https://www.federalreserve.gov/newsevents/testimony/powell20200616a.htm

Chair Powell submitted identical remarks to the Committee on Financial Services, U.S. House of Representatives, Washington, D.C., on June 17, 2020.

Chairman Crapo, Ranking Member Brown, and other members of the Committee, thank you for the opportunity to present the Federal Reserve’s semiannual Monetary Policy Report.

Our country continues to face a difficult and challenging time, as the pandemic is causing tremendous hardship here in the United States and around the world. The coronavirus outbreak is, first and foremost, a public health crisis. The most important response has come from our health-care workers. On behalf of the Federal Reserve, I want to express our sincere gratitude to these dedicated individuals who put themselves at risk, day after day, in service to others and to our nation.

Current Economic Situation and Outlook

Beginning in mid-March, economic activity fell at an unprecedented speed in response to the outbreak of the virus and the measures taken to control its spread. Even after the unexpectedly positive May employment report, nearly 20 million jobs have been lost on net since February, and the reported unemployment rate has risen about 10 percentage points, to 13.3 percent. The decline in real gross domestic product (GDP) this quarter is likely to be the most severe on record. The burden of the downturn has not fallen equally on all Americans. Instead, those least able to withstand the downturn have been affected most. As discussed in the June Monetary Policy Report, low-income households have experienced, by far, the sharpest drop in employment, while job losses of African Americans, Hispanics, and women have been greater than that of other groups. If not contained and reversed, the downturn could further widen gaps in economic well-being that the long expansion had made some progress in closing.

Recently, some indicators have pointed to a stabilization, and in some areas a modest rebound, in economic activity. With an easing of restrictions on mobility and commerce and the extension of federal loans and grants, some businesses are opening up, while stimulus checks and unemployment benefits are supporting household incomes and spending. As a result, employment moved higher in May. That said, the levels of output and employment remain far below their pre-pandemic levels, and significant uncertainty remains about the timing and strength of the recovery. Much of that economic uncertainty comes from uncertainty about the path of the disease and the effects of measures to contain it. Until the public is confident that the disease is contained, a full recovery is unlikely.

Moreover, the longer the downturn lasts, the greater the potential for longer-term damage from permanent job loss and business closures. Long periods of unemployment can erode workers’ skills and hurt their future job prospects. Persistent unemployment can also negate the gains made by many disadvantaged Americans during the long expansion and described to us at our Fed Listens events. The pandemic is presenting acute risks to small businesses, as discussed in the Monetary Policy Report. If a small or medium-sized business becomes insolvent because the economy recovers too slowly, we lose more than just that business. These businesses are the heart of our economy and often embody the work of generations.

With weak demand and large price declines for some goods and services—such as apparel, gasoline, air travel, and hotels—consumer price inflation has dropped noticeably in recent months. But indicators of longer-term inflation expectations have been fairly steady. As output stabilizes and the recovery moves ahead, inflation should stabilize and then gradually move back up over time closer to our symmetric 2 percent objective. Inflation is nonetheless likely to remain below our objective for some time.

Monetary Policy and Federal Reserve Actions to Support the Flow of Credit

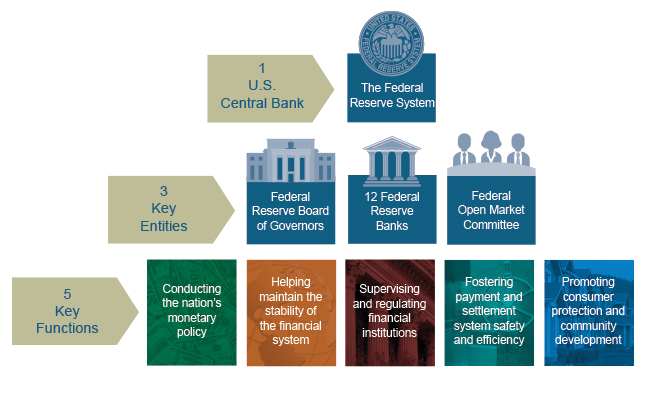

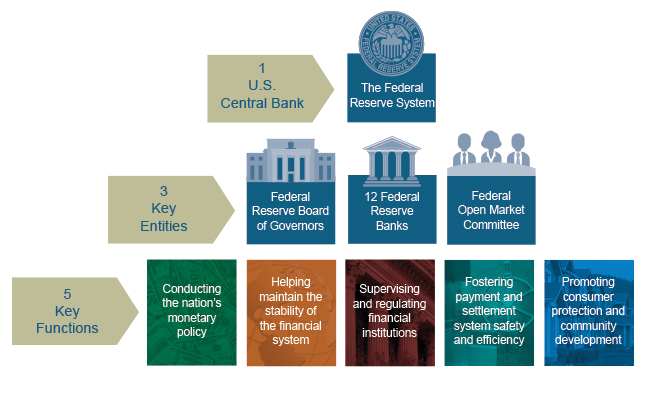

The Federal Reserve’s response to this extraordinary period is guided by our mandate to promote maximum employment and stable prices for the American people, along with our responsibilities to promote the stability of the financial system. We are committed to using our full range of tools to support the economy in this challenging time.

In March, we quickly lowered our policy interest rate to near zero, reflecting the effects of COVID-19 on economic activity, employment, and inflation, and the heightened risks to the outlook. We expect to maintain interest rates at this level until we are confident that the economy has weathered recent events and is on track to achieve our maximum-employment and price-stability goals.

We have also been taking broad and forceful actions to support the flow of credit in the economy. Since March, we have been purchasing sizable quantities of Treasury securities and agency mortgage-backed securities in order to support the smooth functioning of these markets, which are vital to the flow of credit in the economy. As described in the June Monetary Policy Report, these purchases have helped restore orderly market conditions and have fostered more accommodative financial conditions. As market functioning has improved since the strains experienced in March, we have gradually reduced the pace of these purchases. To sustain smooth market functioning and thereby foster the effective transmission of monetary policy to broader financial conditions, we will increase our holdings of Treasury securities and agency mortgage-backed securities over coming months at least at the current pace. We will closely monitor developments and are prepared to adjust our plans as appropriate to support our goals.

To provide stability to the financial system and support the flow of credit to households, businesses, and state and local governments, the Federal Reserve, with the approval of the Secretary of the Treasury, established 11 credit and liquidity facilities under section 13(3) of the Federal Reserve Act. The June Monetary Policy Report provides details on these facilities, which fall into two categories: stabilizing short-term funding markets and providing more-direct support for credit across the economy.

To help stabilize short-term funding markets, the Federal Reserve set up the Commercial Paper Funding Facility and the Money Market Liquidity Facility to stem rapid outflows from prime money market funds. The Fed also established the Primary Dealer Credit Facility, which provides loans against good collateral to primary dealers that are critical intermediaries in short-term funding markets.

To more directly support the flow of credit to households, businesses, and state and local governments, the Federal Reserve established a number of facilities. To support the small business sector, we established the Paycheck Protection Program Liquidity Facility to bolster the effectiveness of the Coronavirus Aid, Relief, and Economic Security Act’s (CARES Act) Paycheck Protection Program. Our Main Street Lending Program, which we are in the process of launching, supports lending to both small and midsized businesses. The Term Asset-Backed Securities Loan Facility supports lending to both businesses and consumers. To support the employment and spending of investment-grade businesses, we established two corporate credit facilities. And to help U.S. state and local governments manage cash flow pressures and serve their communities, we set up the Municipal Liquidity Facility.

The tools that the Federal Reserve is using under its 13(3) authority are appropriately reserved for times of emergency. When this crisis is behind us, we will put them away. The June Monetary Policy Report reviews the implications of these tools for the Federal Reserve’s balance sheet.

Many of these facilities have been supported by funding from the CARES Act. We will be disclosing, on a monthly basis, names and details of participants in each such facility; amounts borrowed and interest rate charged; and overall costs, revenues, and fees for each facility. We embrace our responsibility to the American people to be as transparent as possible, and we appreciate that the need for transparency is heightened when we are called upon to use our emergency powers.

We recognize that our actions are only part of a broader public-sector response. Congress’s passage of the CARES Act was critical in enabling the Federal Reserve and the Treasury Department to establish many of the lending programs. The CARES Act and other legislation provide direct help to people, businesses, and communities. This direct support can make a critical difference not just in helping families and businesses in a time of need, but also in limiting long-lasting damage to our economy.

I want to end by acknowledging the tragic events that have again put a spotlight on the pain of racial injustice in this country. The Federal Reserve serves the entire nation. We operate in, and are part of, many of the communities across the country where Americans are grappling with and expressing themselves on issues of racial equality. I speak for my colleagues throughout the Federal Reserve System when I say, there is no place at the Federal Reserve for racism and there should be no place for it in our society. Everyone deserves the opportunity to participate fully in our society and in our economy.

We understand that the work of the Federal Reserve touches communities, families, and businesses across the country. Everything we do is in service to our public mission. We are committed to using our full range of tools to support the economy and to help assure that the recovery from this difficult period will be as robust as possible.

Thank you. I am happy to take your questions.