through a variety of bad decisions. But still, it’s not that distant. It’s not that inconceivable.

And so I would think that the way forward is to get people in power who really do try to use it for good, get good programs, get good policy, get decent people. And there’s a lot of strengths in America. And this atmosphere of distrust and feeling that everyone is out to get you is self-serving. That will go away fairly quickly if it’s demonstrably not true.

Now personally, I’m terrified. I’m not giving up, but you can see a lot of the things that we read about in the history books about how societies go wrong are no longer abstract. We can see those emotions, we can see those forces out there. But the truth is that a better environment is actually—people become more generous, more positive when things are going okay. And we really don’t want to have a situation where [this] zero-sum, “I’ve got mine, I don’t want anybody else to get it” thinking is validated by experience. So, try to make things work is how we go from here.

Elizabeth:

I can tell you one of the things that gives me hope, Paul, is that in a moment where we are watching some institutions capitulate and fold in a way that is really disheartening, we also have some voices that are getting louder, not softer, and I think one of them is yours. So I wanna say how appreciative I know I am personally and how excited I know the [Roosevelt] Institute is generally to have you on as a senior fellow, in part because I really do think you are a voice out there that’s making sense of what’s happening. That’s helping us put into a context that we can understand the flood of news that we are experiencing. And, again, to demonstrate what it looks like to be a consistent voice with good analysis and moral clarity about what’s happening now, and also who we have been in the past and who we could be again. So we really appreciate your work, and we really appreciate you taking the time to chat today.

Paul:

Well, thank you, and I’m glad to be on board.