Category Archives: Leadership Vision

Quote of the Day: Leading with Integrity

Qualities of Greatness

Quote of the Day: On True Leadership

One System; Two Divergent Views

Healthcare is big business. That’s why JP Morgan Chase is hosting its 42nd Healthcare Conference in San Francisco starting today– the same week Congress reconvenes in DC with the business of healthcare on its agenda as well. The predispositions of the two toward the health industry could not be more different.

Context: the U.S. Health System in the Global Economy

Though the U.S. population is only 4% of the world total, our spending for healthcare products and services represents 45% of global healthcare market. Healthcare is 17.4% of U.S. GDP vs. an average of 9.6% for the economies in the 37 other high-income economies of the world. It is the U.S.’ biggest private employer (17.2 million) accounting for 24% of total U.S. job growth last year (BLS). And it’s a growth industry: annual health spending growth is forecast to exceed 4%/year for the foreseeable future and almost 5% globally—well above inflation and GDP growth. That’s why private investments in healthcare have averaged at least 15% of total private investing for 20+ years. That’s why the industry’s stability is central to the economy of the world.

The developed health systems of the world have much in common: each has three major sets of players:

- Service Providers: organizations/entities that provide hands-on services to individuals in need (hospitals, physicians, long-term care facilities, public health programs/facilities, alternative health providers, clinics, et al). In developed systems of the world, 50-60% of spending is in these sectors.

- Innovators: organizations/entities that develop products and services used by service providers to prevent/treat health problems: drug and device manufacturers, HIT, retail health, self-diagnostics, OTC products et al. In developed systems of the world, 20-30% is spend in these.

- Administrators, Watchdogs & Regulators: Organizations that influence and establish regulations, oversee funding and adjudicate relationships between service providers and innovators that operate in their systems: elected officials including Congress, regulators, government agencies, trade groups, think tanks et al. In the developed systems of the world, administration, which includes insurance, involves 5-10% of its spending (though it is close to 20% in the U.S. system due to the fragmentation of our insurance programs).

In the developed systems of the world, including the U.S., the role individual consumers play is secondary to the roles health professionals play in diagnosing and treating health problems. Governments (provincial/federal) play bigger roles in budgeting and funding their systems and consumer out-of-pocket spending as a percentage of total health spending is higher than the U.S. All developed and developing health systems of the world include similar sectors and all vary in how their governments regulate interactions between them. All fund their systems through a combination of taxes and out-of-pocket payments by consumers. All depend on private capital to fund innovators and some service providers. And all are heavily regulated.

In essence, that makes the U.S. system unique are (1) the higher unit costs and prices for prescription drugs and specialty services, (2) higher administrative overhead costs, (3) higher prevalence of social health issues involving substance abuse, mental health, gun violence, obesity, et al (4) the lack of integration of our social services/public health and health delivery in communities and (5) lack of a central planning process linked to caps on spending, standardization of care based on evidence et al.

So, despite difference in structure and spending, developed systems of the world, like the U.S. look similar:

The Current Climate for the U.S. Health Industry

The global market for healthcare is attractive to investors and innovators; it is less attractive to most service providers since their business models are less scalable. Both innovator and service provider sectors require capital to expand and grow but their sources vary: innovators are primarily funded by private investors vs. service providers who depend more on public funding. Both are impacted by the monetary policies, laws and political realities in the markets where they operate and both are pivoting to post-pandemic new normalcy. But the outlook of investors in the current climate is dramatically different than the predisposition of the U.S. Congress toward healthcare:

- Healthcare innovators and their investors are cautiously optimistic about the future. The dramatic turnaround in the biotech market in 4Q last year coupled with investor enthusiasm for generative AI and weight loss drugs and lower interest rates for debt buoy optimism about prospects at home and abroad. The FDA approved 57 new drugs last year—the most since 2018. Big tech is partnering with established payers and providers to democratize science, enable self-care and increase therapeutic efficacy. That’s why innovators garner the lion’s share of attention at JPM. Their strategies are longer-term focused: affordability, generative AI, cost-reduction, alternative channels, self-care et al are central themes and the welcoming roles of disruptors hardwired in investment bets. That’s the JPM climate in San Franciso.

- By contrast, service providers, especially the hospital and long-term care sectors, are worried. In DC, Congress is focused on low-hanging fruit where bipartisan support is strongest and political risks lowest i.e.: price transparency, funding cuts, waste reduction, consumer protections, heightened scrutiny of fraud and (thru the FTC and DOJ) constraints on horizontal consolidation to protect competition. And Congress’ efforts to rein in private equity investments to protect consumer choice wins votes and worries investors. Thus, strategies in most service provider sectors are defensive and transactional; longer-term bets are dependent on partnerships with private equity and corporate partners. That’s the crowd trying to change Congress’ mind about cuts and constraints.

The big question facing JPM attendees this week and in Congress over the next few months is the same: is the U.S. healthcare system status quo sustainable given the needs in other areas at home and abroad?

Investors and organizations at JPM think the answer is no and are making bets with their money on “better, faster, cheaper” at home and abroad. Congress agrees, but the political risks associated with transformative changes at home are too many and too complex for their majority.

For healthcare investors and operators, the distance between San Fran and DC is further and more treacherous than the 2808 miles on the map.

The JPM crowd sees a global healthcare future that welcomes change and needs capital; Congress sees a domestic money pit that’s too dicey to handle head-on–two views that are wildly divergent.

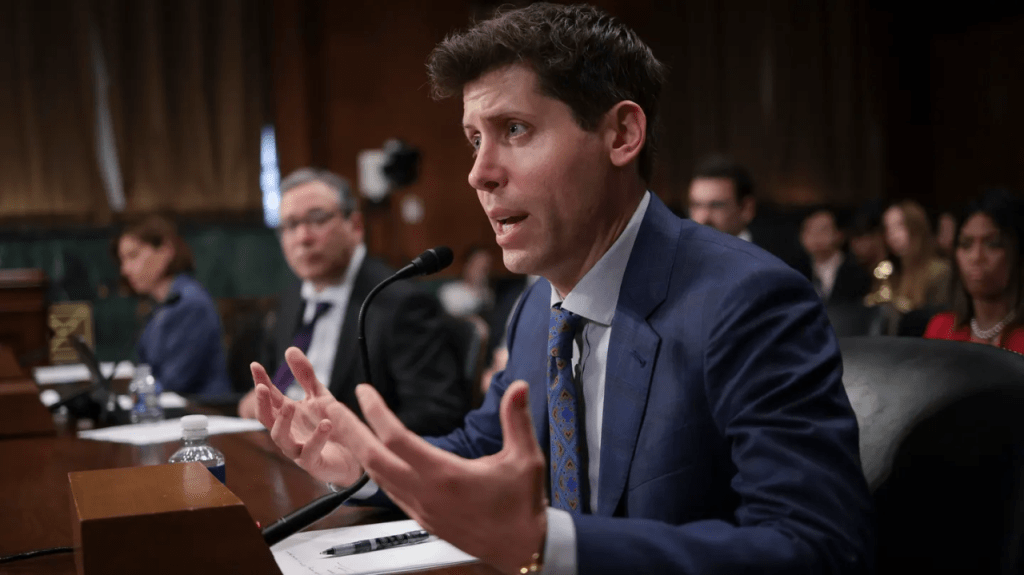

Sam Altman’s wild year offers 3 critical lessons for healthcare leaders in 2024

What a wild end to the year it was for Sam Altman, CEO of OpenAI.

In the span of five white-knuckle days in November, the head of Silicon Valley’s most advanced generative AI company was fired by his board of directors, replaced by not one but two different candidates, hired to lead Microsoft’s AI-research efforts and, finally, rehired back into his CEO position at OpenAI with a new board.

A couple weeks later, TIME selected him “CEO of the Year.” Altman’s saga is more than a tale of tech-industry intrigue. His story provides three valuable lessons for not only aspiring and current healthcare leaders, but also everyone who works with and depends on them.

1. Agree On The Goal, Define It, Then Pursue It Tirelessly

OpenAI’s governance structure presented a unique case: a not-for-profit board, whose stated mission was to protect humanity, found itself overseeing an enterprise valued at more than $80 billion. Predictably, this setup invited conflict, as the company’s humanitarian mission began to clash with the commercial realities of a lucrative, for-profit entity.

But there’s little evidence the bruhaha resulted from Altman’s financial interests. According to IRS filings, the CEO’s salary was only $58,333 at the time of his firing, and he reportedly owns no stock.

While Altman clearly knows the company needs to raise money to fund the creation of ever-more-powerful AI tools, his primary goal doesn’t appear to revolve around maximizing shareholder value or his own wealth.

In fact, I believe Altman and the now-disbanded board shared a common mission: to save humanity. The problem was that the parties were 180 degrees apart when it came to defining how exactly to protect humanity.

Altman’s path to saving humanity involved racing forward as fast as possible. As CEO, he understands generative AI’s potential to radically enhance productivity and alleviate threats like world hunger and climate change.

By contrast, the board feared that breakneck AI development could spiral out of control, posing a threat to human existence. Rather than perceiving AGI (artificial general intelligence) as a savior, much of the board worried that a self-learning system might harm humanity.

This dichotomy pitted a CEO intent on changing the world against a board intent to progress at a cautious, incremental pace.

For Healthcare Leaders: Like OpenAI, American healthcare leaders share a common goal. Be they doctors, insurers or government health agencies, all tout the importance of “value-based care” (VBC), which in general terms, constitutes a financial and care-delivery model based on paying healthcare professionals for the quality of clinical outcomes they achieve rather than the quantity of services they provide. But despite agreeing on the target, leaders differ on what it means and how best to accomplish it. Some think of VBC as “pay for performance,” whereby doctors are paid small incentives based on metrics around prevention and patient satisfaction. These programs fail because clinicians ignore the metrics without incentives and total health suffers.

Other leaders believe VBC means paying insurers a set, annual, upfront fee to provide healthcare to a population of patients. This, too, fails since the insurers turn around and pay doctors and hospitals on a fee-for-service basis, and implement restrictive prior authorization requirements to keep costs down.

Instead of making minor financial tweaks that keep falling short of the goal, leaders who want to transform American medicine must play to win. This will require them to move quickly and completely away from fee-for-service payments (which rewards volume of care) to capitation at the delivery-system level (rewarding superior results by prepaying doctors and hospitals directly without insurers playing the part of middlemen).

Like OpenAI’s former board members, today’s healthcare leaders are playing “not to lose.” They avoid making big changes because they fear the backlash of risk-averse providers. But anything less than all in won’t make a dent given the magnitude of problems. To be effective, leaders must make hard decisions, accept the risks and be confident that once the changes are in place, no one will want to go back to the old ways of doing things.

2. Hire Visionary Leaders Who Inspire Boldly

Many tech-industry commentators have drawn comparisons between Altman and Steve Jobs. Both leaders possess(ed) the rare ability to foresee a better future and turn their visions into reality. And both demonstrate(d) passion for exceeding people’s wants and expectations—not for their own benefit but because they believe in a greater mission and purpose.

Altman and Jobs are what I call visionary leaders, who push their organizations and people to accomplish remarkable outcomes few could’ve believed possible. These types of leaders always challenge conservative boards.

When the OpenAI board realized it’s hard to constrain a CEO like Sam Altman, they fired him.

On day one of that decision, the board might have assumed their action would protect humanity and, therefore, earn the approval of OpenAI’s employees. But the story took a sharp turn when nearly all the company’s 770 workers signed a letter to the board in support of Altman, threatening to quit unless (a) their visionary leader was brought back immediately and (b) the board resigned.

Five days after the battle began, the board was facing a rebellion and had little choice but to back down.

For Healthcare Leaders: The American healthcare system is struggling. Half of Americans say they can’t afford their out-of-pocket expenses, which max out at $16,000 for an insured family. American health is languishing with average life expectancy virtually unchanged since the start of this century. Maternal and infant mortality rates in the U.S. are double what they are in other wealthy nations. And inside medicine, burnout runs rampant. Last year, 71,000 physicians left the profession.

Visionary leadership, often sidelined in favor of the status quo, is crucial for transformative change. In healthcare, boards typically prioritize hiring CEOs with the ability to consolidate market control and achieve positive financial results rather than the ability to drive excellence in clinical outcomes. The consequence for both the providers and recipients of care proves painful.

Like OpenAI’s employees, healthcare professionals want leaders who are genuine, who have the courage to abandon bureaucratic safety in favor of innovative solutions, and who can ignite their passion for medicine. For a growing number of clinicians, the practice of medicine has become a job, not a mission. Without that spark, the future of medicine will remain bleak.

3. Embrace Transformative Technology

OpenAI’s board simultaneously promoted and feared ChatGPT’s potential. In this era of advanced technology, the dilemma of embracing versus restraining innovation is increasingly common.

The board could have shut down OpenAI or done everything in its power to advance the AI. It couldn’t, however, do both. When organizations in highly competitive industries try to strike a safe “balance,” choosing the less-contentious middle ground, they almost always fail to accomplish their goals.

For Healthcare Leaders: Despite being data-driven scientists, healthcare professionals often hesitate to embrace information technologies. Having been burned by tools like electronic healthcare records, which were designed to maximize revenue and not to facilitate medical care, their skepticism is understandable.

But generative AI is different because it has the potential to simultaneously increase quality, accessibility and affordability. This is where technology and skilled leadership must combine forces. It’s not enough for leaders to embrace generative AI. They must also inspire clinicians to apply it in ways that promote collaboration and achieve day-to-day operational efficiency and effectiveness. Without both, any other operational improvements will be incremental and clinical advances minimal at best.

If the boards of directors and other similar decision-making bodies in healthcare want their organizations to lead the process of change, they’ll need to select and support leaders with the vision, courage, and skill to take radical and risky leaps forward. If not, as OpenAI’s narrative demonstrates, they and their organizations will become insignificant and be left behind.

6 priorities for health system strategists in 2024

Health systems are recovering from the worst financial year in recent history. We surveyed strategic planners to find out their top priorities for 2024 and where they are focusing their energy to achieve growth and sustainability. Read on to explore the top six findings from this year’s survey.

Research questions

With this survey, we sought the answers to five key questions:

- How do health system margins, volumes, capital spending, and FTEs compare to 2022 levels?

- How will rebounding demand impact financial performance?

- How will strategic priorities change in 2024?

- How will capital spending priorities change next year?

Bigger is Better for Financial Recovery

What did we find?

Hospitals are beginning to recover from the lowest financial points of 2022, where they experienced persistently negative operating margins. In 2023, the majority of respondents to our survey expected positive changes in operating margins, total margins, and capital spending. However, less than half of the sample expected increases in full-time employee (FTE) count. Even as many organizations reported progress in 2023, challenges to workforce recovery persisted.

40%

Of respondents are experiencing margins below 2022 levels

Importantly, the sample was relatively split between those who are improving financial performance and those who aren’t. While 53% of respondents projected a positive change to operating margins in 2023, 40% expected negative changes to margin.

One exception to this split is large health systems. Large health systems projected above-average recovery of FTE counts, volume, and operating margins. This will give them a higher-than-average capital spending budget.

Why does this matter?

These findings echo an industry-wide consensus on improved financial performance in 2023. However, zooming in on the data revealed that the rising tide isn’t lifting all boats. Unequal financial recovery, especially between large and small health systems, can impact the balance of independent, community, and smaller providers in a market in a few ways. Big organizations can get bigger by leveraging their financial position to acquire less resourced health systems, hospitals, or provider groups. This can be a lifeline for some providers if the larger organization has the resources to keep services running. But it can be a critical threat to other providers that cannot keep up with the increasing scale of competitors.

Variation in financial performance can also exacerbate existing inequities by widening gaps in access. A key stakeholder here is rural providers. Rural providers are particularly vulnerable to financial pressures and have faced higher rates of closure than urban hospitals. Closures and consolidation among these providers will widen healthcare deserts. Closures also have the potential to alter payer and case mix (and pressure capacity) at nearby hospitals.

Volumes are decoupled from margins

What did we find?

Positive changes to FTE counts, reduced contract labor costs, and returning demand led the majority of respondents in our survey to project organizational-wide volume growth in 2023. However, a significant portion of the sample is not successfully translating volume growth to margin recovery.

44%

Of respondents who project volume increases also predict declining margins

On one hand, 84% of our sample expected to achieve volume growth in 2023. And 38% of respondents expected 2023 volume to exceed 2022 volume by over 5%. But only 53% of respondents expected their 2023 operating margins to grow — and most of those expected that the growth would be under 5%. Over 40% of respondents that reported increases in volume simultaneously projected declining margins.

Why does this matter?

Health systems struggled to generate sufficient revenue during the pandemic because of reduced demand for profitable elective procedures. It is troubling that despite significant projected returns to inpatient and outpatient volumes, these volumes are failing to pull their weight in margin contribution. This is happening in the backdrop of continued outpatient migration that is placing downward pressure on profitable inpatient volumes.

There are a variety of factors contributing to this phenomenon. Significant inflationary pressures on supplies and drugs have driven up the cost of providing care. Delays in patient discharge to post-acute settings further exacerbate this issue, despite shrinking contract labor costs. Reimbursements have not yet caught up to these costs, and several systems report facing increased denials and delays in reimbursement for care. However, there are also internal factors to consider. Strategists from our study believe there are outsized opportunities to make improvements in clinical operational efficiency — especially in care variation reduction, operating room scheduling, and inpatient management for complex patients.

Strategists look to technology to stretch capital budgets

What did we find?

Capital budgets will improve in 2024, albeit modestly. Sixty-three percent of respondents expect to increase expenditures, but only a quarter anticipate an increase of 6% or more. With smaller budget increases, only some priorities will get funded, and strategists will have to pick and choose.

Respondents were consistent on their top priority. Investments in IT and digital health remained the number one priority in both 2022 and 2023. Other priorities shifted. Spending on areas core to operations, like facility maintenance and medical equipment, increased in importance. Interest in funding for new ambulatory facilities saw the biggest change, falling down two places.

Why does this matter?

Capital budgets for health systems may be increasing, but not enough. With the high cost of borrowing and continued uncertainty, health systems still face a constrained environment. Strategists are looking to get the biggest bang for their buck. Technology investments are a way to do that. Digital solutions promise high impact without the expense or risk of other moves, like building new facilities, which is why strategists continue to prioritize spending on technology.

The value proposition of investing in technology has changed with recent advances in artificial intelligence (AI), and our respondents expressed a high level of interest in AI solutions. New applications of AI in healthcare offer greater efficiencies across workforce, clinical and administrative operations, and patient engagement — all areas of key concern for any health system today.

Building is reserved for those with the largest budgets

What did we find?

Another way to stretch capital budgets is investing in facility improvements rather than new buildings. This allows health systems to minimize investment size and risk. Our survey found that, in general, strategists are prioritizing capital spending on repairs and renovation while deprioritizing building new ambulatory facilities.

When the responses to our survey are broken out by organization type, a different story emerges. The largest health systems are spending in ways other systems are not. Systems with six or more hospitals are increasing their overall capital expenditures and are planning to invest in new facilities. In contrast, other systems are not increasing their overall budgets and decreasing investments in new facilities.

AMCs are the only exception. While they are decreasing their overall budget, they are increasing their spending on new inpatient facilities.

Why does this matter?

Health systems seek to attract patients with new facilities — but only the biggest systems can invest in building outpatient and inpatient facilities. The high ranking of repairs in overall capital expenditure priorities suggests that all systems are trying to compete by maintaining or improving their current facilities. Will renovations be enough in the face of expanded building from better financed systems? The urgency to respond to the pandemic-accelerated outpatient shift means that building decisions made today, especially in outpatient facilities, could affect competition for years to come. And our survey responses suggest that only the largest health system will get the important first-mover advantage in this space.

AMCs are taking a different tack in the face of tight budgets and increased competition. Instead of trying to compete across the board, AMCs are marshaling resources for redeployment toward inpatient facilities. This aligns with their core identity as a higher acuity and specialty care providers.

Partnerships and affiliations offer potential solutions for health systems that lack the resources for building new facilities. Health systems use partnerships to trade volumes based on complexity. Partnerships can help some health systems to protect local volumes while still offering appropriate acute care at their partner organization. In addition, partnerships help health systems capture more of the patient journey through shared referrals. In both of these cases, partnerships or affiliations mitigate the need to build new inpatient or outpatient facilities to keep patients.

Revenue diversification tactics decline despite disruption

What did we find?

Eighty percent of respondents to our survey continued to lose patient volumes in 2023. Despite this threat to traditional revenue, health systems are turning from revenue diversification practices. Respondents were less likely to operate an innovation center or invest in early-stage companies in 2023. Strategists also reported notably less participation in downside risk arrangements, with a 27% decline from 2022 to 2023.

Why does this matter?

The retreat from revenue diversification and risk arrangements suggests that health systems have little appetite for financial uncertainty. Health systems are focusing on financial stabilization in the short term and forgoing practices that could benefit them, and their patients, in the long term.

Strategists should be cautious of this approach. Retrenchment on innovation and value-based care will hold health systems back as they confront ongoing disruption. New models of care, patient engagement, and payment will be necessary to stabilize operations and finances. Turning from these programs to save money now risks costing health systems in the future.

Market intelligence and strategic planning are essential for health systems as they navigate these decisions. Holding back on initiatives or pursuing them in resource-constrained environments is easier when you have a clear course for the future and can limit reactionary cuts.

Advisory Board’s long-standing research on developing strategy suggests five principles for focused strategy development:

- Strategic plans should confront complexity. Sift through potential future market disruptions and opportunities to establish a handful of governing market assumptions to guide strategy.

- Ground strategy development in answers to a handful of questions regarding future competitive advantage. Ask yourself: What will it take to become the provider of choice?

- Communicate overarching strategy with a clear, coherent statement that communicates your overall health system identity.

- A strategic vision should be supported by a limited number of directly relevant priorities. Resist the temptation to fill out “pro forma” strategic plan.

- Pair strategic priorities with detailed execution plans, including initiative roadmaps and clear lines of accountability.

Strategists align on a strategic vision to go back to basics

What did we find?

Despite uneven recovery, health systems widely agree on which strategic initiatives they will focus more on, and which they will focus less on. Health system leaders are focusing their attention on core operations — margins, quality, and workforce — the basics of system success. They aim to achieve this mandate in three ways. First, through improving efficiency in care delivery and supply chain. Second, by transforming key elements of the care delivery system. And lastly, through leveraging technology and the virtual environment to expand job flexibility and reduce administrative burden.

Health systems in our survey are least likely to take drastic steps like cutting pay or expensive steps like making acquisitions. But they’re also not looking to downsize; divesting and merging is off the table for most organizations going into 2024.

Why does this matter?

The strategic priorities healthcare leaders are working toward are necessary but certainly not easy. These priorities reflect the key challenges for a health system — margins, quality, and workforce. Luckily, most of strategists’ top priorities hold promise for addressing all three areas.

This triple mandate of improving margins, quality, and workforce seems simple in theory but is hard to get right in practice. Integrating all three core dimensions into the rollout of a strategic initiative will amplify that initiative’s success. But, neglecting one dimension can diminish returns. For example, focusing on operational efficiency to increase margins is important, but it’ll be even more effective if efforts also seek to improve quality. It may be less effective if you fail to consider clinicians’ workflow.

Health systems that can return to the basics, and master them, are setting a strong foundation for future growth. This growth will be much more difficult to attain without getting your house in order first.

Vendors and other health system partners should understand that systems are looking to ace the basics, not reinvent the wheel. Vendors should ensure their products have a clear and provable return on investment and can map to health systems’ strategic priorities. Some key solutions health systems will be looking for to meet these priorities are enhanced, easy-to-follow data tools for clinical operations, supply chain and logistics, and quality. Health systems will also be interested in tools that easily integrate into provider workflow, like SDOH screening and resources or ambient listening scribes.

Going back to basics

Craft your strategy

1. Rebuild your workforce.

One important link to recovery of volume is FTE count. Systems that expect positive changes in FTEs overwhelmingly project positive changes in volume. But, on average, less than half of systems expected FTE growth in 2023. Meanwhile, high turnover, churn, and early retirement has contributed to poor care team communication and a growing experience-complexity gap. Prioritize rebuilding your workforce with these steps:

- Recover: Ensure staff recover from pandemic-era experiences by investing in workforce well-being. Audit existing wellness initiatives to maximize programs that work well, and rethink those that aren’t heavily utilized.

- Recruit: Compete by addressing what the next generation of clinicians want from employment: autonomy, flexibility, benefits, and diversity, equity, and inclusion (DEI). Keep up to date with workforce trends for key roles such as advance practice providers, nurses, and physicians in your market to avoid blind spots.

- Retain: Support young and entry-level staff early and often while ensuring tenured staff feel valued and are given priority access to new workforce arrangements like hybrid and gig work. Utilize virtual inpatient nurses and virtual hubs to maintain experienced staff who may otherwise retire. Prioritize technologies that reduce the burden on staff, rather than creating another box to check, like ambient listening or asynchronous questionnaires.

2. Become the provider of choice with patient-centric care.

Becoming the provider of choice is crucial not only for returning to financial stability, but also for sustained growth. To become the provider of choice in 2024, systems must address faltering consumer perspectives with a patient-centric approach. Keep in mind that our first set of recommendations around workforce recovery are precursors to improving patient-centered care. Here are two key areas to focus on:

- Front door: Ensure a multimodal front door strategy. This could be accomplished through partnership or ownership but should include assets like urgent care/extended hour appointments, community education and engagement, and a good digital experience.

- Social determinants of health: A key aspect of patient-centered care is addressing the social needs of patients. Our survey found that addressing SDOH was the second highest strategic priority in 2023. Set up a plan to integrate SDOH screenings early on in patient contact. Then, work with local organizations and/or build out key services within your system to address social needs that appear most frequently in your population. Finally, your workforce DEI strategy should focus on diversity in clinical and leadership staff, as well as teaching clinicians how to practice with cultural humility.

3. Recouple volume and margins.

The increasingly decoupled relationship between volume and margins should be a concern for all strategists. There are three parts to improving volume related margins: increasing volume for high-revenue procedures, managing costs, and improving clinical operational efficiency.

- Revenue growth: Craft a response to out-of-market travel for surgery. In many markets, the pool of lucrative inpatient surgical volumes is shrinking. Health systems are looking to new markets to attract patients who are willing to travel for greater access and quality. Read our findings to learn more about what you need to attract and/or defend patient volumes from out-of-market travel.

- Cost reduction: Although there are many paths health systems can take to manage costs, focusing on tactics which are the most likely to result in fast returns and higher, more sustainable savings, will be key. Some tactics health systems can deploy include preventing unnecessary surgical supply waste, making employees accountable for their health costs, and reinforcing nurse-led sepsis protocols.

- Clinical operational efficiency: The number one strategic priority in 2023, according to our survey, was clinical operational efficiency, no doubt in response to faltering margins. Within this area, the top place for improvement was care variation reduction (CVR). Ensure you’re making the most out of CVR efforts by effectively prioritizing where to spend your time. Improve operational efficiency outside of CVR by improving OR efficiency and developing protocols for complex inpatient management.

Michael Dowling: The most pressing question to start the year

The new year is always an ideal time for healthcare leaders to reflect on the state of our industry and their own organizations, as well as the challenges and opportunities ahead.

As the CEO of a large health system, I always like to reflect on one basic question at the end of each year: Are we staying true to our mission?

Certainly, maintaining an organization’s financial health must always be a priority but we should also never lose sight of our core purpose. In a business like ours that has confronted and endured a global pandemic and immense financial struggles over the past several years, I recognize it’s increasingly difficult to maintain our focus on mission while trying to find ways to pay for rising labor and supply costs, infrastructure improvements needed to remain competitive and other pressures on our day-to-day operations.

After all, the investments we need to make to promote community wellness, mental health, environmental sustainability and health equity receive little or no reimbursement, negatively impacting our financial bottom lines. During an era of unprecedented expansion of Medicaid and Medicare, we get less and less relief from commercial insurers, whose denial and delay tactics for reimbursing medical claims continue to erode the stability of many health systems and hospitals, especially those caring for low-income communities.

Despite those enormous pressures, it’s imperative that we continue to support underserved communities, military veterans struggling with post-traumatic stress, and intervention programs that help deter gun violence and addiction.

The list of other worthy investments goes on and on: charity care to uninsured or underinsured patients who can’t pay their medical bills, funding for emergency services that play such a critical role during public health emergencies, nutritional services for families struggling to put food on the table, programs that combat human trafficking and support women’s health, the LGBTQIA+ community and global health initiatives that aid Ukraine, the Middle East and other countries torn apart by war, famine and natural disasters.

We must also recognize the key role of healthcare providers as educators. School-based mental health programs are saving lives by identifying children exhibiting suicidal behaviors, anger management issues and other troublesome behaviors. School outreach efforts have the added benefit of helping health systems and hospitals address their own labor shortages by introducing young people to career paths that will help shape the future healthcare workforce.

Without a doubt, the “to-do” list of community health initiatives that support our mission is daunting. We can’t do it all alone, but as the largest employers in cities and towns across America, health systems and hospitals can serve as a catalyst to get all sectors of our society — government, businesses, schools, law enforcement, churches, social service groups and other community-based organizations — to recognize that “health” goes far beyond the delivery of medical care.

The health of individuals, families and communities hinges on the prevalence of good-paying jobs, decent and affordable housing, quality education, access to healthy foods, medical care, transportation, clean air and water, low prevalence of crime and illicit drugs, and numerous other variables that typically depend on the zip codes where we live. Those so-called social determinants of health are the driving factors that enable communities and the people who live there to either prosper or struggle, resulting in disparities that are the underlying cause of why so many cities and towns across the country fall into economic decay and become havens for crime and hotbeds for gun violence, which shamefully is now the leading cause of death for children and adolescents.

To revive these underserved communities, many of which are in our own backyards, we have to look at all of the socioeconomic issues they struggle with through the prism of health and use the collective resources of all stakeholders to bring about positive change.

Health is how we work together to build a sense of community. Having a healthy community also requires everyone doing what they can to tone down the political rhetoric and social media-fueled anger that is polarizing our society. Health is bringing back a sense of civility and respect in our public discourse, and promoting the values of honesty, decency and integrity.

As healthcare providers and respected business leaders, we should all make a New Year’s resolution to stay true to our mission and do what we can within our communities to bring oxygen to hope, optimism and a healthier future.

An Open Letter to Hospital Boards of Directors: Long-Term Strategic Planning needs Your Attention

As 2023 comes to an end and prognostics for 2024 pepper Inboxes, high anxiety is understandable. The near-term environment for hospitals, especially public hospitals and not-for-profit health systems, is tepid at best: despite the November uptick in operating margins to 2% (Fitch, Syntellis), the future for hospitals is uncertain and it’s due to more than payer reimbursement, labor costs and regulatory changes.

Putting lipstick on the pig serves no useful purpose:

though state hospital associations, AHA, FAH, AEH and others have been effective in fending off unwelcome threats ranging from 340B cuts, site neutral payments and others at least temporarily, the welcoming environment for hospitals in the throes of the pandemic has been replaced by animosity and distrust.

The majority of the population believes U.S. the health system is heading in the wrong direction and think hospitals are complicit (See Polling data from Gallup and Keckley Poll below). They believe the system puts its profit above patient care and welcome greater transparency about prices and business practices. In states like Colorado (hospital expenditure report), Minnesota (billing and collection), and Oregon (nurse staffing levels), new regulations feed the public’s appetite for hospital accountability alongside bipartisan Congressional efforts to limit tax exemptions and funding for hospitals.

It’s a tsunami hospital boards must address if they are to carry out their fiduciary responsibilities:

- Set Direction: The organization’s long-term strategy in the context of its vision, mission and values.

- Secure Capital: The amount and sourcing of capital necessary to execute the strategy.

- Hire a Competent CEO and Give Direction: Boards set direction; CEOs execute.

Regretfully, near-term pressures on hospitals have compromised long-term strategic planning in which the Board play’s the central role. But most hospital boards lack adequate preparedness to independently assess the long-term future for their organization i.e. analysis of trends and assumptions that cumulatively reshape markets, define opportunities and frame possible destinations for hospitals drawn from 5 zones of surveillance:

- Clinical innovations.

- Technology capabilities.

- Capital Market Access and Deployment.

- Regulatory Policy Changes.

- Consumer Values, Preferences and Actions.

In reality, the near-term issues i.e. labor and supply chain costs, insurer reimbursement, workforce burnout et al—dominate board meetings; long-range strategic planning is relegated to an annual retreat where the management team and often a consultant present a recommendation for approval. But in many organizations, the long-term strategic plans (LTSPs) fall short:

- Most LTSPs offer an incomplete assessment of clinical innovations and technologies that fundamentally alter how health services will be provided, where and by whom.

- Most LTSPs are based on an acute-centric view of “the future” and lack input about other sectors and industries where the healthcare market is relevant and alternative approaches are executed.

- Most LTSPs are aspirational and short on pragmatism. Risks are underestimated and strengths over-estimated.

- Most LTSPs are designed to affirm the preferences of the hospital CEO without the benefit of independent, studied review and discussion with the board.

- Most LTSPs don’t consider all relevant ‘future state’ options despite the Board’s fiduciary obligation to assure they do.

- Most rely on data that’s inadequate/incomplete/misleading, especially in assessing how and chare capital markets are accessing and deploying capital in healthcare services.

- Most LTSPs are not used as milestones for monitoring performance nor are underlying assumptions upon which LRSPs are based revisited.

My take:

The Board’s role in Long-Range Strategic Planning is, in many ways, it’s most important. It is the basis for deciding the capital requirements necessary to its implementation and the basis for hiring, keeping and compensating the CEO. But in most hospitals, the board’s desire to engage more directly around long-term strategy for the organization is not addressed. Understandable…

- Boards are getting more media attention these days, and it’s usually in an unflattering context. Disclosures of Board malperformance in high profile healthcare organizations like Theranos, Purdue and others has been notable. Protocols for responding among Board members in investor-owned organizations is a priority, but less-so in many not-for-profit settings including hospitals often caught by surprise by media.

- And Board members are asking for their organizations to engage them in more in strategy development. In the latest National Association of Corporate Directors’ survey, 81% of directors cited “oversight of strategic execution” and 80% “oversight of strategy development” as their top concerns from a list of 13 options. Hospital boards are no exception: they want to be engaged and cringe when treated as rubber stamps.

Hospital boards intuitively understand that surviving/thriving in 2024 is important but no guarantee of long-term stability given sobering realities with long-term impact:

- The core business of hospitals–inpatient, outpatient and emergency services—is subject to market constraints on its prices, consumer and employer expectations and non-traditional competition. Bricks, sticks and clicks strategies will be deployed in a regulatory environment that’s agnostic to an organization’s tax status and competition is based on value that’s measured and publicly comparable.

- The usefulness of artificial intelligence will widen in healthcare services displacing traditional operating models, staffing and resource allocation priorities.

- Big tech (Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG), Amazon (AMZN), Meta (META), Tesla (TSLA) and Nvidia (NVDA)—collectively almost 60% of all S&P 500 gains in 2023—will play a direct and significant role in how the healthcare services industry responds to macro-opportunities and near-term pressures. They’re not outside looking in; they’re inside looking out.

- Private capital will play a bigger role in the future of the system and in capitalizing hospital services. Expanded scale and wider scope will be enabled through partnerships with private capital and strategic partners requiring governance and leadership adaptation. And, the near-term hurdles facing PE—despite success in fund-raising—will redirect their bets in health services and expectations for profits.

- State and federal regulatory policies and compliance risks will be more important to execution. Growth through consolidation will face bigger hurdles, transparency requirements in all aspects of operations will increase and business-as-usual discontinued.

- The scale, scope and effectiveness of an organization’s primary and preventive health services will be foundational to competing: managing ‘covered lives’, reducing demand, integrating social determinants and behavioral health, enabling consumer self-care, leveraging AI and enabling affordability will be key platform ingredients that enable growth and sustainability.

- Media attention to hospital business practices including the role Boards play in LRSPs will intensify.

Granted: the issues facing hospitals are reliably short-term: as Congress returns next week, for instance, funding for the FDA, Community Health Center Fund, Teaching Health Center Graduate Medical Education Program, National Health Services Corps and Veterans Health is not authorized and $16 billion in cuts to Medicaid disproportionate share payments remains unsettled, so the short-term matters.

But arguably, engaging the hospital board in longer term planning is equally important. It’s not a luxury.

Happy New Year. Buckle up!

So Much to Worry About

If you are a hospital executive—and if you are reading this, you probably are—then you have no shortage of worries. The worry list is long:

- Trying to control expenses.

- Dealing with declining revenue, especially when considered on an after-inflation basis.

- Struggling with ongoing staffing issues that have no immediate solutions.

- Solving the longstanding problem of patient access to appointments and service.

And the list could go on and on.

But maybe the biggest concern is one that is not on many worry lists: the remarkable development of artificial intelligence (AI) and how AI is relentlessly pushing into business practice generally and into healthcare more specifically.

While the long-term worry is how your hospital will carefully and properly adopt AI inside the business and clinical parts of your organization, the more immediate and short-term worry is whether you, as an executive, understand AI in a way that you can be ultimately useful to your organization.

Full disclosure: I can’t help here much. For me, AI is a pretty big black box. But when I confront this kind of business problem I start reading and learning. One of the most useful AI articles I have come across is “The Optimists: The Full Story of Microsoft’s Relationship with OpenAI,” which was published in the December 11, 2023, issue of The New Yorker magazine. The article was written by Charles Duhigg, a former winner of the Pulitzer Prize.

I am hoping that for your own professional development you will read the Duhigg article, but just in case, here are the highlights:

- Microsoft has reportedly invested $13 billion in the for-profit arm of OpenAI.

- Using OpenAI technology, Microsoft has built a series of AI assistants into Word, Outlook, and PowerPoint. These AI assistants are now known as Office Copilots.

- Knowledgeable commentators say these Microsoft applications are only moderately sophisticated but, honestly, they seem rather remarkable to me. Here are some of Duhiggs’s examples of requests Office Copilot users can make:

- “Tell me the pros and cons of each plan described on that video call.”

- “What’s the most profitable product in these twenty spreadsheets?”

- How about writing projects? Duhigg notes that the Office Copilot can:

- Create a financial narrative of the past decade based on a company’s last ten executive summaries.

- Turn a memo into a PowerPoint.

- Compile a to-do list for Teams video attendees, in multiple languages, after listening in on a meeting.

- Later in the article Duhigg details the functionality of the Word Copilot:

- “You can ask it to reduce a five-page document to ten bullet points…[o]r…it can take the ten bullet points and transform them into a five-page document.”

- It can write a memo based on previous emails you have written.

- “You can ask, ‘Did I forget to include anything that usually appears in a contract like this?,’ and the Copilot will review your previous contracts.”

Duhigg reports that Microsoft previously acquired a company called GitHub. GitHub is “a website where users shared code and collaborated on software.” Microsoft operates GitHub as an independent division. GitHub has been a very big success and is used by software engineers and, in a short period of time, has grown to over 100 million users.

OpenAI created an artificial intelligence tool that autocompletes software code. Despite reservations at Microsoft, GitHub President Nat Friedman decided to release the GitHub Copilot autocomplete tool. The result has been $100 million in revenue to GitHub in less than a year.

At the end of the article, Duhigg notes that these early AI business applications are both “impressive and banal.” Banal because they don’t yet live up to the sci-fi predictions for AI and its long-term impact on society.

Honestly, I don’t see it that way. This OpenAI/Microsoft collaboration is only scratching the surface and its potential uses are already endless, waiting to be invented by 100s of millions of users all over the world, including in healthcare. From my seat, the sky is the limit here. Almost anything seems possible.

I hope this summary of Mr. Duhigg’s exceptional article proves useful and advances your awareness of AI’s aggressive and rapid move into day-to-day business—here, through many of the Microsoft productivity programs that every one of us uses every day. In any case, I recommend that you read Duhigg’s entire article. It is most certainly worth your time.