The healthcare industry is still licking its wounds from $1 trillion in federal funding cuts included in the One Big Beautiful Bill Act (OBBBA) signed into law July 4.

Adding insult to injury, the Center for Medicare and Medicaid services issued a 913-page proposed rule last Tuesday that includes unwelcome changes especially troublesome for hospitals i.e. adoption of site neutral payments, expansion of hospital price transparency requirements, reduction of inpatient-only services, acceleration of hospital 340B discount repayment obligations and more.

The combination of the two is bad news for healthcare overall and hospitals especially: the timing is precarious:

- Economic uncertainty: Economists believe a recession is less likely but uncertainty about tariffs, fear about rising inflation, labor market volatility a housing market slowdown and speculation about interest rates have capital markets anxious. Healthcare is capital intense: the impact of the two in tandem with economic uncertainty is unsettling.

- Consumer spending fragility: Consumer spending is holding steady for the time being but housing equity values are dropping, rents are increasing, student loan obligations suspended during Covid are now re-activated, prices for hospital and physicians are increasing faster than other necessities and inflation ticked up slightly last month. Consumer out-of-pocket spending for healthcare products and services is directly impacted by purchases in every category.

- Heightened payer pressures: Insurers and employers are expecting double-digit increases for premiums and health benefits next year blaming their higher costs on hospitals and drugs, OBBBA-induced insurance coverage lapses and systemic lack of cost-accountability. For insurers, already reeling from 2023-2024 financial reversals, forecasts are dire. Payers will heighten pressure on healthcare providers—especially hospitals and specialists—as a result.

Why healthcare appears to have borne the brunt of the funding cuts in the OBBBA is speculative:

Might a case have been made for cuts in other departments? Might healthcare programs other than Medicaid have been ripe for “waste, fraud and abuse” driven cuts? Might technology-driven administrative costs reductions across the expanse of federal and state government been more effective than DOGE- blunt experimentation?

Healthcare is 18% of the GDP and 28% of total federal spending: that leaves room for cuts in other industries.

Why hospitals, along with nursing homes and public health programs, are likely to bear the lion’s share of OBBBA’ cut fallout and CMS’ proposed rule disruptions is equally vexing. Might the high-profile successes of some not-for-profit hospital operators have drawn attention? Might Congress have been attentive to IRS Form 990 filings for NFP operators and quarterly earnings of investor-owned systems and assume hospital finances are OK? Might advocacy efforts to maintain the status quo with facility fees, 340B drug discounts, executive compensation et al been overshadowed by concerns about consolidation-induced cost increases and disregard for affordability? Hospital emergency rooms in rural and urban communities, nursing homes, public health programs and many physicians will be adversely impacted by the OBBBA cuts: the impact will vary by state. What’s not clear is how much.

My take:

Having read both the OBBBA and CMS proposed rules and observed reactions from industry, two things are clear to me:

The antipathy toward the healthcare industry among the public and in Congress played a key role in passage of the OBBBA and regulatory changes likely to follow.

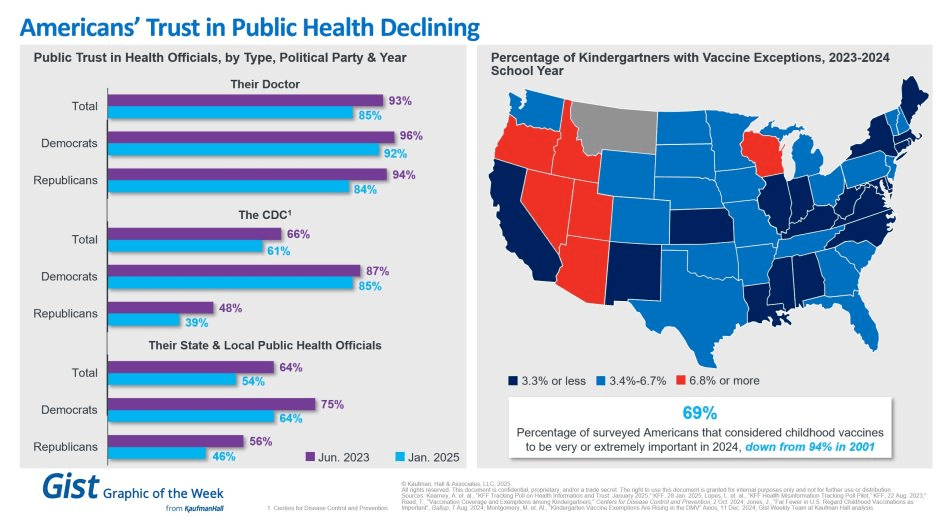

Polls show three-fourths of likely voters want to see transformational change to healthcare and two-thirds think the industry is more concerned with its profit over their care: these views lend to hostile regulatory changes. The public and the majority of elected officials think the industry prioritizes protection of the status quo over obligations to serve communities and the greater good.

The result: winners and losers in each sector, lack of continuity and interoperability, runaway costs and poor outcomes.

No sector in healthcare stands as the surrogate for the health and wellbeing of the population. There are well-intended players in each sector who seek the moral high ground for healthcare, but their boards and leaders put short-term sustainability above long-term systemness and purpose. That void needs to be filled.

The timing of these changes is predictably political.

Most of the lower-cost initiatives in both the OBBBA changes and CMS proposals carry obligations to commence in 2026—in time for the November 2026 mid-term campaigns. Most of the results, including costs and savings, will not be known before 2028 or after. They’re geared toward voters inclined to think healthcare is systemically fraudulent, wasteful and self-serving.

And they’re just the start: officials across the Departments of Health and Human Services, Justice, Commerce, Labor and Veterans Affairs will add to the lists.

Buckle up.