Health systems are recovering from the worst financial year in recent history. We surveyed strategic planners to find out their top priorities for 2024 and where they are focusing their energy to achieve growth and sustainability. Read on to explore the top six findings from this year’s survey.

Research questions

With this survey, we sought the answers to five key questions:

- How do health system margins, volumes, capital spending, and FTEs compare to 2022 levels?

- How will rebounding demand impact financial performance?

- How will strategic priorities change in 2024?

- How will capital spending priorities change next year?

Bigger is Better for Financial Recovery

What did we find?

Hospitals are beginning to recover from the lowest financial points of 2022, where they experienced persistently negative operating margins. In 2023, the majority of respondents to our survey expected positive changes in operating margins, total margins, and capital spending. However, less than half of the sample expected increases in full-time employee (FTE) count. Even as many organizations reported progress in 2023, challenges to workforce recovery persisted.

40%

Of respondents are experiencing margins below 2022 levels

Importantly, the sample was relatively split between those who are improving financial performance and those who aren’t. While 53% of respondents projected a positive change to operating margins in 2023, 40% expected negative changes to margin.

One exception to this split is large health systems. Large health systems projected above-average recovery of FTE counts, volume, and operating margins. This will give them a higher-than-average capital spending budget.

Why does this matter?

These findings echo an industry-wide consensus on improved financial performance in 2023. However, zooming in on the data revealed that the rising tide isn’t lifting all boats. Unequal financial recovery, especially between large and small health systems, can impact the balance of independent, community, and smaller providers in a market in a few ways. Big organizations can get bigger by leveraging their financial position to acquire less resourced health systems, hospitals, or provider groups. This can be a lifeline for some providers if the larger organization has the resources to keep services running. But it can be a critical threat to other providers that cannot keep up with the increasing scale of competitors.

Variation in financial performance can also exacerbate existing inequities by widening gaps in access. A key stakeholder here is rural providers. Rural providers are particularly vulnerable to financial pressures and have faced higher rates of closure than urban hospitals. Closures and consolidation among these providers will widen healthcare deserts. Closures also have the potential to alter payer and case mix (and pressure capacity) at nearby hospitals.

Volumes are decoupled from margins

What did we find?

Positive changes to FTE counts, reduced contract labor costs, and returning demand led the majority of respondents in our survey to project organizational-wide volume growth in 2023. However, a significant portion of the sample is not successfully translating volume growth to margin recovery.

44%

Of respondents who project volume increases also predict declining margins

On one hand, 84% of our sample expected to achieve volume growth in 2023. And 38% of respondents expected 2023 volume to exceed 2022 volume by over 5%. But only 53% of respondents expected their 2023 operating margins to grow — and most of those expected that the growth would be under 5%. Over 40% of respondents that reported increases in volume simultaneously projected declining margins.

Why does this matter?

Health systems struggled to generate sufficient revenue during the pandemic because of reduced demand for profitable elective procedures. It is troubling that despite significant projected returns to inpatient and outpatient volumes, these volumes are failing to pull their weight in margin contribution. This is happening in the backdrop of continued outpatient migration that is placing downward pressure on profitable inpatient volumes.

There are a variety of factors contributing to this phenomenon. Significant inflationary pressures on supplies and drugs have driven up the cost of providing care. Delays in patient discharge to post-acute settings further exacerbate this issue, despite shrinking contract labor costs. Reimbursements have not yet caught up to these costs, and several systems report facing increased denials and delays in reimbursement for care. However, there are also internal factors to consider. Strategists from our study believe there are outsized opportunities to make improvements in clinical operational efficiency — especially in care variation reduction, operating room scheduling, and inpatient management for complex patients.

Strategists look to technology to stretch capital budgets

What did we find?

Capital budgets will improve in 2024, albeit modestly. Sixty-three percent of respondents expect to increase expenditures, but only a quarter anticipate an increase of 6% or more. With smaller budget increases, only some priorities will get funded, and strategists will have to pick and choose.

Respondents were consistent on their top priority. Investments in IT and digital health remained the number one priority in both 2022 and 2023. Other priorities shifted. Spending on areas core to operations, like facility maintenance and medical equipment, increased in importance. Interest in funding for new ambulatory facilities saw the biggest change, falling down two places.

Why does this matter?

Capital budgets for health systems may be increasing, but not enough. With the high cost of borrowing and continued uncertainty, health systems still face a constrained environment. Strategists are looking to get the biggest bang for their buck. Technology investments are a way to do that. Digital solutions promise high impact without the expense or risk of other moves, like building new facilities, which is why strategists continue to prioritize spending on technology.

The value proposition of investing in technology has changed with recent advances in artificial intelligence (AI), and our respondents expressed a high level of interest in AI solutions. New applications of AI in healthcare offer greater efficiencies across workforce, clinical and administrative operations, and patient engagement — all areas of key concern for any health system today.

Building is reserved for those with the largest budgets

What did we find?

Another way to stretch capital budgets is investing in facility improvements rather than new buildings. This allows health systems to minimize investment size and risk. Our survey found that, in general, strategists are prioritizing capital spending on repairs and renovation while deprioritizing building new ambulatory facilities.

When the responses to our survey are broken out by organization type, a different story emerges. The largest health systems are spending in ways other systems are not. Systems with six or more hospitals are increasing their overall capital expenditures and are planning to invest in new facilities. In contrast, other systems are not increasing their overall budgets and decreasing investments in new facilities.

AMCs are the only exception. While they are decreasing their overall budget, they are increasing their spending on new inpatient facilities.

Why does this matter?

Health systems seek to attract patients with new facilities — but only the biggest systems can invest in building outpatient and inpatient facilities. The high ranking of repairs in overall capital expenditure priorities suggests that all systems are trying to compete by maintaining or improving their current facilities. Will renovations be enough in the face of expanded building from better financed systems? The urgency to respond to the pandemic-accelerated outpatient shift means that building decisions made today, especially in outpatient facilities, could affect competition for years to come. And our survey responses suggest that only the largest health system will get the important first-mover advantage in this space.

AMCs are taking a different tack in the face of tight budgets and increased competition. Instead of trying to compete across the board, AMCs are marshaling resources for redeployment toward inpatient facilities. This aligns with their core identity as a higher acuity and specialty care providers.

Partnerships and affiliations offer potential solutions for health systems that lack the resources for building new facilities. Health systems use partnerships to trade volumes based on complexity. Partnerships can help some health systems to protect local volumes while still offering appropriate acute care at their partner organization. In addition, partnerships help health systems capture more of the patient journey through shared referrals. In both of these cases, partnerships or affiliations mitigate the need to build new inpatient or outpatient facilities to keep patients.

Revenue diversification tactics decline despite disruption

What did we find?

Eighty percent of respondents to our survey continued to lose patient volumes in 2023. Despite this threat to traditional revenue, health systems are turning from revenue diversification practices. Respondents were less likely to operate an innovation center or invest in early-stage companies in 2023. Strategists also reported notably less participation in downside risk arrangements, with a 27% decline from 2022 to 2023.

Why does this matter?

The retreat from revenue diversification and risk arrangements suggests that health systems have little appetite for financial uncertainty. Health systems are focusing on financial stabilization in the short term and forgoing practices that could benefit them, and their patients, in the long term.

Strategists should be cautious of this approach. Retrenchment on innovation and value-based care will hold health systems back as they confront ongoing disruption. New models of care, patient engagement, and payment will be necessary to stabilize operations and finances. Turning from these programs to save money now risks costing health systems in the future.

Market intelligence and strategic planning are essential for health systems as they navigate these decisions. Holding back on initiatives or pursuing them in resource-constrained environments is easier when you have a clear course for the future and can limit reactionary cuts.

Advisory Board’s long-standing research on developing strategy suggests five principles for focused strategy development:

- Strategic plans should confront complexity. Sift through potential future market disruptions and opportunities to establish a handful of governing market assumptions to guide strategy.

- Ground strategy development in answers to a handful of questions regarding future competitive advantage. Ask yourself: What will it take to become the provider of choice?

- Communicate overarching strategy with a clear, coherent statement that communicates your overall health system identity.

- A strategic vision should be supported by a limited number of directly relevant priorities. Resist the temptation to fill out “pro forma” strategic plan.

- Pair strategic priorities with detailed execution plans, including initiative roadmaps and clear lines of accountability.

Strategists align on a strategic vision to go back to basics

What did we find?

Despite uneven recovery, health systems widely agree on which strategic initiatives they will focus more on, and which they will focus less on. Health system leaders are focusing their attention on core operations — margins, quality, and workforce — the basics of system success. They aim to achieve this mandate in three ways. First, through improving efficiency in care delivery and supply chain. Second, by transforming key elements of the care delivery system. And lastly, through leveraging technology and the virtual environment to expand job flexibility and reduce administrative burden.

Health systems in our survey are least likely to take drastic steps like cutting pay or expensive steps like making acquisitions. But they’re also not looking to downsize; divesting and merging is off the table for most organizations going into 2024.

Why does this matter?

The strategic priorities healthcare leaders are working toward are necessary but certainly not easy. These priorities reflect the key challenges for a health system — margins, quality, and workforce. Luckily, most of strategists’ top priorities hold promise for addressing all three areas.

This triple mandate of improving margins, quality, and workforce seems simple in theory but is hard to get right in practice. Integrating all three core dimensions into the rollout of a strategic initiative will amplify that initiative’s success. But, neglecting one dimension can diminish returns. For example, focusing on operational efficiency to increase margins is important, but it’ll be even more effective if efforts also seek to improve quality. It may be less effective if you fail to consider clinicians’ workflow.

Health systems that can return to the basics, and master them, are setting a strong foundation for future growth. This growth will be much more difficult to attain without getting your house in order first.

Vendors and other health system partners should understand that systems are looking to ace the basics, not reinvent the wheel. Vendors should ensure their products have a clear and provable return on investment and can map to health systems’ strategic priorities. Some key solutions health systems will be looking for to meet these priorities are enhanced, easy-to-follow data tools for clinical operations, supply chain and logistics, and quality. Health systems will also be interested in tools that easily integrate into provider workflow, like SDOH screening and resources or ambient listening scribes.

Going back to basics

Craft your strategy

1. Rebuild your workforce.

One important link to recovery of volume is FTE count. Systems that expect positive changes in FTEs overwhelmingly project positive changes in volume. But, on average, less than half of systems expected FTE growth in 2023. Meanwhile, high turnover, churn, and early retirement has contributed to poor care team communication and a growing experience-complexity gap. Prioritize rebuilding your workforce with these steps:

- Recover: Ensure staff recover from pandemic-era experiences by investing in workforce well-being. Audit existing wellness initiatives to maximize programs that work well, and rethink those that aren’t heavily utilized.

- Recruit: Compete by addressing what the next generation of clinicians want from employment: autonomy, flexibility, benefits, and diversity, equity, and inclusion (DEI). Keep up to date with workforce trends for key roles such as advance practice providers, nurses, and physicians in your market to avoid blind spots.

- Retain: Support young and entry-level staff early and often while ensuring tenured staff feel valued and are given priority access to new workforce arrangements like hybrid and gig work. Utilize virtual inpatient nurses and virtual hubs to maintain experienced staff who may otherwise retire. Prioritize technologies that reduce the burden on staff, rather than creating another box to check, like ambient listening or asynchronous questionnaires.

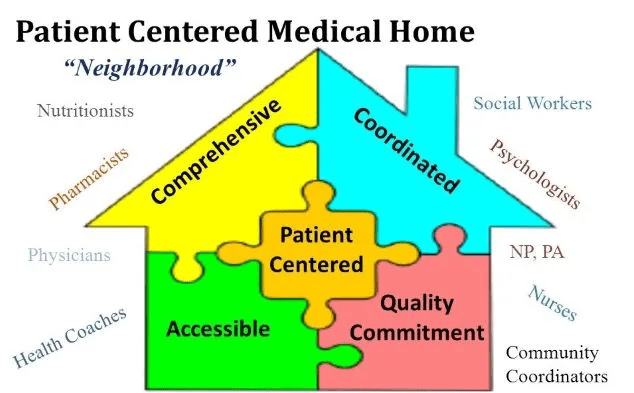

2. Become the provider of choice with patient-centric care.

Becoming the provider of choice is crucial not only for returning to financial stability, but also for sustained growth. To become the provider of choice in 2024, systems must address faltering consumer perspectives with a patient-centric approach. Keep in mind that our first set of recommendations around workforce recovery are precursors to improving patient-centered care. Here are two key areas to focus on:

- Front door: Ensure a multimodal front door strategy. This could be accomplished through partnership or ownership but should include assets like urgent care/extended hour appointments, community education and engagement, and a good digital experience.

- Social determinants of health: A key aspect of patient-centered care is addressing the social needs of patients. Our survey found that addressing SDOH was the second highest strategic priority in 2023. Set up a plan to integrate SDOH screenings early on in patient contact. Then, work with local organizations and/or build out key services within your system to address social needs that appear most frequently in your population. Finally, your workforce DEI strategy should focus on diversity in clinical and leadership staff, as well as teaching clinicians how to practice with cultural humility.

3. Recouple volume and margins.

The increasingly decoupled relationship between volume and margins should be a concern for all strategists. There are three parts to improving volume related margins: increasing volume for high-revenue procedures, managing costs, and improving clinical operational efficiency.

- Revenue growth: Craft a response to out-of-market travel for surgery. In many markets, the pool of lucrative inpatient surgical volumes is shrinking. Health systems are looking to new markets to attract patients who are willing to travel for greater access and quality. Read our findings to learn more about what you need to attract and/or defend patient volumes from out-of-market travel.

- Cost reduction: Although there are many paths health systems can take to manage costs, focusing on tactics which are the most likely to result in fast returns and higher, more sustainable savings, will be key. Some tactics health systems can deploy include preventing unnecessary surgical supply waste, making employees accountable for their health costs, and reinforcing nurse-led sepsis protocols.

- Clinical operational efficiency: The number one strategic priority in 2023, according to our survey, was clinical operational efficiency, no doubt in response to faltering margins. Within this area, the top place for improvement was care variation reduction (CVR). Ensure you’re making the most out of CVR efforts by effectively prioritizing where to spend your time. Improve operational efficiency outside of CVR by improving OR efficiency and developing protocols for complex inpatient management.