https://www.fiercehealthcare.com/hospitals/industry-voices-6-ways-pandemic-will-remake-health-systems?mkt_tok=eyJpIjoiTURoaU9HTTRZMkV3TlRReSIsInQiOiJwcCtIb3VSd1ppXC9XT21XZCtoVUd4ekVqSytvK1wvNXgyQk9tMVwvYXcyNkFHXC9BRko2c1NQRHdXK1Z5UXVGbVpsTG5TYml5Z1FlTVJuZERqSEtEcFhrd0hpV1Y2Y0sxZFNBMXJDRkVnU1hmbHpQT0pXckwzRVZ4SUVWMGZsQlpzVkcifQ%3D%3D&mrkid=959610

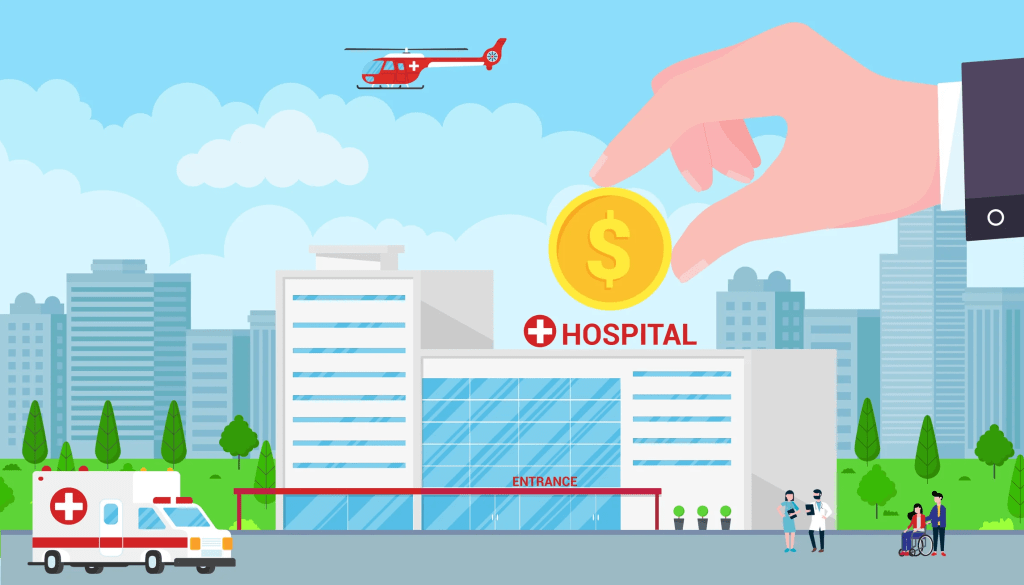

Provider executives already know America’s hospitals and health systems are seeing rapidly deteriorating finances as a result of the coronavirus pandemic. They’re just not yet sure of the extent of the damage.

By the end of June, COVID-19 will have delivered an estimated $200 billion blow to these institutions with the bulk of losses stemming from cancelled elective and nonelective surgeries, according to the American Hospital Association.

A recent Healthcare Financial Management Association (HFMA)/Guidehouse COVID-19 survey suggests these patient volumes will be slow to return, with half of provider executive respondents anticipating it will take through the end of the year or longer to return to pre-COVID levels. Moreover, one-in-three provider executives expect to close the year with revenues at 15 percent or more below pre-pandemic levels. One-in-five of them believe those decreases will soar to 30 percent or beyond.

Available cash is also in short supply. A Guidehouse analysis of 350 hospitals nationwide found that cash on hand is projected to drop by 50 days on average by the end of the year — a 26% plunge — assuming that hospitals must repay accelerated and/or advanced Medicare payments.

While the government is providing much needed aid, just 11% of the COVID survey respondents expect emergency funding to cover their COVID-related costs.

The figures illustrate how the virus has hurled American medicine into unparalleled volatility. No one knows how long patients will continue to avoid getting elective care, or how state restrictions and climbing unemployment will affect their decision making once they have the option.

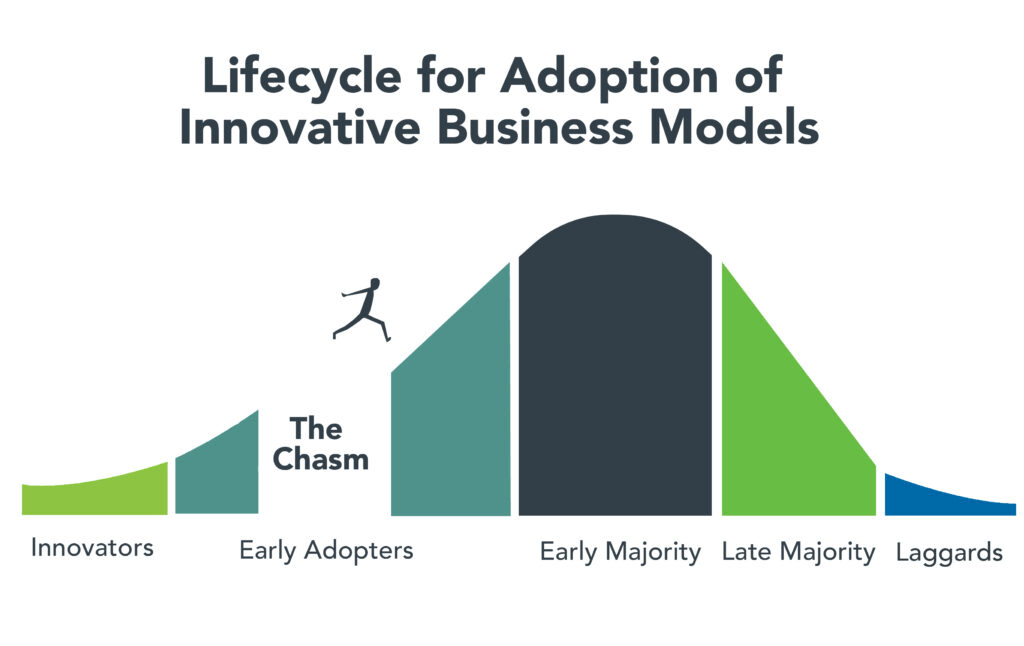

All of which leaves one thing for certain: Healthcare’s delivery, operations, and competitive dynamics are poised to undergo a fundamental and likely sustained transformation.

Here are six changes coming sooner rather than later.

1. Payer-provider complexity on the rise; patients will struggle.

The pandemic has been a painful reminder that margins are driven by elective services. While insurers show strong earnings — with some offering rebates due to lower reimbursements — the same cannot be said for patients. As businesses struggle, insured patients will labor under higher deductibles, leaving them reluctant to embrace elective procedures. Such reluctance will be further exacerbated by the resurgence of case prevalence, government responses, reopening rollbacks, and inconsistencies in how the newly uninsured receive coverage.

Furthermore, the upholding of the hospital price transparency ruling will add additional scrutiny and significance for how services are priced and where providers are able to make positive margins. The end result: The payer-provider relationship is about to get even more complicated.

2. Best-in-class technology will be a necessity, not a luxury.

COVID has been a boon for telehealth and digital health usage and investments. Two-thirds of survey respondents anticipate using telehealth five times more than they did pre-pandemic. Yet, only one-third believe their organizations are fully equipped to handle the hike.

If healthcare is to meet the shift from in-person appointments to video, it will require rapid investment in things like speech recognition software, patient information pop-up screens, increased automation, and infrastructure to smooth workflows.

Historically, digital technology was viewed as a disruption that increased costs but didn’t always make life easier for providers. Now, caregiver technologies are focused on just that.

The new necessities of the digital world will require investments that are patient-centered and improve access and ease of use, all the while giving providers the platform to better engage, manage, and deliver quality care.

After all, the competition at the door already holds a distinct technological advantage.

3. The tech giants are coming.

Some of America’s biggest companies are indicating they believe they can offer more convenient, more affordable care than traditional payers and providers.

Begin with Amazon, which has launched clinics for its Seattle employees, created the PillPack online pharmacy, and is entering the insurance market with Haven Healthcare, a partnership that includes Berkshire Hathaway and JPMorgan Chase. Walmart, which already operates pharmacies and retail clinics, is now opening Walmart Health Centers, and just recently announced it is getting into the Medicare Advantage business.

Meanwhile, Walgreens has announced it is partnering with VillageMD to provide primary care within its stores.

The intent of these organizations clear: Large employees see real business opportunities, which represents new competition to the traditional provider models.

It isn’t just the magnitude of these companies that poses a threat. They also have much more experience in providing integrated, digitally advanced services.

4. Work locations changes mean construction cost reductions.

If there’s one thing COVID has taught American industry – and healthcare in particular – it’s the importance of being nimble.

Many back-office corporate functions have moved to a virtual environment as a result of the pandemic, leaving executives wondering whether they need as much real estate. According to the survey, just one-in-five executives expect to return to the same onsite work arrangements they had before the pandemic.

Not surprisingly, capital expenditures, including new and existing construction, leads the list of targets for cost reductions.

Such savings will be critical now that investment income can no longer be relied upon to sustain organizations — or even buy a little time. Though previous disruptions spawned only marginal change, the unprecedented nature of COVID will lead to some uncomfortable decisions, including the need for a quicker return on investments.

5. Consolidation is coming.

Consolidation can be interpreted as a negative concept, particularly as healthcare is mostly delivered at a local level. But the pandemic has only magnified the differences between the “resilients” and the “non-resilients.”

All will be focused on rebuilding patient volume, reducing expenses, and addressing new payment models within a tumultuous economy. Yet with near-term cash pressures and liquidity concerns varying by system, the winners and losers will quickly emerge. Those with at least a 6% to 8% operating margin to innovate with delivery and reimagine healthcare post-COVID will be the strongest. Those who face an eroding financial position and market share will struggle to stay independent..

6. Policy will get more thoughtful and data-driven.

The initial coronavirus outbreak and ensuing responses by both the private and public sectors created negative economic repercussions in an accelerated timeframe. A major component of that response was the mandated suspension of elective procedures.

While essential, the impact on states’ economies, people’s health, and the employment market have been severe. For example, many states are currently facing inverse financial pressures with the combination of reductions in tax revenue and the expansion of Medicaid due to increases in unemployment. What’s more, providers will be subject to the ongoing reckonings of outbreak volatility, underscoring the importance of agile policy that engages stakeholders at all levels.

As states have implemented reopening plans, public leaders agree that alternative responses must be developed. Policymakers are in search of more thoughtful, data-driven approaches, which will likely require coordination with health system leaders to develop flexible preparation plans that facilitate scalable responses. The coordination will be difficult, yet necessary to implement resource and operational responses that keeps healthcare open and functioning while managing various levels of COVID outbreaks, as well as future pandemics.

Healthcare has largely been insulated from previous economic disruptions, with capital spending more acutely affected than operations. But the COVID-19 pandemic will very likely be different. Through the pandemic, providers are facing a long-term decrease in commercial payment, coupled with a need to boost caregiver- and consumer-facing engagement, all during a significant economic downturn.

While situations may differ by market, it’s clear that the pre-pandemic status quo won’t work for most hospitals or health systems.