https://mailchi.mp/cfd0577540a3/the-weekly-gist-november-11-2022?e=d1e747d2d8

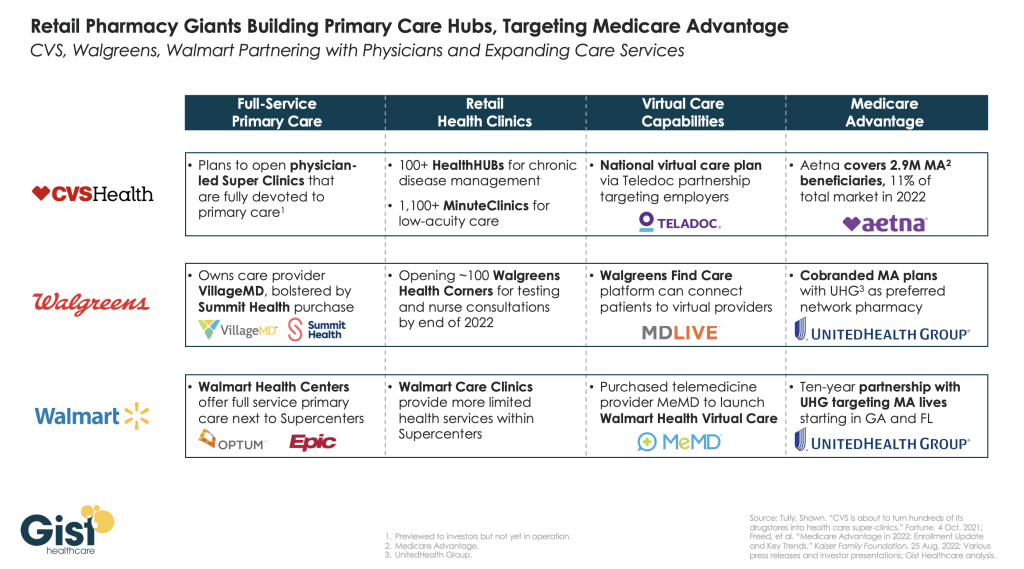

Retailers and insurers are building out their primary care strategies in a bid to become the new front door for patients seeking healthcare services, especially seniors on highly profitable Medicare Advantage (MA) plans. In the graphic above, we examine the capabilities of three of the largest pharmacy chains—CVS Health, Walgreens, and Walmart—to deliver full-service primary care across in-person and virtual settings.

CVS pioneered the pivot to care provision in 2006 with its acquisition of MinuteClinic, which now has over 1,000 locations. The company has further expanded its concept of pairing retail and pharmacy services with primary care by opening over 100 HealthHUBs, which provide an expanded slate of care services. However, CVS lags competitors in the rollout of full-service primary care practices, with its proposed physician-led Super Clinics still stuck in the planning stages.

Walgreens, with its majority stake in VillageMD (on track for 200 co-branded practices by the end of the year) and the recent acquisition of Summit Health (which operates another 370 primary and urgent care clinics) has assembled the most impressive primary care footprint of the three companies.

Walmart, the largest by number of stores but also the newest to healthcare, has opened more than 25 Walmart Health Centers, a step up from earlier experimentation with in-store care clinics, offering more services and partnering with Epic Systems to integrate electronic health records.

CVS’s key advantage over its competitors comes from its payer business, having acquired Aetna in 2018, now the fourth-largest MA payer by membership. Walgreens and Walmart have both aligned themselves with UnitedHealth Group (UHG) to participate in MA, with Walmart having struck a ten-year partnership to steer UHG MA beneficiaries to Walmart Health Centers in Florida and Georgia.

While aligning with UHG expands the reach of these retail giants into MA risk, UHG, whose OptumHealth division is by far the largest employer of physicians nationwide, remains the healthcare juggernaut most poised to unseat incumbent providers as the home for consumers’ healthcare needs.