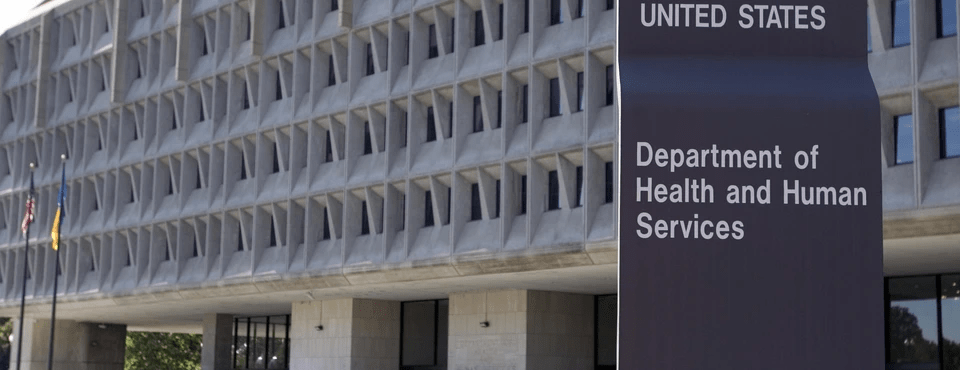

A 3-page ruleopens in a new tab or window published in the Federal Register today and signed by HHS Secretary Robert F. Kennedy Jr. ends the ability of stakeholders to comment on many of the agency’s policies regarding benefits, contracts, and grants within the agency.

“The intent of this policy is very clearly to enable the administration to adopt major policy changes very quickly, without first letting the public know what those changes are going to be,” said Samuel Bagenstos, JD, who served as general counsel to the Office of Management Budget and subsequently HHS during the 4 years of the Biden administration.

Under this new policy, which says it “is rescinding the policy on public participation in rule making,” rules issued by any of the divisions within HHS that fall under the Administrative Procedure Act (APA) would be affected — except for Medicare, which falls under a separate provision of the Medicare Act, Bagenstos told MedPage Today during a phone call Friday.

Medicaid, the Substance Abuse and Mental Health Services Administration, the Administration for Children and Families, the National Institutes of Health, and many other agencies fall under this new rule, he said, for all policies having to do with grants or benefits or both.

The policy ends a practice that has been an important part of U.S. healthcare for more than 50 years.

“For example, if they wanted to allow work requirements under Medicaid, they could do that now … without going through rule changing policies,” said Bagenstos, who now is a professor of law at the University of Michigan in Ann Arbor.

Bagenstos said he doubts the new rule “is going to hold up in court. There are very substantial grounds to challenge this as being arbitrary and capricious.”

Typically, HHS issues a notice of proposed policies and then allows a period, typically 60 days, for interested and affected parties to give feedback on how the rule would impact them and/or the public. Often hundreds and sometimes thousands of comments in support or opposition are typically posted on regulations.govopens in a new tab or window for each proposed rule. After the comment period, the agency reviews each comment and often provides a written response in the final rule explaining why the provision was or wasn’t finalized.

This new rule contends that the APA exempts the agency from having to adhere to the commenting process in rulemaking when the matter relates to “agency management or personnel or to public property, loans, grants, benefits or contracts.”

In 1971, HHS adopted a policy that waived the APA’s statutory exemption from procedural rulemaking requirements, the so-called “Richardson Waiver.” The waiver required HHS to use notice and comment rulemaking procedures.

But under the new rule, that waiver is “contrary to the clear text of the APA and imposes on the Department obligations beyond the maximum procedural requirements specified in the APA.”

It concludes, “Effective immediately, the Richardson Waiver is rescinded and is no longer the policy of the Department.”

The new rule relieves these agencies of a tremendous amount of work. It states: “The extra-statutory obligations of the Richardson Waiver impose costs on the Department and the public, are contrary to the efficient operation of the Department, and impede the Department’s flexibility to adapt quickly to legal and policy mandates.”

Steven Balla, PhD, co-director of the George Washington Regulatory Studies Center in Washington, D.C., said that while it’s unclear how the new policy will be enforced, “It hit me out of the blue.”

“There’s historically been a bipartisan consensus that there are these two practices that you should follow when writing rules, and one is to seek public input, and the other is to do regular regulatory impact analysis. You have studies of the costs and benefits, the likely impacts of what you’re going to do,” he said.

He thinks that going forward, policies that must be published in the Federal Register “that have the full force of law as a regulation would all still have to go through notice and comment, unless the agency [invokes] a good cause exemption from the Administrative Procedure Act.”

The announcement also seems inconsistent with the Trump administration’s stated goal to improve transparency in public policy, a key element of which is public involvement that would be taken away, he said. “It’s a big deal, for sure.”

In the hours following the unpublished rule’s posting on Friday, several organizations expressed opposition mixed with confusion.

Stella Dantas, MD, president of the American College of Obstetricians and Gynecologists (ACOG), said in a statement that such a policy could weaken the healthcare system and harm patients and clinicians.

“The practice, delivery, and regulation of medicine is incredibly complex. The experiences of patients, clinicians, administrators, and other stakeholders across medicine must be taken into account in order to avoid unintended outcomes,” she said. Expert input from medical societies, researchers, and patient advocates is necessary “to inform regulatory bodies and ensure the soundness of final rules and other actions.”

Kate Smith Sloan, president and CEO of LeadingAge, an association of 5,400 non-profit organizations including nursing homes that provide a variety of services for seniors, echoed many of ACOG’s views. In a statement, she said the policy “has the potential to significantly harm older adults and the nonprofit providers who serve them.”

“The possibility that HHS under the Trump White House will eliminate or significantly scale back public comment on policies impacting payment, regulations, safety, operations, and other critical areas is truly troubling — a move we can only hope will not have the negative impact that we fear it might,” she said.

Ted Okon, MBA, executive director of the Community Oncology Alliance, a non-profit organization of oncology practices, told MedPage Today in an email that the administration needs to provide more clarification on the rule. But he said the ability to comment on any policy impacting cancer care “is critical … to provide agencies with real-world data and insight that is not available to them in D.C.”

Alice Bers, JD, litigation director for the Center for Medicare Advocacy, said that the “likely attempt to avoid public comment on actions and policies the agency expects will be unpopular” and “will have broad impact across HHS and its subagencies.”

Like Bagenstos, Bers doesn’t think the changes would impact Medicare policy, which has its own notice and comment requirements under the Medicare Act separate from the APA.

It was not immediately clear whether the HHS under Kennedy plans to pursue additional policy changes on annual Medicare rulemaking, a complex process that affects payment amounts, reporting, qualification and quality requirements affecting hospitals, physician practices, nursing homes, hospices, and many other healthcare settings.

Said Bagenstos: “They’d need to get Congress to repeal it [which] I can’t really see happening.”

Several large healthcare advocacy organizations appeared caught off guard by the new rule.

Representatives of the American Medical Association, the American Hospital Association, and the California Hospital Association said on Friday they were reviewing the new policy.