https://mailchi.mp/11f2d4aad100/the-weekly-gist-august-12-2022?e=d1e747d2d8

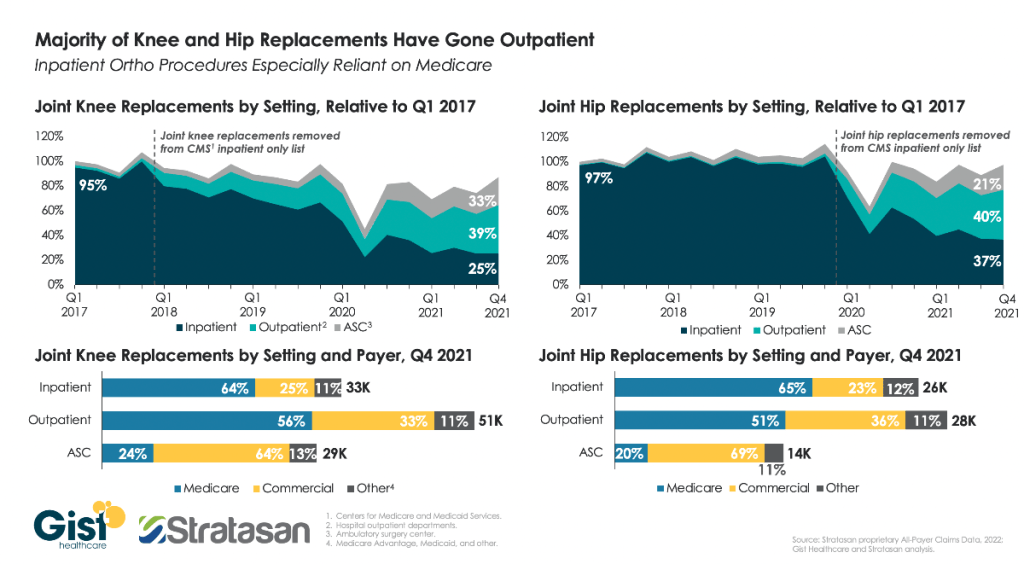

One of COVID’s many effects on the health system business model has been the accelerated migration of care to outpatient settings, with orthopedic surgeries, such as knee and hip replacements, leading the way. For this week’s graphic, we partnered with Stratasan, a Syntellis-owned healthcare data analytics firm that provides market intelligence for strategic planning, to track how quickly joint replacements have shifted to hospital outpatient and ambulatory surgery centers (ASCs) over the last five years.

Using data from Stratasan’s proprietary All-Payer Claims Database, we found that by the end of 2021, only one in four knee replacements and one in three hip replacements were performed in inpatient facilities, down from over 95 percent in 2018. A major catalyst for the shift was the removal of the procedures from Medicare’s Inpatient Only list, first knee replacements in 2018, then hip replacements in 2020.

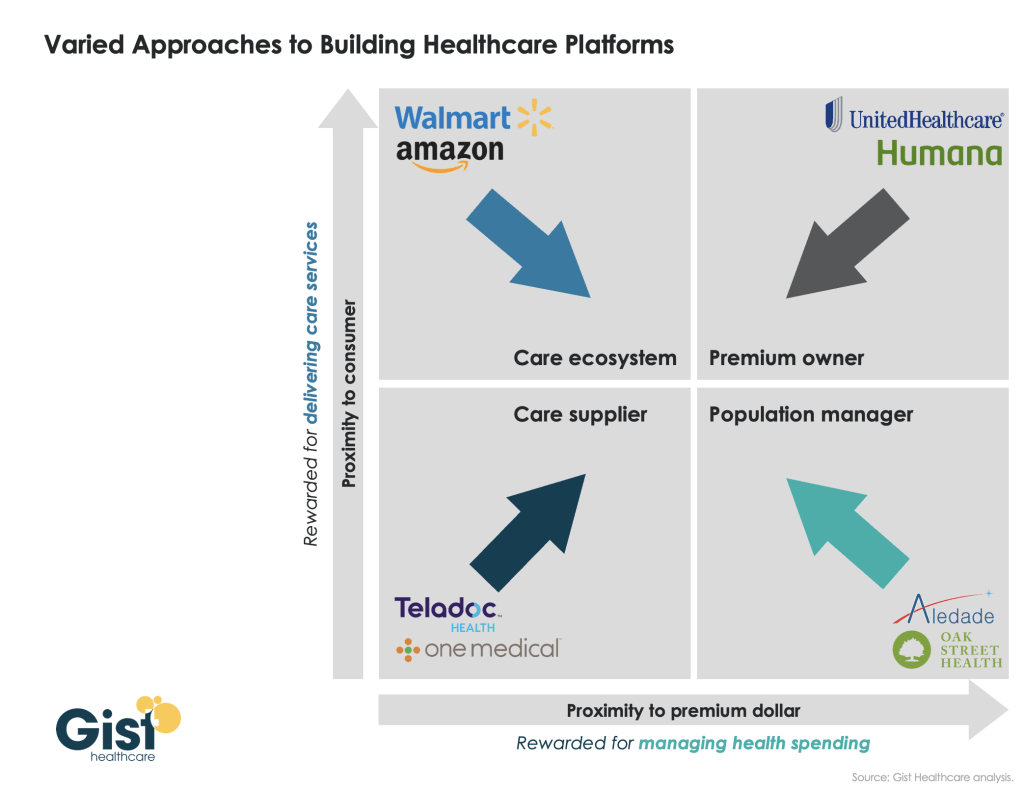

This change triggered an outpatient shift across all payers; COVID’s dampening effect on inpatient demand only exacerbated the trends. Patients who undergo these surgeries in an inpatient hospital tend to be sicker, older, and more likely to be on Medicare. This translates to an altered payer mix for these procedures, with hospitals seeing a drop in lucrative commercial payment and an uptick in lower Medicare reimbursements.

Amid rising expenses and slow-to-return volumes across the board, this outpatient migration presents another significant challenge to health systems’ financial bottom lines, and they must either find ways to recapture revenues in ambulatory settings, or watch a once reliable source of revenue walk—gingerly—out their doors.