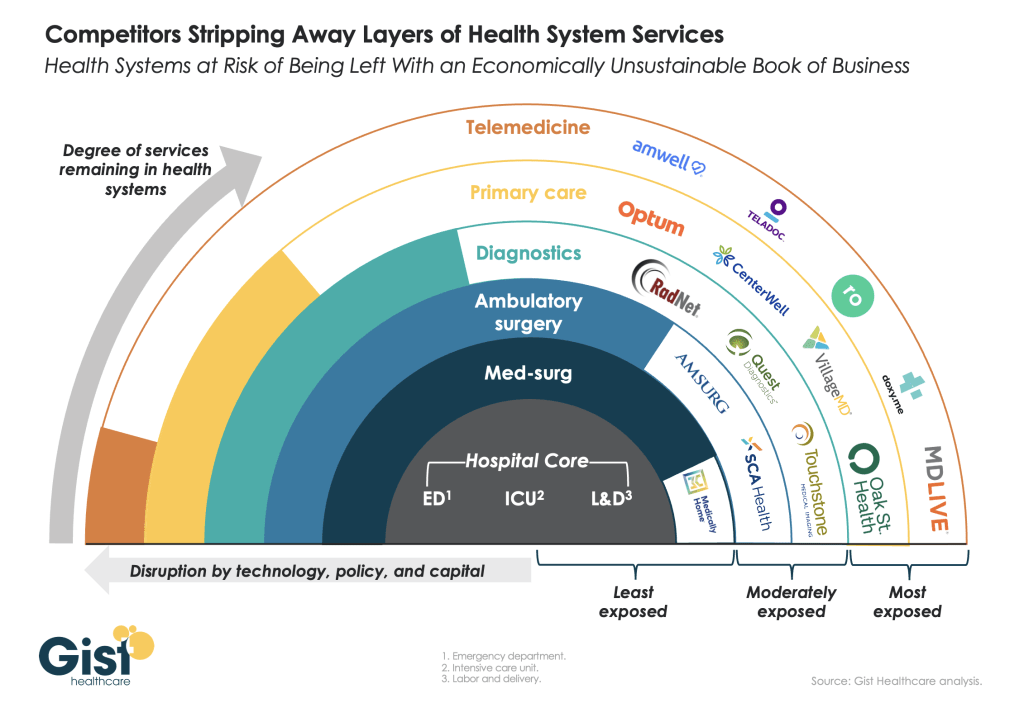

If you’re a U.S. health industry watcher, it would appear the $4.5 trillion system is under fire at every corner.

Pressures to lower costs, increase accessibility and affordability to all populations, disclose prices and demonstrate value are hitting every sector. Complicating matters, state and federal legislators are challenging ‘business as usual’ seeking ways to spend tax dollars more wisely with surprisingly strong bipartisan support on many issues. No sector faces these challenges more intensely than hospitals.

In 2022 (the latest year for NHE data from CMS), hospitals accounted for 30.4% of total spending ($1.35 trillion. While total healthcare spending increased 4.1% that year, hospital spending was up 2.2%–less than physician services (+2.7%), prescription drugs (+8.4%), private insurance (+5.9%) and the overall inflation rate (+6.5%) and only slightly less than the overall economy (GDP +1.9%). Operating margins were negative (-.3%) because operating costs increased more than revenues (+7.7% vs. 6.5%) creating deficits for most. Hardest hit: the safety net, rural hospitals and those that operate in markets with challenging economic conditions.

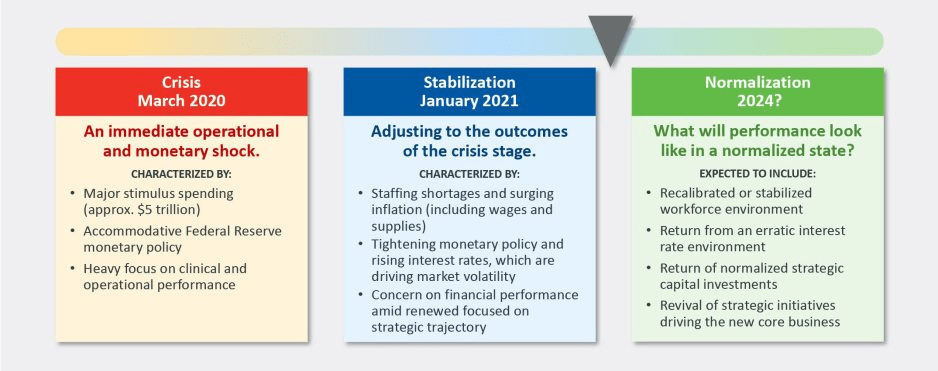

In 2023, the hospital outlook improved. Pre-Covid utilization levels were restored. Workforce tensions eased somewhat. And many not-for-profits and investor-owned operators who had invested their cash flows in equities saw their non-operating income hit record levels as the S&P 500 gained 26.29% for the year.

In 2024, the S&P is up 5.15% YTD but most hospital operators are uncertain about the future, even some that appear to have weathered the pandemic storm better than others. A sense of frustration and despair is felt widely across the sector, especially in critical access, rural, safety net, public and small community hospitals where long-term survival is in question.

The cynicism felt by hospitals is rooted in four conflicts in which many believe hospitals are losing ground:

Hospitals vs. Insurers:

Insurers believe hospitals are inefficient and wasteful, and their business models afford them the role of deciding how much they’ll pay hospitals and when based on data they keep private. They change their rules annually to meet their financial needs. Longer-term contracts are out of the question. They have the upper hand on hospitals.

Hospitals take financial risks for facilities, technologies, workforce and therapies necessary to care. Their direct costs are driven by inflationary pressures in their wage and supply chains outside their control and indirect costs from regulatory compliance and administrative overhead, Demand is soaring. Hospital balance sheets are eroding while insurers are doubling down on hospital reimbursement cuts to offset shortfalls they anticipate from Medicare Advantage. Their finances and long-term sustainability are primarily controlled by insurers. They have minimal latitude to modify workforces, technology and clinical practices annually in response to insurer requirements.

Hospitals vs. the Drug Procurement Establishment:

Drug manufacturers enjoy patent protections and regulatory apparatus that discourage competition and enable near-total price elasticity. They operate thru a labyrinth of manufacturers, wholesalers, distributors and dispensers in which their therapies gain market access through monopolies created to fend-off competition. They protect themselves in the U.S. market through well-funded advocacy and tight relationships with middlemen (GPOs, PBMs) and it’s understandable: the global market for prescription drugs is worth $1.6 trillion, the US represents 27% but only 4% of the world population.

And ownership of the 3 major PBMs that control 80% of drug benefits by insurers assures the drug establishment will be protected.

Prescription drugs are the third biggest expense in hospitals after payroll and med/surg supplies. They’re a major source of unexpected out-of-pocket cost to patients and unanticipated costs to hospitals, especially cancer therapies. And hospitals (other than academic hospitals that do applied research) are relegated to customers though every patient uses their products.

Prescription drug cost escalation is a threat to the solvency and affordability of hospital care in every community.

Hospitals vs. the FTC, DOJ and State Officials:

Hospital consolidation has been a staple in hospital sustainability and growth strategies. It’s a major focus of regulator attention. Horizontal consolidation has enabled hospitals to share operating costs thru shared services and concentrate clinical programs for better outcomes. Vertical consolidation has enabled hospitals to diversify as a hedge against declining inpatient demand: today, 200+ sponsor health insurance plans, 60% employ physicians directly and the majority offer long-term, senior care and/or post-acute services. But regulators like the FTC think hospital consolidation has been harmful to consumers and third-party data has shown promised cost-savings to consumers are not realized.

Federal regulators are also scrutinizing the tax exemptions afforded not-for-profit hospitals, their investment strategies, the roles of private equity in hospital prices and quality and executive compensation among other concerns. And in many states, elected officials are building their statewide campaigns around reining in “out of control” hospitals and so on.

Bottom line: Hospitals are prime targets for regulators.

Hospitals vs. Congress:

Influential members in key House and Senate Committees are now investigating regulatory changes that could protect rural and safety net hospitals while cutting payments to the rest. In key Committees (Senate HELP and Finance, House Energy and Commerce, Budget), hospitals are a target. Example: The Lower Cost, More Transparency Act passed in the the House December 11, 2023. It includes price transparency requirements for hospitals and PBMs, site-neutral payments, additional funding for rural and community health among more. The American Hospital Association objected noting “The AHA supports the elimination of the Medicaid disproportionate share hospital (DSH) reductions for two years. However, hospitals and health systems strongly oppose efforts to include permanent site-neutral payment cuts in this bill. In addition, the AHA has concerns about the added regulatory burdens on hospitals and health systems from the sections to codify the Hospital Price Transparency Rule and to establish unique identifiers for off-campus hospital outpatient departments (HOPDs).” Nonetheless, hospitals appear to be fighting an uphill battle in Congress.

Hospitals have other problems:

Threats from retail health mega-companies are disruptive. The public’s trust in hospitals has been fractured. Lenders are becoming more cautious in their term sheets. And the hospital workforce—especially its doctors and nurses—is disgruntled. But the four conflicts above seem most important to the future for hospitals.

However, conflict resolution on these is problematic because opinions about hospitals inside and outside the sector are strongly held and remedy proposals vary widely across hospital tribes—not-for profits, investor-owned, public, safety nets, rural, specialty and others.

Nonetheless, conflict resolution on these issues must be pursued if hospitals are to be effective, affordable and accessible contributors and/or hubs for community health systems in the future. The risks of inaction for society, the communities served and the 5.48 million (NAICS Bureau of Labor 622) employed in the sector cannot be overstated. The likelihood they can be resolved without the addition of new voices and fresh solutions is unlikely.

PS: In the sections that follow, citations illustrate the gist of today’s major message: hospitals are under attack—some deserved, some not. It’s a tough business climate for all of them requiring fresh ideas from a broad set of stakeholders.

PS If you’ve been following the travails of Mission Hospital, Asheville NC—its sale to HCA Healthcare in 2019 under a cloud of suspicion and now its “immediate jeopardy” warning from CMS alleging safety and quality concerns—accountability falls squarely on its Board of Directors. I read the asset purchase agreement between HCA and Mission: it sets forth the principles of operating post-acquisition but does not specify measurable ways patient safety, outcomes, staffing levels and program quality will be defined. It does not appear HCA is in violation with the terms of the APA, but irreparable damage has been done and the community has lost confidence in the new Mission to operate in its best interest. Sadly, evidence shows the process was flawed, disclosures by key parties were incomplete and the hospital’s Board is sworn to secrecy preventing a full investigation.

The lessons are 2 for every hospital:

Boards must be prepared vis a vis education, objective data and independent counsel to carry out their fiduciary responsibility to their communities and key stakeholders. And the business of running hospitals is complex, easily prone to over-simplification and misinformation but highly important and visible in communities where they operate.

Business relationships, price transparency, board performance, executive compensation et al can no longer to treated as private arrangements.