Predicting COVID-19’s Long-Term Impact on the Home Health Care Market

The Patient-Driven Groupings Model (PDGM) and its unintended ripple effects were supposed to be the dominant story this year for the nation’s 12,000 or so Medicare-certified home health care providers. But the coronavirus has rewritten the script for 2020, throwing most of the industry’s previous projections out the window.

While PDGM — implemented on Jan. 1 — will still shape home health care’s immediate future, several other long-term trends have emerged as a result of the coronavirus and its impact on the U.S. health care system.

These trends include unexpected consolidation drivers and the sudden embrace of telehealth technology, the latter of which is a development that will affect home health providers in ways both profoundly positive and negative. Unforeseen, long-term trends will also likely include drastic overhauls to the Medicare Home Health Benefit, a revival of SNF-to-home diversion and more.

Now that providers have had roughly three full months to adapt to the coronavirus and transition out of crisis mode, Home Health Care News is looking ahead to what the industry can expect for the rest of 2020 and beyond.

‘Historic’ consolidation will still happen, with some unexpected drivers

Although the precise extent was often up for debate, most industry insiders predicted some level of consolidation in 2020, driven by PDGM, the phasing out of Requests for Anticipated Payment (RAPs) and other factors.

That certainly appeared to be true early on in the year, with Amedisys Inc. (Nasdaq: AMED), LHC Group Inc. (Nasdaq: LHCG) and other home health giants reporting more inbound calls related to acquisition opportunities or takeovers of financially distressed agencies.

In fact, during a fourth-quarter earnings call, LHC Group CEO and Chairman Keith Myers suggested that 2020 would kick off a “historic” consolidation wave that would last several years.

“As a result of this transition in Q4 and the first few months of 2020, we have seen an increase in the number of inbound calls from smaller agencies looking to exit the business,” Myers said on the call. “Some of these opportunities could be good acquisition candidates, and others we can naturally roll into our organic growth through market-share gains.”

Most of those calls stopped with the coronavirus, however.

Although the vast majority of home health agencies have experienced a decline in overall revenues during the current public health emergency, many have been able to compensate for losses thanks to the federal government’s multi-faceted response.

For some, that has meant taking advantage of the approximately $1.7 billion the U.S. Centers for Medicare & Medicaid Services (CMS) has distributed through its advanced and accelerated payment programs. For others, it has meant accepting the somewhat murky financial relief sent their way under the Provider Relief Fund.

In addition to those two possible sources of financial assistance, all Medicare-certified home health agencies have benefitted from Congress’s move to suspend the 2% Medicare sequestration until Dec. 31.

Eventually, those coronavirus lifelines and others will be pulled back, kickstarting M&A activity once again.

“We believe that a lot of the support has stopped or postponed the shakeout that’s occurring in home health — or that we anticipated would be occurring around this time,” Amedisys CEO and President Paul Kusserow said in March. “We don’t believe it’s over, though.”

Not only will consolidation happen, but some of it will be fueled by unexpected players.

With the suspension of elective surgeries and procedures, hospitals and health systems have lost billions of dollars. Rick Pollack, president and CEO of the American Hospital Association (AHA), estimated that hospitals are losing as much as $50 billion a month during the coronavirus.

“I think it’s fair to say that hospitals are facing perhaps the greatest challenge that they have ever faced in their history,” Pollack, whose organization represents the interests of nearly 5,000 hospitals, told NPR.

To cut costs, some hospitals may look to get rid of their in-house home health divisions. It’s a trend that may already be happening, too.

The Home Health Benefit will look drastically different

With a mix of temporary and permanent regulatory changes, including a redefinition of the term “homebound,” the Medicare Home Health Benefit already looks very different now than it did three months ago. But the benefit will likely go through further retooling in the not-too-distant future.

Broadly, the Medicare Part A Trust Fund finances key services for beneficiaries.

While vital to the national health care infrastructure, the fund is going broke — and fast. In the most recent CMS Office of the Actuary report released in April, the Trust Fund was projected to be entirely depleted by 2026.

The COVID-19 virus has only accelerated the drain on the fund, with some predicting it to run out of money two years earlier than anticipated. A group of health care economics experts from Harvard and MIT wrote about the very topic on a joint Health Affairs op-ed published Wednesday.

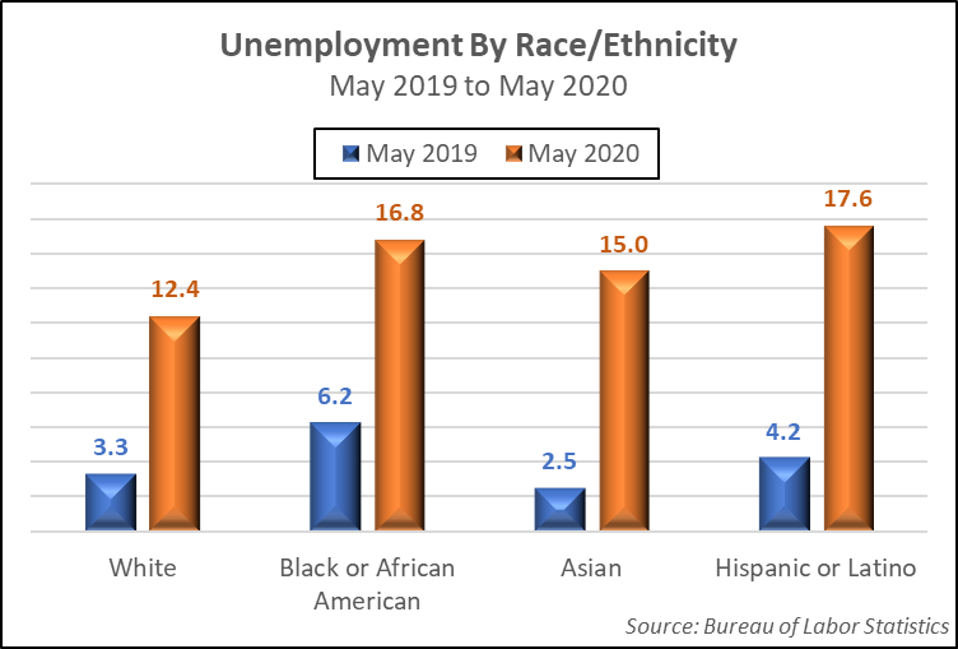

“COVID-19 is causing the Medicare Part A program and the Hospital Insurance (HI) Trust Fund to contend with large reductions in revenues due to increased unemployment, reductions in salaries, shifts to part-time employment from full time and a reduction in labor force participation,” the group wrote. “In addition to revenue declines, there was a 20% increase in payments to hospitals for COVID-related care and elimination of cost sharing associated with treatment of COVID.”

Besides those and other cost pressures, Medicare is simultaneously expanding by about 10,000 new people every day. The worst-case scenario: the Medicare Part A Trust Fund goes broke closer to 2024.

There are numerous policy actions that can be taken to reduce the financial strain on the trust fund. In their op-ed, for example, the team of Harvard and MIT researchers suggested shifting all of home health care under Part B.

In 2018, Medicare spent about $17.9 billion on home health benefits, with roughly 66% of that falling under Part B, which typically includes community-based care that isn’t linked to hospital or nursing home discharge. Consolidating all of home health care into Part B would move billions of dollars away from Part A, in turn expanding the Trust Fund’s lifecycle.

“Such a policy change would move nearly $6 billion in spending away from the Part A HI Trust Fund but would put upward pressure on the Part B premium,” the researchers noted.

Of course, all post-acute care services may still undergo a transformation into a unified payment model one day. However, the coronavirus has devastated skilled nursing facility (SNF) operators, who were already dealing with the Patient-Driven Payment Model (PDPM), a payment overhaul of their own.

Regulators may shy away from introducing further disruption until SNFs have a chance to recover, a process likely to take years — if not decades.

Previously, the Trump administration had estimated that a unified payment system based on patients’ clinical needs rather than site of care would save a projected $101.5 billion from 2021 to 2030.

Telehealth will be a double-edged sword

The move toward telehealth was a long-term trend that home health providers were cognizant of before COVID-19, even if some clinicians were personally skeptical of virtual visits. But because the virus has demanded social distancing, telehealth has forced its way into health care in a manner that would have been almost unimaginable in 2019.

In late April, during a White House Coronavirus Task Force briefing, President Donald Trump indicated that the number of patients using telehealth had increased from about 11,000 per week to more than 650,000 people per week.

Meanwhile, MedStar Health went from delivering just 10 telehealth visits per week to nearly 4,000 per day.

Backed by policymakers, technology companies and consumers, telehealth is likely here to stay.

“I think the genie’s out of the bottle on this one,” CMS Administrator Seema Verma said in April. “I think it’s fair to say that the advent of telehealth has been just completely accelerated, that it’s taken this crisis to push us to a new frontier, but there’s absolutely no going back.”

The telehealth boom could mean improved patient outcomes and new lines of business for home health providers. But it could also mean more competition moving forward.

For telehealth to be a true game-changer for home health providers, Congress and CMS would need to pave the way for direct reimbursement. Currently, a home health provider cannot get paid for delivering virtual visits in fee-for-service (FFS) Medicare.

Sen. Susan Collins (R-Maine) has floated the idea of introducing legislation that would allow for direct telehealth reimbursement in the home health space, but, so far, no concrete steps have been taken — at least in public. With a hyper-polarized Congress and a long list of other national priorities taking up the spotlight, it’s impossible to guess whether home health telehealth reimbursement will actually happen.

While home health providers can’t directly bill for in-home telehealth visits, hospitals and certain health care practitioners can. That regulatory imbalance could lead to providers being used less frequently as “the eyes and ears in the home,” some believe.

A new SNF-to-home diversion wave will emerge

Over the past two decades, many home health providers have been able to expand their patient census by poaching patients from SNFs. Often referred to as SNF-to-home diversion, the approach didn’t just benefit home health providers, though. It helped cut national health care spending by shifting care into lower-cost settings.

At first, the stream of SNF residents being shifted into home health care was like water being shot from a firehose: In 2009, there were 1,808 SNF days per 1,000 FFS Medicare beneficiaries, a March 2018 analysis from consulting firm Avalere Health found. By 2016, that number plummeted to 1,539 days per 1,000 beneficiaries — a 15% drop.

In recent years, that steady stream has turned into a slow trickle, with more patients being sent to home health care right off the bat. In the first quarter of 2019, 23.3% of in-patient hospital discharges were coded for home health care, while 21.1% were coded for SNFs, according to data from analytics and metrics firm Trella Health.

Genesis HealthCare (NYSE: KEN) CEO George Hager suggested the initial SNF-to-home diversion wave was over in March 2019. Kennett Square, Pennsylvania-based Genesis is a holding company with subsidiaries that operate hundreds of skilled nursing centers across the country.

“To anyone [who] would want [to] or has toured a skilled nursing asset, I would challenge you to look at the patients in our building and find patients that could be cared for in a home-based or community-based setting,” Hager said during a presentation at the Barclays Global Healthcare Conference. “The acuity levels of an average patient in a skilled nursing center have increased dramatically.”

Yet that was all before the coronavirus.

Over the last three months, more than 40,600 long-term care residents and workers have died as a result of COVID-19, according to an analysis of state data gathered by USA Today. That’s about 40% of the U.S.’s overall death toll.

CMS statistics place that number closer to 26,000.

In light of those figures and infection-control issues in congregate settings, home health providers will see a new wave of SNF-to-home diversion as robust as the first. As the new diversion wave happens, providers will need to be prepared to care for patients with higher acuity levels and more co-morbidities.

“[That’s going to change] the psyche of the way people are going to view SNFs and long-term care facilities for the rest of our generation,” Bruce Greenstein, LHC Group’s chief strategy and innovation officer, said during a June presentation at the Jefferies Virtual Healthcare Conference. “You would never want to put your parent in a facility if you don’t have to. You want options now.”

One stat to back up this idea: Over 50% of family members are now more likely to choose in-home care for their loved ones than they were prior to the coronavirus, according to a survey from health care research and consulting firm Transcend Strategy Group.

Separate from SNF-to-home diversion, hospital-to-home models will also likely continue to gain momentum after the coronavirus.

There will be a land grab for palliative care

Over the past two years, home health providers have aggressively looked to expand into hospice care, partly due to the space’s relatively stable reimbursement landscape. Amedisys — now one of the largest hospice providers in the U.S. — is the prime example of that.

During the COVID-19 crisis, palliative care has gained greater awareness. Generally, palliative care is specialized care for people living with advanced, serious illnesses.

“Right now, we are seeing from our hospital partners and our community colleagues the importance of palliative care, including advanced care as well as appropriate pain and symptom management,” Capital Caring Chief Medical Officer Dr. Matthew Kestenbaum previously told HHCN. “The number of palliative care consults we’re being asked to perform in the hospitals and in the community has actually increased. The importance of palliative care is absolutely being shown during this pandemic.”

As community-based palliative care programs continue to prove their mettle amid the coronavirus, home health providers will increasingly consider expanding into the market to further diversify their services.

Currently, just 10% of community-based palliative care programs are operated by home health agencies.

Demand will reach an all-time high

The home health industry may ultimately shrink in terms of raw number of agencies, but the overall size of the market is very likely to expand at a faster-than-anticipated pace.

In years to come, home health providers will still ride the macro-level tailwinds of an aging U.S. population with a proven preference to age in place — that hasn’t changed. But because of SNF-to-home diversion and calls to decentralize the health care system with home- and community-based care, providers will see an increase in referrals from a variety of sources.

In turn, home health agencies will need to ramp up their recruitment and retention strategies.

There’s already early evidence of this happening.

Last week, in St. Louis, Missouri, four home-based care agencies announced that they were hiring a combined 1,000 new employees to meet the surge in demand, according to the St. Louis Dispatch.

Meanwhile, Brookdale Senior Living Inc. (NYSE: BKD) similarly announced plans to hire 4,500 health care workers, with 10% of those hires coming from the senior living operator’s health care services segment.

Bayada Home Health Care likewise announced plans to ramp up hiring.

“We are absolutely hiring more people now than ever,” Bayada CEO David Baiada previously told HHCN. “The need for services — both because of societal and demographic evolution, but also because of what we anticipate as a rebound and an increase in the demand for home- and community-based care delivery as a result of the pandemic — is requiring us to continue to accelerate our recruitment efforts.”

The bottom line: The coronavirus may have presented immediate obstacles for home health providers, but the long-term outlook is brighter than ever.