Sign of the Times: Financial Advisor

Financial distress increasingly prevalent in health system M&A deals

https://mailchi.mp/1e28b32fc32e/gist-weekly-february-9-2024?e=d1e747d2d8

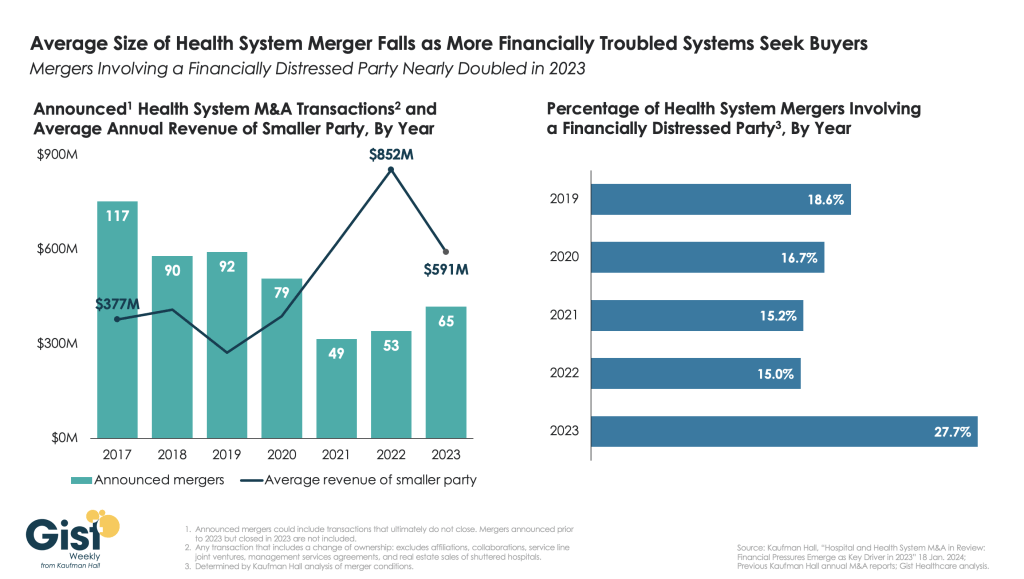

This week’s graphic highlights data from Kaufman Hall’s recently released 2023 Hospital and Health System M&A Report on the current dynamics in health system mergers and acquisitions (M&A) activity.

After a slowdown during the pandemic, 2023 saw an uptick in M&A activity with 65 announced transactions, the most since 2020. Continuing the trend of the past two years, the number of announced “mega mergers,” in which the smaller party had at least $1B in annual revenue, represented more than a tenth of total announced transactions.

However, the average size of mergers fell in 2023, as financial distress emerged as a key driver of M&A activity. The percent of mergers involving a financially distressed party spiked to nearly 28 percent in 2023, almost double the level seen in prior years.

CARES Act funding had buoyed some health systems’ balance sheets through the pandemic, but with the end of federal aid, more systems needed to seek shelter through scale.

With the median hospital operating margin still barely hitting two percent, we anticipate this heightened level M&A activity to continue in 2024 as health systems search for stronger partners that can help them stabilize financially.

How GoFundMe use demonstrates the problem of healthcare affordability

https://mailchi.mp/1e28b32fc32e/gist-weekly-february-9-2024?e=d1e747d2d8

Published this week in The Atlantic, this piece chronicles the increase in Americans using crowdfunding sites like GoFundMe to cover—or at least attempt to cover—their catastrophic medical expenses. Envisioned as a tool to fund “ideas and dreams,” the GoFundMe platform saw a 25-fold increase in the number of campaigns dedicated to medical care from 2011 to 2020.

Medical campaigns have garnered at least one third of all donations and raised $650M in contributions.

The article’s accounts of life-saving care leading to bankrupting medical bills are heartbreaking and familiar, and despite some success stories, the average GoFundMe medical campaign falls well short of its target donation goal.

The Gist:

Although unfortunately not surprising, these crowdfunding stats reflect our nation’s healthcare affordability crisis.

Online campaigns can alleviate real financial burdens for some people; however, they come at the costs of publicly exposing personal medical information, potentially offering false hope, and financially imposing on friends and family.

The majority of personal bankruptcies are caused by medical expenses, and recent changes like removing some levels of medical debt from credit reports are only a small step toward reducing the personal financial effects of medical debt.

Absent larger-scale healthcare payment and coverage reform, healthcare industry leaders continue to be challenged with finding ways to decouple the provision of essential medical care from the risk of financial ruin for patients.

Cano Health files for bankruptcy

https://mailchi.mp/1e28b32fc32e/gist-weekly-february-9-2024?e=d1e747d2d8

On Sunday, Miami, FL-based Cano Health, a Medicare Advantage (MA)-focused primary care clinic operator, filed for bankruptcy protection to reorganize and convert around $1B of secured debt into new debt.

The company, which went public in 2020 via a SPAC deal worth over $4B, has now been delisted from the New York Stock Exchange. After posting a $270M loss in Q2 of 2023, Cano began laying off employees, divesting assets, and seeking a buyer. As of Q3 2023, it managed the care of over 300K members, including nearly 200K in Medicare capitation arrangements, at its 126 medical centers.

The Gist:

Like Babylon Health before it, another “tech-enabled” member of the early-COVID healthcare SPAC wave is facing hard times. While the low interest rate-fueled trend of splashy public offerings was not limited to healthcare, several prominent primary care innovators and “insurtechs” from this wave have struggled, adding further evidence to the adages that healthcare is both hard and difficult to disrupt.

Given that Cano sold its senior-focused clinics in Texas and Nevada to Humana’s CenterWell last fall, Cano may draw interest from other organizations looking to expand their MA footprints.

A Ground-Breaking Transaction

In mid-January, General Catalyst (GC) and Summa Health announced the

signing of a non-binding LOI for GC to acquire Summa, which, if

consummated, would be a groundbreaking transaction. Summa Health is a

vertically integrated not-for-profit health system located in Akron, Ohio that operates acute care hospitals, a network of health care services, a physician group practice, and a health plan. Like much of the health system sector, Summa has found the operating environment for the past couple of years to be challenging.

GC is a venture capital firm that had approximately $25B in assets under management at the end of 2022, across a dozen fund families and a number of sectors, including its Health Assurance funds, that have a stated mission of “creating a more proactive, affordable & equitable system of care.”

Health Assurance has investments in more than 150 digital health companies worldwide and has implemented working relationships with more than a dozen of the country’s most noteworthy health systems and hospital operators.

In October, GC announced the formation of a new venture called the Health Assurance

Transformation Corporation (HATCo), for the purpose of providing financial and operational advisory assistance to health systems, including using GC’s suite of digital health companies. At that time, HATCo announced plans to buy a health system in order to drive transformation in the delivery of care by leveraging technology, updating workforce/staffing models, and becoming more proactive in creating revenue streams for health systems.

Their plans included an intent to streamline operations

and find efficiencies using technology, as well as implementing value-based payment models,

including fully capitated risk contracts to incentivize better utilization management, an initiative that requires significant data analytics.

GC had been looking for a system with market relevance and a sweet spot in terms of size – big enough to have a full complement of services, but nimble enough to accept significant change. In Summa, it has also found a system that maintains its own health plan, which GC can use to help accelerate the shift to capitated models.

The transaction that Summa and GC are contemplating is a new and innovative attempt at

addressing the underlying problems that plague the acute care industry.

In particular, 1) a continued

reliance on fee-for-service revenue when reimbursement has been pressured from every angle and rate increases have failed to keep pace with the rising cost of providing care, 2) capital to fund a growing list of competing needs, and 3) the challenges of staffing for quality in a tight market for clinical labor. Summa appears to be banking on the idea that GC and the data- and technology driven solutions that reside within their portfolio companies can ease those pressures.

HATCo’s proposed purchase of Summa requires a conversion of the health system to for profit. The purchase price of the health system will contribute to the corpus for a large foundation that will address social determinants of health in the Akron community, and the operating entities would become subsidiaries of HATCo.

HATCo has stated publicly that it will continue Summa’s existing charity care commitment, that Summa’s existing management team will stay in place, and the health system Board will continue to have local community representation. HATCo has also emphasized that

it plans to hold Summa for an extended period and have it serve as a digital innovation testing ground and incubation site for new healthcare IT, where it believes that aligning incentives will drive financial improvement and better care.

Innovative approaches to meaningful problems should be applauded but there is skepticism.

Will bottom line pressures affect the quality of care?

Will the typical investment horizon of venture capital align with the time frames needed to prove these solutions are taking hold?

Health system evolution has traditionally been measured in decades, rather than the 5-7 year hold periods that private capital prefers. There are also perceived conflicts to consider as Summa will be paying the GC-owned companies for their services.

Acute care hospitals are central elements of their communities and their constituents are broader than most companies, often including large workforces, union leadership, politicians, government regulators, and of course patients and their families.

This transaction will receive significant scrutiny with any number of constituents taking issue with a health system’s purchase by a venture capital firm. One hurdle is the conversion process itself, which requires review and approval by the Ohio Attorney General and regulators may want to impose restrictions on GCs ability to operate that are incompatible with its plans. The hurdles to closing are daunting, but the challenges facing health systems are equally daunting.

And while this proposed combination may not come to fruition, the need for innovative solutions remains.

The Four Conflicts that Hospitals must Resolve in 2024

If you’re a U.S. health industry watcher, it would appear the $4.5 trillion system is under fire at every corner.

Pressures to lower costs, increase accessibility and affordability to all populations, disclose prices and demonstrate value are hitting every sector. Complicating matters, state and federal legislators are challenging ‘business as usual’ seeking ways to spend tax dollars more wisely with surprisingly strong bipartisan support on many issues. No sector faces these challenges more intensely than hospitals.

In 2022 (the latest year for NHE data from CMS), hospitals accounted for 30.4% of total spending ($1.35 trillion. While total healthcare spending increased 4.1% that year, hospital spending was up 2.2%–less than physician services (+2.7%), prescription drugs (+8.4%), private insurance (+5.9%) and the overall inflation rate (+6.5%) and only slightly less than the overall economy (GDP +1.9%). Operating margins were negative (-.3%) because operating costs increased more than revenues (+7.7% vs. 6.5%) creating deficits for most. Hardest hit: the safety net, rural hospitals and those that operate in markets with challenging economic conditions.

In 2023, the hospital outlook improved. Pre-Covid utilization levels were restored. Workforce tensions eased somewhat. And many not-for-profits and investor-owned operators who had invested their cash flows in equities saw their non-operating income hit record levels as the S&P 500 gained 26.29% for the year.

In 2024, the S&P is up 5.15% YTD but most hospital operators are uncertain about the future, even some that appear to have weathered the pandemic storm better than others. A sense of frustration and despair is felt widely across the sector, especially in critical access, rural, safety net, public and small community hospitals where long-term survival is in question.

The cynicism felt by hospitals is rooted in four conflicts in which many believe hospitals are losing ground:

Hospitals vs. Insurers:

Insurers believe hospitals are inefficient and wasteful, and their business models afford them the role of deciding how much they’ll pay hospitals and when based on data they keep private. They change their rules annually to meet their financial needs. Longer-term contracts are out of the question. They have the upper hand on hospitals.

Hospitals take financial risks for facilities, technologies, workforce and therapies necessary to care. Their direct costs are driven by inflationary pressures in their wage and supply chains outside their control and indirect costs from regulatory compliance and administrative overhead, Demand is soaring. Hospital balance sheets are eroding while insurers are doubling down on hospital reimbursement cuts to offset shortfalls they anticipate from Medicare Advantage. Their finances and long-term sustainability are primarily controlled by insurers. They have minimal latitude to modify workforces, technology and clinical practices annually in response to insurer requirements.

Hospitals vs. the Drug Procurement Establishment:

Drug manufacturers enjoy patent protections and regulatory apparatus that discourage competition and enable near-total price elasticity. They operate thru a labyrinth of manufacturers, wholesalers, distributors and dispensers in which their therapies gain market access through monopolies created to fend-off competition. They protect themselves in the U.S. market through well-funded advocacy and tight relationships with middlemen (GPOs, PBMs) and it’s understandable: the global market for prescription drugs is worth $1.6 trillion, the US represents 27% but only 4% of the world population.

And ownership of the 3 major PBMs that control 80% of drug benefits by insurers assures the drug establishment will be protected.

Prescription drugs are the third biggest expense in hospitals after payroll and med/surg supplies. They’re a major source of unexpected out-of-pocket cost to patients and unanticipated costs to hospitals, especially cancer therapies. And hospitals (other than academic hospitals that do applied research) are relegated to customers though every patient uses their products.

Prescription drug cost escalation is a threat to the solvency and affordability of hospital care in every community.

Hospitals vs. the FTC, DOJ and State Officials:

Hospital consolidation has been a staple in hospital sustainability and growth strategies. It’s a major focus of regulator attention. Horizontal consolidation has enabled hospitals to share operating costs thru shared services and concentrate clinical programs for better outcomes. Vertical consolidation has enabled hospitals to diversify as a hedge against declining inpatient demand: today, 200+ sponsor health insurance plans, 60% employ physicians directly and the majority offer long-term, senior care and/or post-acute services. But regulators like the FTC think hospital consolidation has been harmful to consumers and third-party data has shown promised cost-savings to consumers are not realized.

Federal regulators are also scrutinizing the tax exemptions afforded not-for-profit hospitals, their investment strategies, the roles of private equity in hospital prices and quality and executive compensation among other concerns. And in many states, elected officials are building their statewide campaigns around reining in “out of control” hospitals and so on.

Bottom line: Hospitals are prime targets for regulators.

Hospitals vs. Congress:

Influential members in key House and Senate Committees are now investigating regulatory changes that could protect rural and safety net hospitals while cutting payments to the rest. In key Committees (Senate HELP and Finance, House Energy and Commerce, Budget), hospitals are a target. Example: The Lower Cost, More Transparency Act passed in the the House December 11, 2023. It includes price transparency requirements for hospitals and PBMs, site-neutral payments, additional funding for rural and community health among more. The American Hospital Association objected noting “The AHA supports the elimination of the Medicaid disproportionate share hospital (DSH) reductions for two years. However, hospitals and health systems strongly oppose efforts to include permanent site-neutral payment cuts in this bill. In addition, the AHA has concerns about the added regulatory burdens on hospitals and health systems from the sections to codify the Hospital Price Transparency Rule and to establish unique identifiers for off-campus hospital outpatient departments (HOPDs).” Nonetheless, hospitals appear to be fighting an uphill battle in Congress.

Hospitals have other problems:

Threats from retail health mega-companies are disruptive. The public’s trust in hospitals has been fractured. Lenders are becoming more cautious in their term sheets. And the hospital workforce—especially its doctors and nurses—is disgruntled. But the four conflicts above seem most important to the future for hospitals.

However, conflict resolution on these is problematic because opinions about hospitals inside and outside the sector are strongly held and remedy proposals vary widely across hospital tribes—not-for profits, investor-owned, public, safety nets, rural, specialty and others.

Nonetheless, conflict resolution on these issues must be pursued if hospitals are to be effective, affordable and accessible contributors and/or hubs for community health systems in the future. The risks of inaction for society, the communities served and the 5.48 million (NAICS Bureau of Labor 622) employed in the sector cannot be overstated. The likelihood they can be resolved without the addition of new voices and fresh solutions is unlikely.

PS: In the sections that follow, citations illustrate the gist of today’s major message: hospitals are under attack—some deserved, some not. It’s a tough business climate for all of them requiring fresh ideas from a broad set of stakeholders.

PS If you’ve been following the travails of Mission Hospital, Asheville NC—its sale to HCA Healthcare in 2019 under a cloud of suspicion and now its “immediate jeopardy” warning from CMS alleging safety and quality concerns—accountability falls squarely on its Board of Directors. I read the asset purchase agreement between HCA and Mission: it sets forth the principles of operating post-acquisition but does not specify measurable ways patient safety, outcomes, staffing levels and program quality will be defined. It does not appear HCA is in violation with the terms of the APA, but irreparable damage has been done and the community has lost confidence in the new Mission to operate in its best interest. Sadly, evidence shows the process was flawed, disclosures by key parties were incomplete and the hospital’s Board is sworn to secrecy preventing a full investigation.

The lessons are 2 for every hospital:

Boards must be prepared vis a vis education, objective data and independent counsel to carry out their fiduciary responsibility to their communities and key stakeholders. And the business of running hospitals is complex, easily prone to over-simplification and misinformation but highly important and visible in communities where they operate.

Business relationships, price transparency, board performance, executive compensation et al can no longer to treated as private arrangements.

Keeping employers in the health benefits business

https://mailchi.mp/09f9563acfcf/gist-weekly-february-2-2024?e=d1e747d2d8

“What if 10 percent, or even five percent, of the employers in our market decide to stop providing health benefits?” a Chief Strategy Officer (CSO) at a midsized health system in the Southeast recently asked.

“Their health insurance costs have been growing like crazy for 20 years. Some of these companies could easily decide to just give their employees some amount of tax-advantaged dollars and let them do their own thing.” An emerging option for employers is the relatively new individual coverage Health Reimbursement Arrangement (ICHRA), which allows employers to give tax-deductible contributions to employees to use for healthcare, including purchasing health insurance on an exchange.

According to the CSO, “What happens is this: We’ll go from getting 250 percent of Medicare for beneficiaries in a commercial group plan to getting 125 percent for beneficiaries in a market plan. I don’t know any provider with the margins to withstand that kind of shift without significant pain—certainly not us.”

The conversation shifted to a discussion about treating employers like true customers that pay generously for healthcare services, which involves increasing engagement with them and better understanding their specific problems with their employees’ healthcare. What complaints are they hearing about their employee’s difficulties with things like making timely appointments or finding after-hours care?

Provider organizations can help keep employers in the health insurance market by regularly checking in with them about their healthcare challenges, meaningfully focusing on mitigating their pain points, and exploring new kinds of mutually beneficial partnerships.

They should also carefully monitor the employer market in their region and create financial assessments of the potential impact of employers shifting employees to health insurance stipend arrangements.

Providers exiting insurance networks over contracting impasses

https://mailchi.mp/09f9563acfcf/gist-weekly-february-2-2024?e=d1e747d2d8

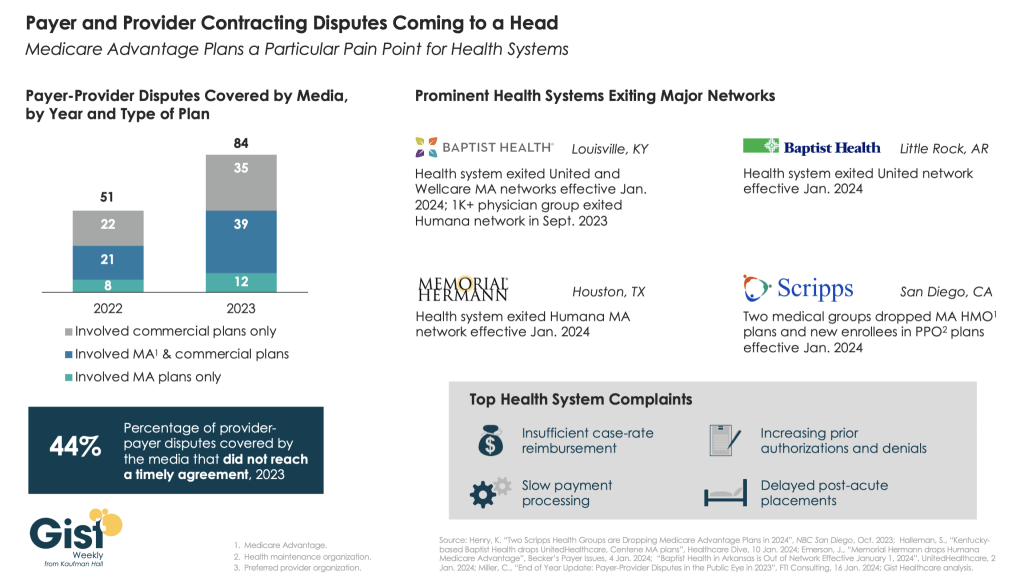

In this week’s graphic, we highlight new data on the increase in payer-provider contracting disputes covered by the media.

From 2022 to 2023, there was a 69 percent increase in the number of payer-provider contracting disputes that received media coverage. Nearly half of last year’s disputes did not reach agreement and resulted in network exits.

Large provider organizations—including Louisville, KY-based Baptist Health, Little Rock, AR-based Baptist Health, Houston, TX-based Memorial Hermann Health System, and two large medical groups affiliated with San Diego-based Scripps Health—dropped Medicare Advantage (MA) plans from at least one major payer, like United or Humana, as of Jan. 1, 2024.

Some dropped the payer’s commercial plans as well. Provider organizations leaving these networks have cited insufficient reimbursement rates and unsatisfactory business practices that drive up their cost of care delivery, especially around increased prior authorization requirements.

While contracting disputes will ultimately be influenced by the competitive strength of a given provider and payer in a particular market, it’s important for both sides to recognize that the patients in the middle of these disputes can be the ones most harmed when they can no longer see their trusted physicians.

Fitch says lower operating margins may be the new normal for nonprofit hospitals

https://mailchi.mp/09f9563acfcf/gist-weekly-february-2-2024?e=d1e747d2d8

On Monday, Fitch Ratings, the New York City-based credit rating agency, released a report predicting that the US not-for-profit hospital sector will see average operating margins reset in the one-to-two percent range, rather than returning to historical levels of above three percent.

Following disruptions from the pandemic that saw utilization drop and operating costs rise, hospitals have seen a slower-than-expected recovery.

But, according to Fitch, these rebased margins are unlikely to lead to widespread credit downgrades as most hospitals still carry robust balance sheets and have curtailed capital spending in response.

The Gist: As labor costs stabilize and volumes return, the median hospital has been able to maintain a positive operating margin for the past ten months.

But nonprofit hospitals are in a transitory period, one with both continued challenges—including labor costs that rebased at a higher rate and ongoing capital restraints—and opportunities—including the increase in outpatient demand, which has driven hospital outpatient revenue up over 40 percent from 2020 levels.

While the future margin outlook for individual hospitals will depend on factors that vary greatly across markets, organizations that thrive in this new era will be the ones willing to pivot, take risks, and invest heavily in outpatient services.