https://www.insurance.wa.gov/news/aliera-ordered-pay-1-million-selling-illegal-health-insurance

Insurance Commissioner Mike Kreidler’s action against Aliera Healthcare, Inc. (Aliera) ordering the company to stop selling health insurance illegally was upheld on Nov. 13 after the company appealed. Today, Aliera was ordered to pay a $1 million fine. It has 90 days to appeal.

Kreidler took action against Aliera and its partner, Trinity Healthshare, Inc. (Trinity) in May 2019 after an investigation revealed that since August 2018, the companies sold 3,058 policies to Washington consumers and collected $3.8 million in premium. Trinity agreed to Kreidler’s order.

“Aliera and Trinity promised to provide people with coverage when they needed it only to leave consumers with huge medical bills,” said Kreidler. “I’m taking action today to send a message to all scam artists – if you harm our consumers, you will pay heavily.

“Shopping for health insurance can be very stressful – especially if you have to worry about being ripped off. True insurance companies have to meet rigorous standards before they can sell coverage to consumers. These companies are hiding behind a federal and state exemption that exists for legitimate health care sharing ministries and using it to rake in profit across the country on the backs of vulnerable consumers.”

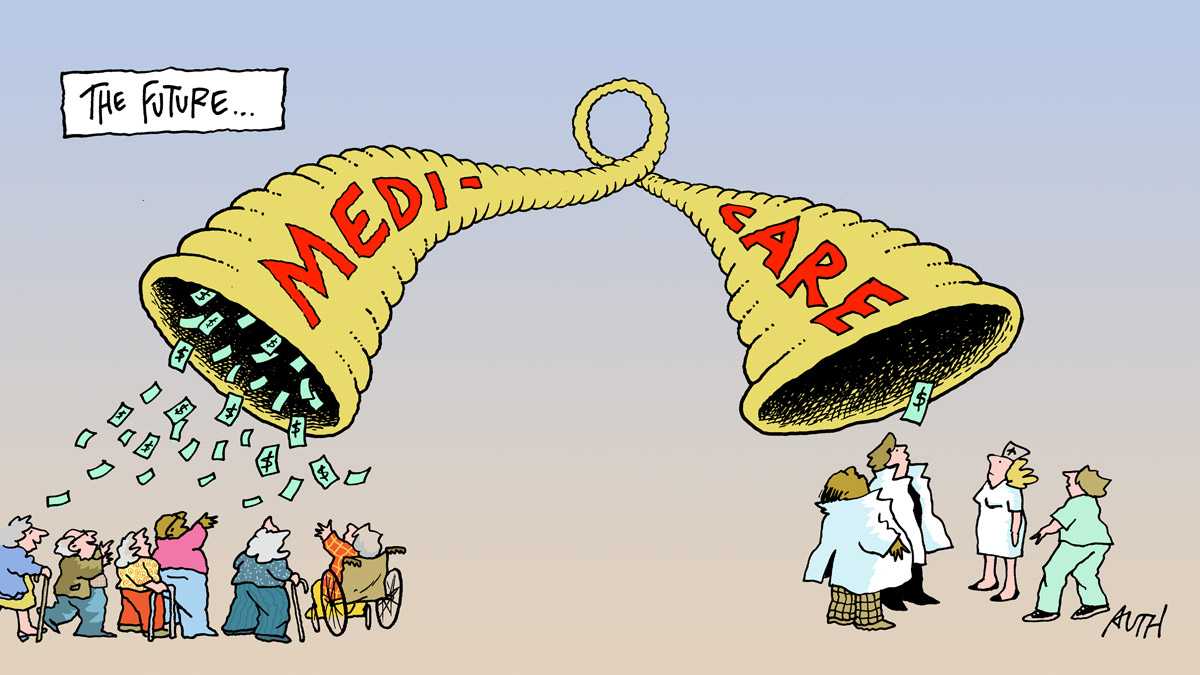

Aliera, an unlicensed insurance producer in Washington, administered and marketed health coverage on behalf of Trinity HealthShare. Trinity represents itself as a health care sharing ministry. Such ministries are exempt from state insurance regulation only if they meet statutory requirements. If so, they do not have to meet the same consumer protections guaranteed under the Affordable Care Act. This includes providing coverage for anyone with a pre-existing medical condition.

A legal health care sharing ministry is a nonprofit organization whose members share a common set of ethical or religious beliefs and share medical expenses consistent with those beliefs.

Kreidler’s office has received more than 20 complaints from consumers. Some believed they were buying health insurance without knowing they had joined a health care sharing ministry. Many discovered this when the company denied their claims because their medical conditions were considered pre-existing under the plan.

“Real health care sharing ministries can offer a valuable service to their members,” Kreidler said. “Unfortunately, we’re seeing players out there trying to use the exemptions for legitimate ministries to skirt insurance regulation and mislead trusting consumers. I want these outfits to know we’re on to them and we will hold them accountable.”

Kreidler’s investigation found Aliera:

- Sold insurance without a Washington insurance producer license.

- Represented an unauthorized insurer, Trinity.

- Operated an unlicensed discount plan organization.

Kreidler’s investigation into Trinity found that it failed to meet key federal and state requirements:

Trinity was formed on June 27, 2018, without any members. Federal and state laws require that health care sharing ministries be formed before Dec. 31, 1999, and their members to have been actively sharing medical costs.